The Amazon Food&Forest Bioeconomy Financing Initiative, developed by Impact Bank and The Nature Conservancy Brazil (TNC), provides financial support through a fintech platform that aims to enhance the bankability of local regenerative businesses. The initiative aggregates cross-sectoral projects and fosters partnerships with ecosystem enablers to help promote the development of socio-bioeconomy businesses.

ABOUT

The Amazon rainforest faces an urgent threat from land-use conversion, which primarily involves turning forests into farmland, urban areas, and mining sites. It is the main source of Brazilian greenhouse gas emissions, accounting for 48% of total emissions. This representation increases to 79% when evaluating Amazonian states.

Indigenous Peoples and Local Communities (IPLC)-led sustainable ventures, such as forest product sourcing, community-based tourism, clean energy development, and arts and crafts, are examples of businesses that make up the socio-bioeconomy. These ventures can play a significant role in supporting regenerative practices in the region.

However, micro, small, and medium-sized enterprises (MSMEs), cooperatives, and associations often face challenges in accessing capital to grow their businesses. Private investors are also hesitant to invest due to the high risks associated with small-scale projects and a lack of track record.

INNOVATION

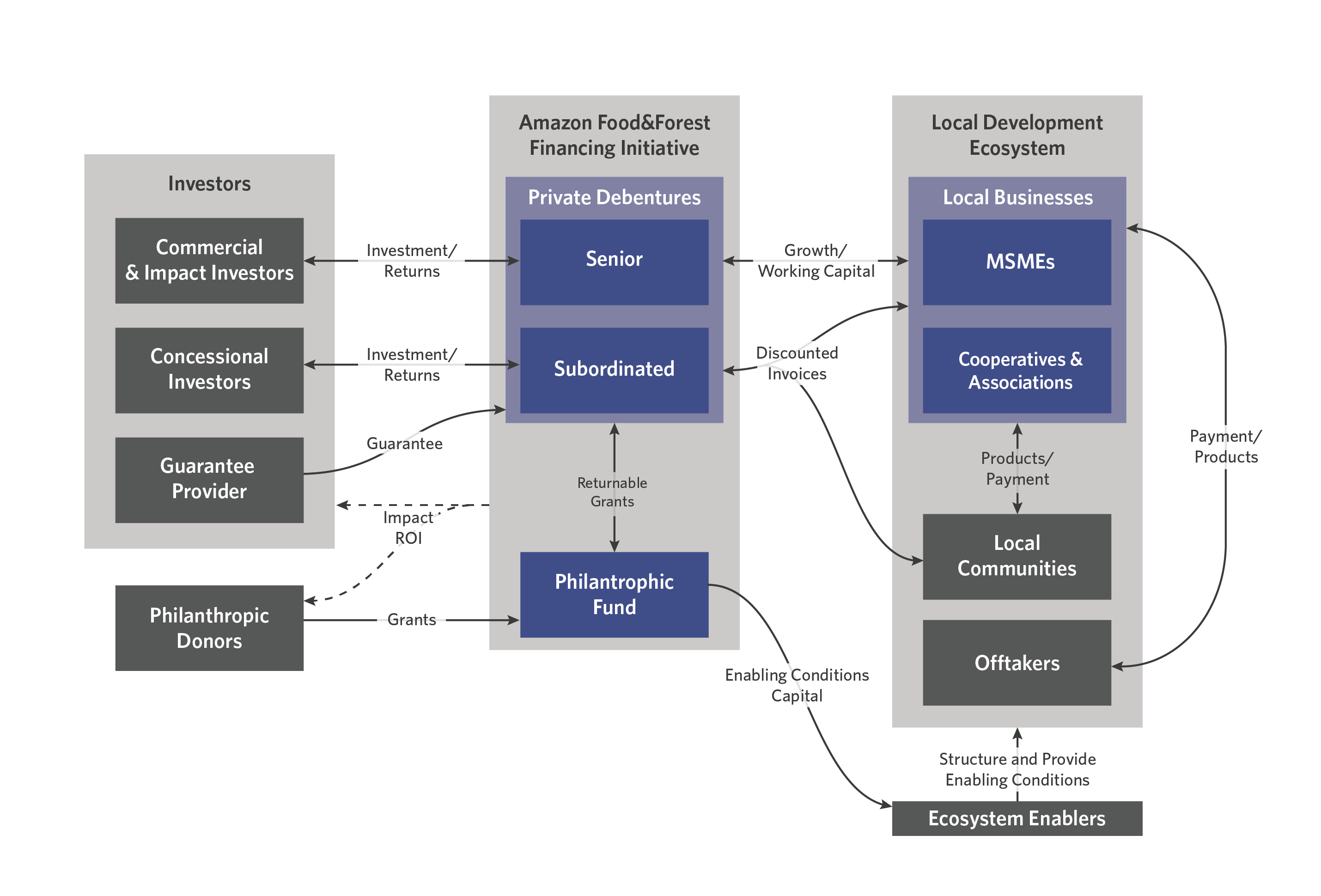

Amazon Food&Forest directly tackles the credit access barrier by transforming non-bankable community projects into investable opportunities. Its simple, cost-effective and flexible blended finance model combines private, concessional, and philanthropic capital to bridge the financial gap and provide much-needed resources to MSMEs, cooperatives, and Indigenous communities. The vehicle aggregates these small-scale projects into a bankable pipeline, in collaboration with local partners (ecosystem enablers). It is anchored in an inclusive banking technology, and it also encompasses an impact management platform – solutions that promote investment risk management and attract larger investors for the initiative. This approach unlocks capital for the socio-bioeconomy and fosters sustainable development and rainforest conservation.

“To unlock the full potential of the Socio Bioeconomy, blended finance approaches are a vital catalyst to tackle a financial flow gap in support of thriving community-led economies. The Lab is the perfect environment and a very unique opportunity to improve the strategy and maximize the scale and the impact of the Amazon Food & Forest Financing Initiative.”

