Proposals for discussion

Context

As the world moves into a post-COVID recovery phase, leaders across the public and private sector are calling for recovery finance measures to be aligned with the SDGs and the climate objectives of the Paris Agreement.

To help facilitate action on this issue, CPI developed three investment blueprints for financial instruments that can deliver concrete action consistent with cross-institutional collaboration encouraged by the Framework for Sustainable Finance Integrity. These blueprints describe financial structuring and other implementation requirements that, we believe, show strong promise for green and resilient recovery finance. These are intended as proposals for discussion and, ultimately, action.

Sustainable Finance Blueprints

Debt for Climate Swaps

The pandemic has exacerbated the debt vulnerabilities of many low- and medium-income countries. Many sovereigns face a liquidity crunch because government revenues declined due to reduced economic activity, while the timing and the quantum of external debt servicing payments has remained the same.

For Low-Income Countries (LICs), interventions such as the Debt Service Suspension Initiative (DSSI) provide liquidity relief. However, no such interventions exist for Middle-Income Countries (MICs) with high external sovereign debts. Even for MICs that don’t need debt rescheduling or do not face any immediate liquidity crisis, spending towards achieving climate goals will be challenging under current conditions.

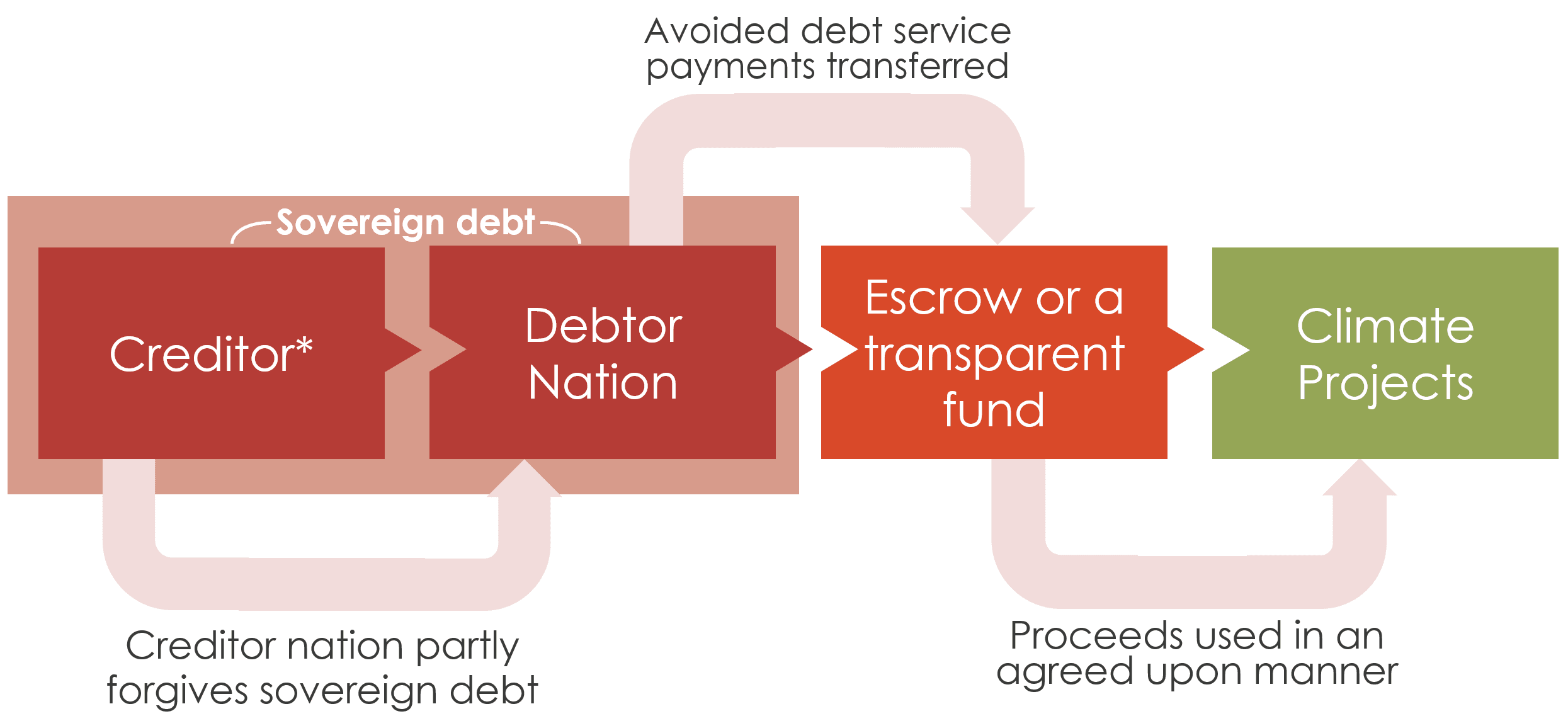

Debt for Climate (DFC) Swaps are financial instruments/arrangements that reorient part of the debt servicing payments to activities that can meet the twin aims of boosting economic recovery and addressing climate change. The nature of activities are agreed upon between the creditor and debtor nation before the actual spend.

