What Is Agriculture Risk Management?

Agriculture risk management encompasses the rural insurance sector and other risk management instruments, protecting rural production against adverse climate events. With the increased frequency and intensity of extreme weather events, agriculture has become increasingly vulnerable. Protecting producers from damage caused by major droughts or floods makes it possible to resume farming in subsequent harvests. This chapter accounts for rural insurance flows guided by public policy support for subsidies aimed at increasing resilience in the countryside, including PROAGRO, the PSR, and the Crop Guarantee Fund.

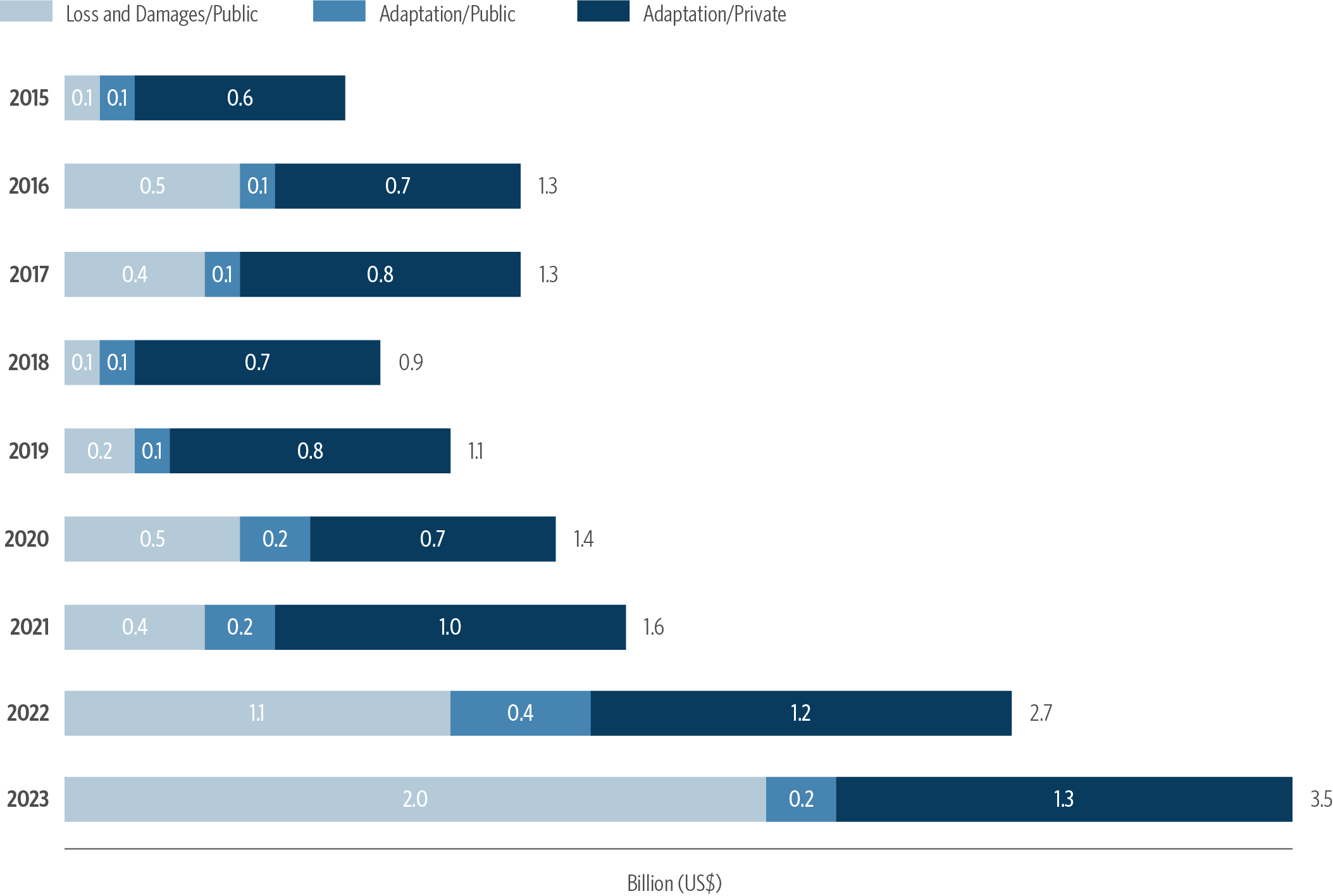

Between 2021 and 2023, agricultural risk management instruments that were aligned with climate objectives totaled US$ 2.6 billion per year. Of this total, US$ 1.4 billion per year (55%) came from public sources. This significant public participation is mainly explained by resources for loss and damages, amounting to US$ 1.2 billion per year (44%). These amounts are associated with compensations paid by federal programs, such as PROAGRO and the Crop Guarantee Fund, to cover agricultural losses resulting from climate events. Figure 8 shows the growth in agricultural risk management flows, segmented by climate use and source of funds.

Figure 8. Climate Finance for Agriculture Risk Management, by Source of Funds and Climate Use, 2015-2023

Source: CPI/PUC-RIO based on data from /BCB (2023), Siop/MPO (2023), MAPA (2023) and SES/SUSEP (2023), 2024

In Brazil, agricultural risk management is encouraged by public policies, as is rural credit. The main programs in this area are PSR, PROAGRO, Crop Guarantee Fund, and the Minimum Price Guarantee Policy (Política de Garantia de Preços Mínimos – PGPM) each with different forms of operation, objectives, and target beneficiaries.[1]

These instruments are the main mechanisms for climate adaptation in the area of land use, as they increase the resilience of agriculture activities and reduce vulnerability to adverse climate events, such as excessive rainfall and droughts (Chiavari et al. 2023).[2]

