Originally conceptualized by the Alliance of Small Island States (AOSIS) in 1991, the policy agenda regarding loss & damage has been characterized by considerable ambiguity, complexity, and controversy as various actors have opined on the normative question: who should be held to account for the losses and damages associated with anthropogenic climate change, and on what basis? Coloring this difficult question is the troubling reality that people who contributed least to the problem are those first and most adversely affected by it.[1]

With countries formally, and finally, recognizing the need for loss & damage finance at COP27, the coming years will demand a “mosaic of solutions” to put this policy agenda into practice, leaving less room to sidestep the issue, as has been the case in the past. This blog seeks to unpack the loss & damage policy-finance agenda, reflecting on how we could, or should, define it from a climate finance tracking perspective. Definitional clarity is now an essential prerequisite for turning the Breakthrough Agreement into breakthrough action.

While loss & damage (hereafter L&D) continues to be interpreted differently by different actors, on certain points a (general) consensus has emerged:

- Losses and damages can be categorized as either economic (those for which a monetary value is easily given), for example, loss of income and damage to assets; or non-economic (those for which a monetary value is not easily, or meaningfully, given), for example, loss of life and damage to cultural identity.

- Losses and damages can arise from both chronic (slow-onset) events (for example, sea-level rise or glacial retreat) and acute (extreme) events (for example, flooding or drought).

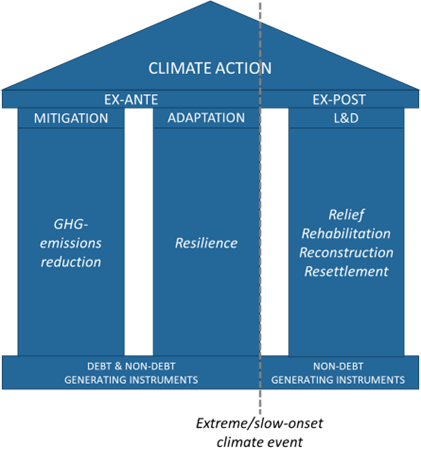

- L&D can be considered the third pillar of climate action; that is, where (i) mitigation is insufficient and (ii) adaptation inadequate (iii) loss & damage ensues (Broberg & Romera, 2020).

- L&D, therefore, lies “beyond adaptation;” that is, where the limits – either soft or hard – to adaptation are reached and climate risks become unavoided (they could, in theory, be avoided but will not be due to some constraint) or unavoidable (Mechler et al., 2019).

Given points 3 and 4, and in light of the Paris Agreement which explicitly separates adaptation (Article 7) from L&D (Article 8), efforts should be channelled into determining, in practical terms, how the boundaries between these concepts can be established. Based on CPI’s experience in tracking adaptation finance, I propose that the following points concerning temporality and typology are considered in, or inform, efforts to delineate between adaptation finance and L&D finance:

Temporality: the “when”

- Currently, adaptation is thought of in ex-ante terms; that is, adaptation is the label given to projects or activities designed to address a specific climate risk(s), with the intention of reducing vulnerability to that risk(s), thereby averting or minimizing the losses and damages it would otherwise cause.

- L&D could, then, be thought of in ex-post terms; that is, L&D would be the label given to projects/activities which, retrospectively, address the (unavoided; unavoidable) losses and damages – both economic and non-economic – resulting from an acute or chronic climate event.

Typology: the “what” & “how”

(i) R-words – relief, rehabilitation, reconstruction, and resettlement

- Adaptation is the label given to projects/activities which (intend to) increase resilience to a specific climate risk(s); that is, they increase the capacity of an individual, asset, or wider system to cope with a specific climate risk(s).

- L&D could, then, be the label given to projects/activities which provide relief, rehabilitation, reconstruction, or resettlement in the face of an acute or chronic climate event (Practical Action, 2021). These words have the benefit of being inherently people-oriented – which L&D activities are likely to be – but intentionally also work in relation to ecosystem- or asset-oriented L&D activities. Arguably, ex-post disaster-risk management activities, which provide relief in the aftermath of a climate shock, should be tracked as L&D finance, rather than adaptation finance as is currently the case.