DFC Swaps could be used to enhance climate-related spending while boosting economic recovery. In the blueprint, we suggest eligibility and condition criteria, principles for using proceeds from swaps, and offer concrete opportunities for using the redirected flows in select countries to address mitigation through examples such as accelerated coal power retirement, increased energy efficiency adoption, and adaptation and nature-based solutions to enhance resilience.

Recovery Bonds

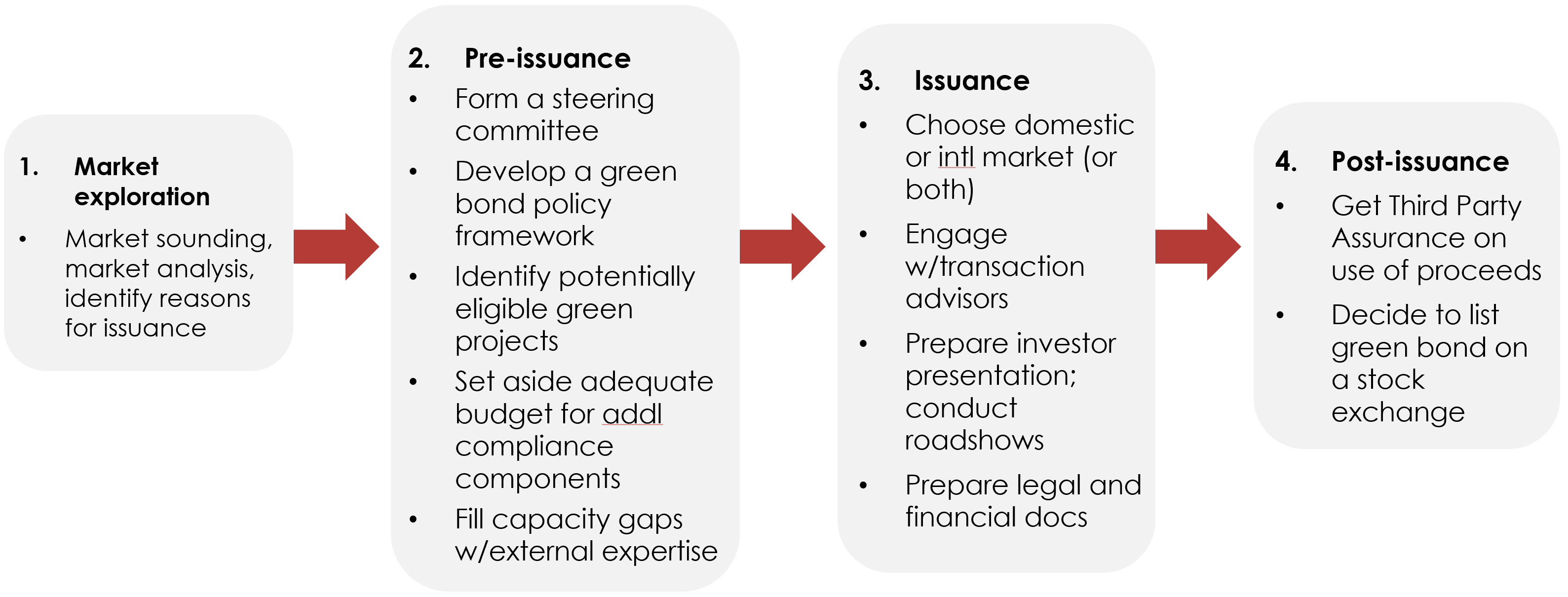

As climate impacts become more severe, countries need targeted approaches to capital borrowing and deployment that are designed to decrease emissions, increase renewable energy distribution, address other climate mitigation and adaptation solutions, and create long-lasting green jobs for a secure economy. Additionally, financial resources needed for post-COVID recovery are likely to be large enough to require sovereign borrowing. The Recovery Bond blueprint assesses the potential for sovereign bonds to bring economic, social, and climate priorities together by raising capital for sustainable and climate-resilient post-COVID recovery efforts. Recovery Bonds refer to sovereign and sub-sovereign debt instruments issued with the primary aim of aiding economic recovery after the COVID containment phase. They link a country’s borrowing to the targeted deployment of capital designed to facilitate a low-carbon, sustainable recovery.

