What Are Capital Markets and Other Financial Instruments?

This section is dedicated to tracking existing financial instruments, beyond rural credit, that are capable of attracting private investment and mobilizing the capital market for climate objectives in the land use sector. To this end and considering the scarcity of consistent and standardized data in this area, three relevant instruments were analyzed: thematic bonds, CBIOs, and the BNDES’ direct and indirect operations. As a result, the flows tracked in this section are likely to be underestimated.

Mobilizing private resources at scale is key to financing the transition to a low-carbon and resilient economy. Public resources will not be sufficient to achieve climate goals, and it is necessary to design a financial model that works with a diversity of sources—including public, private, and mixed-finance—and instruments.

This report explored the relevance of private flows directed by the Agricultural Plan in the section on rural credit. However, the climate transition depends on structuring private investments beyond rural credit, and on catalyzing them through innovative financial instruments.

There is great expectation placed upon the capital market’s potential to mobilize climate finance in the land use sector, but a lack of transparency surrounding some of the instruments used restricts the ability to map these flows. One example is the limited visibility of the climate criteria used in mechanisms such as sustainable investment funds, which prevents them from being measured and accounted for.

Thematic bonds, on the other hand, are financial assets for capital market funding aimed at projects with measurable environmental and/or social benefits, which receive external evaluations and therefore have explicit evaluation indicators and criteria, generally in line with international standards. However, these bonds represent a small portion of climate finance via the capital market, and it is necessary to expand such transparency to other sustainability financing tools

New initiatives offer greater transparency about the climate impact of financial assets. One example is the launch of B3’s[1] Green Bonds, announced in 2024, based on the Green Equity Principles of the World Federation of Exchanges (B3 2024), which establish a certification by evaluation entities for companies listed on this stock exchange or in the process of Initial Public Offering to give credibility and guarantee that they are aligned with environmental commitments. As of October 2024, only two companies have obtained such certification, but this is a promising model for proving that a company is committed to promoting sustainability.

This section explores three mechanisms that are channeling private climate finance to Brazil’s land use sector: thematic bonds, CBIOs and BNDES finance. Of tracked finance from these instruments, the bioenergy and biofuels sector received 54% (US$ 1.9 billion per year). This sector is characterized by technological and economic maturity due to robust and long-lasting public policies starting from the 1970s and involving investments in research and development, as well as considerable government subsidies, which were gradually reduced to allow the progressive entry private actors (Chiavari and Tam 2011).

