Costs have declined dramatically in the renewable energy sector and deployment levels are at an all-time high. But why does the outlook for future investments seem so mixed across Europe?

Today, policy and finance issues are now arguably at least as important as technology, with policy now the key determining factor in ensuring continued growth in renewables. Policymakers are not in the same position as they were five years ago however when the costs of technologies such as solar were much higher and policy decisions had very different outcomes. Even the costs of offshore wind are falling significantly as indicated by DONG’s recent winning bids for the Borssele 1 and 2 projects at €72.2/MWh and Vattenfall’s astonishing €49.9/MWh bid for Kriegers Flak.

In future, investment will need to come from a variety of sources and not just from large utilities which has traditionally been the case. This means that policy will need to change dramatically to adapt to this new, broader range of potential financing options.

Our latest report which is published today, European Renewable Energy Policy and Investment 2016 finds that the cost of financing will be driven as much by the types of investors as by how investors evaluate project risks, returns and policy. In other words, how investment is divided among utilities, institutional investors, households or companies is one of the most important factors determining the average cost of renewable energy to the system.

In Germany and Spain, for example, very different policy incentives were concentrated on very specific investor categories, ie, small end users in Germany and the utility sector in Spain. Both approaches achieved high levels of deployment in a relatively short time but were not necessarily cost-effective.

What does this mean for policymakers & investors?

We found that there is plenty of investment available to meet and exceed current EU and country level targets, if the right policy is in place. Policy will determine not only how much investment is available, but also the mix of investors and its cost. Policies set in motion today could develop, or close off, options that could be major sources of investment and technological advancement in the future.

In addition:

- Long-term targets are essential for attracting investment so a decrease in targets can be devastating for a developer since sunk development costs may need to be written off to reflect the reduced likelihood of completing the project

- The adoption of renewables across the EU has been fuelled by a varied mix of investor types, often introducing new entrants and causing a change to the previous ownership structure of energy systems.

- There is enough investment appetite in Germany to comfortably meet ambitious targets provided that support levels and other key policies are set appropriately. This gives comfort to policy makers that their ambitious targets can be achieved (and potentially exceeded), however there is insufficient capital for just one or two categories of investors to meet the targets on their own so policies must appeal to a broader investor base.

- Now is a good time to encourage investment with base rates at historically low levels, which in turn depresses equity return requirements, however policies are not in place to encourage this investment in many regions. Interest rate increases will necessitate higher support levels.

- Political risk perception is increasing and has a negative impact on investor appetite. Across the majority of EU regional contexts and renewable technologies we see a negative outlook of eroding investment sentiment.

- Misalignment of policies within EU member states and across EU directives is having unintended consequences, damaging the outlook for a rapid, coherent energy transition.

What does this mean for policymakers?

Policy should always encourage the lowest possible cost investment from the most appropriate set of investors in keeping with four main objectives:

- Balance cost-effectiveness and deployment

- Balance short-term cost-efficiency versus longer-term development.

- Develop technology mixes and options.

- Shape the industry to achieve industrial objectives and/or public support.

Regional views

An important part of this work was the regional perspectives, looking specifically at two countries, Germany and the UK, and two regions, the Nordics and Iberia. We also looked at three widely deployed technologies, solar PV, onshore wind and offshore wind and have forecast investor appetite within those categories for each region up to 2020.

