Context

Steel consumption is an essential factor for economic growth. Steel contributes significantly to developing sectors such as railways, construction, automobiles, etc. A similar growth pattern exists between India’s gross domestic product and steel production[1]. While the steel demand has plateaued in most advanced economies, it is growing with a CAGR of 4.79% in India.

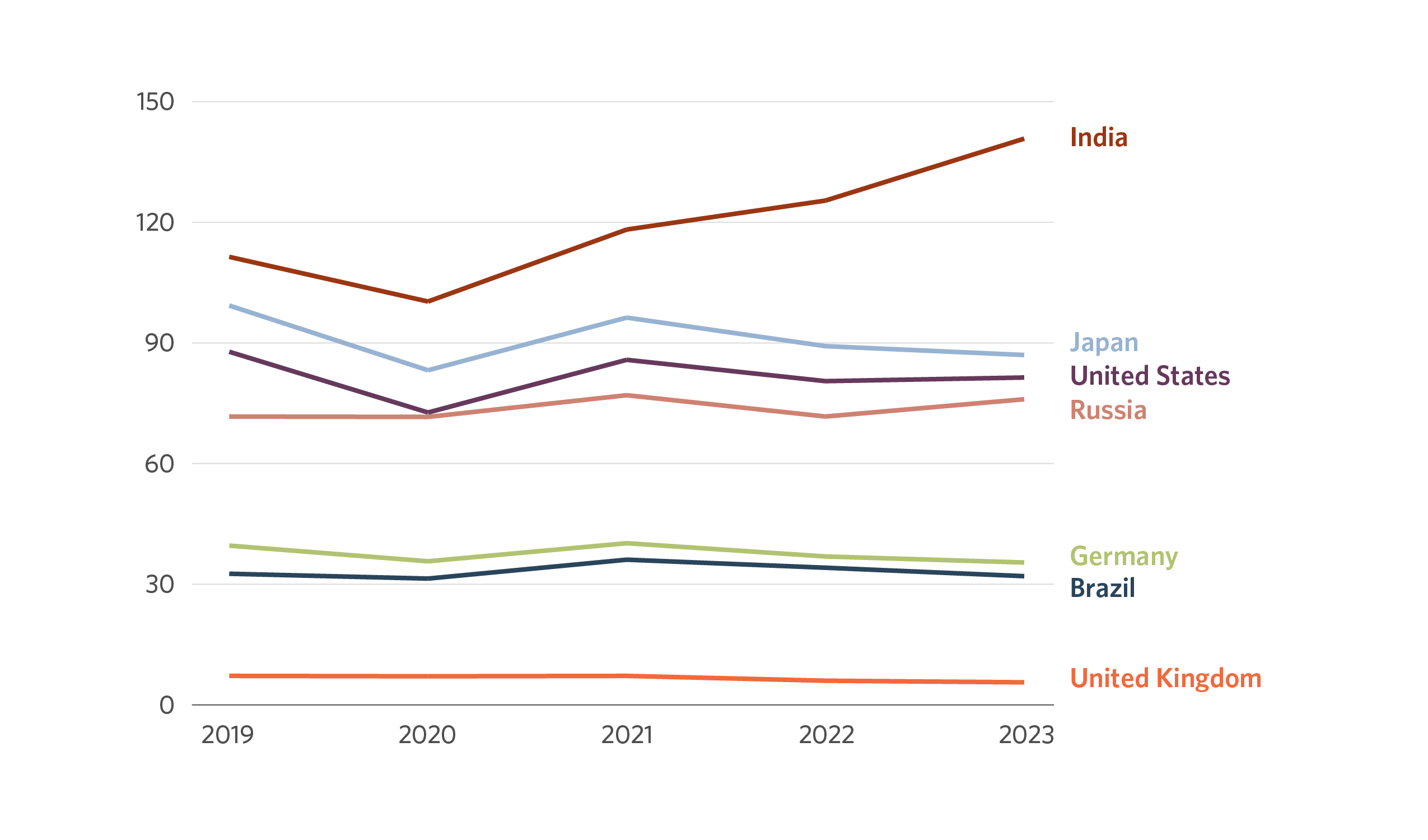

Figure 1: Total Crude Steel Production

Source: World Steel Association

The iron and steel (I&S) industry, a hard-to-abate sector, is India’s largest industrial emitter, accounting for approximately 10-12% of the country’s total carbon emissions. Its hard-to-abate nature stems from two primary factors: reliance on carbon-intensive processes and the complexity of replacing fossil-fuel-based energy as feedstock.

