California’s budget for the next fiscal year, signed by Governor Brown on June 20, includes $832 million in auction revenues from the Cap and Trade Program, which will go toward high-speed rail, public transportation, energy efficiency, and other projects to support low-carbon, sustainable communities. Where did that money come from? In some cases, from industrial firms like cement producers and food processors, which are responsible for 20% of statewide greenhouse gas emissions and are required to buy allowances to cover some of their emissions.

Our new study, Cap and Trade in Practice: Barriers and Opportunities for Industrial Emissions Reductions in California, explores how those industrial firms are making decisions under the Cap and Trade Program. More specifically, we wanted to know if industrial firms, given their typical decision-making processes, would invest in the emissions reductions options that are most cost-effective on paper — and if not, what are the barriers? We focus on the cement industry, which is a major player in the industrial sector and is also the largest consumer of coal in California.

The carbon price is making a difference

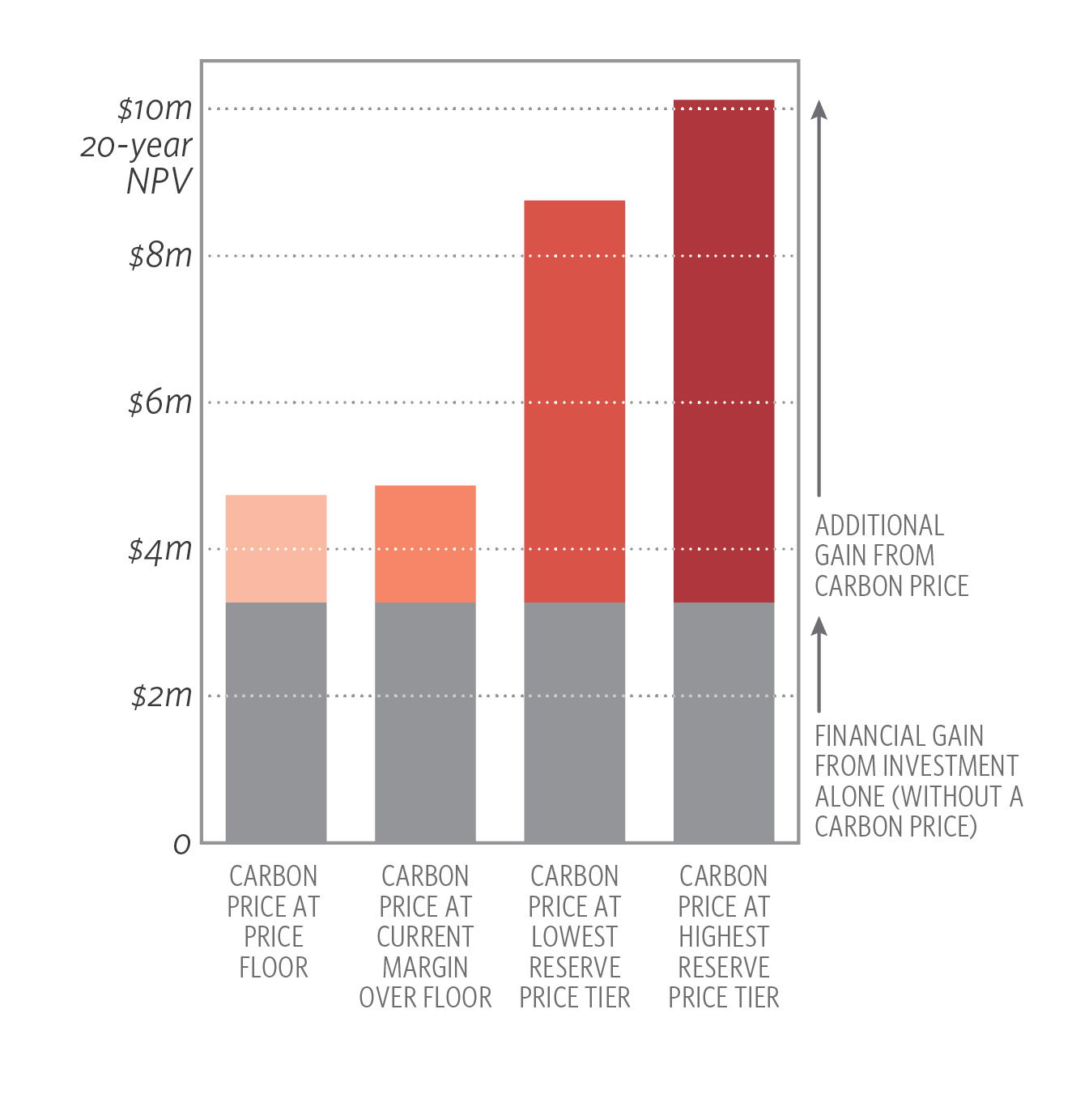

We find that the carbon price is making a difference in how cement firms approach business decisions about actions that would reduce emissions, such as investing in energy efficiency or switching to cleaner fuel. Firms are considering the carbon price when they make investment decisions, and our modeling shows that the carbon price significantly changes the financial attractiveness of several abatement options.

As an example, this graph shows how the carbon price adds to the value of an investment in energy efficiency. The additional savings from reducing the firm’s obligations under the Cap and Trade Program would add around 50% to the value of the investment if the carbon price is near the price floor — or could more than triple the value of the investment if the carbon price is at the top of its target range.

Industry could make more progress at lower cost if policy helps to fill gaps

While it’s clear the carbon price is affecting firms’ decisions, there are also non-price barriers that keep firms from pursuing low-cost and cost-saving abatement options. Overcoming these barriers can help both individual industries to save money and California to pursue the lowest-cost path as a whole, but additional policy levers beyond the carbon price are necessary. We identified three key sets of barriers and solutions for the cement industry that may also be important for firms in other industries:

- Firms have very short required payback periods for capital investments. Even if an energy efficiency or fuel switching investment would save more money over its useful lifetime, firms generally won’t consider it unless it pays back within three years. Financial support for longer-term investments with a big impact on emissions reductions could help firms pursue these abatement opportunities.

- Switching to lower-carbon fuels, such as solid waste and other biomass, offers some of the most promising options for emissions reductions in the cement industry — but cement firms need more certainty that alternative fuels will be available at predictable prices in the future. Policy measures to accelerate commercialization of alternative fuels could help firms make this transition.

- Prescriptive standards and entrenched customer purchasing practices often don’t allow firms to blend lower-carbon materials into cement — an otherwise attractive abatement option. A range of initiatives across government agencies could increase blending of alternative materials where safe and appropriate, such as changes in purchasing practices by Caltrans and other large customers, customer education programs, initiatives to influence standard-setting processes, and collaborative research efforts between government and industry.

It’s important to keep in mind that actions in one industry won’t make or break the success of the Cap and Trade Program. As long as CARB enforces the cap, the state will meet its emissions reduction goals. But if there are barriers to low-cost or cost-saving abatement options in one industry, other sectors will need to make up the difference, potentially at greater cost.

Our findings suggest that California policymakers should continue to pay attention to opportunities and barriers in each sector of the economy. Sector-specific policies in addition to the carbon price can help lower barriers to low-cost emissions reductions — providing a solid foundation for the Cap and Trade Program.

Visit the California Carbon Dashboard for an updated look at the carbon price and more news about AB32.