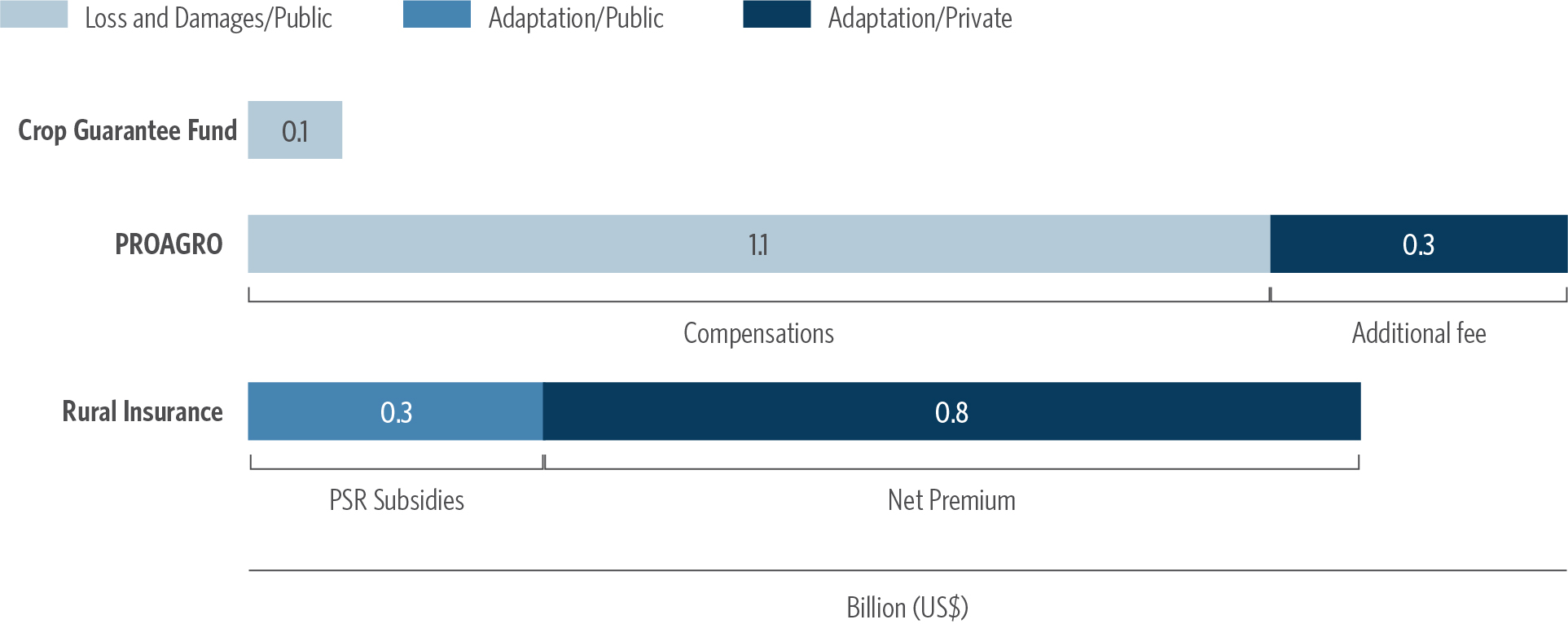

Figure 9. Climate Finance for Agriculture Risk Management by Type and Source of Resource, 2021-2023

Note: The figures refer to the annual average, adjusted as per the IPCA, with reference to December 2023. The additional fee is similar to the “premium” paid when taking out insurance. In PROAGRO, this fee is calculated as a rate of the total amount to be covered by PROAGRO (BCB 2022).

Source: CPI/PUC-RIO with data from Sicor/BCB (2023), Siop/MPO (2023), MAPA (2023) and SES/SUSEP (2023), 2024

Despite the growth in loss and damages finance, adaptation continues to be the main use of climate finance for agricultural risk management, at US$ 1.4 billion per year. This figure represents 54% of climate finance for land use adaptation spending in Brazil over the period. The PSR was responsible for 78% of these flows, amounting to US$ 1.1 billion per year. PROAGRO, mobilized 22% of the flows for adaptation, with US$ 0.3 billion per year.

Agriculture Guarantee Program (PROAGRO)

PROAGRO exempts producers from fulfilling their financial obligations in credit operations rural costing and compensates them for their own resources used for production operating expenses in the event of losses due to adverse climate events. Although the financial institutions are responsible for the program’s operations, the risks are assumed by the federal government since public resources are contributed to the PROAGRO fund to guarantee the payment of compensations (Souza, Pereira, and Stussi 2022).

Beneficiaries can join the program by paying the PROAGRO aditional fee, which is similar to an insurance premium. It is calculated annually by the National Monetary Council (Conselho Monetário Nacional – CMN) and can be changed in accordance with the federal government’s agricultural policy (BCB 2023). Under this model, the program’s expenses are shared between rural producers, who pay the premium, and the federal government, which supplements them when the compensations exceed the amount collected with the additional premium.