Gabriel Ribenboim, Co-founder & CEO of Impact Bank

“We hope to nurture a long-term relationship with the Lab, as climate finance instruments must incorporate lessons learned and evolve, both in terms of products and scale. We also expect to increase our network, build up expertise, and expose the instrument to different sources of capital holders and policymakers.”

Marina Aragão, Economics & Finance Lead – Brazilian Amazon at TNC Brazil.

IMPACT

Amazon Food&Forest Pilot Phase has 17 pilots planned in different conservation units and IPLC lands in Brazil. The consecutive market phase establishes the instrument structure, combining philanthropic and concessional capital to derisk the commercial impact investments. This approach, modeled to increase ticket sizes, aims to attract private investments through portfolio risk management. The phase’s goal is to raise USD 23.12 million and expand activities across various socio-bioeconomy value chains within conservation units and IPLCs territories in the Brazilian Amazon biome.

The support provided to businesses and IPLCs in Amazon’s socio-bioeconomy will improve livelihoods and biodiversity and avoid land-use emissions measured and reported. Proponents will use indicators to measure carbon avoidance and removals, hectares of conserved areas, increase in women`s involvement, people impacted, and revenue increase for families and businesses.

DESIGN

The Amazon Food&Forest Bioeconomy Financing Initiative creates a unique investment vehicle by combining:

• Private debentures issued in two tranches: This debt instrument will have (1) a senior tranche for commercial and impact investors seeking rates near to commercial returns and (2) a subordinated tranche for concessional investors.

• Philanthropic fund: Managed by the proponents, the fund will support (1) set-up costs and operational expenses of the whole mechanics; (2) technical assistance funding for the ecosystem enablers; (3) additional funding for the subordinated tranche as returnable grants, to incentive private capital, and a (4) provision of guarantee.

This dual structure is essential for the local development. While some MSMEs can assume debt, the underlying communities, associations, and cooperatives require philanthropic capital to improve governance, management, and other local needs. The combination of private debentures and the philanthropic fund will allow the Amazon Food&Forest Bioeconomy Financing Initiative to create clear incentives for locally grounded sociobioeconomic businesses.