This publication is CPI’s analysis of CRAFT, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

Between 2003 and 2013, natural disasters caused $1.5 trillion dollars in economic damages worldwide, $550 billion of which was in developing countries. As climate change worsens, so will these challenges. Therefore, in sectors such as agriculture, water, energy, and financial services, companies and communities are increasingly looking for ways to reduce their vulnerability to climate change. There is a market opportunity to offer services and solutions to help customers assess and manage their climate risks and reduce costs. Investment is especially needed to bring existing technologies and solutions to new sectors, geographies, and users, particularly in developing countries.

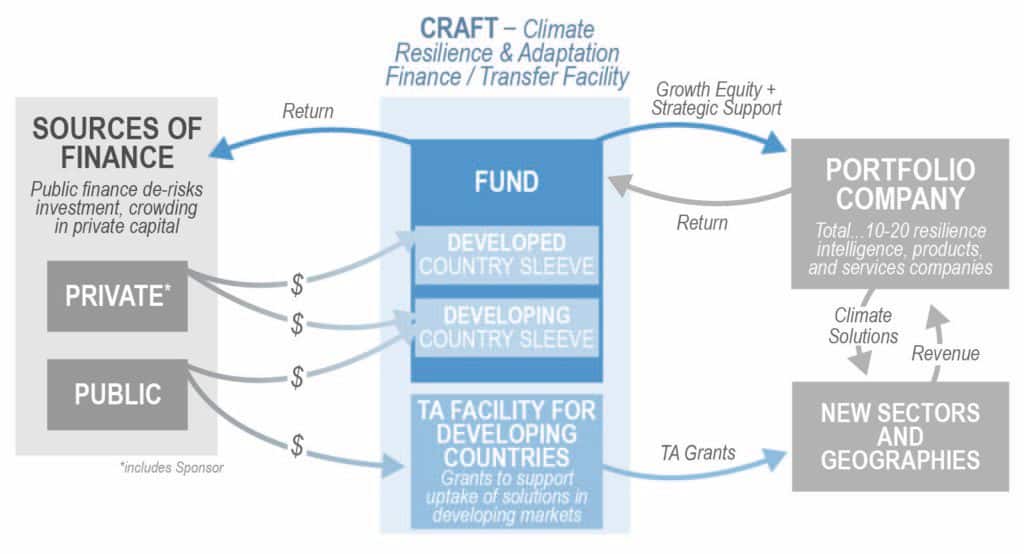

CRAFT will be the first commercial investment vehicle to focus on expanding the availability of technologies and solutions for climate adaptation and resilience.

As a growth equity fund, CRAFT will invest in 10-20 companies, located in both developed and developing countries, which have proven technologies and solutions for climate resilience and have demonstrated market demand and revenue. The Fund, together with an accompanying Technical Assistance Facility, will help companies – like weather analytics, catastrophe risk modeling services, and drought resilient seed companies, among others – expand into new sectors and geographic markets.

CRAFT will target companies in countries already experiencing substantial economic losses from climate change. The intentional inclusion of technology transfer from developed to developing countries into the fund will help build capacity in developing countries. As demand builds, investee companies can also begin to expand into lower income countries.

For every one dollar of concessional financing and technical assistance grants, CRAFT will leverage an estimated 3.3 dollars of direct commercial investment to enhance the resilience of communities, businesses, and critical infrastructure. By making the business case for investment in climate resilience, the Fund will also help catalyze a global market for climate resilient products and services; promote climate resilient development; and contribute to rapidly evolving resilience standards and metrics.

CRAFT will leverage concessional and commercial investment to enhance the resilience of communities, businesses, and critical infrastructure, while also helping catalyze a global resilience market.

The Fund’s primary investment team is in place, with regional partnerships being developed to assist with investment origination and due diligence.

For the Fund to move forward, its developing country sleeve in particular will benefit from the identification of one or more “anchor” investors, such as development finance institutions, to help attract and mobilize capital from private investors. The Fund will seek to enter into the due diligence process with one such investor in the fall of 2017, after which further private and public investment could be secured in 2018. In parallel, the Fund’s Proponents will develop the design of, and seek donors to, the Technical Assistance Facility.

Addressing a critical area of uncertainty and need, CRAFT is a solution that is immediately actionable, with a highly experienced team led by Lightsmith Group committed to its success, an initial pipeline of investments identified, and regional partnerships under development.

DESIGN

The fund combines a standard growth equity investment fund structure with technical assistance to enable the deployment of climate resilience services and technologies in developing countries. The design includes:

- Two legally and financially separate sleeves for developed and developing country investments. The two investment sleeves will enable clear separation of risk profiles. While both sleeves target USD 250 million each in total funding commitments, the developing country sleeve will target USD 150 million of commercial funding and USD 100 million of concessional funding to de-risk investments.

- Technical support to help resilience companies expand in developing country markets. In addition to financing and strategic support provided by the Fund, a TA Facility will provide grants for technical support helping companies enter and expand in developing country markets.The TA Facility will fund market studies; preparation and implementation support activities; and knowledge and capacity building. The TA Facility will target USD 20 million in grant-based funding and will have a separate governance structure from the Fund.

- A waterfall structure de-risks private investment, enabling 20-25% gross returns for commercial investors, in line with expectations for growth equity. Both the developed and developing country sleeves will incorporate a 6% preferred return threshold for commercial investors. Beyond this, returns will be distributed at an 80/20 ratio to limited partners and the Sponsor. The developing country sleeve will incorporate an additional concessional equity layer.