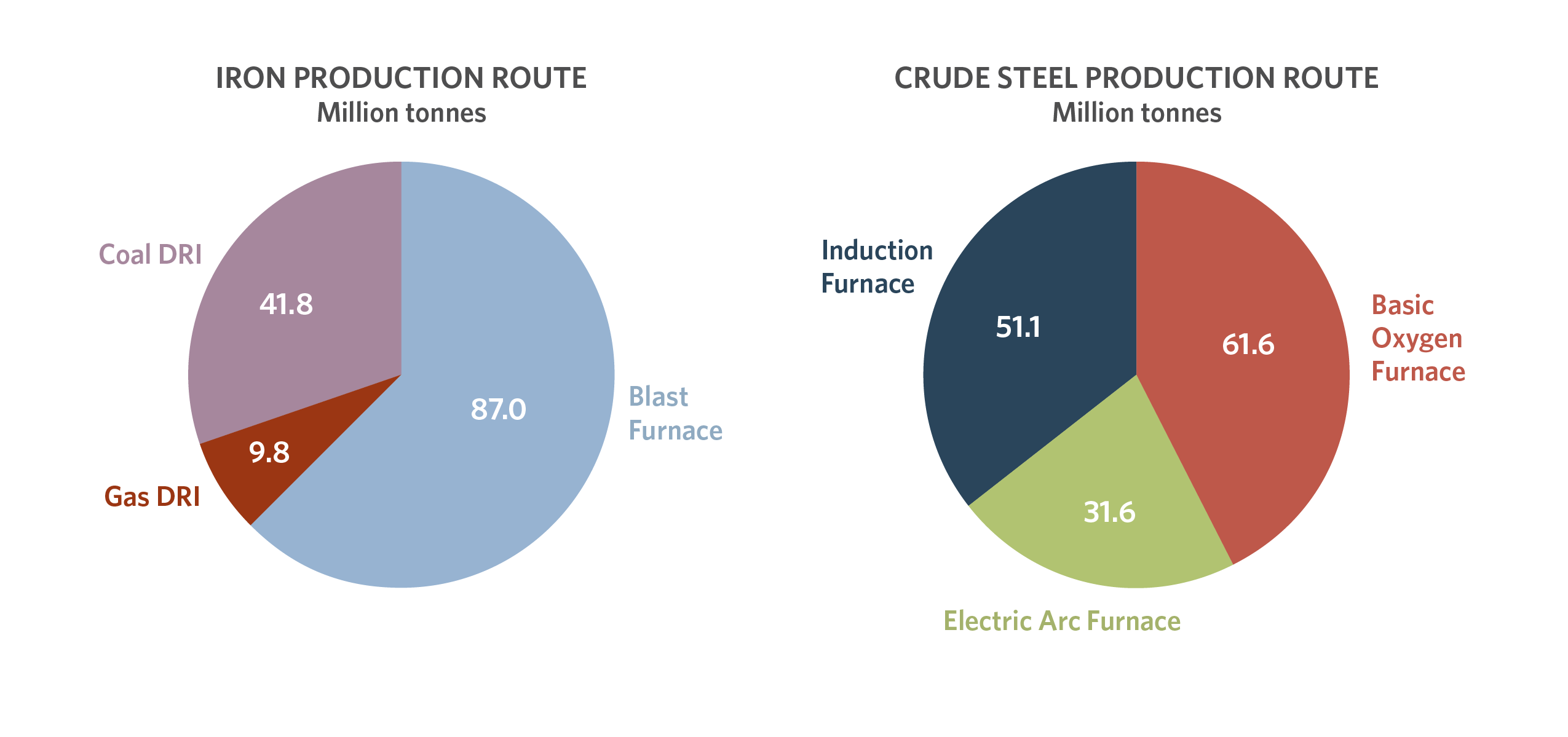

India’s steel sector comprises two segments: the primary sector, which includes large integrated steel plants (ISPs), and the secondary sector, which comprises smaller secondary steel producers (SSPs). They have different production routes: the primary sector utilizes the Blast Furnace-Basic Oxygen Furnace (BF-BOF) steelmaking route, while the secondary sector largely relies on the Direct Reduced Iron-Electric Arc Furnace (DRI-EAF)/ Direct Reduced Iron-Induction Furnace (DRI-IF) route.

