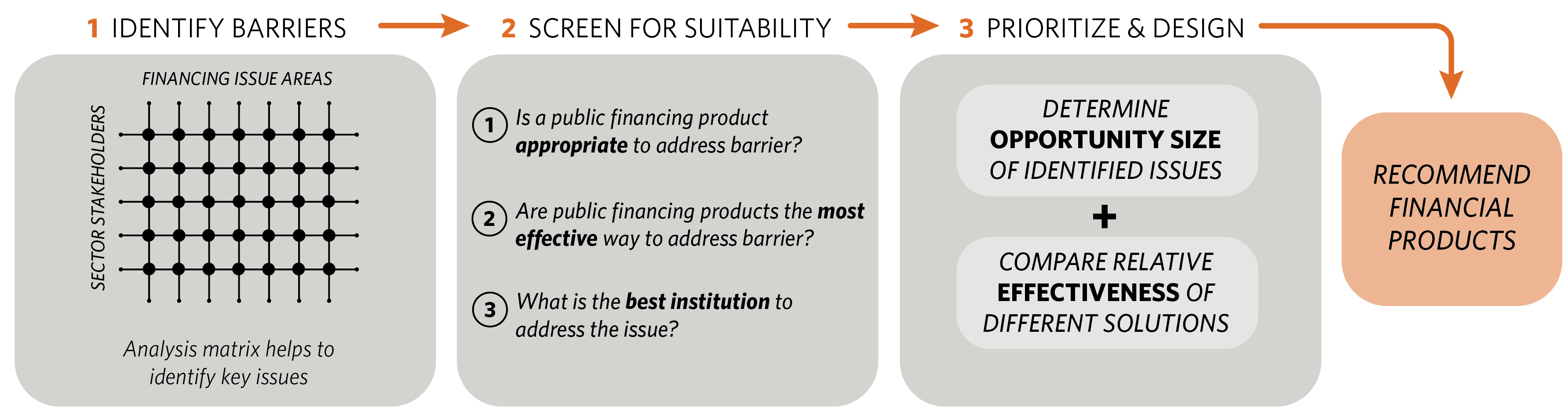

This brief illustrates CPI’s approach to identifying effective uses of public financial interventions for low-carbon projects. It presents our analysis of the financial barriers affecting large-scale renewable energy in California, utilizing the approach in Figure 1.

This brief illustrates how our methodology can successfully sort through the many possible applications of public financing and risk bearing mechanisms in a sector to identify where such mechanisms could have the greatest effect. We would ultimately aim to apply our framework across all relevant sectors in a jurisdiction, in order to identify the most effective ways a public financing mechanisms can drive decarbonization across the whole economy.

Our analysis of large-scale renewable generation in California showed that the majority of projects are well supported by existing policy and financing practices; however, there are still areas where public financing could effectively and substantively help the sector. The first step of our framework, illustrated in step 1 of Figure 1, revealed seven ways in which existing stakeholders in this sector may not have all of their needs met. The next steps of our framework—identifying which of those barriers can be most effectively solved by public finance institutions, and prioritizing and designing policy solutions—ultimately focused on three ways in which public financial interventions could be helpful:

- A public institution could aggregate and securitize projects to lower transaction costs associated with tax equity financing, either by holding the projects in the institution itself or by facilitating the creation of a separate entity such as a YieldCo.

- Small and medium enterprises could gain access to much more attractive renewable energy finance through alternate forms of loan security facilitated by public programs, like property taxes (as done with Property Assessed Clean Energy programs), or on-bill repayment.

- Finally, a public institution could bear project risk for innovative, early-stage renewable technologies through loan guarantees, an interest-rate buydown or concessional lending.

For this example, we have completed framework step two, ‘Screen for Suitability,’ but we have only done a preliminary look at the opportunity sizing and policy effectiveness analysis that comprises step three. Our first look at the opportunity size for each of these possibilities suggests that public intervention in any one of them could have a significant impact. Pending interest from policymakers, CPI could conduct a more thorough investigation of the opportunity size, for example using financial modeling to quantify the impacts of public financing intervention and compare the effectiveness of various specific policies.

Figure 1: CPI’s analysis framework for evaluating green banking and other financial interventions for low-carbon projects