Enhancing collaboration between public development banks in emerging markets and developing economies

International development finance institutions (DFIs) and multilateral development banks (MDBs) can cooperate with local public development banks (PDBs) in emerging and developing economies (EMDEs) to leverage their comparative strengths and enhance adaptation finance flows. New analysis from CPI identifies how DFIs/MDBs and national development banks (NDBs) can work more effectively together to achieve adaptation finance goals.

Ongoing calls for the international financial architecture to increase climate ambition have stressed the need for all types of public development banks (PDBs) to work as a cohesive system. However, recent CPI research found current collaboration on climate finance between MDBs and NDBs in EMDEs to be limited (Enhancing MDB-NDB Cooperation). Furthermore, only a few of these collaborations centered on adaptation or had adaptation benefits.

This latest report advances the understanding of adaptation finance collaboration between DFIs/MDBs and NDBs in EMDEs by:

- Identifying challenges that hinder collaboration between DFIs/MDBs and NDBs for adaptation.

- Offering recommendations to increase the quality and quantity of collaboration on adaptation finance.

Current status and challenges to collaborations for adaptation

PDBs have a growing interest in initiating collaborations on adaptation finance. Collaboration between different kinds of PDBs could strengthen their internal capabilities to either begin or increase their engagement with adaptation, mainstreaming of climate risks, and tracking of adaptation finance.

Very few of the collaborations between PDBs reviewed for this report envisioned adaptation benefits as the primary outcome of the transaction. While many of the transactions delivered adaptation and resilience benefits, this was not typically their central focus. Rather, adaptation was commonly considered to be a co-benefit and was most frequently bundled with other end-uses, such as mitigation or disaster risk reduction.

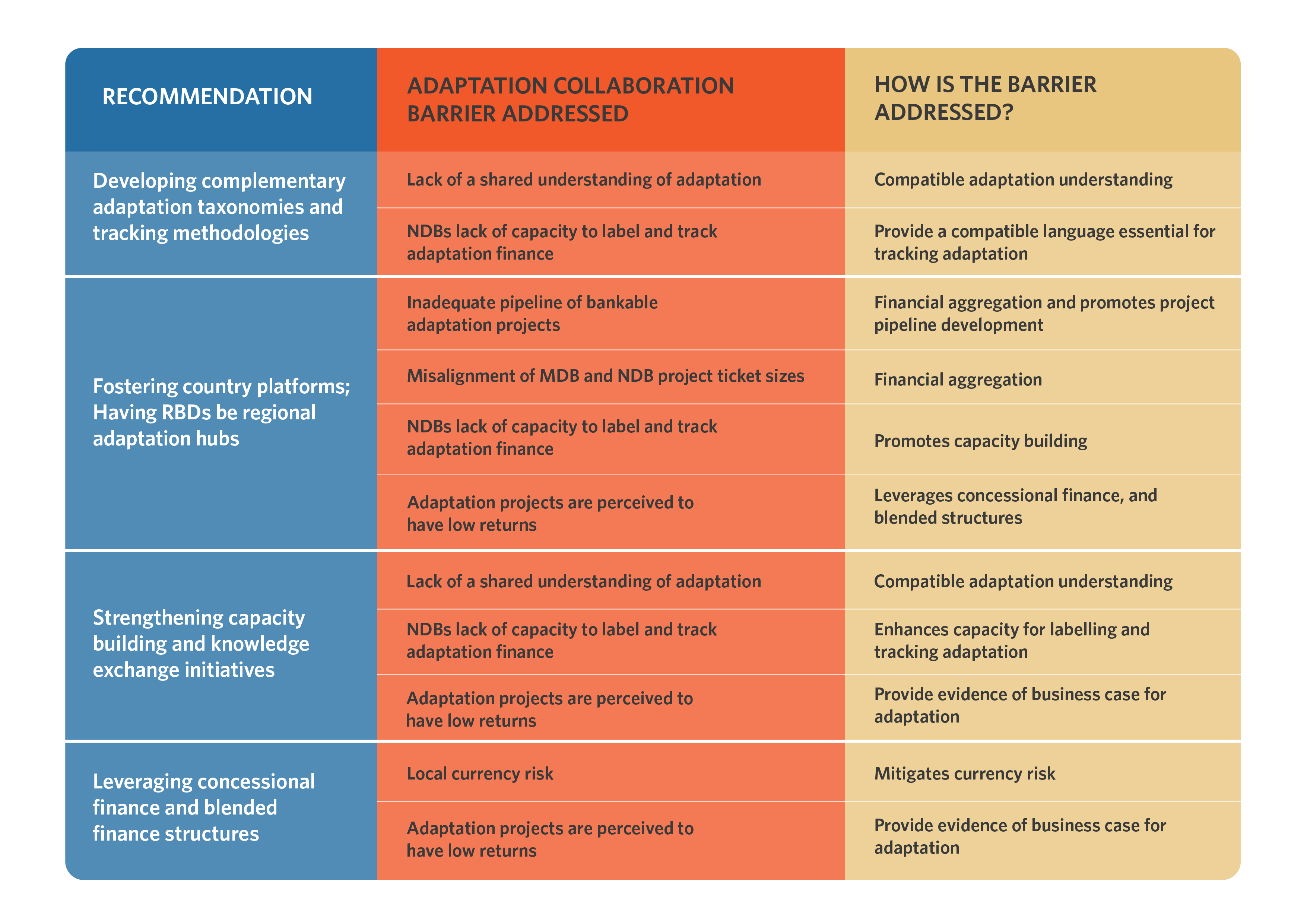

This report identifies barriers that hinder collaboration between DFIs/MDBs and NDBs for climate adaptation. Challenges for NDBs’ cooperation with DFIs/MDBs include a lack of shared understanding with smaller NDBs on what qualifies as adaptation finance, long and complex processes to apply to their DFI/MDB funds, and a focus within DFI/MDBs on projects with large ticket sizes. Meanwhile, NDBs face a lack of capacity to track adaptation finance, an inadequate pipeline of bankable projects, an internal perception that adaptation projects have lower returns, and local currency risk.

Recommendations to strengthen collaboration

This report offers the following recommendations to improve the quality and quantity of DFI/MDB-NDB adaptation finance collaborations:

1. COMPLEMENTARY Adaptation Taxonomies

Developing taxonomies that are both complementary and context-specific can provide a foundation for DFIs/MDBs and domestic PDBs in EMDEs to forge a common understanding for defining and tracking adaptation.

2. COUNTRY PLATFORM APPROACHES

Country platform approaches hold the potential to better align international adaptation finance flows with national adaptation needs through enhanced coordination.

3. REGIONAL ADAPTATION HUBS

Where country platforms are not appropriate, regional development banks (RDBs) could play a role as regional adaptation hubs, aggregating context-specific adaptation financing needs, international financing, and gaps in capacity development.

4. CAPACITY-BUILDING and knowledge-sharing

Enhancing capacity-building and knowledge-sharing initiatives can deepen adaptation finance understanding and facilitate the effective implementation of adaptation projects in EMDEs. In particular, this support can enable:

- Common understanding of definitions and applications of adaptation.

- NDBs to more effectively track and label adaptation finance.

- Proof-of-concept for the return profiles of adaptation projects.

5. Blended finance

By leveraging concessional finance and their expertise in blending finance, MDBs can play a pivotal role in de-risking international adaptation finance to bolster the business case for adaptation.

A summary of these recommendations is shown in the figure below.