This publication is CPI’s analysis of Conexsus Impact Fund, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

Since 2018, Brazil has lost over two million hectares of native vegetation in the Amazon alone despite the country’s commitment to restore 12 million hectares of forests and 15 million hectares of degraded pasturelands by 2030. Incentivizing sustainable smallholder agriculture and producers within forest-based value chains can help keep remaining forests intact and reduce land use emissions. However, only 2 to 3% of the annual USD 6 billion subsidized credit line for small producers go to sustainable production systems and forest based value chains.

The Conexsus Impact Fund is the only fund in Brazil designed to redirect federal subsidized credit (Pronaf) to sustainable production systems and those that keep forests standing.

INNOVATION

The fund will provide financial management assistance, helping rural and forest-based enterprises to better understand Pronaf’s credit approval process and strengthening their capacity in accounting, cash-flow management, documentation, and governance. In addition, financial offerings will help enterprises meet cash flow needs and build a financial track record, requirements that often prohibit enterprises from accessing low-rate lines of credit.

Lastly, a network of “credit enablers” will help build a pipeline of sustainable agriculture and forestry-based projects for local banks, addressing financial institutions’ limited familiarity with forest areas.

IMPACT

As of September 2020, the fund has already raised and disbursed USD 2 million to provide working capital and financial relief to part of its target client base that has been affected by the COVID-19 pandemic. Then, the loan portfolio will be expanded to USD 10 million and the financial products offered by the fund can leverage up to ten times more affordable Pronaf credit lines to these institutions.

Conexsus has the intention to provide financial mentoring and loans to approximately 600 institutions over the initial lifetime of the fund, impacting 30,000 producers’ households and covering 2.5 million hectares. Over time the Fund has the potential to contribute to keeping at least 900mn tCO2 in stock in existing vegetation.

DESIGN

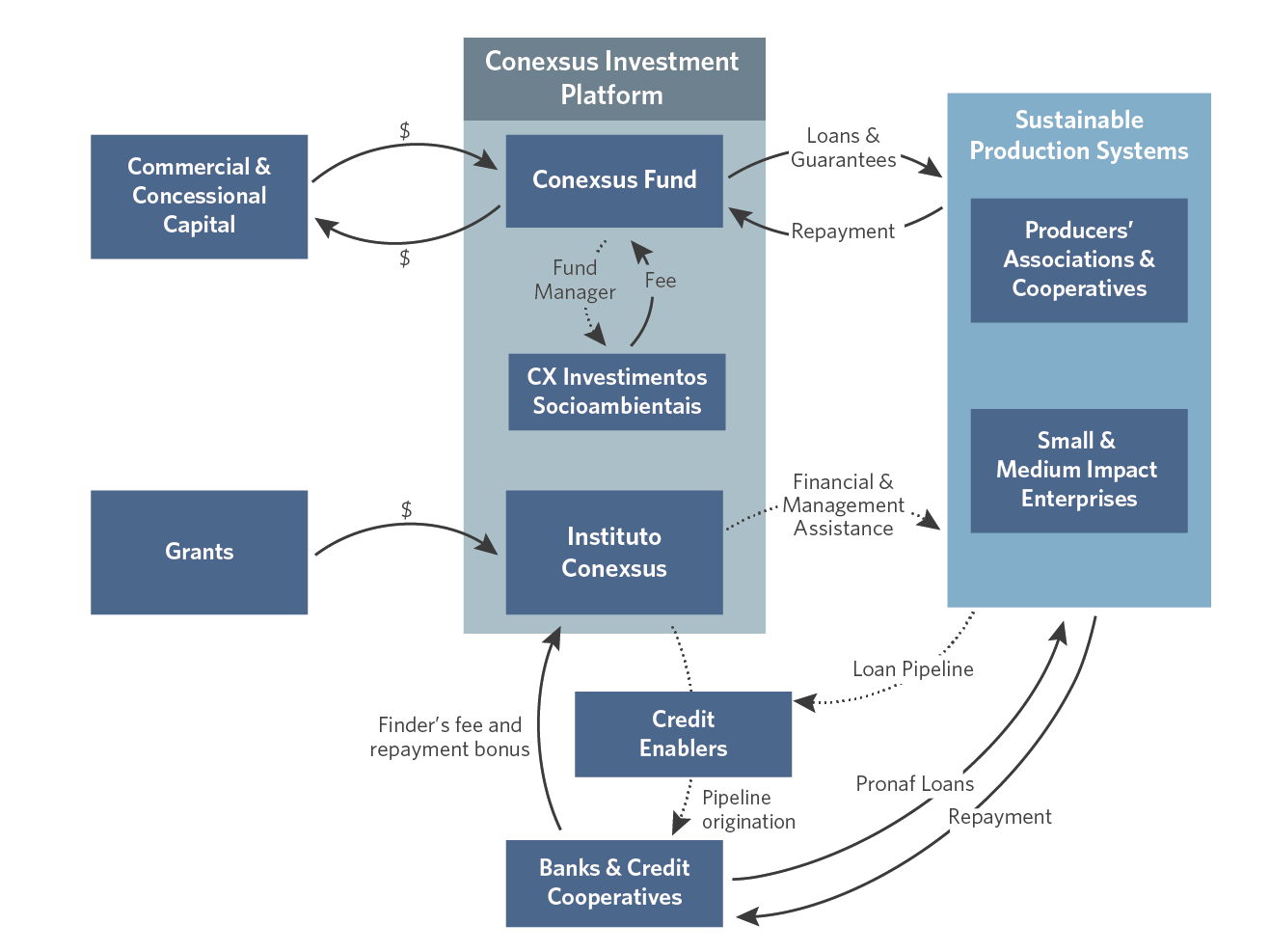

The Conexsus Impact Fund operates within the Conexsus Investment Platform. First, Instituto Conexsus will identify cooperatives, associations and SMES that are eligible to Pronaf loans through its credit enablers program. These cooperatives and associations will also receive financial mentoring.

Second, CX Investimentos Socioambientais, acting as an expert consultant, will access these institutions and identify loan opportunities originated by the credit enablers and recommend transactions to the fund. The third and key piece of the platform will evaluate which potential loans they will approve and disburse. And as doing so, they will also be creating the credit history required by financial institutions operating Pronaf resources. Once these cooperatives and SMEs receive Pronaf resources, they pay back the funds’ loans.

The platform will raise resources to the fund from concessional and commercial capital providers, and the financial mentoring/ credit enablers’ program will be paid by a combination of resources coming from a finders’ fee charged to Pronaf providers, a fee charged to the fund manager by CX Investimentos Socioambientais, and by grants from philanthropic institutions.