As the main instrument of Brazilian agricultural policy, the Agricultural Plan (Plano Safra) is crucial for sustainable development, establishing credit lines aimed at ensuring financing for crop production and product commercialization. The goal of the agricultural policy has been to assist producers in dealing with difficulties and uncertainties. Given its relevance to agricultural practices and land use, it is essential to fully align the Agricultural Plan with Brazil’s climate goals, and to link its portfolio to low-carbon emission practices, similarly to how the National Program for Low-Carbon Emissions in Agriculture (Programa para Redução da Emissão de Gases de Efeito Estufa na Agricultura – ABC+ Program) operates today.

Rural credit is the most important source of financing for the agricultural sector. The government allocated approximately R$ 340 billion for rural credit in the 2022/23 agricultural year, accounting for about 29% of the total agricultural production in the country, estimated in R$ 1.2 trillion.[1] The Agricultural Plan also allocates resources to the Rural Insurance Premium Subsidies Program (Programa de Subvenção ao Prêmio do Seguro Rural – PSR). Given the increasing risks of extreme weather events caused by climate change, rural insurance can play an important role in risk reduction, protecting rural producers’ subsistence, and ensuring food security.

To develop a sustainable, low-carbon, and climate-resilient agriculture, long-term public and private investments are necessary for the technological transition. Small producers should be prioritized due to their potential contribution to environmental conservation and food security, as well as their vulnerability to extreme weather events. Enhancing risk management policies in agriculture can also have significant positive impacts on the sector by creating incentives for the adoption of sustainable and resilient practices.

Given the current climate and agricultural landscape in the country, Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio), co-leader of the Green Finance Task Force of the Brazilian Coalition on Climate, Forests and Agriculture (Coalizão Brasil Clima, Florestas e Agricultura), contributed, in partnership with Agroicone, with proposals to boost sustainability in the 2023/24 Agricultural Plan.[2] These proposals were submitted to the Agricultural Policy Secretariat (Secretaria de Política Agrícola – SPA) of the Ministry of Agriculture and Livestock (Ministério da Agricultura e Pecuária – MAPA) and outline the necessary steps for the country to advance towards sustainable agriculture and the economic and social development of the most vulnerable rural regions. This technical note discusses these proposals and their relevance for the continuous improvement of rural credit and insurance, aiming at the mitigation and adaptation of climate risks in Brazil.

Proposal 1. Aligning Rural Credit Rules with Sustainability and Prioritizing the ABC+ Credit Lines

The first set of proposals aims to improve norms and resource allocation in rural credit, prioritizing sustainable rural credit lines, with a focus on climate-resilient and low carbon emission practices.

The ABC+ Program, which is the main rural credit line designed to promote environmental preservation, should be strengthened, along with the PRONAF ABC+ line, a subprogram of the National Plan for Family Farming (Programa Nacional de Fortalecimento da Agricultura Familiar – PRONAF).

The ABC+ Program finances producers who adopt suitable practices, adapted technologies, and efficient production systems that contribute to greenhouse gas emissions mitigation.[3] Despite its importance, the program had a budget allocation of R$ 6.2 billion for the 2022/23 agricultural year, representing only 1.8% of the total Agricultural Plan, or 6.6% of the total investment resources. Likewise the ABC+ Program, PRONAF offers investment lines that generate positive environmental externalities, the PRONAF ABC+.[4]

It is important to increase the available resources for the ABC+ Program and PRONAF ABC+ to R$ 8 billion and R$ 5 billion, respectively, and to reduce interest rates in specific subprograms of the ABC+ Program and investment credit lines of PRONAF ABC+. Furthermore, other relevant measures include increasing the limit of working capital rural credit funded by controlled resources for enterprises with an active rural insurance policy, and revising the conditions and requirements of rural credit financing, aligning incentives with sustainability goals.

Compliance with the Agricultural Climate Risk Zoning (Zoneamento Agrícola de Risco Climático – ZARC) in all rural credit operations is crucial to minimize agro-climatic risks. Additionally, the verification of pasture quality for investment financing in PRONAF, PRONAMP,[5] MODERAGRO,[6] and for cattle acquisition financing not linked to any specific program will contribute to identifying contracts with the potential to reduce negative environmental impacts. In the case of pasture degradation, credit should be granted alongside pasture recovery and the implementation of stewardship measures, falling under specific ABC+ lines.