(ii) Instruments

- Adaptation finance may be deployed in the form of grants, loans (concessional or non-concessional), policy-based financing and working capital, among others (EIB, 2022). In fact, CPI’s 2021 Global Landscape of Climate Finance showed that 72% of tracked adaptation finance in 2019/2020 was deployed as debt. That is, many of the actors in the adaptation space (primarily DFIs) expect their money back with a return on the investment, rather than providing the funding as aid; this is a challenging reality for vulnerable countries already facing high debt exposure.

- Viable financial instruments for the more urgent relief/resettlement side of L&D are likely to be narrower in range than what we currently see with adaptation finance; structured such that funding can be made available on very short notice (Climate Analytics, 2021). We could envisage a more blended approach, however, for the longer-term measures supporting rehabilitation/reconstruction. Ultimately, there is a strong argument to be made that only non-debt-generating instruments would be appropriate for L&D given, and so as not to worsen, the equity issue at the heart of the problem.

Three pillars of climate action

Unpacking the L&D discourse, with a view towards operationalizing a dedicated Fund, is no small task and easily runs the risk of glossing over the many and important nuances which have enriched, but also complicated, the discussion since 1991. Nonetheless, writing from a climate finance tracking perspective in 2023, we need clear terminology and concrete typologies, with a consensus from the outset on the temporal dimension underpinning our work.[2] Combining these practical requirements with the consensus points established in the literature, I suggest we approach L&D from an ex-post perspective, preliminarily determine relevant activities according to the 4 R’s – relief, rehabilitation, reconstruction, and resettlement – and decide upon a typology of (acceptable and viable) financial instruments which could effectively and equitably address the losses and damages associated with anthropogenic climate change. In doing so, we may move to a clearer understanding of what L&D finance should actually entail (a pressing agenda in the run-up to COP28) and, in turn, bolster the momentum to fully institutionalize and subsequently implement Loss & Damage as the third pillar of climate action, alongside Mitigation and Adaptation.

References

Broberg, Morten and Romera, Beatriz Martinez, 2020. “Loss and damage after Paris: more bark than bite?” Available at: https://www.tandfonline.com/doi/full/10.1080/14693062.2020.1778885

Chancel, Lucas, Bothe, Philipp and Voituriez, Tancrède, 2023. “Climate Inequality Report 2023. Fair taxes for a sustainable future in the Global South.” Available at: https://wid.world/wp-content/uploads/2023/01/CBV2023-ClimateInequalityReport-2.pdf

Climate Analytics, 2021. “Facing the facts – the need for loss and damage finance can no longer be denied.” Available at: https://climateanalytics.org/blog/2021/facing-the-facts-the-need-for-loss-and-damage-finance-can-no-longer-be-denied/

Climate Policy Initiative (CPI), 2021. “Global Landscape of Climate Finance 2021.” Available at: https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2021/

European Investment Bank (EIB), 2022. “Joint methodology for tracking climate change adaptation finance.” Available at: https://www.eib.org/en/publications/20220242-mdbs-joint-methodology-for-tracking-climate-change-adaptation-finance

Mechler, Reinhard, Bouwer, Laurens M., Schinko, Thomas, Surminski, Swenja, Linnerooth-Bayer, JoAnne (eds), 2019. “Loss and Damage from Climate Change. Concepts, Methods and Policy Options.” Available at: https://link.springer.com/book/10.1007/978-3-319-72026-5

Practical Action, 2021. “Assessing and addressing climate-induced loss and damage in Bangladesh.” Available at: https://www.preventionweb.net/media/74453/download

[1] According to the Climate Inequality Report (Chancel et al., 2023), “the bottom 50% of the world population contributes to 12% of global emissions but is exposed to 75% of relative income losses due to climate change. Conversely, the top 10% of the world population is responsible for close to half of all emissions, but faces just 3% of relative income losses.”

[2] harmonizing terminology and typologies, with a common understanding of when in time you account for the project/activity (i.e. at the stage of financial commitment rather than financial disbursement), has been essential for CPI to be able to provide consistent and comparable data, in turn producing a widely-accepted baseline against which to measure progress in global climate finance flows; see the Global Landscape of Climate Finance: A Decade of Data.