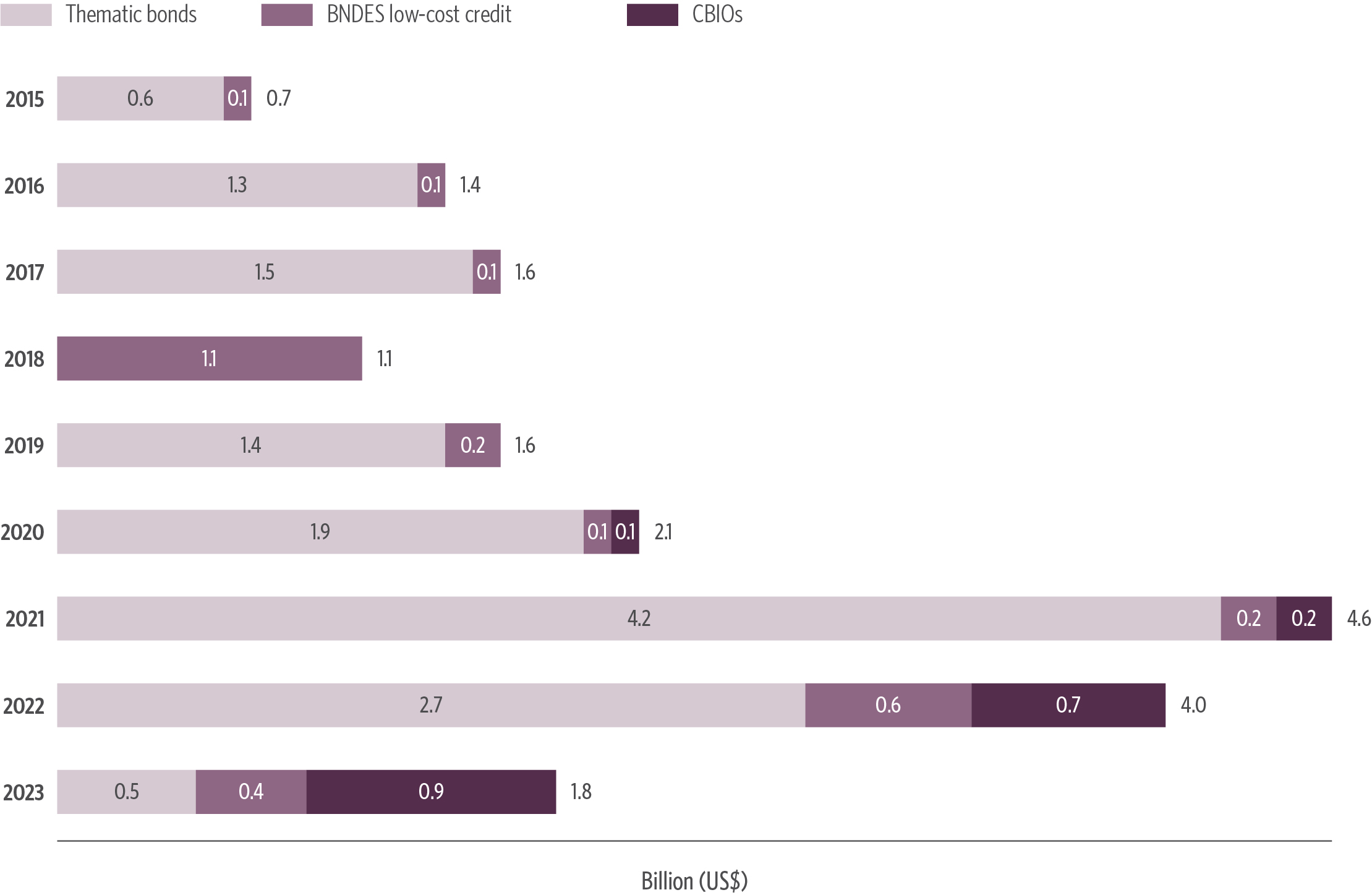

Figure 11. Capital Markets and Other Financial Instruments Flows by Instrument, 2015-2023

Source: CPI/PUC-RIO with data from BNDES (2023), B3 (2023) and NINT (2023), 2024

Thematic Bonds

Thematic bonds[2] mobilized US$ 2.5 billion per year in climate finance for land use over the period, concentrated in the biofuels and planted forest sectors. This figure represents 14% of the flows tracked—making thematic bonds the third-largest tracked instrument, behind rural credit and risk management instruments—and demonstrates the potential of the capital market for climate finance for the land use sector, despite being an insufficient instrument.

