Interoperability between sustainable finance taxonomies is essential to facilitate seamless cross-border flows of climate finance, helping countries mobilise the resources needed to achieve the net-zero targets outlined in their Nationally Determined Contributions (NDCs).

While the potential benefits of diverse approaches to developing taxonomies are acknowledged, significant differences in objectives, methodologies, and design can lead to incompatibility, exacerbating market fragmentation and information asymmetries resulting in higher verification costs, particularly for cross-border investments (IFC, 2024).

Consequently, several global initiatives have emerged to promote methodological approaches and principles that enhance alignment and interoperability between taxonomies, underscoring that the challenges posed by market fragmentation have become a significant concern for market participants and taxonomy users (Climate Policy in Action, 2023). As global initiatives continue to shape the future of sustainable finance, aligning the South African Green Finance Taxonomy (SA GFT) with international standards is strategically imperative, and should be embedded into its ongoing maintenance and implementation for several reasons:

- To expand and maintain South Africa’s position as an attractive destination for foreign direct investment, assisting in bridging the climate finance gap that domestic sources alone cannot fill.

- To support setting a fair carbon price in line with international standards and ensuring market consistency.

- To guide the local financial market in developing credible labels for green investment products to ensure competitiveness in global capital markets.

- To establish credible, taxonomy-based metrics that non-financial corporations can disclose to demonstrate the green and transition credentials of their activities and assets, enabling easier international market access.

- To effectively navigate the potential challenges and opportunities in the rapidly evolving international sustainable finance landscape.

METHODOLOGY

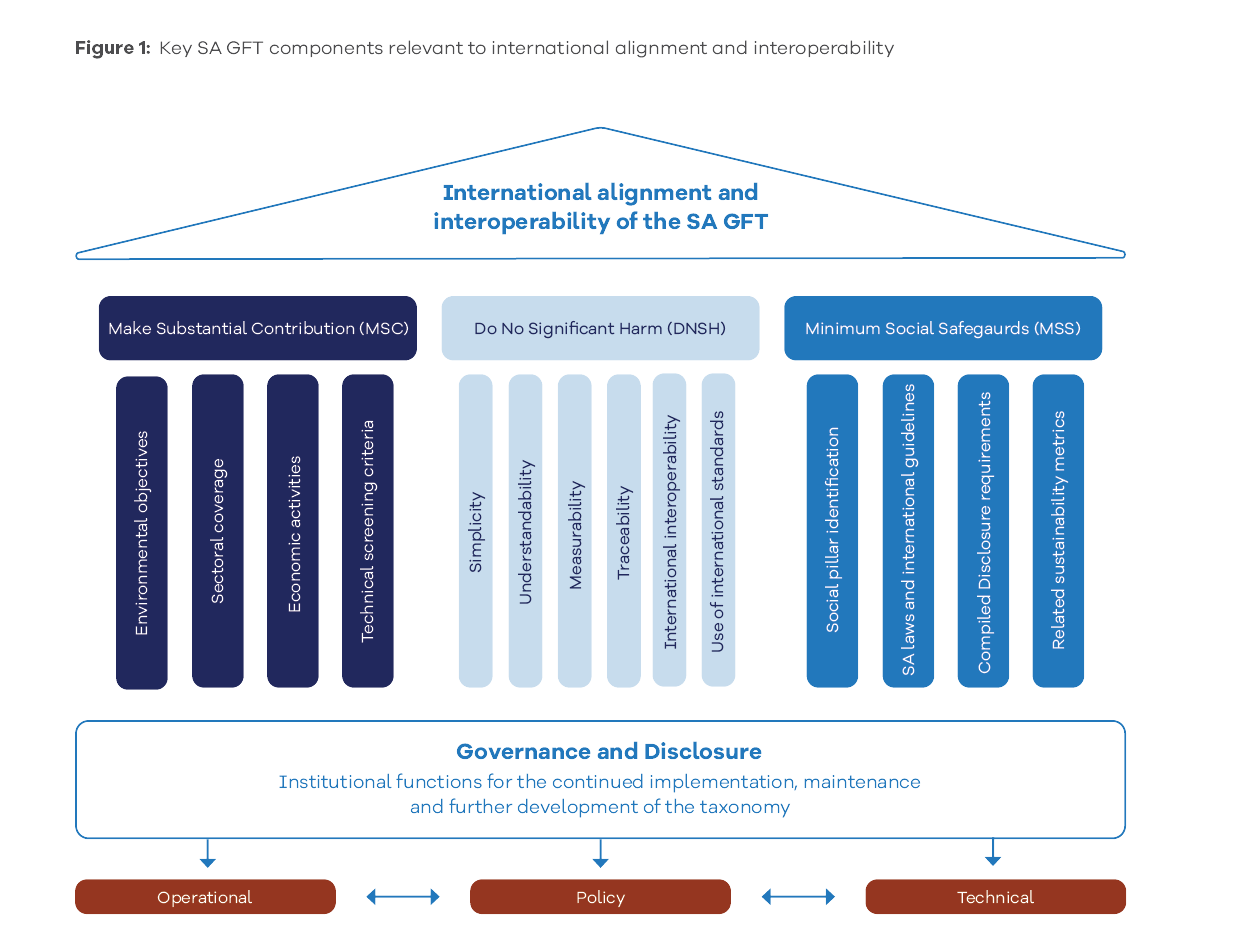

This study evaluates the SA GFT’s international alignment and interoperability with other green and sustainable finance taxonomies through a comparative analysis of three key principles that define the eligibility criteria for economic activities, sectors, and projects to qualify as green. These principles—or pillars—are as follows (SA National Treasury, 2022):

- The activity must make a substantial contribution (MSC) to at least one of the SA GFT’s six taxonomy objectives.