The publication of data for consultation in rural credit granting, as part of the Sustainable Rural Credit Bureau initiative,[7],[8] will enable financial institutions to access relevant information and thereby green their portfolios. The inclusion of deforestation data is suggested, as well as data on pasture quality, water potential for irrigation, and ZARC maps with stewardship levels in the Rural Credit and PROAGRO Operations System (Sistema de Operações do Crédito Rural e do Proagro – SICOR).[9]

Currently, the restriction on granting credit for properties with embargoes exists only for the Amazon Biome and applies only to embargoes issued by the Brazilian Institute of Environment and Renewable Natural Resources (Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais – IBAMA). Therefore, it is also necessary to restrict the credit for properties with illegal deforestation (except when the property is already undergoing environmental regularization) and for areas with active embargoes issued by federal and state environmental agencies in all biomes.

The allocation of resources in rural credit programs that prioritize low-carbon emission practices and strengthening programs aimed at family farming are measures that can contribute to mitigating the environmental impacts of agricultural activities and facilitate the technological transition in rural areas. In turn, the revision of conditions and requirements for rural credit financing, combined with increased flow of information, can help ensure transparency and commitment of financial institutions to sustainability goals. Finally, forbidding credit granting for properties with illegal deforestation or current embargoes by environmental agencies is an important measure to tackle environmental degradation and deforestation.

Proposal 2. Improving Risk Management in Agriculture

The second set of proposals aims to enhance instruments for managing climate, environmental and social risks in the agricultural sector, with a focus on the Rural Insurance Premium Subsidies Program (Programa de Subvenção ao Prêmio do Seguro Rural – PSR), strengthening the country’s agricultural policy through measures that protect rural producers and reduce socio-environmental negative impacts of climatic events in the sector.

The Brazilian agricultural production faces increasing risks due to climate change, with adverse weather events becoming more frequent, leading to significant crop losses and an increase in rural insurance claim payments. In 2021/22, severe drought led to a more than fourfold increase in insurance claim payments compared to the previous harvest, according to data from the Superintendence for Private Insurance (Superintendência de Seguros Privados – SUSEP),[10] while demand for rural insurance has tripled in the past five years, as reported by the National Confederation of Insurance Companies (Confederação Nacional das Seguradoras – CNSEG).[11]

Given this scenario, public policies for managing agricultural risks need to be improved to ensure the necessary investments for transitioning to low-carbon production and facilitating the sector’s adaptation to the new climate reality. It is crucial to incentivize the adoption of modern and sustainable practices that contribute to adaptation, resilience, and mitigation in the context of climate change. These practices, in turn, require considerable investments and appropriate financial instruments to make their implementation feasible. In this context, the PSR is particularly relevant for mitigating risks and providing support to producers, especially those who struggle to cover the higher costs of insurance policies. The program subsidizes part of the cost (premium) that rural producers pay to insurance companies when purchasing insurance policies.

Securing R$ 2 billion in resources for the economic subsidy of the PSR is crucial, considering that its funds may be subject to budget cuts and its execution compromised.[12] Furthermore, the measures aim to prioritize the allocation of subsidy resources to small and medium-sized producers who currently hire the Agricultural Activity Guarantee Program (Programa de Garantia da Atividade Agropecuária – PROAGRO), seeking to expand access to the PSR for this audience, as well as for producers who adopt sustainable agricultural practices and benefit from ABC+ credit.

Another important measure is the implementation of the ZARC Stewardship Levels (ZARC Níveis de Manejo – ZARC NM) in rural insurance, especially within the scope of the PSR.[13] This entails discussing and developing an Implementation Plan for ZARC NM with insurance companies to underwrite risks based on the adopted stewardship level. Finally, the proposals aim at integrated risk management in agriculture, through the dissemination of actions and strategies adopted in the Program for Integrated Risk Management in Agriculture (Programa Agro Gestão Integrada de Riscos – AGIR), particularly by promoting the training of rural claim adjusters, professionals responsible for preparing technical reports and conducting rural insurance inspections.