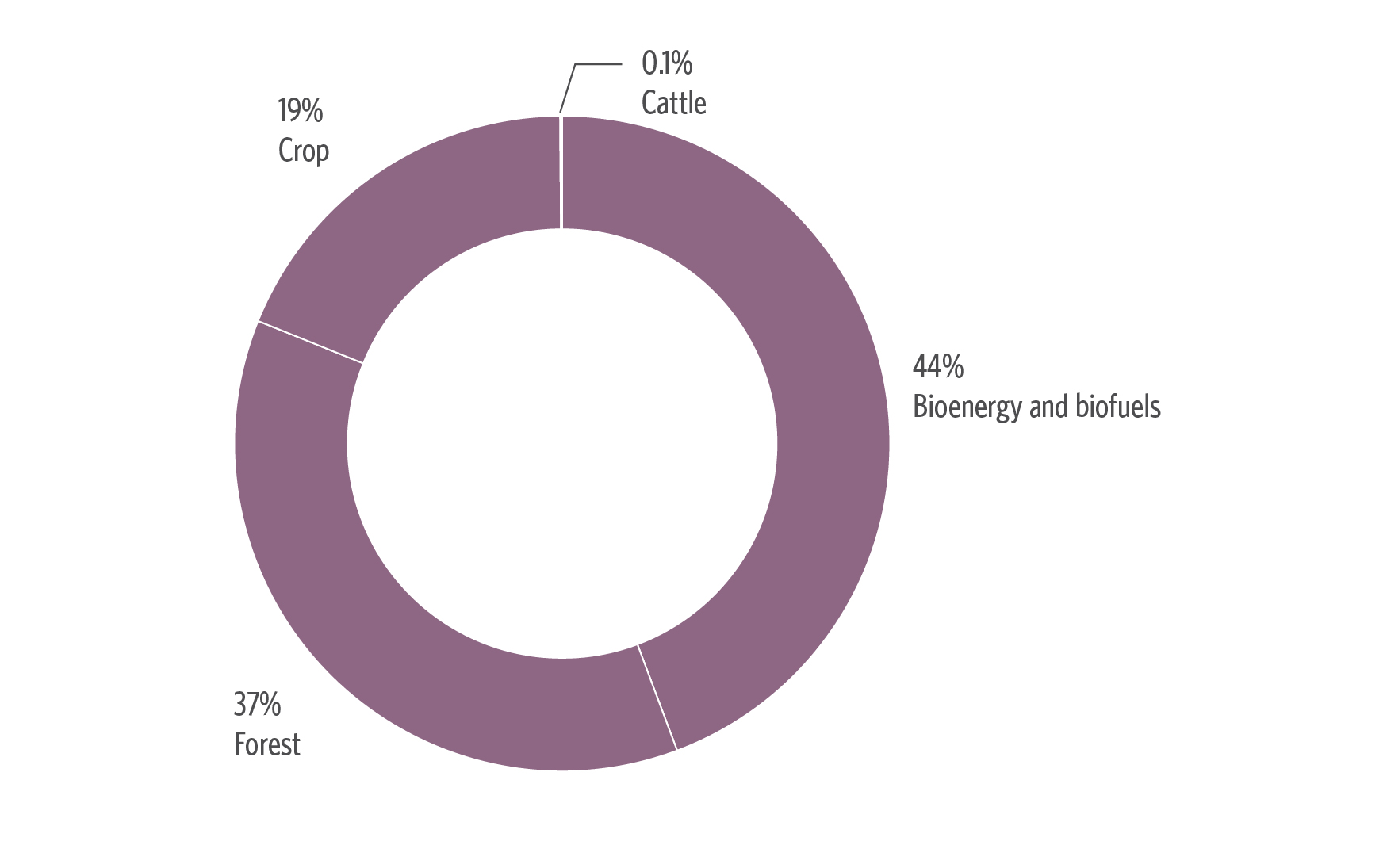

Figure 12. Climate Thematic Bonds for Land Use by Sector, 2021-2023

Source: CPI/PUC-RIO with data from NINT (2023), 2024

Between 2021 and 2023, thematic bonds mobilized US$ 1.1 billion per year for the bioenergy and biofuels sector, accounting for 44% of the finance tracked from thematic bonds. This amount was distributed across the biofuel production chain, from sugarcane cultivation to the construction of plants.

The forest sector mobilized US$ 0.9 billion per year, 37% of the tracked bonds, of which planted forests received 94%. The Suzano company[3] concentrated 86% of the forest bonds with three operations between 2021 and 2022, making commitments to reduce GHG emissions and the intensity of water use in its operations.

However, the land use share among thematic bonds issued in the country fell between 2021 and 2023. In 2021, US$ 4.2 billion were issued in bonds tracked by this report, 22% of the ESG bonds issued in the country according to the NINT database. In 2023, only US$ 0.5 billion were issued, 4% of the thematic bonds issued in the year and a drop of 89% in two years.

CBIOs

CBIOs, the main instrument of the RENOVABIO, mobilized US$ 600 million per year between 2021 and 2023. Each CBIO corresponds to one ton of carbon equivalent avoided, emitted by biofuel producers. These bonds are bought by fuel distributors, following compulsory annual individual GHG emission reduction targets determined by the Brazilian National Agency for Petroleum, Natural Gas and Biofuel (Agência Nacional de Petróleo, Gás Natural e Biocombustível – ANP) (MME 2024).

The negotiated value of CBIOs is determined by the demand established by the ANP and rose from US$ 8/CBIO on average in 2021 to US$ 22/CBIO in 2023. This increase has had a disproportionate impact on the growth in CBIO emissions, which between 2020 and 2023 financed 109 million tons of CO2 equivalent not emitted by the use of biofuels.

CBIOs represent an innovative public policy model for mobilizing resources for climate goals, using the polluter-pays and protector-recipient model to finance less polluting fuels. However, the effectiveness of this instrument has been questioned, and it was the subject of TCU Judgment no. 251/2023[4] that criticized its governance model, structure, and the effect of price instability on the market.