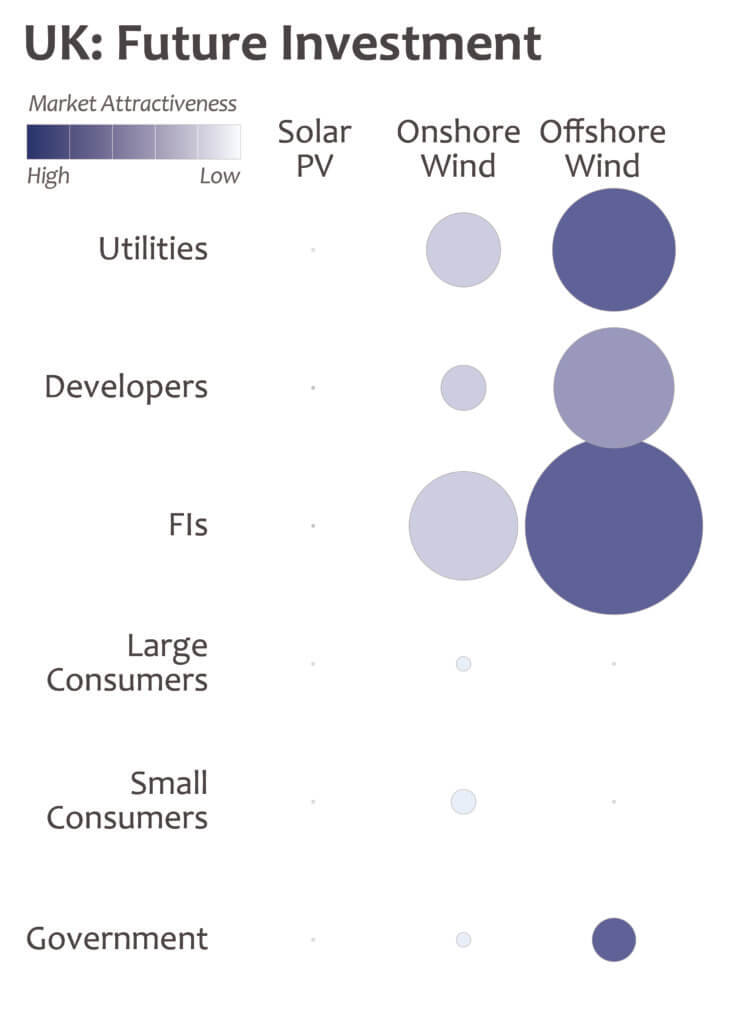

United Kingdom

Future offshore wind investments in the UK look promising among utilities, developers and financial institutions

While the UK has a solid track record with building renewable power assets and is the global leader in offshore wind, its slow progress with decarbonising the heat and transport sectors means that it is unlikely to hit its 2020 renewable energy targets with the current suite of policies.

Over the last six years, the British government has changed several key renewable energy support policies including making cuts to feed-in tariffs for small and large-scale renewables, the transition away from a 14-year-old green certificate scheme with support levels set by government (the Renewables Obligation or RO) towards a Contract for Difference (CfD), with support levels set by competition. These changes have caused a period of uncertainty among investors.

If the current macroeconomic environment persists, investor interest in the UK market will likely mean sufficient capital is available to fund the existing project pipeline. However, it is likely that there will be less competition for projects as some investors are put off by political uncertainty, meaning less downward pressure on the cost of capital than there otherwise might have been.

