Climate finance has demonstrated remarkable resilience and growth amid global crises, reaching USD 1.46tn in 2022. Its upward trend has persisted through the COVID-19 pandemic and subsequent economic recovery efforts, as well as elevated inflation rates, and international conflicts.

The need to raise climate action is more urgent than ever. The projected economic losses that can be avoided by 2100 by realizing a 1.5°C warming scenario are estimated to be 5x greater than the climate finance needed by 2050 to achieve it (CPI, 2024a). While climate finance needs will likely ease beyond 2050, economic damages under a BAU scenario will continue to exponentially increase in the future.

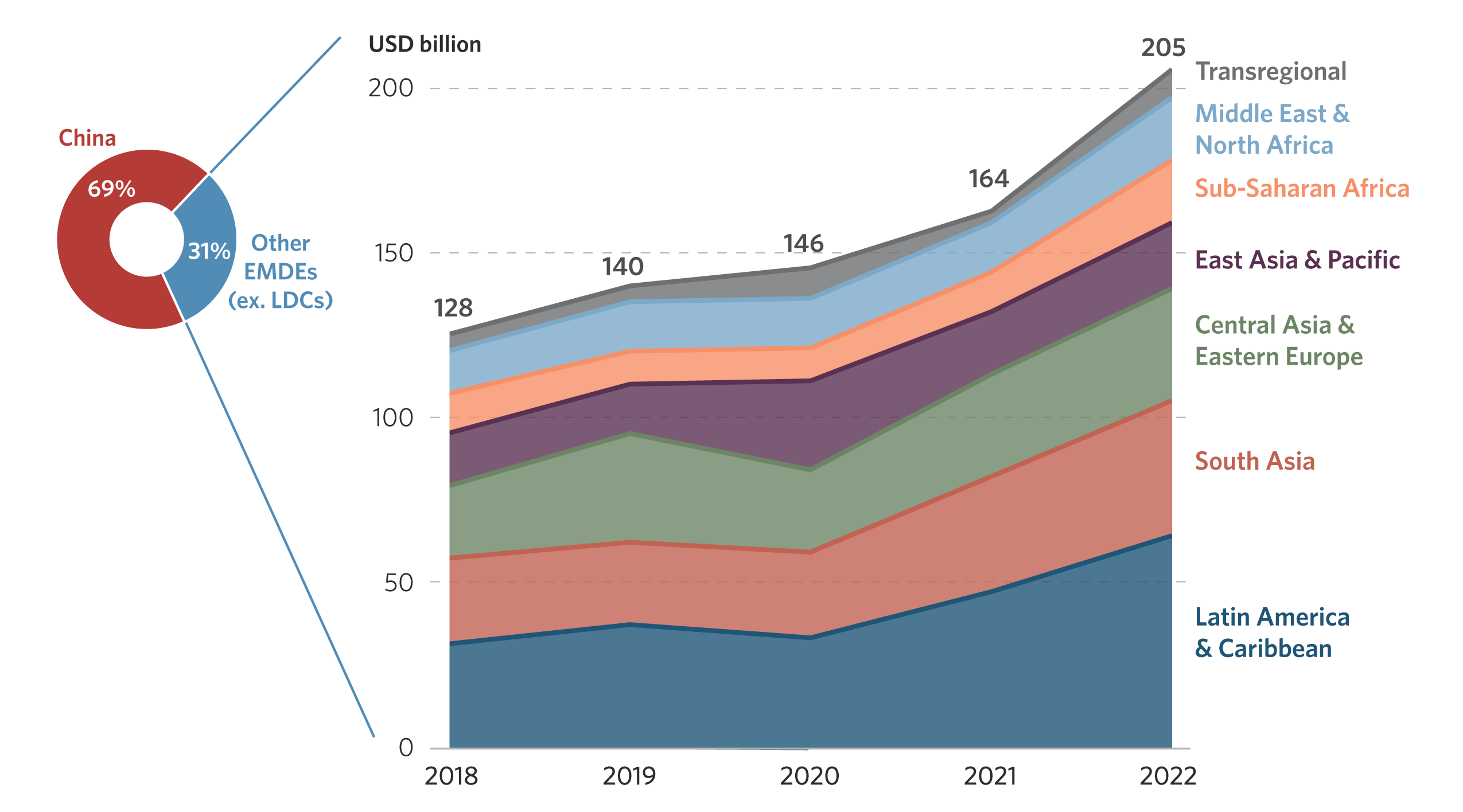

Increases in climate finance have been inconsistent across economies.

