The South African Climate Finance Landscape 2023: Interactive Data Visualization

Tracked annual climate finance reached R131 billion p.a. on average in 2019 - 2021, an all-time high, but still far from the annual estimated needs of R334 - R535 billion p.a.

Climate finance commitments more than doubled from 2017 to 2021, with annual average of R62 billion p.a. for years 2017 and 2018; vs annual average of R131 billion p.a. for years 2019, 2020 and 2021.

Although we saw an increase in climate finance tracked...

...it still needs to increase by at least three

to fivefold to achieve the country’s climate objectives.

South Africa currently requires on

average ~R334 billion p.a. and ~R535 billion p.a. to meet net zero by 2050 and NDC by 2030,

respectively.

Domestic sources of climate finance in South Africa accounted for 91% (R119 billion p.a.).

With the remaining 9% (R12 billion p.a.) coming from international sources.

Private actors were the predominant source of climate finance in South Africa (86%) with the public sector accounting for 14%. The direct inverse is observed in Africa as a whole.

By sector, clean energy attracted 53% of tracked public climate finance, followed by agriculture, fisheries, forestry and land use (26%). Clean energy secured 65% of tracked private climate finance followed by energy efficiency and demand side management (DSM) (19%).

Debt emerged as the predominant financial instrument for climate finance with 75% (R98 billion p.a.); with grants and concessional finance accounting for approximately 3% combined.

South Africa’s high allocation to debt (75%) in relation to Africa (28%) and global figures (53%), suggests climate finance in South Africa, at an average cost of debt between 10% and 12% p.a., is comparatively expensive.

Climate mitigation emerges as the primary end-use sector representing 81% (R106 billion p.a.) of total tracked climate finance. Adaptation finance accounted for 12% (R16 billion p.a.), and dual benefits accounting for 7% (R9 billion p.a.) Adaptation remains well below the African continent average of 39% (CPI 2022).

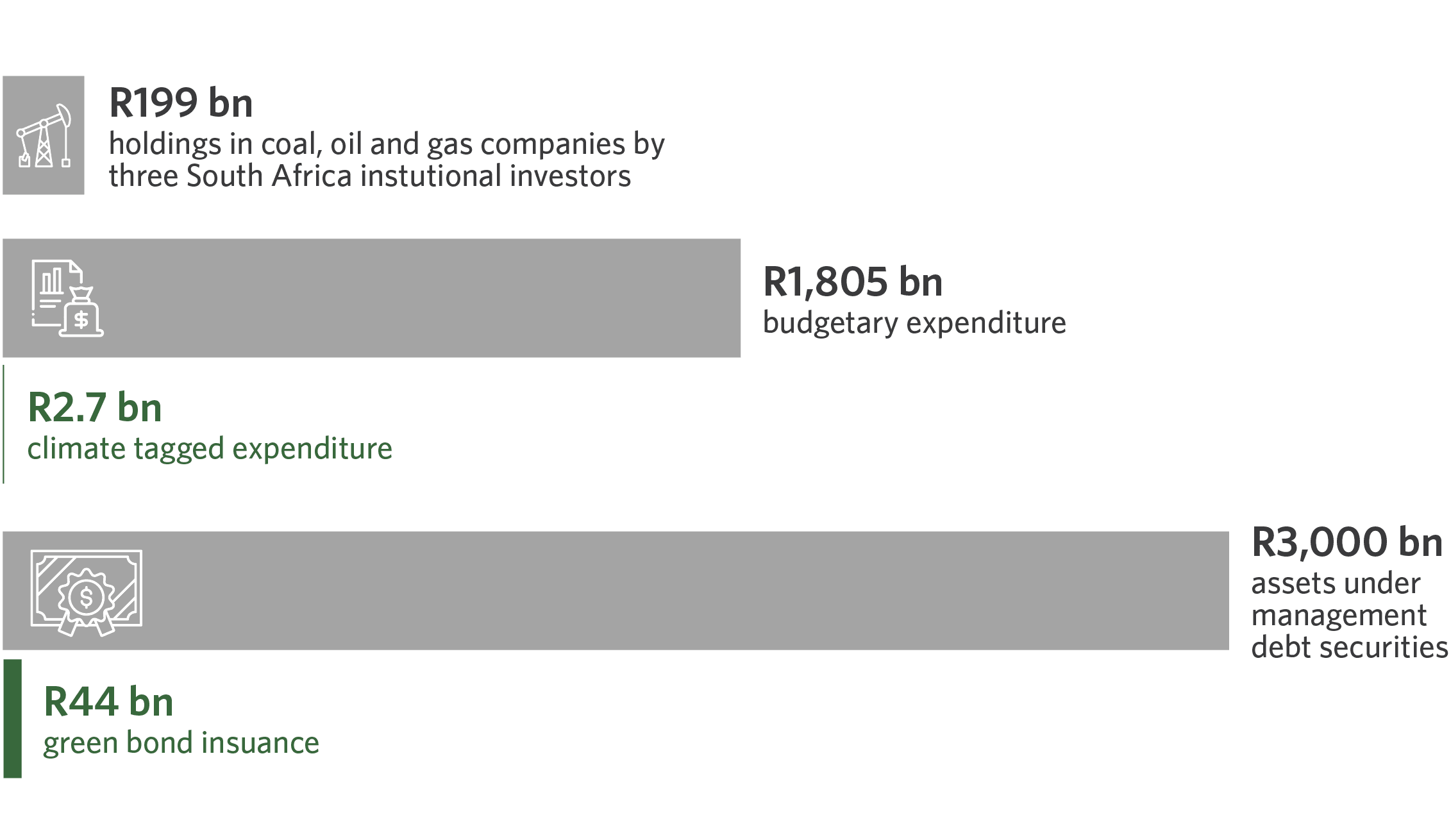

There is significant misalignment between climate finance needs and financial flows, globally as well as for South Africa. For example, South Africa spent an average of USD 3.9 billion annually on fossil fuel subsidies between 2019 and 2021. Green flows such as climate-tagged budgetary expenditure and green bonds are dwarfed by other financial flows in South Africa, including fossil fuel investment.

Key Recommendations

1. Scale the pipeline of investment-ready low-carbon and climate-resilient projects.

2. Prioritize and scale concessional finance to target less mature technologies and hard to-abate sectors.

3. Scale international risk-sharing mechanisms and innovative finance solutions to stimulate investment.

4. Enhance and strengthen government budget tracking, measurement, reporting, and verification systems.

5. Awareness, capacity building and alignment must be the centre points of a coordinated effort from all stakeholders.

6. Public and private sector investors can take steps to price climate risk into investment decisions.

Explore the Data