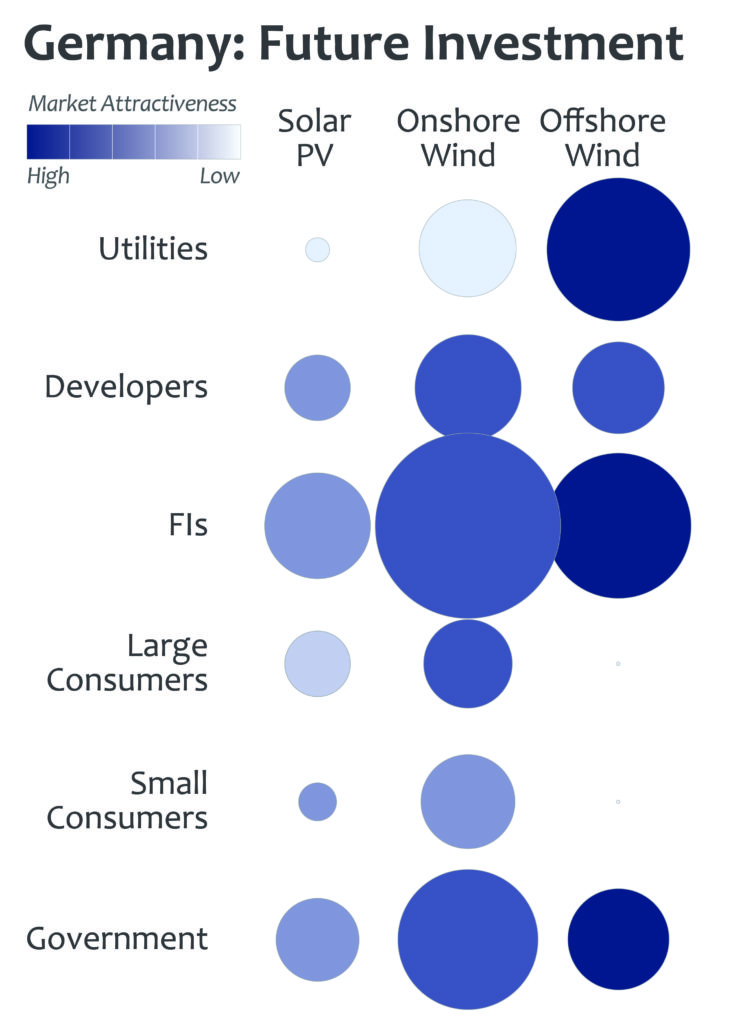

Germany

Future investments across all categories in Germany look promising

Germany has the third-highest level of renewable energy installations by capacity in the world behind the US and China. It also has a range of ambitious targets that exceed the minimal levels set out by the EU. These targets include achieving 35% of generation from renewables in 2020, 50% by 2030 and 80% by 2050, and keeping CO2 levels at 60% of 1990 levels by 2020.

While Germany’s goals for onshore wind and solar remain ambitious, it is clear that policymakers are setting their sights on offshore wind as a major new source of energy. Our analysis indicates that these targets are, overall, achievable.

Now that amendments to Germany’s renewable laws have been announced uncertainty has reduced, although it will take some time before the significance of these changes is fully understood. Once investors fully understand the impacts of policy changes, then it is very likely that the ambitious renewable deployment targets can be achieved.

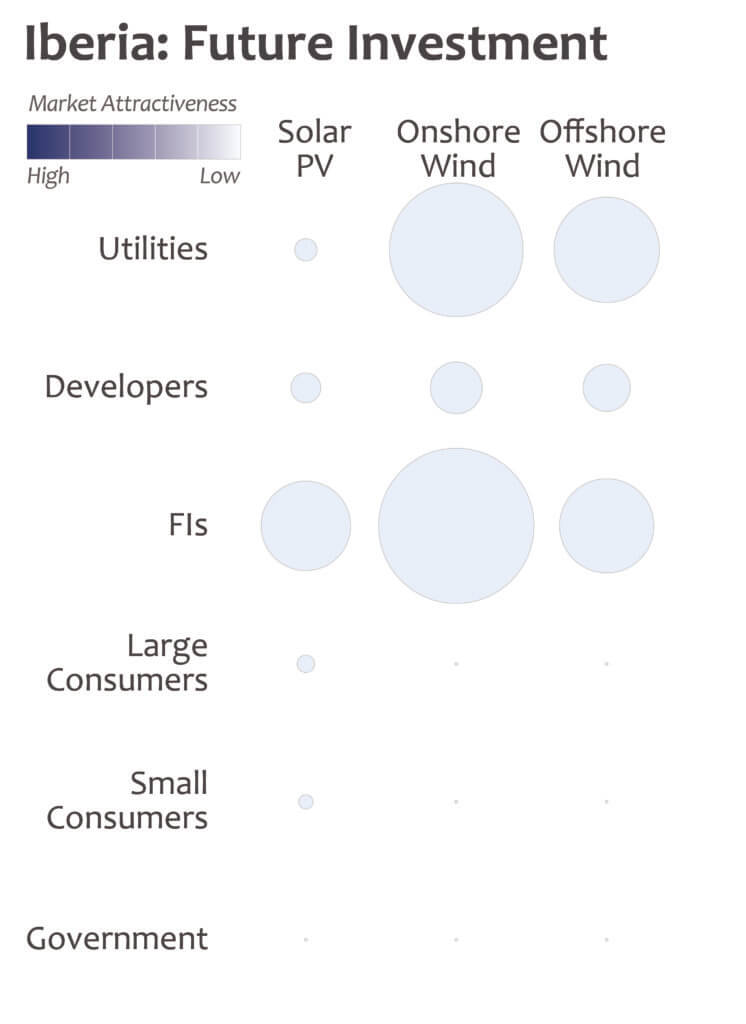

Iberia

Potential investments could be large in Iberia, but investor appetite is still low in the region

The last decade has seen a period of upheaval in Spanish and Portuguese politics, and in particular in their once-thriving renewable energy sectors. Following the global financial crisis, governments in both countries have taken greater control of rates of growth in the renewable sector. The investor pool has shrunk, chilled by uncertainty and losses because of a series of regulatory changes.