Figure 2: Iron Production Route in Million Tonnes in India (FY23-24)

Figure 3: Crude Steel Production Route in Million Tonnes in India (FY23-24)

Source: Ministry of Steel

Barriers to decarbonization for the primary and secondary sectors differ because of their technological differences and would require policy support tailored to their unique needs and challenges.

Financing the Transition in the I&S Sector

Industrial sectors like steel are likely to undergo a gradual transition because they often do not have a financially viable ‘green alternative,’ i.e., they do not have a commercially available pathway to decarbonization fully aligned with the Paris Agreement. This hinders their ability to access the green financing market for new projects via instruments such as green bonds as they require capital allocation into demonstrable green technologies.

Considering this, Transition finance (TF) is emerging as an important finance category that enables the flow of finance towards ‘transitional activities’ in hard-to-abate sectors such as steel.

Broadly, transitional activities refer to those activities that are important for emission reduction in the hard-to-abate and energy-intensive sectors but cannot be classified as green because they do not meet environmental criteria such as zero or near-zero emissions. TF is essential for investments in incremental decarbonization levers for existing BF-BOF plants that gradually reduce the emission intensity of the sector, thus paving the way for the slow maturation of future zero-emissions technologies while ensuring incremental carbon abatement today.

Financial instruments are the critical enablers of finance flows to emission-intensive industries, which are often locked out of the green finance market because they do not have demonstrable green technologies. TF instruments are broadly categorized into four segments:

| Instrument: | KPI-linked | Use-of-proceeds | Hybrid | Traditional |

| Example: | Sustainability-linked loans (SLLs), Sustainability-linked bonds (SLBs) | Transition loans, Transition bonds | Sustainability-linked green bonds (SLGBs)[2] | Public/private equity, traditional loans/bonds |

Instruments under the umbrella of TF may not be limited to those labeled as ‘transition.’ We have observed suggestions that any instrument may be categorized as a TF instrument if it incentivizes an entity-wide transformation to lower emission intensity[3]. These may include instruments such as sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs).

There are no universally accepted guidelines for instruments labeled as ‘transition,’ their capital allocation requirements, and penalty mechanisms (if any). Based on the observation of instruments issued so far, they can be categorized as use-of-proceeds without any penalty mechanism.

How can the TF capital enable steel decarbonization?

The secondary steel sector has a viable near-term decarbonization pathway because of its higher use of scrap steel, technologically feasible low-emission feedstock (DRI via natural gas/hydrogen), and an electrified production process.

Therefore, the primary sector is a better candidate for TF as there are no commercially viable ‘green’ technologies, but there are technologies that can provide incremental emission reductions today. The capital raised via TF instruments can be leveraged for gradual primary sector transition in two significant ways:

- Integration of best available technologies (BATs): A massive scope exists for adopting BATs in the BF-BOF plants, enabling improved energy efficiency and recovery. BATs such as Pulverized Coal Injection (PCI), Coke-DRY-Quenching (CDQ), and Top Pressure Recovery Turbine (TRT) have a negative cost of CO2 abatement and are therefore economically viable for CO2 mitigation. Cumulatively, selected BATs can deliver up to 15% reduction in emissions for the BF-BOF route (CPI, 2023[ZF6] ).

- Partial [ZF7] CCU/S-based BF-BOF plants: TF proceeds can be used to set up CCU/S units for the BF-BOF-based ISPs that can capture the flue gases released from the flue stack, a major contributor to the CO2 emissions in steelmaking. Although the CO2 abatement potential for this intervention is high, the technology is not commercially mature, and the cost of abatement remains unviable at $50-60/tCO2 (CPI, 2024). Nevertheless, the cost of abatement is expected to fall in the coming decades because of technological innovation, policy and financing support, and cost reduction in the set-up of CCU/S units, making this a good candidate for TF. The potential of converting the captured CO2 into value-added downstream products is under investigation by CPI, which could improve the viability of this option.

According to tracked data up to 2023, the Indian steel sector had about 195 MTPA of steel production capacity in the pipeline awaiting financial closure. Two-thirds of the new capacity is expected to be added through the BF-BOF route. If the plants under development can access TF, it would help them achieve their emission intensity targets/goals by integrating emission reduction technologies in their proposed plants. Therefore, TF can be pivotal in enabling the gradual transition of the primary sector’s current and planned plants by bridging the gap until commercially viable low-carbon technologies emerge.