Proposal 3. Prioritizing the Allocation of Resources from the Constitutional Funds for Small Producers and Sustainability (ABC+ Program and PRONAF ABC+)

The third set of proposals aims to improve the allocation of resources from the Constitutional Financing Funds (Fundos Constitucionais de Financiamento – FCFs) to promote sustainable development through the adoption of technologies, productivity improvement, and resilience on rural properties. It is necessary to allocate resources from the FCFs to the ABC+ Program and PRONAF ABC+. Additionally, the FCFs should enhance their regulatory instruments and financing rules, aligning them with the National Rural Credit System (Sistema Nacional de Crédito Rural – SNCR) to harmonize and simplify rural credit.

The FCFs are guaranteed by the Federal Constitution and were designed to promote economic development in vulnerable sectors and municipalities of the North, Northeast, and Midwest regions. The funds’ resources are an important source of financing in rural credit, accounting for approximately 37% of the total resources allocated for investment in the 2021/22 Brazilian Agricultural Plan, considering only controlled resources.

However, the efficient allocation of these resources remains a challenge, as the rules for defining priority beneficiaries are wide-ranging and include virtually all rural establishments in the covered regions.[14] The expansion in the definition of priority groups has occurred over the years, contributing to the concentration of fund resources, whereby larger producers gained more access to resources with each revision. Therefore, redefining criteria and simplifying rules can help in both resource allocation and a better understanding and evaluation of policy guidelines.

In this sense, allocating FCFs resources to the ABC+ Program and PRONAF ABC+, assigning a share of these funds for financing investment projects, will allow for a better targeting of credit towards socio-environmental and development goals. It is suggested to allocate approximately 10% of the financed amount for investment by the FCFs towards sustainable practices, and to establish a schedule and targets for the incorporation of the criteria defined by the ABC+ Program and PRONAF ABC+ credit lines into the entire scope of investment resources classified as “not linked to a specific program” by 2030.

Furthermore, the proposals also include the possibility of including a working capital credit limit with controlled resources from the FCFs, by revoking the rule that excludes this limit, and harmonizing the criteria and incentives of the FCFs with the rest of the National Rural Credit System.

CONCLUSION

The Brazilian Agricultural Plan (Plano Safra) is a crucial tool to foster the development of sustainable agriculture in Brazil. Given the significant allocation of public resources and subsidies in agricultural policy, it is essential that these resources are well directed, yielding benefits to society through the promotion of agricultural sustainability and environmental preservation. Rural credit can reconcile production and conservation, promoting productivity gains while reducing pressures on native vegetation.

It is essential that the Agricultural Plan provides better conditions and incentives to rural producers who adopt sustainable practices and comply with the Forest Code,[15] across all its lines and programs. Prioritizing small and medium-sized producers can increase land productivity and mitigate adverse impacts on the environment. A sustainable and responsible approach to agriculture and the environment in Brazil starts with the Agricultural Plan.

