New CPI/PUC-Rio Report

Report Highlights

- The financial services available to Brazil’s farmers are determined by the structure of the credit distribution channels and not only by the agricultural potential in those areas.

- Brazil’s credit distribution channels are characterized by numerous financial terms and funding sources, complex qualification requirements, and a high concentration of financial institutions in the Southern and Southeastern regions of Brazil.

- The uneven distribution channels increase uncertainty for farmers as they manage their cash flows and financial risks.

- The current system also likely slows the nation’s potential for gains from agricultural production and investment.

- The new report by CPI/PUC-Rio recommends that credit services and distribution channels be designed to fit the needs of farmers and the potential of their agricultural areas.

When farmers plant crops, they must often pay production costs upfront. If at harvest time, they have successfully navigated the environmental risks to their crops, they may also face market risks that threaten their ability to recover costs and make a profit. This is why access to financial services is crucial for the Brazilian farmers and agricultural producers. Credit gives rural farmers the financial resources they need to plan for and minimize risks.

However, the credit services available to Brazil’s farmers today have been determined by the structure of the credit distribution channels (such as banks and cooperatives) and not only by the agricultural potential in those areas. Climate Policy Initiative (CPI/PUC-Rio) in partnership with the Credit Bank of Brazil, outlines the important implications the design of the system has on producers and their ability to anticipate and deal with risks.

“While rural credit is a crucial policy to support farmers, it was created when Brazilian agriculture was quite different,” said Juliano Assunção of CPI/PUC-Rio. “We need to understand how financial services can better meet farmers’ evolving needs.”

In Brazil, retail bank branches and cooperatives are the most important distribution channels for rural credit, but they vary in the way they distribute resources among locations, which leaves farmers with notably different options for credit solutions depending on where they live and bank. The report highlights three aspects to this challenge for policymakers and providers:

- Funding sources are numerous and diverse and the resources available fluctuate considerably from year to year;

- Each funding source and credit program obligates the bank or cooperative to follow a specific set of rules and requirements; and

- Less developed agricultural regions of Brazil have more limited access to financial institutions.

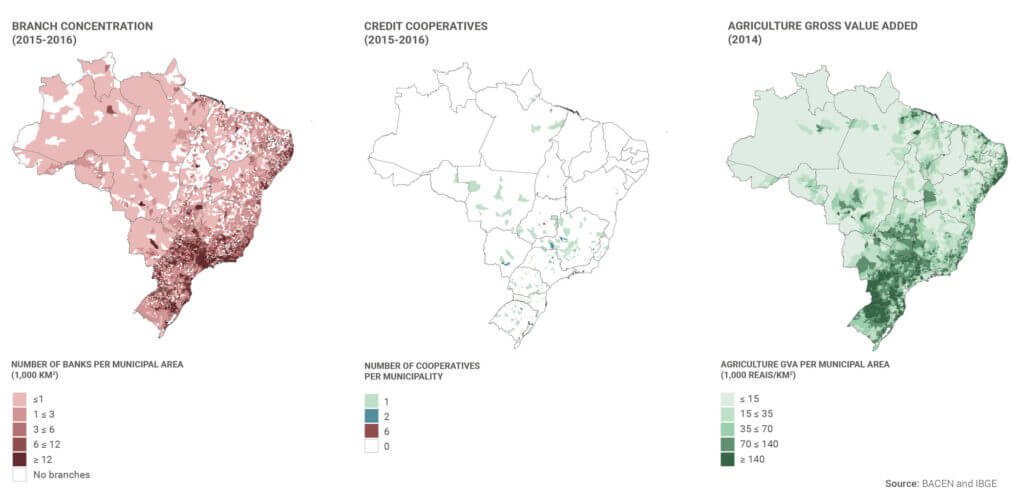

The report shows that financial institutions are highly concentrated in only a few areas in Brazil, even though the five million rural credit recipients are spread across the country. As the accompanying figure illustrates, bank branches and cooperatives during the 2015-2016 crop year were heavily located in the Southern and Southeastern regions of Brazil. In rural areas, financial providers tend to be located mainly where agricultural production is higher. Thus producers who live in less productive regions and are most likely in need of subsidized credit are exactly those who have the least access to it.

Bank Branches, Credit Cooperatives and Agriculture in Brazil

This geographic distribution also creates inefficiencies in rural credit allocation because financial institutions vary significantly in the amounts they lend to farmers. Three major banks –Banco do Brasil, Itaú, and Bradesco – and credit cooperatives offered over three-quarters of all rural credit in the 2015-2016 crop-year. As a result, the amount of funds available to rural farmers was based in part on each farmer’s proximity to one of these financial institutions.

Ultimately, this uneven system often results in a mismatch of credit supply and demand across the country and increases uncertainty for the farmers and their ability to deal with risk. It also likely slows the nation’s potential for gains from agricultural production and investment.

The report recommends that credit services and distribution channels be re-shaped to fit the needs of the individual farmers and the potential of their agricultural areas with adequate investments to boost productivity.

“This has been an important first step in our understanding of how access to rural credit affects farmers,” said Assunção. “Our next stage will be to work with the Brazilian Central Bank to quantify and measure the impact that the distribution channels of rural credit have on producers.”

See publication at https://goo.gl/5JsCuJ.

Media Contact

Mariana Campos

mariana.campos@cpirio.org

+55 21 3527-2520 / 21 97299-3553