The fiscal system may inadvertently increase deforestation

Indonesia’s palm oil sector has been making headlines recently because of the sector’s connection with fires from peatland conversion. Late last year, President Joko “Jokowi” Widodo announced a shift in peatland management, with policies designed to halt agricultural expansion into peat forests while facilitating the rehabilitation of already degraded peatlands.

Given the economic importance of palm oil, Indonesian policy makers, industry, and communities are looking for ways to grow the sector’s productivity without contributing to this deforestation and emissions.

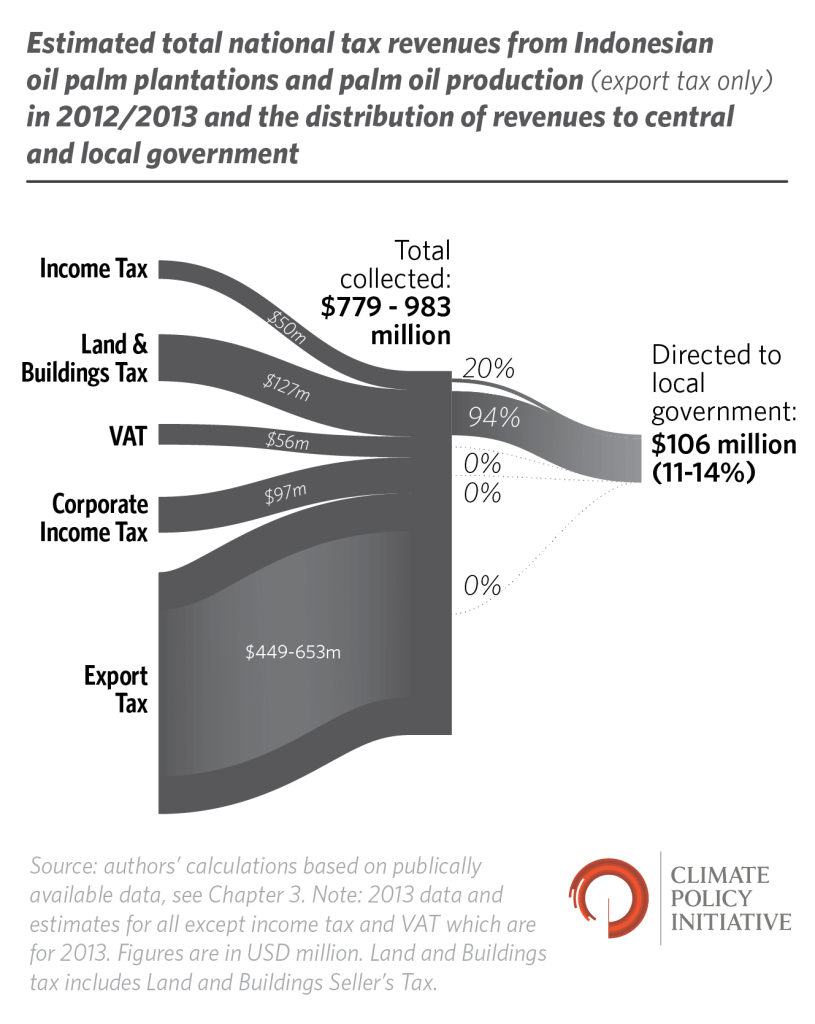

This graphic, produced by Tim Varga and Angela Falconer, shows that of the nearly one billion USD the Indonesian government collects annually in tax revenues from palm oil, less than 15% goes to the regions that produce the crop. This distribution is much smaller than it is for other sectors. For example, in mining, 80% of royalties, or over one billion USD, goes to regional governments. Comparatively, regions receive a much smaller share of revenues from palm oil, and in fact, one of the only paths for regional governments to gain revenues from palm oil is through granting land permits. As a result, Indonesia’s current revenue collection and distribution system may indirectly incentivize land expansion and peatland conversion over other more sustainable means of growing the sector’s productivity. The study recommends adjustments to revenue sharing mechanisms as a way to increase productivity and meet the government’s goals. Read the full study here: https://climatepolicyinitiative.org/publication/improving-land-productivity-through-fiscal-policy/ CPI analysts recently looked at how fiscal incentives for palm oil – and land use more broadly – could be adjusted to contribute to a more efficient and sustainable sector.

CPI analysts recently looked at how fiscal incentives for palm oil – and land use more broadly – could be adjusted to contribute to a more efficient and sustainable sector.