Realizing the potential of the Resilience and Sustainability Facility

The Resilience and Sustainability Trust (RST) of the International Monetary Fund (IMF) has the potential to help low- and middle-income countries (LMICs) enhance long-term economic resilience to climate change and other structural challenges. It was established in 2022 to help countries integrate climate considerations into their macroeconomic policies and create an enabling environment for the mobilization of climate finance. The RST’s operational arm—the Resilience and Sustainability Facility (RSF)—provides affordable, long-term loans to help countries strengthen fiscal buffers and make structural reforms that advance the RST’s objectives.

The global climate crisis demands major reform of the international financial architecture to mobilize finance for emissions reduction and global resilience. The IMF is evolving its role in this broader finance system through instruments like the RST.

RSF programs require collaboration among a broad set of stakeholders, as they involve reforms in policy areas beyond the IMF’s traditional focus. While the IMF has been incorporating climate considerations into its analysis and programming for years (see Figure ES1), its primary mandate is to support global macroeconomic and financial stability. It is still evolving its operational frameworks to accommodate avenues for collaboration with ministries responsible for sectors affected by climate change and the low-carbon transition, as well as with development partners that can finance macro-critical climate investments.

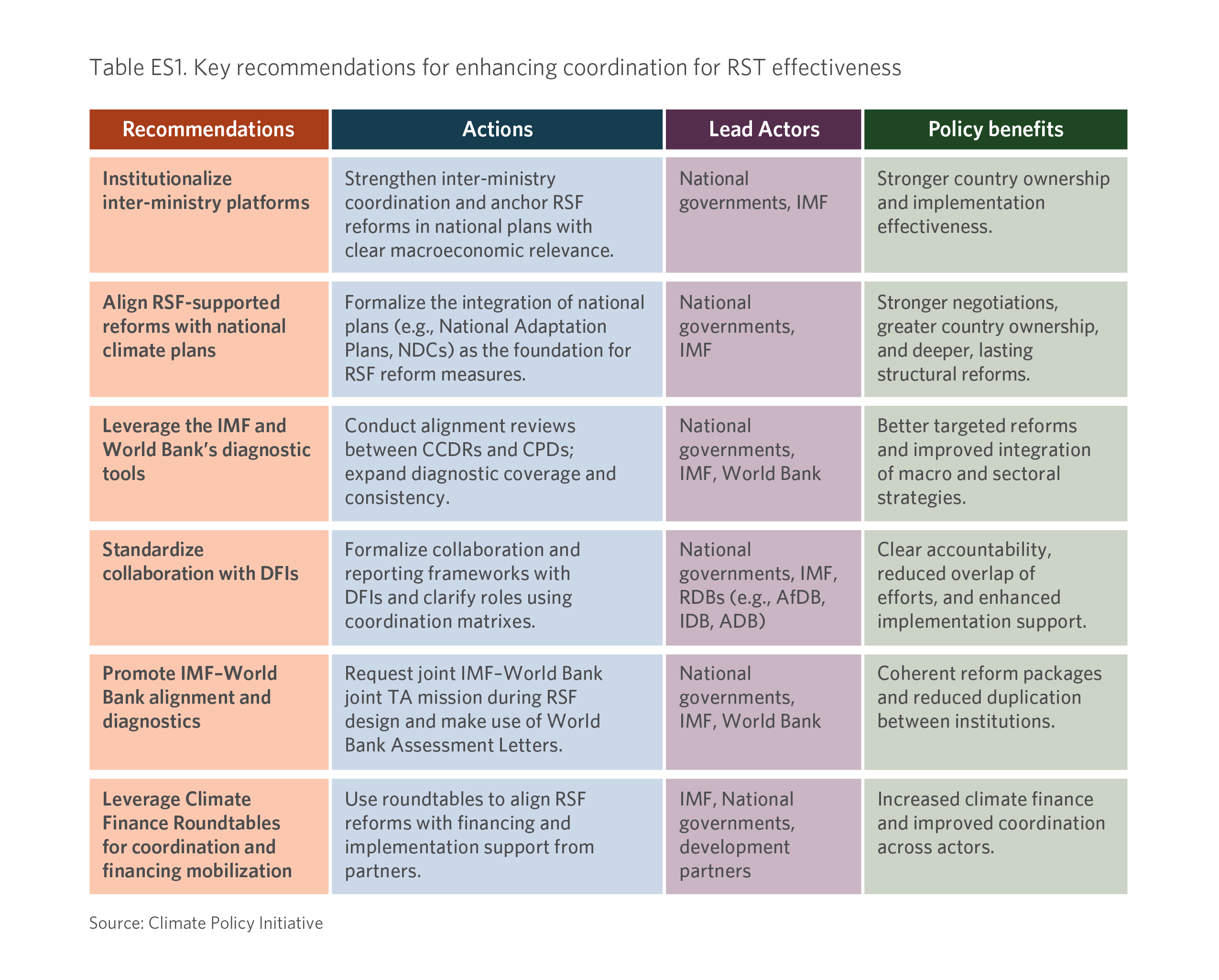

This paper outlines recommendations to enable the IMF, national authorities, and development partners to leverage their distinct expertise to strengthen macroeconomic stability while addressing climate risks. While finance ministries will lead on RSF implementation, they will require meaningful inputs from other institutions, including sectoral ministries and development partners.

This primer has three objectives:

- Identify the central mechanisms through which the RSF coordinates with key domestic and international actors.

- Assess how these mechanisms contribute to the RSF’s effectiveness in addressing climate-related challenges.

- Identify opportunities to improve these mechanisms to fully realize the RSF’s potential.

By providing guidance on improving these coordination mechanisms, this paper aims to empower recipient countries to leverage their engagement with the RSF to implement macroeconomic policy frameworks that are truly suited to addressing climate change.

This study focuses on a critical but often overlooked question: How can effective stakeholder coordination improve RSF implementation and impact?

KEY FINDINGS ON COORDINATION

NATIONAL AUTHORITIES

Stronger engagement between finance ministries, sectoral ministries, and the RSF can maximize its impact. While the IMF primarily engages with finance ministries and central banks, RSF programs require collaboration across sectoral ministries to integrate climate risks and goals into macroeconomic reforms.

However, misalignment with national climate plans, limited sectoral ministry involvement, and overlapping climate initiatives can impede RSF implementation. Governments can use the following engagement tools to help address these challenges:

- Institutionalizing inter-ministry platforms can engage sectoral ministries in the design and implementation of national RSF programs. Structured coordination enhances policy alignment, reform implementation, and monitoring, as demonstrated by examples including Bangladesh’s National Committee for Environment and Climate Change, the Barbados Blue Green Bank, and Senegal’s Green Taxonomy initiative.

- Aligning RSF-supported reforms with national climate plans can embed national priorities in RSF measures and drive deeper structural reforms. This was the case with Bangladesh’s National Adaptation Plan, Barbados’s Economic Recovery Plan, and Senegal’s development strategy.

- Leveraging the IMF and World Bank’s diagnostic tools can complement national climate strategies and enhance the design of well-integrated climate resilience policies.

DEVELOPMENT PARTNERS

Stronger collaboration among the RSF, World Bank, regional development banks (RDBs), and bilateral development finance institutions (DFIs) can increase program impacts. These development partners support RSF design and implementation by (1) providing complementary sectoral expertise, (2) capacity building, and (3) financing for long-term climate projects.

However, inconsistent coordination, weak engagement with RDBs, and uneven implementation of the World Bank-IMF Enhanced Framework—particularly in the use of joint diagnostic tools—hinder RSF implementation.

To address these challenges:

- Development partners can adopt standardized collaboration frameworks, especially in regions with weak RDB-IMF cooperation.

- National governments should promote IMF–World Bank alignment and joint diagnostics by securing technical assistance (TA) for policy integration, coordinating diagnostics between the IMF and the World Bank, and advocating for joint reporting.

CATALYZING CLIMATE FINANCE

The IMF can mobilize climate finance through two key channels: (1) Macro-critical climate reforms and (2) IMF Climate Finance Roundtables. By helping countries to integrate climate risks into fiscal planning, public financial management, and financial sector resilience, the RSF improves investment conditions and catalyzes private sector participation. It also leverages the IMF’s convening power through Climate Finance Roundtables, which provide a platform for governments, development partners, and private actors to align investments with national priorities to scale up climate finance. However, the following challenges limit its effectiveness:

- RSF reforms often focus on procedural rather than structural changes, limiting their impact on investment conditions. It is unclear whether RSF arrangements drive additional public investment beyond existing commitments.

- The inconsistent implementation of Climate Finance Roundtables weakens the ability to shape policy and mobilize private capital. Only ten of the 21 RSF recipient countries have held roundtables. Limited country ownership, weak stakeholder engagement, and resource constraints also reduce impact.

To maximize the RSF’s catalytic role, the IMF, national governments, and development partners should leverage Climate Finance Roundtables by adopting structured approaches to coordination financing mobilization and long-term institutionalization. Case studies from Barbados, Bangladesh, and Rwanda demonstrate how improved coordination can attract additional financing from multilateral development banks, the Green Climate Fund, and private investors.