- An activity fulfilling the MSC criteria must also Do No Significant Harm (DNSH) to any of the other five objectives.

- In addition to meeting the MSC and DNSH criteria, the activity must also meet Minimum Social Safeguards (MSS). In addition, the analysis draws on global practices to identify the institutional, operational, and technical functions necessary for governance and disclosure, which are essential for the ongoing implementation, maintenance, and further development of the SA GFT. Figure 1 below presents a high-level overview of the analytical framework and key elements central to the empirical analysis.

KEY INSIGHTS AND RECOMMENDATIONS

The analysis indicates that the SA GFT demonstrates high international interoperability and alignment, evidenced by its relatively broad coverage of environmental objectives, economic sectors, and activities for compliance with the MSC principle. The development of performance criteria for climate change mitigation is prioritised. This supports interoperability with international taxonomies, which have similarly prioritised climate change mitigation to date, and aligns with the urgent need to identify credible activities that substantially contribute to achieving the goals outlined by the Paris Agreement.

However, its usability and adoption face challenges associated with demonstrating alignment with the DNSH and MSS pillars. Therefore, clear user guidelines and robust mechanisms are required to ensure the SA GFT remains practical and relevant for stakeholders. Furthermore, current governance and disclosure frameworks lack clarity regarding roles and responsibilities, along with other structural issues relating to support for adoption, such as the absence of compliance incentives. These gaps impede effective implementation and continuous improvement, limiting the SA GFT’s ability to remain aligned with evolving global standards and practices.

To overcome these challenges, the following recommendations are proposed for each of the pillars.

RECOMMENDATIONS UNDER THE MAKE SUBSTANTIAL CONTRIBUTION PILLAR

-

Leverage the wide coverage of economic activities within the SAGFT to lead efforts in advancing interoperability, particularly with global initiatives such as the G20 sustainable finance agenda, as well as with the broader African region.

-

Balance interoperability with localisation to maintain flexibility by incorporating elements that reflect the local context, such as specific activities and metrics tailored to the country’s sustainability challenges and opportunities.

-

Facilitate compatibility between the SA GFT and other taxonomies by developing toolkits that streamline economic sector and activity categorization, such as correspondence tables formally recognised by international peers, which ease the compliance burden for users.

-

Foster collaboration with other jurisdictions and international bodies to enhance interoperability, such as international working group participation, best practice sharing, and developing joint technical screening criteria for sectors common across multiple taxonomies.

RECOMMENDATIONS UNDER THE DO NO SIGNIFICANT HARM PILLAR

-

Introduce alternative classifications for economic activities within the SA GFT to make compliance with the DNSH criteria more flexible, moving away from an all-or-nothing approach. Specifically, the SA GFT could adopt an ‘eligible vs aligned’ classification system, whereby ‘aligned’ activities fully meet all the MSC, DNSH and MSS requirements while ‘eligible’ activities fully satisfy MSC but may not fully meet DNSH and/or MSS.

-

Establish a working group to improve usability, international interoperability, and disclosure of the DNSH principle by conducting phased reviews of South Africa’s DNSH implementation, identifying gaps, formulating plans to address them and integrating international best practices. This working group can also design capacity-building programmes and toolkits to support the effective implementation of DNSH.

-

Improve the use of specific quantitative thresholds:

-

Where possible, quantitative thresholds should be prioritised to simplify performance measurement and reduce uncertainties associated with discretionary judgements or process-based DNSH criteria.

-

When quantitative thresholds are not feasible, such as with generic DNSH criteria, improvements can be made by using clear, objective language.

-

-

Enhance traceability and specificity:

-

Where relevant regulations or standards are missing from the criteria, add references. Although 57% of the generic DNSH criteria include thresholds, many are not linked to specific regulations or standards. This creates uncertainty as to whether these thresholds align with the goals of the Paris Agreement or other international and national standards.

-

Improve usability by adding details to clarify the scope of terms used in the criteria.

-

Where regulations or standards are referenced, clearly specify relevant sections providing guidance on the type of evidence that can be used to demonstrate compliance.

-

-

Minimise the use of subjective language or provide a definition where unavoidable. Subjective language is a common issue across taxonomies with DNSH criteria. When its use is inevitable, a clear definition should always be provided.

-

Facilitate international interoperability:

-

When resources allow, conduct a line-by-line assessment of the DNSH criteria in the taxonomies of other major or relevant economies to evaluate interoperability with the SA GFT.

- The use of international standards, such as those of the International Organization for Standardization (ISO) or UN frameworks, should be increased, where possible, to improve international interoperability.

-

RECOMMENDATIONS UNDER THE MINIMUM SOCIAL SAFEGUARDS PILLAR

-

Integrate relevant existing national regulations, such as the Broad-based Black Economic Empowerment (B-BBEE) Act 53 of 2003 and the Women Empowerment and Gender Equality Bill of 2013 in the MSS framework.

-

Engage with market participants to understand challenges with MSS compliance, enabling regulators to refine the framework in practical ways that address usability issues and support effective adoption across industries.

-

Provide clear and practical guidance to reduce ambiguity in MSS compliance, including actionable steps, templates, case studies, and best practices to help users integrate MSS into daily operations.

-

Develop standardised metrics for MSS compliance that align with widely recognised sustainability reporting frameworks, such as those of the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Johannesburg Stock Exchange (JSE). These metrics should be measurable, verifiable, and easily applicable across sectors.

-

Design and adopt a standardised reporting framework to integrate and strengthen social due diligence processes.

-

Promote more flexible common ground social safeguards, helping investors and companies face fewer barriers when navigating different sustainable finance taxonomies.