Two options are discussed:

- a how-to guide for issuing a Sovereign Green Recovery Bond with proceeds used to support a green recovery (as well as a performance-based variant with interest payable in offsets useable for net-zero commitments); and

- a Fossil Fuel Subsidy Reform Bond that uses the repayment cashflows to drive emissions reductions through a (partial) elimination of consumption fossil fuel subsidies. Proceeds from such a bond could be used for green activities similar to a regular green bond and/or to enhance safety nets including improving healthcare infrastructure, support businesses, generating employment, and avoiding systematic defaults in the financial sector.

Sovereign green recovery bonds and fossil fuel subsidy reform bonds differ in their contractual development, but both produce a climate-beneficial outcome. While green bonds focus on the use of the proceeds that are reserved for qualified projects, a bond linked to the reduction of fossil fuel subsidies focuses instead on how bondholders could be repaid.

Results-based Financing

By linking financial rewards to climate objectives, Results-based Financing enables innovative financing arrangements that have the potential to accelerate funding from the private sector for a sustainable, post-COVID recovery.

The idea that results-based finance can contribute to achieving long-term climate objectives is not new. What is novel is combining financing models, indicators linked to climate performance, and partnerships to create new investment alternatives that improve public spending and attract the private sector towards low-carbon transitioning efforts. This is especially important considering the limited funding available from the public sector, especially in emerging markets where COVID is exacerbating debt burdens.

RBF interventions are applicable to a wide range of projects for both mitigation and adaptation while contributing to economic growth. RBF interventions are also well suited to sectoral focus, targeting industries most affected by the pandemic, such as tourism and transport, and industries that are catalytic to create more sustainable urban environments, like solid waste management, energy, and water and sanitation.

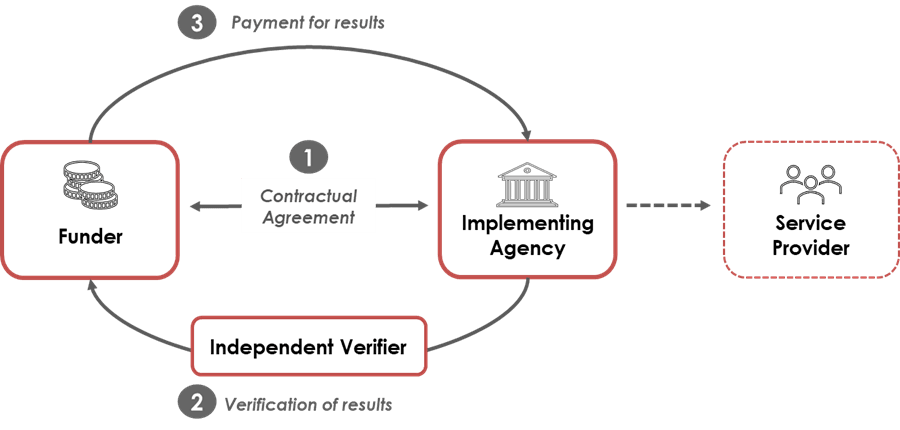

The mechanics of an RBF arrangement center on a contractual agreement between a funder and an implementing partner. Instead of contracting delivery of individual activities, the contract specifies that payments will be made if certain outputs or outcomes are achieved, which are verified by an independent third party. This aligns the incentives from all parties in a way that maximizes efficiency. Results can take the form of simple outputs that are readily monitored – like the number of trees planted – or more complex arrangements focused on outcomes such as the restoration of a forest.

RBF addresses key challenges compared to other procurement approaches. These include improved transparency and accountability through robust monitoring and verification frameworks that are built into contracts. Another important benefit is the aligning of incentives between service providers and funders around the achievement of results which can lead to more cost-efficient outcomes and better-quality services.

While RBF interventions have some challenges, discussed in the blueprint, which include upfront resources required for proper structuring and verification, RBF is an exciting opportunity to innovate on public procurement, mobilize private finance, and contribute substantial climate and economic impacts.

Engagement

CPI welcomes engagement to refine these proposals with a view to increase their visibility, adoption and impact, in particular:

- Identifying collaborators, both technical as well as high level decision makers

- Building support among stakeholders from government, philanthropy, public and private finance institutions and businesses, and civil society

- Enabling pilots to demonstrate viability and impact

Contact

Feel free to contact any of the authors of the above blueprints, or contact our group at framework@cpiglobal.org.