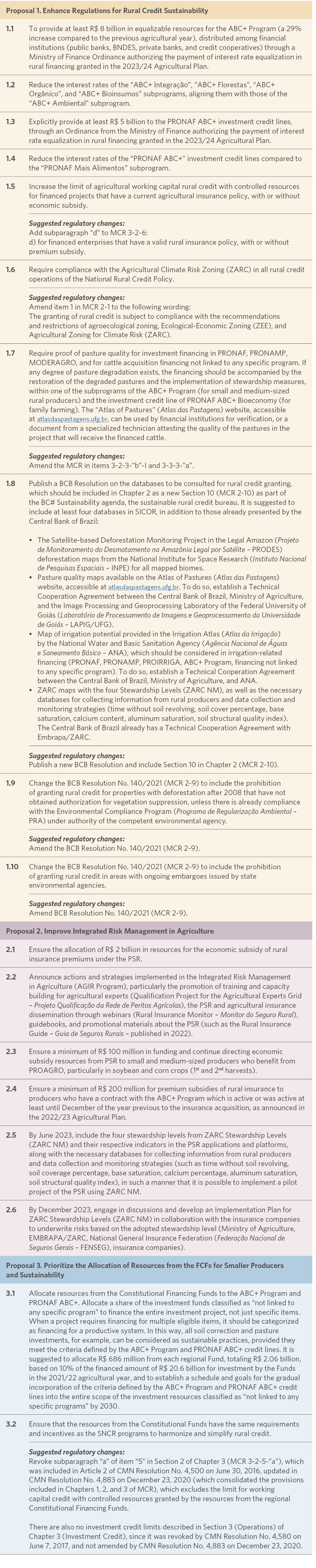

ANNEX. PROPOSALS TO THE BRAZILIAN 2023/24 AGRICULTURAL PLAN

Table 1. Full Proposals from the Brazilian Coalition for the 2023/24 Agricultural Plan

The authors would like to thank Wagner Oliveira, Natalie Hoover El Rashidy, and Giovanna de Miranda for the editing and revision of the text and Nina Oswald Vieira for formatting and graphic design.

[1] MAPA. The estimated value of agricultural production in 2022 is R$ 1.185 trillion. 2022. bit.ly/3oqSmU8.

[2] Detailed information about the proposals can be accessed on the Brazilian Coalition’s contributions webpage for the 2023/24 Agricultural Plan: bit.ly/40fXqIn. Also, see Technical Notes from Agroicone, co-leader of the Green Finance Task Force, at bit.ly/3M75sPR.

[3] The ABC+ Program is part of the set of strategies of the Sectoral Plan for Climate Change Adaptation and Low-Carbon Emission in Agriculture (Plano Setorial para Adaptação à Mudança do Clima e Baixa Emissão de Carbono na Agropecuária – ABC+ Plan), a public policy composed of a group of actions aimed at promoting the expansion of the adoption of certain sustainable agricultural technologies with high potential for mitigating greenhouse gas emissions and fighting global warming.

[4] The PRONAF ABC+ subprograms finance investments in sustainable production systems and technologies. They are: PRONAF ABC+ Bioeconomy, PRONAF ABC+ Agroecology, PRONAF ABC+ Forests, and PRONAF ABC+ Semiarid.

[5] National Program to Support Medium-Sized Rural Producers (Programa Nacional de Apoio ao Médio Produtor Rural – PRONAMP).

[6] Program for Modernization of Agriculture and Conservation of Natural Resources (Programa de Modernização da Agricultura e Conservação de Recursos Naturais – MODERAGRO).

[7] The BC# Sustainability Agenda foresees the implementation of a Sustainable Rural Credit Bureau, an open banking tool that will allow differentiating credit operations based on sustainability criteria. bit.ly/3GQcyFt.

[8] The BC# Sustainability Agenda was launched in September 2020 by the Central Bank of Brazil and aims to promote sustainable finance and reduce socio-environmental and climate risks in the economy and in the financial system. bit.ly/3mEQ7Mu.

[9] SICOR is the administrative data system of the Central Bank of Brazil that contains detailed information about rural credit operations in the country.

[10] Souza, Priscila, Wagner Oliveira, and Mariana Stussi. Challenges of Rural Insurance in the Context of Climate Change: the Case of Soybeans. Rio de Janeiro: Climate Policy Initiative, 2023. bit.ly/42JGr3b.

[11] CNSEG. Demand for Rural Insurance has tripled in the last 5 years. January 23, 2023. bit.ly/3pdW7g5.

[12] The amount of resources allocated to subsidize rural insurance policies is determined by decree. Thus, the PSR’s budget is subject to budget constraints, which in turn can jeopardize its execution and create uncertainty for producers regarding the guarantee of access to subsidies to pay insurance premiums.

[13] This new zoning considers indicators highly correlated with stewardship and water stress, enabling the separation of risks into four stewardship levels. The higher the stewardship level, the greater the resilience to water stress for the specific crop, and consequently, the greater the desirable environmental externalities.

[14] Souza, Priscila and Leila Pereira. Priorities That Do Not Prioritize: The Mismatch Between the Objectives and the Application of Resources from Constitutional Funds Leads to Credit Concentration in the Rural Sector. Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/4312zq0.

[15] The Native Vegetation Protection Law (No. 12,651/2012) is broadly known as the Forest Code. The Brazilian Forest Code is a legislation that establishes rules and regulations for the protection and sustainable use of forests in Brazil.