PROAGRO’s additional fee, paid in precaution of climate events, is a resource for climate adaptation. In the period analyzed, the additional amount totaled US$ 315 million per year.

As the government’s contributions to the payment of compensations occur in response to climate events and aim to reduce their impacts, these are classified as loss and damages. Between 2021 and 2023, the federal government had US$ 1.1 billion per year in budget expenses for PROAGRO compensations, which rose from US$ 0.4 billion in 2021 to US$ 1.9 billion in 2023.

This sharp growth can be attributed to the recent increase in climate events impacting national agriculture. However, the program’s lack of transparency points to the possibility of fraud in the process of activating the compensations, which has led to an audit by the Brazilian Court of Accounts (Tribunal de Contas da União – TCU) (TCU 2024).

Rural Insurance Premium Subsidy Program (PSR)

The PSR, administered by the Ministry of Agriculture and Livestock (Ministério da Agricultura e Pecuária – MAPA), is a program to support the purchase of rural insurance that aims to ensure the financial recovery of producers from adverse climate events (Souza and Assunção 2020). Through the PSR, the federal government subsidizes the cost of rural insurance policies purchased from private insurers by producers. In the period analyzed, this subsidy averaged US$ 287 million per year, while the net premium paid by rural producers totaled US$ 847 million. However, the program registered a 17% drop between 2022 and 2023.

