Executive Summary

California is both one of the largest economies and one of the largest emitters globally, making its climate change policies some of the most important in the world. They are also some of the most ambitious. In particular, California’s Global Warming Solutions Act of 2006 (AB32) set a series of policies and programs across all major business sectors to return California emissions to 1990 levels by 2020. A key component of this set of policies is the Cap and Trade Program, which caps greenhouse gas (GHG) emissions from key business sectors in California. The Cap and Trade Program both acts as a backstop to ensure that AB32’s GHG reduction targets are met and drives the lowest-cost emissions abatement solutions across economic sectors through its trading and offset mechanisms.

With the Cap and Trade Program in its second year of full operation, we have the opportunity to see how firms make business decisions in the presence of a carbon price — whether abatement options that have been identified as technically feasible prove to be attractive in practice, or whether barriers prevent firms from pursuing otherwise cost-effective abatement options.

This working paper examines how abatement decisions under the Cap and Trade Program work in practice in one industry. Through financial modeling and stakeholder interviews, we look at how the carbon price affects business decisions to invest in energy savings and emissions abatement in the cement industry — a major emitter covered under the Cap and Trade Program. In particular, our work aims to:

- Provide policymakers in California, other U.S. states, and other jurisdictions a window into how U.S. industrial firms make compliance decisions under a carbon pricing system in the context of broader business practices

- Identify barriers to cost-effective abatement by industrial firms under carbon pricing policies, and policy levers that could address those barriers

We explore these questions by modeling a set of representative abatement options under a range of carbon prices. Based on interviews with industry experts, we also consider additional decision factors not included in the model, such as customer priorities and risk perception.