In Portugal, recent M&A transactions suggest that international investor confidence in the sustainability of the regime remains, however, as in Spain, short term political objectives remain uncertain.

There are important lessons to be learned by policymakers both in the peninsula and outside about the importance of long-term planning, transparent regulation made by independent regulators, and a balance between the interests of all stakeholders in the energy system. These will be instructive if the countries are to pursue the next phase of decarbonisation successfully in the 2020s. Reducing the tariff deficit and increasing interconnection with the rest of Europe will be vital steps towards strengthening the case for more renewables.

Nordic region

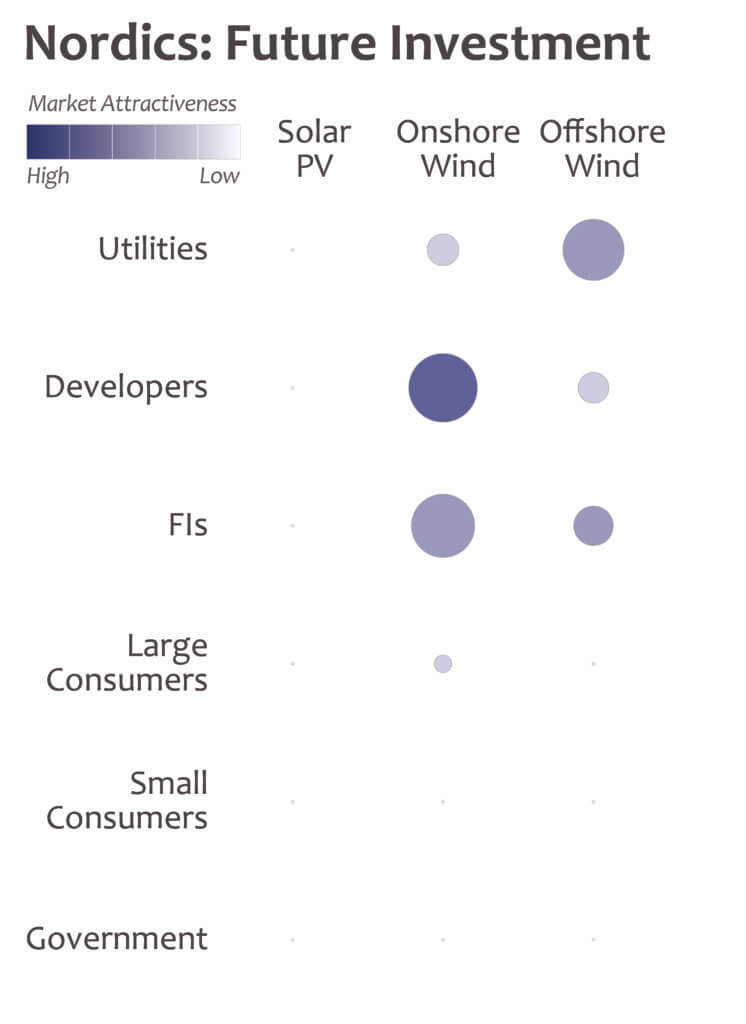

Future investment in the Nordic region favours larger investors, such as utilities, developers and financial institutions

The Nordic region’s objective is to accelerate and implement a smooth energy transition in a market characterized by general over-capacity, low wholesale prices, flat or limited demand growth and most of the EU 2020 targets already achieved. In such a market, maintaining the momentum of the transition is not an easy task. In fact, investors that had initially piled into the Nordic wind market due to its intrinsic resource value, have more recently been hurt by low prices due to the oversupply of green certificates. These have resulted in investor losses, reduced incentives for new wind investments and an overall reduction in investor interest in the region.

However, investors and capital remain available, while the intrinsic long-term value of Nordic wind resources remains world class.