Crop Guarantee Fund

The Crop Guarantee Fund supports family farming in semi-arid regions and is integrated into the rural credit line of the National Program for Strengthening Family Farming (Programa Nacional de Fortalecimento da Agricultura Familiar – PRONAF). It offers a conditional benefit to producers living in areas that have demonstrably suffered crop losses due to drought or excessive rainfall. The government contribution to this program guarantees the resources needed to pay beneficiaries. During the period analyzed, this contribution averaged US$ 40 million per year. These funds are classified as loss and damages, as they compensate for losses caused by climate events.

The functioning of PROAGRO and PSR is analyzed in detail in a CPI/PUC-RIO report, which reveals how the design of each program generates different incentives for producers, experts, and financial agents, impacting the efficiency of public spending (Souza, Pereira, and Stussi 2022). The study shows opportunities to improve the rules of the programs, in order to reduce fraud and direct resources to more vulnerable producers and those who use more sustainable agriculture practices (See Box below).

Intensification of Climate Events and Public Policy Design

The increase in the frequency and intensity of extreme weather events is generating ever greater losses and increasing unpredictability in crops. This, in turn, increases the demand for rural insurance, as well as the compensations paid and the cost of premiums. In recent years, Brazil has faced serious climate events with strong impacts on agricultural production, such as the severe drought in the 2021/2022 agricultural year, which led to a fourfold increase in compensations compared to the previous year (Souza, Oliveira, and Stussi 2023). In 2024, the floods in Rio Grande do Sul and the worst drought in the country’s history reinforced the trend of the worsening of such events.

These extreme phenomena challenge current agricultural risk management instruments. The increase in public spending on programs such as PROAGRO shows that the current model is becoming unsustainable in the face of growing climate risk. Agricultural risk management policies need to be revised to adapt to this new reality without overburdening public accounts and, at the same time, guaranteeing protection for rural producers.

In this sense, Agricultural Climate Risk Zoning (Zoneamento Agrícola de Risco Climático – ZARC) has been adopted to define the recommended planting windows, with the aim of reducing climate risks, such as water deficit, during the crop’s exposure period in the soil. The ZARC establishes risk ranges of 20%, 30%, and 40%, to deal with the chances of climate problems occurring.

ZARC is a fundamental criterion for both PSR and PROAGRO, influencing the conditions for contracting insurance based on the sustainability techniques employed by producers. Currently, the Brazilian Agricultural Research Corporation (Empresa Brasileira de Pesquisa Agropecuária – EMBRAPA) is developing the ZARC Management Level (ZARC Nível de Manejo – ZARC NM), a more comprehensive modality that incorporates various criteria to assess the producer’s level of commitment to sustainable practices, especially in soil management.

The evolution of ZARC and the introduction of ZARC NM are strategic to increase the resilience of agricultural production, as well as to protect public accounts by ensuring that climate risks are mitigated by appropriate agricultural practices. This is expected to reduce losses associated with planting errors and ensure more effective and sustainable risk management.

The review of current programs also needs to address governance issues, such as fraud prevention, which has been a growing concern. This review should also be accompanied by policies that encourage the adoption of better agricultural practices by producers, in order to mitigate risks in the long term.

PROAGRO has recently undergone important changes. In order to encourage safer farming practices in the 2024/2025 Agricultural Plan, compensations began to vary according to the planting season, with a reduction in the amount compensated for operations in risk areas according to ZARC. For planting dates with 30% risk, there was a 25% reduction in the compensations. For planting dates with a 40% risk, there was a 50% reduction in the compensation.

In addition, the mandatory limit has been reduced to R$ 270,000 per agricultural year (US$ 54,050), from R$ 335,000 (US$ 67,063), in order to focus the program on small farmers and family farmers.

[1] The Minimum Price Guarantee Policy is a policy focused on correcting distortions in the prices of agriculture products and therefore has no direct relationship with the occurrence of climate events. As such, this policy was not included in the tracking of climate finance in this study.

[2] The analysis only includes financial flows for agriculture risk management with coverage exclusively related to climate risks, such as excessive rainfall, drought, extreme temperature variation, hail, frost, strong winds and cold winds, diseases and pests, among others. Therefore, only a subset of rural insurance policies is accounted for in the figures presented, not including, for example, producer life insurance. For more information, see Appendix II.