Climate finance growth slowed in many of the EMDEs (ex. LDCs) between 2018 and 2020 amid pandemic-constrained public budgets, interruptions to operations and implementation of projects, and worsened borrowing conditions (IMF, 2022a). EMDEs (ex. LDCs) in sub-Saharan Africa and LAC were hit particularly hard, with their climate finance in 2020 falling below 2018 levels.

Between 2020 and 2022, a more favorable economic climate and strong performances in a handful of countries led to an increase in climate finance to EMDEs (ex. LDCs). Over this period, climate finance to EMDEs (ex. LDCs) in sub-Saharan Africa increased from USD 10bn to USD 19bn. In South Asia, climate finance grew from USD 26bn to USD 41bn.

Increases in private funding to energy systems contributed to the private sector supplying over 50% of mitigation finance over 2018 to 2022 in EMDEs (ex. LDCs) in several regions, including LAC, South Asia, Central Asia and Eastern Europe, and MENA.

Aside from China, where 98% of climate finance flows domestically, many EMDEs (ex. LDCs) struggle to mobilize domestic climate finance. However, a number of countries made significant progress in overcoming this challenge between 2018 to 2022.

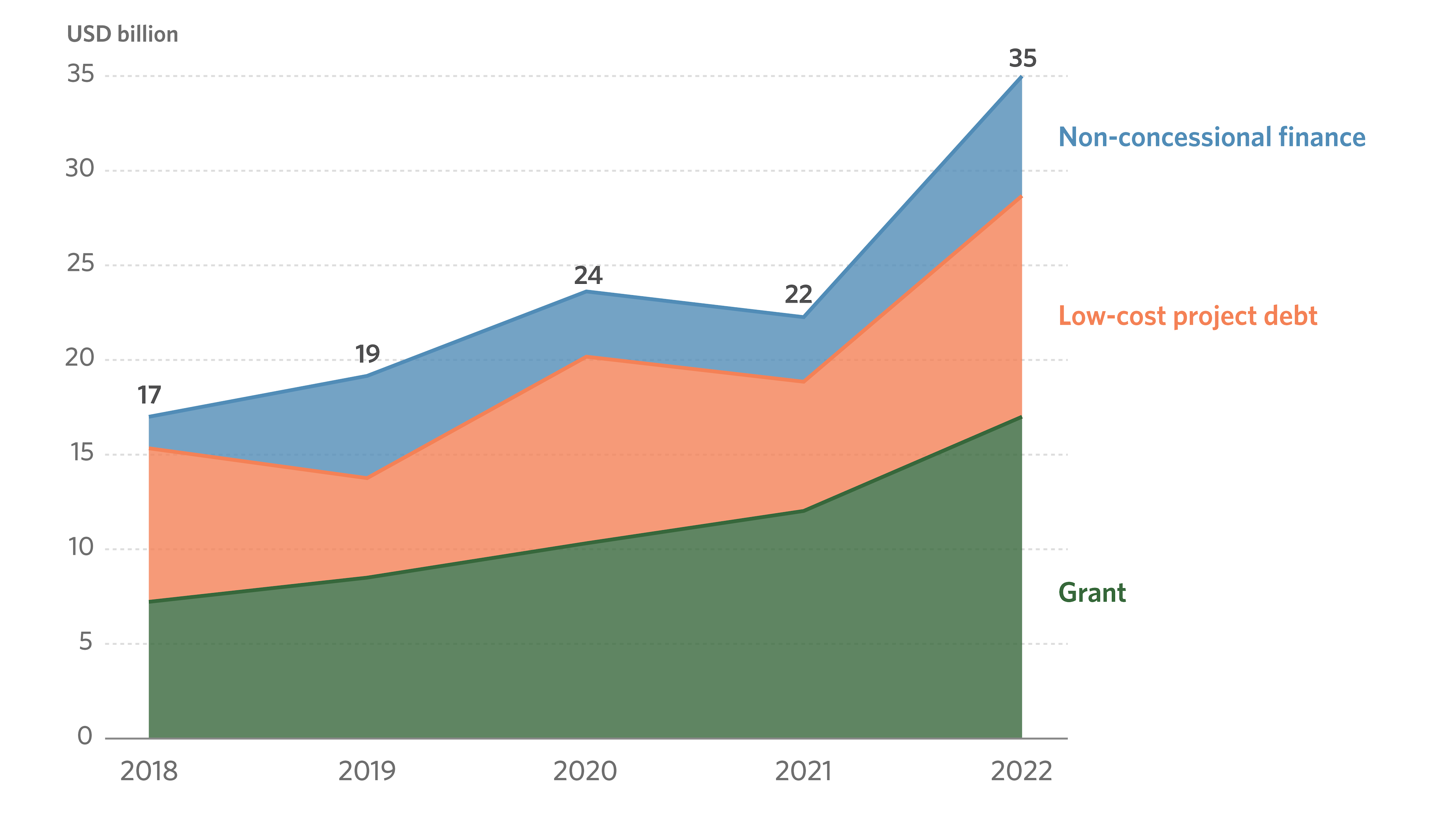

Total climate finance to LDCs reached USD 39bn in 2022. This marks a significant increase from 2018 levels, where climate finance totaled just USD 19bn—more than doubling over the five years.