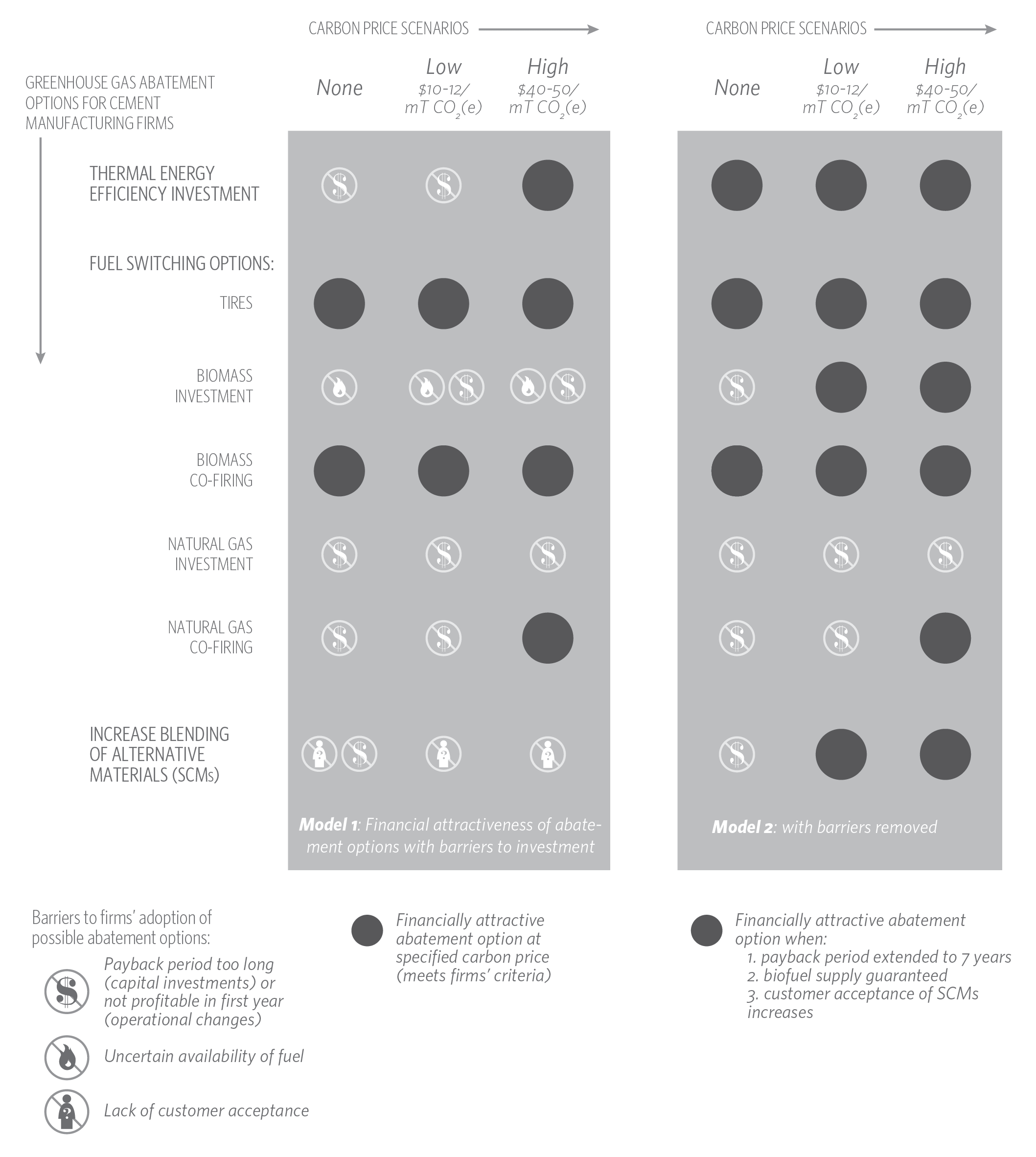

We find that the carbon price signal is making a difference in how firms approach abatement decisions. Our modeling indicates that introducing a carbon price brings some abatement options within firms’ investment criteria, and a high carbon price makes more abatement options financially attractive (see Figure ES1). Industry stakeholders confirm that firms are currently factoring an expected carbon price into their investment decisions, and the introduction of the Cap and Trade Program has driven more interest in abatement strategies. However, the impact of the carbon price on a decision to abate emissions also depends on a range of other factors specific to each abatement option. In most cases, the carbon price is not the most important factor in making an abatement decision financially attractive.

Three barriers to otherwise cost-effective abatement options stand out for the cement industry and may also prove important for other industries:

Firms have short payback period criteria and capital constraints for investments. Internal constraints on and criteria for capital investment emerged as a key barrier to cost-effective abatement investments. Typically, firms only invest in projects with very short payback periods (1.5-3 years, according to CPI interviews). This conservative cutoff for investment means that firms are unlikely to invest in projects that take longer to pay back, even if projects are very profitable over the lifetime of the investment. The impact of the recession has further exacerbated conservative payback period criteria, because abatement projects face tight competition from other capital projects considered by a cement firm. Our modeling suggests that if firms’ maximum payback periods were longer, more investments would appear financially attractive under both low and high carbon prices.

Firms require more predictability and availability of alternative fuels. Some promising abatement options involve switching to lower-carbon fuels that are not yet widely used in California; firms require more certainty about future fuel availability and prices before making major investments.

Customer purchasing practices and practices of other actors along the value chain make it difficult for firms to engage in abatement activities. Prescriptive standards and entrenched customer purchasing practices make it difficult for firms to blend more alternative materials (supplementary cementitious materials, or “SCMs”) into cement — an otherwise attractive option for emissions abatement at the cement plant. A firm’s ability to change blending rates also depends on its control over the concrete manufacturing facilities where blending of SCMs often occurs.

The impact of these three barriers on firms’ abatement decisions is illustrated across a range of carbon prices in Figure ES1. The scenarios on the left show the abatement options (shaded in dark gray) that appear to meet firms’ stated criteria for pursuing investments or operational changes. For the abatement options that do not meet those criteria (unshaded), the table lists the key barriers that stand in the way.

The right-side scenarios in Figure ES1 show how investment decisions would likely change if the barriers identified earlier were removed. Specifically, the figure illustrates which abatement options would meet firms’ criteria if:

- Firms lengthen their payback period cutoff to seven years from the initial investment.

- Firms are confident that biofuel supplies are reliable and predictable.

- Customer purchasing practices become flexible enough to enable firms to determine SCM rates that meet customer performance needs (corresponding to cement containing 15% SCMs).

Policy uncertainty has also played a role in industry decisions during the first year of the California Cap and Trade Program. Regulators continued to clarify and modify aspects of the program throughout its first year, and the industry has focused attention on ensuring favorable treatment under the program — in particular, securing freely allocated allowances to cover its compliance obligations.