Structured Finance for Nature (SFN) stacks green bonds to finance a diversified portfolio of natural assets, with 60% dedicated to protecting intact ecosystems.

ABOUT

Intact forests and wetlands are critical for carbon sequestration, biodiversity, and community resilience, but these ecosystems are rapidly deteriorating, especially in Southeast Asia. Environmental markets offer a potential solution. Carbon credits are a an important revenue stream, but a more holistic market is needed. The sector faces financial uncertainties and regulatory challenges. Despite these obstacles, the growing demand for high-quality efforts to conserve and restore critical ecosystems presents opportunities for innovative financial mechanisms to support ecosystem conservation.

INNOVATION

SFN addresses key challenges hindering the establishment of a new class of natural assets. By aggregating diverse assets and creating a blended capital stack, SFN mitigates high upfront costs, long return timelines and project-specific risks. Rigorous monitoring and verification systems ensure project integrity and meet next-generation transparency expectations. With the launch of this instrument, Forest Carbon aims to establish a replicable model for capital deployment, and set an industry standard in community benefit sharing.

“These bonds will be issued and sold by successful developers of forest conservation and carbon projects to a new and untapped market of ESG investors. These investors are equally passionate about preserving forests, protecting endangered species, and aiding impoverished communities, alongside seeking high returns on their investments.”

Tom Houston, Chairman of the Board at Forest Carbon

IMPACT

This instrument was designed to support Forest Carbon’s goal of reaching 1 million hectares under management by 2026, targeting intact forests with high biodiversity, wetland areas, and degraded forests.

Securing these areas with environmental markets will prevent further habitat fragmentation and biodiversity loss, directly supporting climate mitigation and carbon removal efforts. When operational, the portfolio will prevent the emission of 2.5 million tCO2e and remove over 200,000 tCO2e annually, comparable to removing 600,000 cars from the road.

The portfolio will also protect more than 200 endangered or vulnerable species by restoring and managing critical habitats. The instrument also aims to lead the sector in benefit sharing, dedicating a minimum of 20% of pre-tax profits to be reinvested in community benefit sharing, funding community forestry and well-being programs. Over the 40-year asset lifetime, it will deliver more than USD 400 million in community investment.

DESIGN

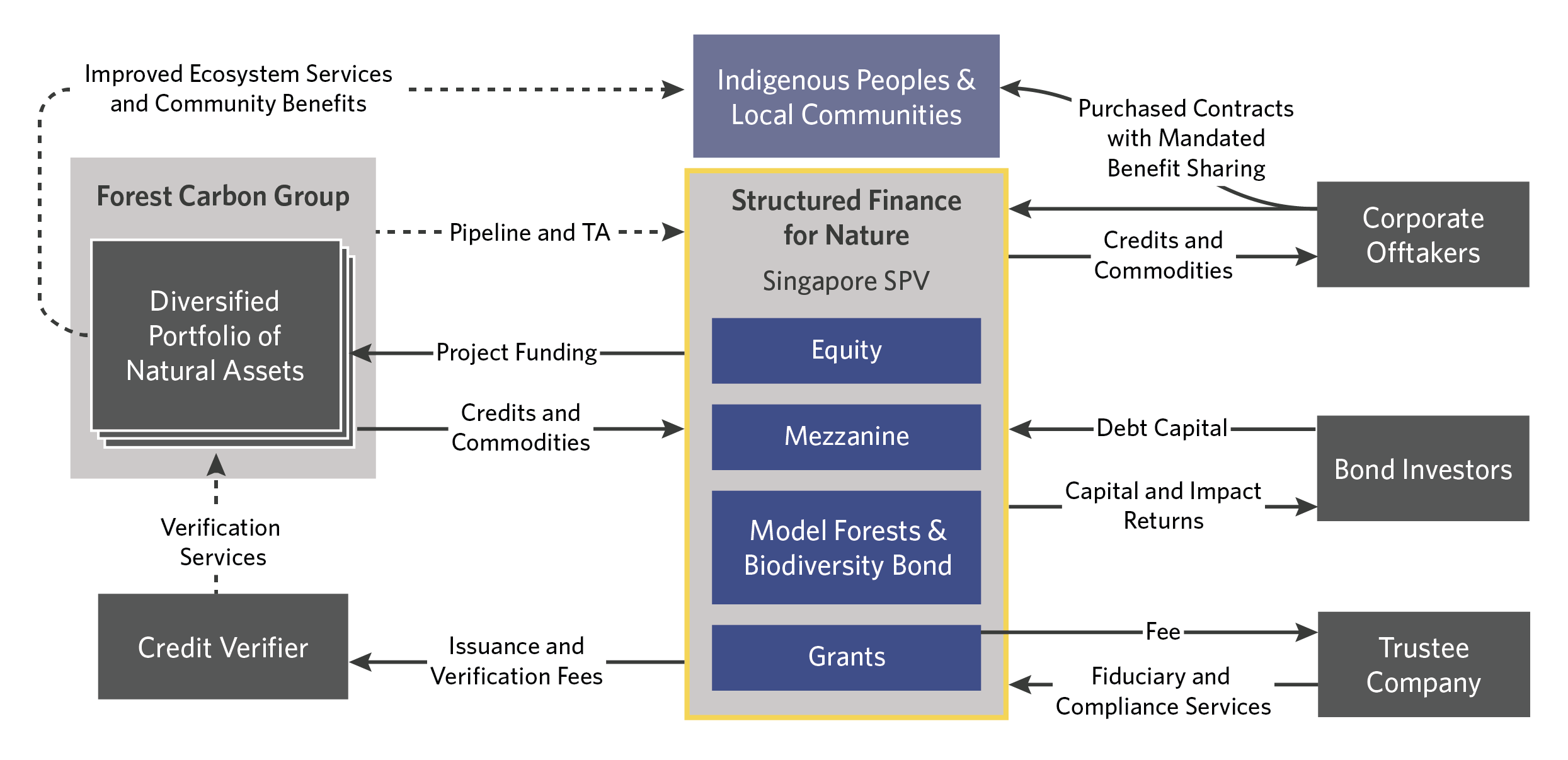

SFN operates as a Special Purpose Vehicle (SPV) to deploy capital into Forest Carbon’s pipeline – with 60% dedicated to intact ecosystems (carbon reduction and insetting) and 40% dedicated to forest and wetland restoration (nature based carbon removal).

Investors in the portfolio have multiple options for participation, according to the capital structure, which includes equity, mezzanine debt, and a publicly accessible green bond. The Model Forests and Biodiversity Bond also has a specific issuance designed for smaller investment increments accessible to high-net-worth individuals and family offices to allow smaller investors to participate alongside Development Finance Institutions (DFIs).

The instrument generates revenue primarily by selling carbon credits, although additional income streams, such as insetting other payments for ecosystem services, are considered on a project-by-project basis. These funds are reinvested into project operations and community development initiatives. By prioritizing local communities as partners, Forest Carbon ensures long-term success and maximizes positive social and environmental impacts.

Forest Carbon’s target is to raise USD 50 million for the Model Forests and Biodiversity Bond, and USD 100 million overall for SFN.