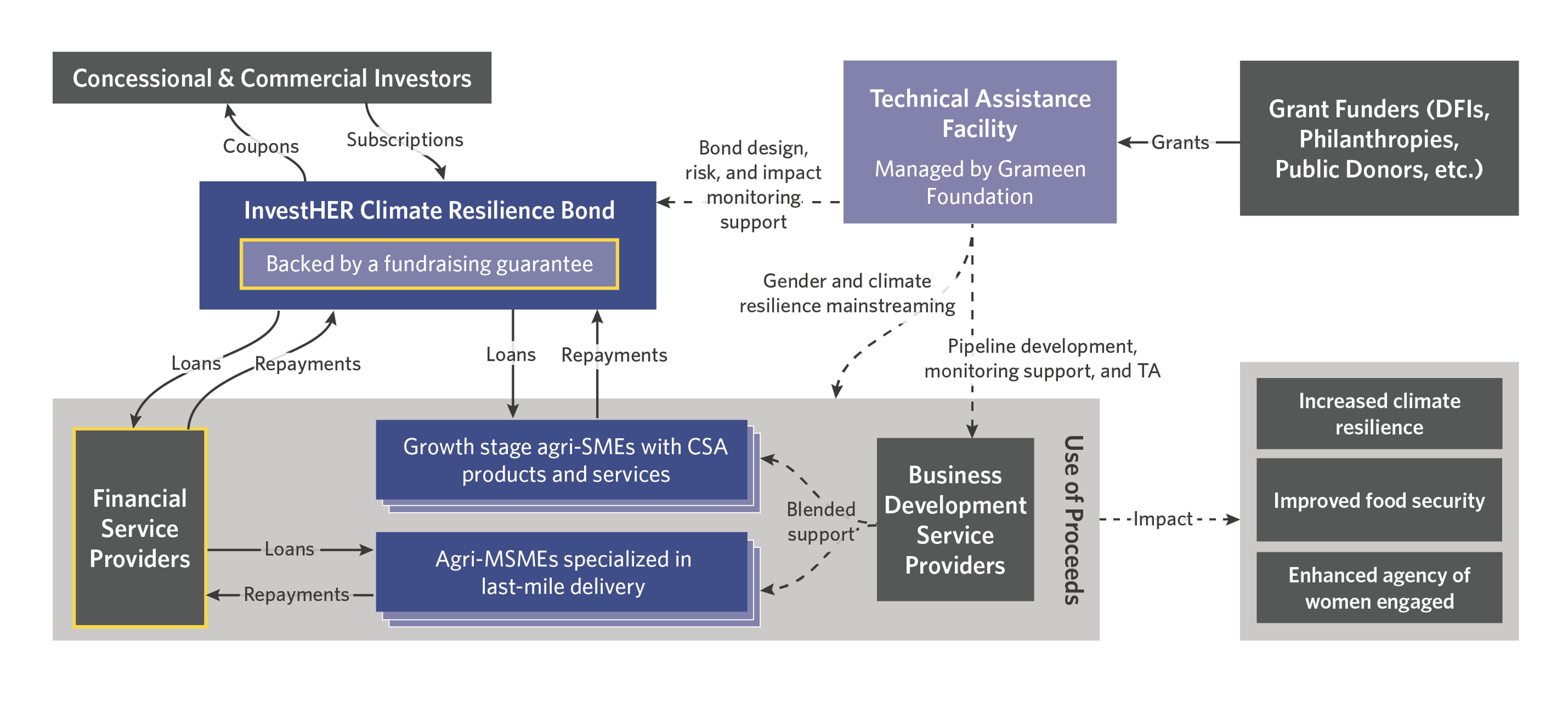

The InvestHER Climate Resilience Bond promotes CSA practices and gender mainstreaming by improving access to credit for women-led or owned agri-SMEs and providing technical assistance to enhance their impact on women farmers.

ABOUT

Uganda’s agrifood system accounts for approximately 40% of its GDP with over 85% of working women in Uganda employed in the sector. According to the World Bank, climate-induced food crop losses in Uganda could reach USD 1.5 billion by 2050. Investment in climate-smart agriculture (CSA) is critical to helping women in agrifood systems cope with these challenges. However, with under 5% of Ugandan agri-MSMEs having access to formal loans or credit lines, mobilizing the finance necessary to scale CSA practices has been challenging. Women-led or owned agri-SMEs in particular lack equal access to critical resources, such as credit and extension services.

INNOVATION

The InvestHER Climate Resilience Bond is Uganda’s first gender and climate bond and among the few in Africa designed to mobilize finance to address both challenges in the agricultural sector. The bond is designed to increase the accessibility and affordability of credit for growth-stage agri-SMEs and rural agri-MSMEs.

“We believe that we are in a position to develop an innovative financial mechanism that will position Ugandan women-led SMEs to extend products and services that will mitigate or address climate change in rural communities. We hope to leverage the Lab’s rich pool of resources, investor network, and expertise to make our audacious goal happen. With the Lab’s support, we are confident that we will be on the right track regarding the bond design and framework, leading to a high success rate for execution.”

Lisa Smith, Director of Institutional Relations at Grameen Foundation

IMPACT

The InvestHER Climate Resilience Bond in Uganda aims to raise USD 25m in local currency (UGX). Proceeds will fund loans to women-owned or led growth-stage agriSMEs, helping them expand into rural areas and serve more women farmers with CSA products and services. The bond also supports financial service providers (FSPs) that lend to smaller enterprises and women farmers, facilitating their adoption of CSA practices. Approximately 95% of the bond’s beneficiaries will be women-owned or led agri-MSMEs.

This bond strengthens the climate resilience of women in agrifood systems by enhancing their access to tailored formal credit and building their knowledge and capacity in CSA practices.

DESIGN

The instrument will support both climate-relevant growth-stage agri-SMEs and local FSPs, which will onlend to rural agri-MSMEs, to address two challenges: the accessibility and affordability of credit.

To solve for the affordability issue, a fundraising guarantee will de-risk the bond for investors. This will enable the issuer to lower the coupon given the reduction in risk. The lower coupon payments will improve the spread of the bond and enable the issuer to lend proceeds at more favorable rates, both directly to growth-stage agri-SMEs and indirectly to agri-MSMEs through FSPs.

To address the accessibility aspect, Grameen Foundation is exploring the possibility of apportioning some of the proceeds from the bond as direct deposits in FSPs. This portion will serve as cash equity or collateral against lending to a new segment of customers that were previously ineligible to borrow.

The technical assistance provided by the Grameen Foundation can be broadly categorized into three main areas: bond design, and risk and impact monitoring; gender and climate mainstreaming; and pipeline development and monitoring.