BNDES

Development banks, including both the BNDES and regional development banks, have great potential to attract private resources to the Brazilian climate agenda.

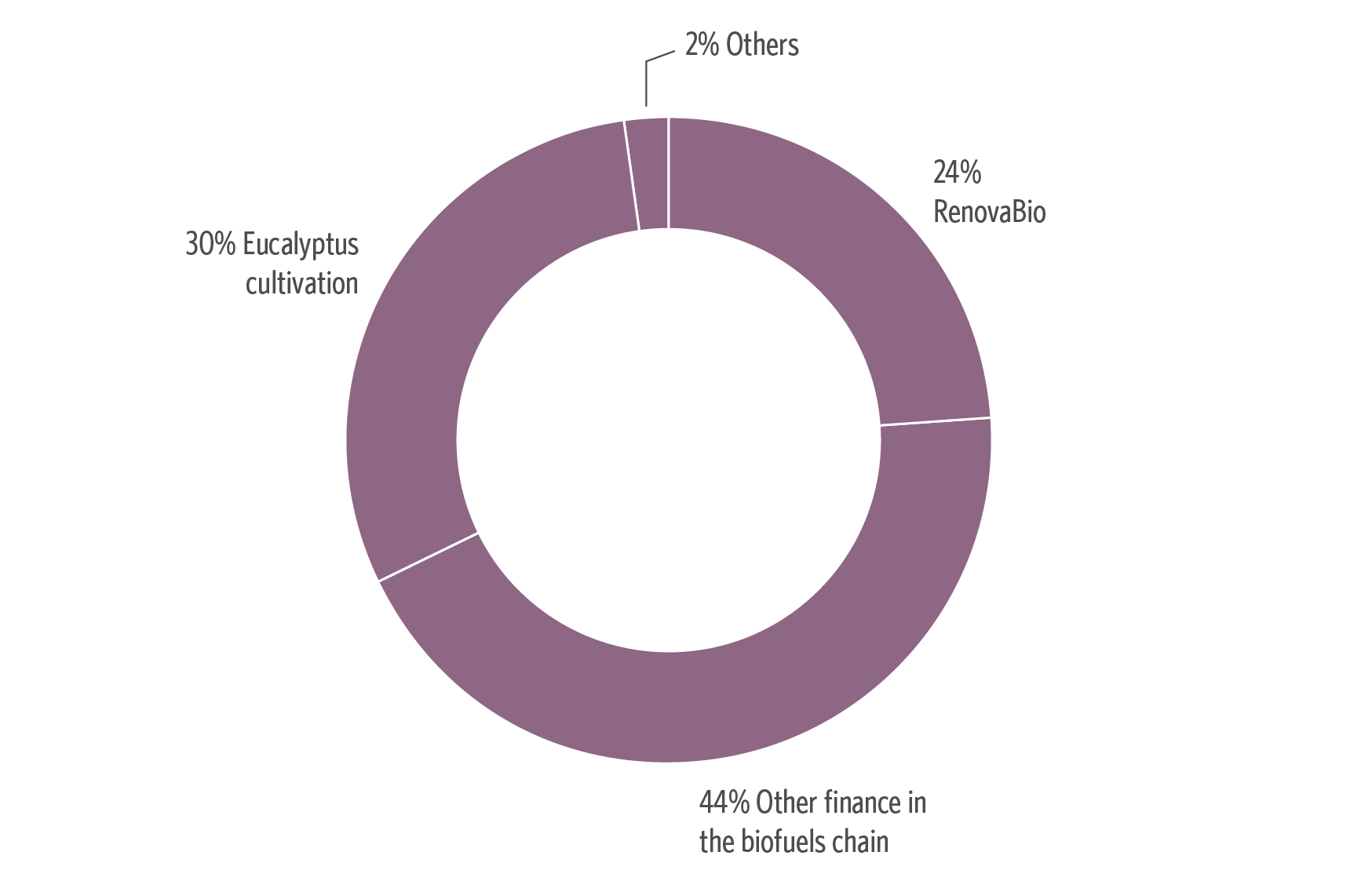

Figure 13. BNDES Climate Finance for Land Use (Direct and Indirect Operations), 2021-2023

