Geothermal is competitive. Its low cost per unit of energy generated, when compared with other renewable energies and fossil-fuelled generation make it an attractive option for policy-makers in developing countries to meet growing energy demand.

It is also compatible with energy grid needs. Its high capacity factor and its ability to continuously feed into the energy system makes it particularly suitable for reliable baseload production while its potential flexibility makes it suitable to respond to fluctuating supply from technologies such as wind and solar PV depending on a power grid’s needs.

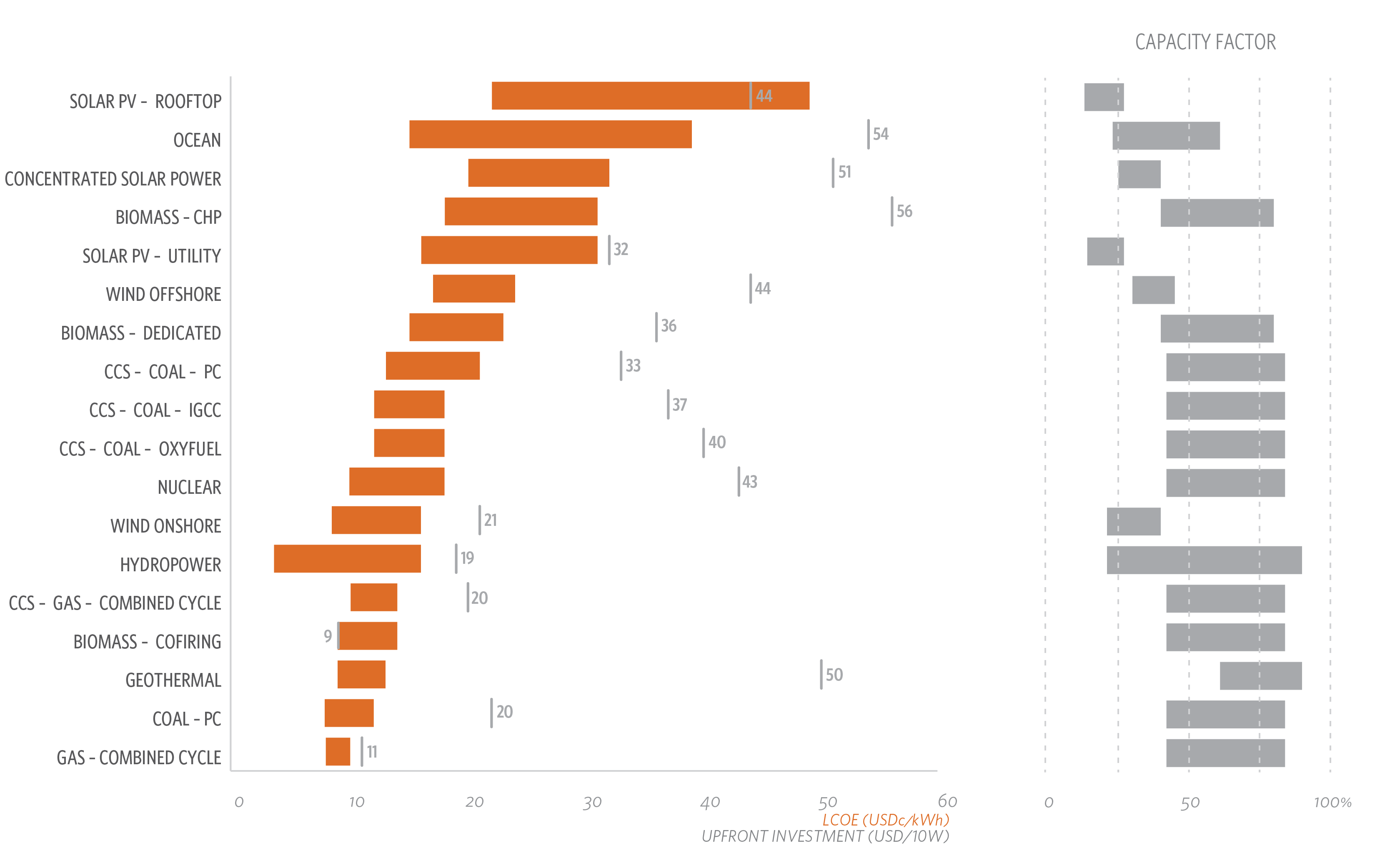

However, risks in the early exploration and drilling phases, combined with high investment costs, have slowed the scale up of the technology and limited the private investment that is needed if geothermal is to play a bigger role in the energy system. Climate Policy Initiative’s (CPI) recently published analysis of global geothermal markets and financing models finds that public finance plays the most prominent role in financing geothermal. 76-90% of all project investments utilize some aspect of public debt or equity support, as well as support instruments. This is why CPI and the Climate Investment Funds (CIF) are embarking on a joint project that aims to identify the best way public funds can mobilize private sector participation in geothermal, particularly for developing countries. On October 25th, in partnership with Energy Sector Management Assistance Program (ESMAP), and with the support of UNEP-DTU and the Danish Ministry of Foreign Affairs, the team organized the First Geothermal Dialogue at the UN City in Copenhagen. The dialogue, the first in a series of three, assembled countries receiving support from the CIF for geothermal projects and host countries involved in other (‘non-CIF’) geothermal projects, donor countries, project developers and financiers, multilateral development banks, representatives of the CIF Administrative Unit. What emerged from discussions were three points that we want to explore in our work: Cost comparisons between energy technologies show that geothermal requires high up front investment but can provide low cost power

Cost comparisons between energy technologies show that geothermal requires high up front investment but can provide low cost power