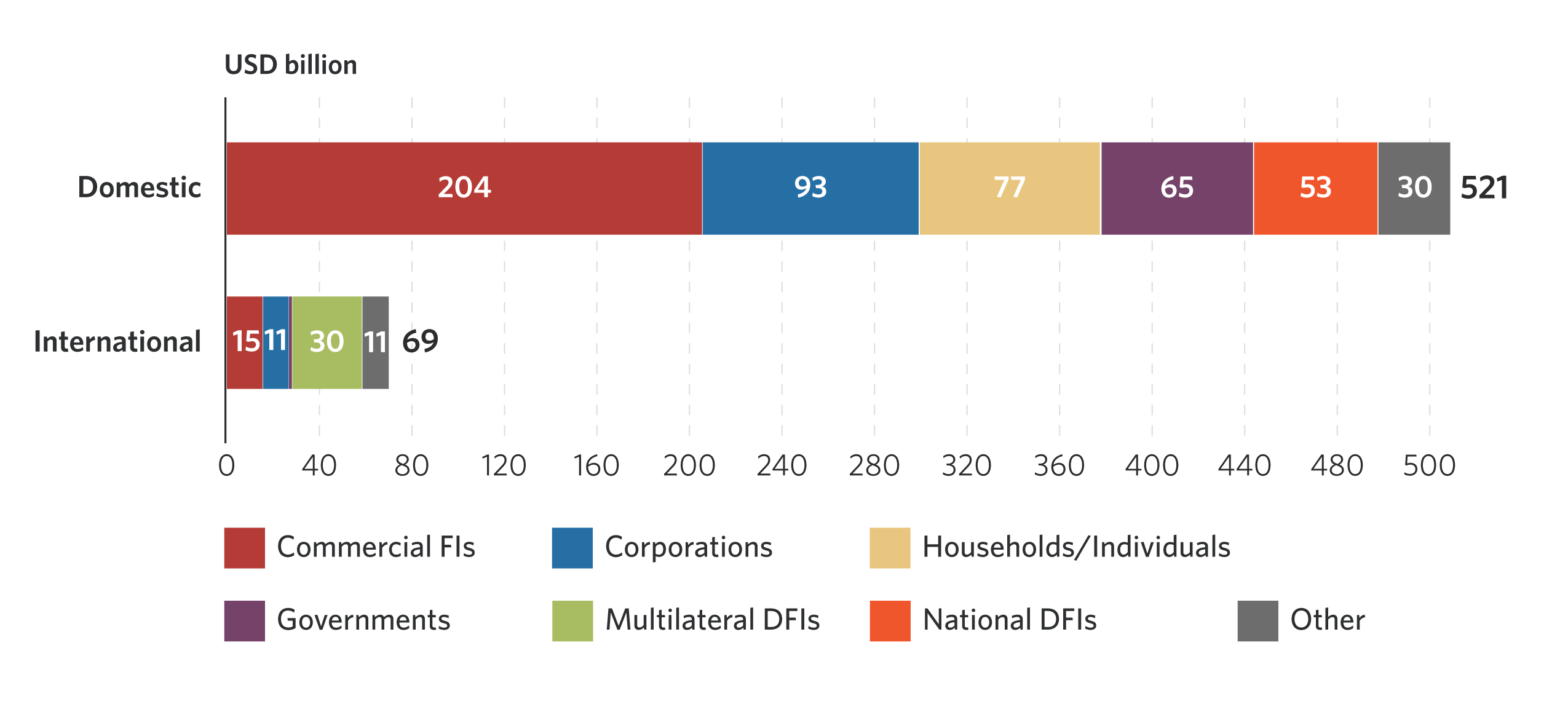

Advanced economies have seen substantial growth in climate finance, from USD 342bn in 2018 to USD 589bn in 2022, a 15% CAGR.

Several factors contributed to this sustained growth, including government stimulus packages, significant domestic public policy support in key sectors such as transport and buildings, and availability of more commercial opportunities.

Domestic climate finance in advanced economies grew from USD 294bn in 2018 to USD 521bn in 2022, representing 88% of total climate finance in these countries.