Source: CPI/PUC-RIO with data from BNDES (2023), 2024

The BNDES operates across different areas tracked in this report, including the Climate Fund, the Amazon Fund and on Rural Credit (see Box below). In this section, we explore the bank’s direct and indirect finances, operated respectively by the institution itself and by partner financial institutions

The BNDES’ direct and indirect finance operations mobilized an average of US$ 422 million in low-cost credit aligned with climate goals for the land use sector. Support for the biofuel production chain[5] was the bank’s main area of climate finance for land use in this period, accounting for 67% of its tracked resources, with a highlight being US$ 100 million per year through the BNDES RENOVABIO credit line.[6] Another 30% of the flows were directed to the planted forest sector, with eucalyptus cultivation totaling US$ 126 million per year. Added to the low-cost credit financed by the BNDES, US$ 17 million per year went to grants through the bank’s Socio-Environmental Fund, which dedicated 98% of this amount to the Brazilian Biodiversity Fund (Fundo Brasileiro para a Biodiversidade – FUNBIO).

The BNDES’ Crosscutting Role in the Climate Agenda for Land Use

BNDES is a key player in the Brazilian climate transaction and operates in the land use sector in several areas explored in this report, in addition to that described in this section:

- The BNDES operates rural credit and is the source of 9% of the climate rural credit tracked in this report, US$ 0.9 billion per year, with RENOVAGRO accounting for 20%, compared to 8% of the total climate rural credit tracked.[7]

- The bank operates the reimbursable resources of the Climate Fund, which mobilized US$ 14 million per year over the period, as a channel for financing the transition to a resilient low-carbon economy.

- As manager of the Amazon Fund, the bank directs the resources made available by international governments to protect the Legal Amazon and promote an economy aligned with the sustainable use of the forest. The bank channeled US$ 26 million in 2023, discussed in the International Development and Cooperation section.

The finance channeled by the bank continues to be of great importance not only for its direct operations, but also for the crowding-in effect of investments for the agenda. Blended finance mechanisms, which make use of catalytic capital to mitigate the risk of projects and attract the private sector, have the potential to expand investment agendas in strategic sectors for a climate redirection of the Brazilian economy, and the alignment of the bank’s priorities with the needs of this agenda is necessary.

In this context, the BNDES Blended Finance pilot initiative was launched in 2022 to boost socio-environmental investments through a hybrid finance model. The bank launched a call for proposals that received 50 proposals, with R$ 905 million (US$ 174 million) in requested resources. Of the three applicable sectors, the forest bioeconomy sector received the highest demand, of R$ 461 million (US$ 88 million), demonstrating the potential impact of this type of blended finance. Eleven proposals were selected, four of which related to forest bioeconomy with a total demand of R$ 76 million (US$ 14 million), which began to be made available in 2024 (BNDES 2022).

The current management of the BNDES has paid more attention to the native forest sector, and over the last year has announced new mechanisms for financing this agenda, such as BNDES Forest Credits, with R$ 1 billion (US$ 200 million) to stimulate private investments in native forests (BNDES 2024b). The expansion and diversification of innovative instruments to attract private capital to meet climate objectives by the BNDES and subnational development banks is one means of further leveraging resources for this agenda.

[1] B3 is Brazil’s stock exchange, hosted in São Paulo.

[2] Thematic bonds are debt instruments that raise funds to finance projects with an environmental, social or governance impact. This report selects bonds with established climate targets associated with the land use sector.

[3] Suzano is a Brazilian multinational company that produces paper and pulp products from eucalyptus tree. It is the world’s largest eucaliptus producer (Suzano nd).

[4] Learn more at: Tribunal de Contas da União (TCU), Judgment no. 251/2023. bit.ly/3BWaTPd.

[5] Among the flows tracked in the biofuel production chain are finances for sugarcane cultivation, classified in the crop sector of this report.

[6] BNDES RENOVABIO is a direct support program from the BNDES, within the scope of RENOVABIO, for ESG credit for the biofuels sector, to improve energy and environmental efficiency and certify production, which is necessary for the issuance of CBIOs. Learn more at: National Bank for Economic and Social Development (BNDES). BNDES amplia para R$ 3,5 bilhões recursos para o setor de biocombustíveis. 2023. Access date: October 9, 2024. bit.ly/3UggWnX.

[7] RENOVAGRO (formerly ABC+) is the Program for Financing Sustainable Agricultural Production Systems, dedicated to reducing environmental impacts in agriculture.