Accessing TF – Transition Plans and their Credibility

Entity-level transition plans are the cornerstone of industrial transition to lower emissions. A feasible, benchmarked, and ambitious transition plan is a critical enabler for companies to access transition finance. It is crucial to ensure that transition plans are realistic, avoid superficial or misleading claims, and adhere to core transition finance principles. This involves benchmarking against recognized standards and best practices and ensuring alignment with science-based targets for achieving net-zero emissions.

In our work, we have established a framework for assessing the credibility of transition plans based on guidance provided by Climate Bonds Initiative (CBI), the Organisation for Economic Co-operation and Development (OECD), and the Association of Southeast Asian Nations (ASEAN).

Some Indian steel companies have disclosed their transition plans. JSW Steel is a leader in this regard, and we have assessed their plan against our framework.

Table 1: Assessment Framework

| Element | Guidance | JSW Steel Limited |

| Net-zero emissions goal | Science-based target is consistent with the 1.5° C target of the Paris Agreement, with no to low overshoot and, at the least, well below 2° C. | For phase I, the bet is on energy efficiency, material circularity, renewable energy, operational efficiency, etc. Phase II bets on reducing the cost of green hydrogen and CCU/S. While the sustainability report talks about partnerships & opportunities, there is no specific roadmap for adoption or securing funding for technologies beyond 2030. |

| Interim targets (phasing) | The net-zero target year is 2050. The targets for phases I and II have been derived from the IEA iron and steel technology roadmap published in 2020, which is consistent with the 1.5° C scenario. | The long-term transition goal comprises interim (short, medium, and long-term) quantifiable and time-bound targets. Include an explanation of methodologies, assumptions used, and benchmarking undertaken. |

| Technology selection | Any science-based pathways/roadmap is consistent with the goals of the Paris Agreement. | There is no clarity on the use of offsets. Considering the plan suggests an emission intensity of 0.996 tCO2/TCS in 2050, offsets and CCUS will play an essential role in achieving net zero. |

| Coverage: scope 1, 2, and 3 | Scope 1 & 2 at the minimum. Include Scope 3, where material and exclusion are to be explained and justified. | JSW Steel will be net-neutral in carbon emissions for all operations under direct control. There is no specific mention of the inclusion or exclusion of scope III emissions. |

| Use of carbon credits & offsets | It should not be used as an alternative to reducing emissions or delaying mitigation action. Ideally, there should be no more than 10 percent abatement. | The financial plan details the transition’s implications, the financing requirements for executing the transition plan, and how to achieve such financing. |

| Financing | The financial plan details the implications of the transition, the financing requirements for the execution of the transition plan, and how to achieve such financing. | JSW has raised two SLBs linked to its 2030 emission-intensity reduction target; however, its sustainability report does not chart a path for raising or deploying funds beyond 2030. |

| Avoiding carbon lock-in | Identify existing assets and new investments at risk of leading to carbon lock-in. Develop a strategy and process for the responsible retirement of high-emitting assets. | No mention. |

| Do No Significant Harm (DNSH) | Avoid harm to other sustainability objectives (e.g., biodiversity) at the activity and entity level. | No mention. |

| Governance | Define processes and responsibilities for regular monitoring and reporting progress aligned with disclosure standards (e.g., IFRS S1 and S2), timely revisions of targets, and updated plans. | The governance framework is in place with the Board of Directors at Apex. |

| Third-party verification | Third-party verification of credibility of transition plans and activities for effectiveness, completeness, and performance against benchmarks. | No mention. |

| Just transition considerations | Assess and account for adverse environmental and social impacts, including on the labor force and communities, from the transition in the transition plan. A strategy for mitigating such impacts is to be included in the plan. | No mention. |

Source: CPI Analysis

A credible transition plan is crucial for steel companies to chart their way forward to net zero and secure transition finance to accelerate decarbonization. It is advisable for other Indian steel companies to explore and adopt similar strategies.

Future Work

This blog serves as an introduction to our work on transition finance for the Indian I&S sector. Stay tuned for the upcoming release of our discussion paper on February 25th and a full-fledged report on the topic later in the year.

[1] The Indian Steel Industry: Growth, Challenges, and Digital Disruption

[2] Green sustainability-linked bonds: Getting to the heart of accountability and impact in sustainable financing

[3] Transition Finance: Investigating the State of Play – A Stocktake of Emerging Approaches and Financial Instruments