Introduction

Climate change and fiscal challenges are closely interlinked, especially in developing countries, sometimes forming a vicious cycle. Climate change can exacerbate fiscal pressure by diminishing economic output and therefore tax revenues, as well as consuming fiscal resources for disaster relief and reconstruction. At the same time, a heavy debt burden can limit fiscal space for climate action, intensifying the impacts of climate change. This cyclical relationship has prompted the implementation of debt-for-climate (DFC) swaps, which have the potential to simultaneously address both challenges.

Debt-for-climate swaps

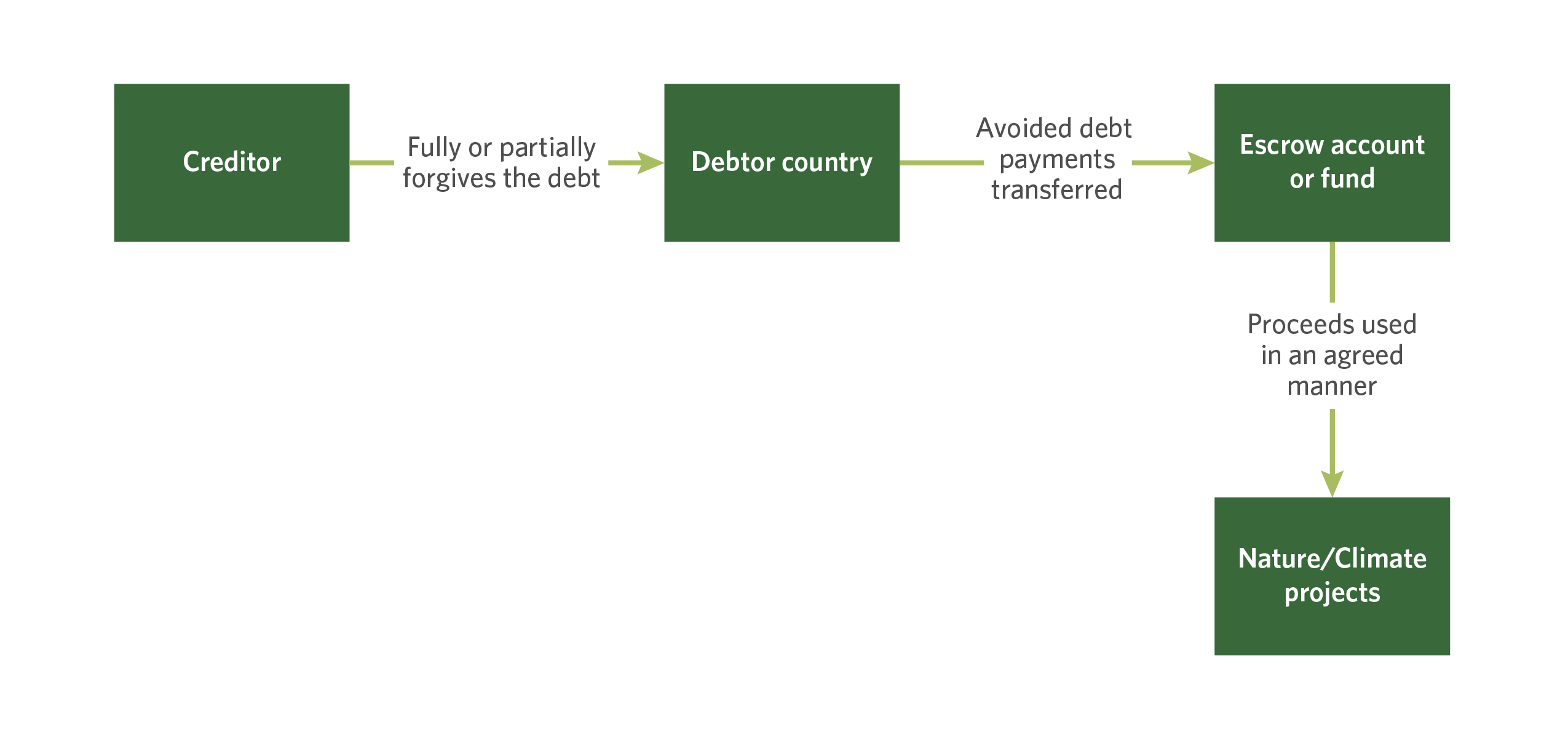

In this primer, we define DFC swaps as operations that involve the cancellation, exchange, or refinancing of a portion of a country’s public debt in return for its policy commitments to invest the resultant debt service savings in projects for environmental conservation or climate change mitigation and adaptation. DFC swaps can involve official bilateral debt or privately held debt and may feature partial debt relief or refinancing to create fiscal headroom for climate investments, depending on the interests of the parties involved. We note that “debt-for-nature swaps” are a subset of DFC swaps as defined above, particularly for older transactions that often featured some level of debt relief while allocating a portion of the debt service savings to conservation projects. This primer refers to “DFC swap” as an umbrella term that captures these types of arrangements.

History

The concept of DFC swaps emerged in the 1980s, with the earliest swap occurring in 1987 in Bolivia, facilitated by Conservation International. Originally, swaps were conceived as general development financing instruments before evolving into specialized mechanisms addressing nature and conservation. Throughout the 1990s, numerous countries engaged in similar arrangements, often facilitated by international conservation organizations and bilateral agreements. In recent years, these swaps have gained renewed interest as developing countries face increasing climate impacts and financial strains, resulting in larger and more innovative deals. Such swaps have been conducted in the Seychelles (2015), Belize (2021), and Ecuador (2023), as detailed in Section 5 below.

Types of swaps and transaction mechanism

DFC swaps can be grouped into two broad categories:

a. Official bilateral or non-commercial: These are direct arrangements between a debtor country and one or more official creditors that involve the cancellation of debt with the agreement that the resulting debt service savings will be directed toward an agreed use to fund climate-related actions or investments. They have sometimes been used to achieve additional debt relief alongside a Paris Club agreement when only a portion of the debt service savings are redirected to the climate-related project, or as additional financing where political or policy circumstances made a swap more easily available than the provision of grant or other concessional financing. One example of such exchanges is AFD’s Debt Reduction-Development Contract.

b. Trilateral or commercial: These arrangements involve the buyback or exchange of debt held by private creditors, often financed by donors through an international NGO. There are differing structures, but the core mechanism is that the NGO provides or facilitates a loan to the debtor country at below-market interest rates, with two key requirements:

- The debtor country must use the proceeds to repurchase debt held by commercial creditors.

- The debt relief generated—calculated as the difference between the avoided debt service requirements on the retired debt and those of the new, lower-cost debt—must be allocated to finance climate-related projects.

These transactions can include the use of a trust fund to administer the savings, as well as credit enhancements (e.g., in the form of guarantees, political-risk insurance, parametric insurance) to reduce the cost of the new borrowing. It is also possible to involve innovative mechanisms for the new debt, such as repayment with carbon credits, to increase the debt service savings.

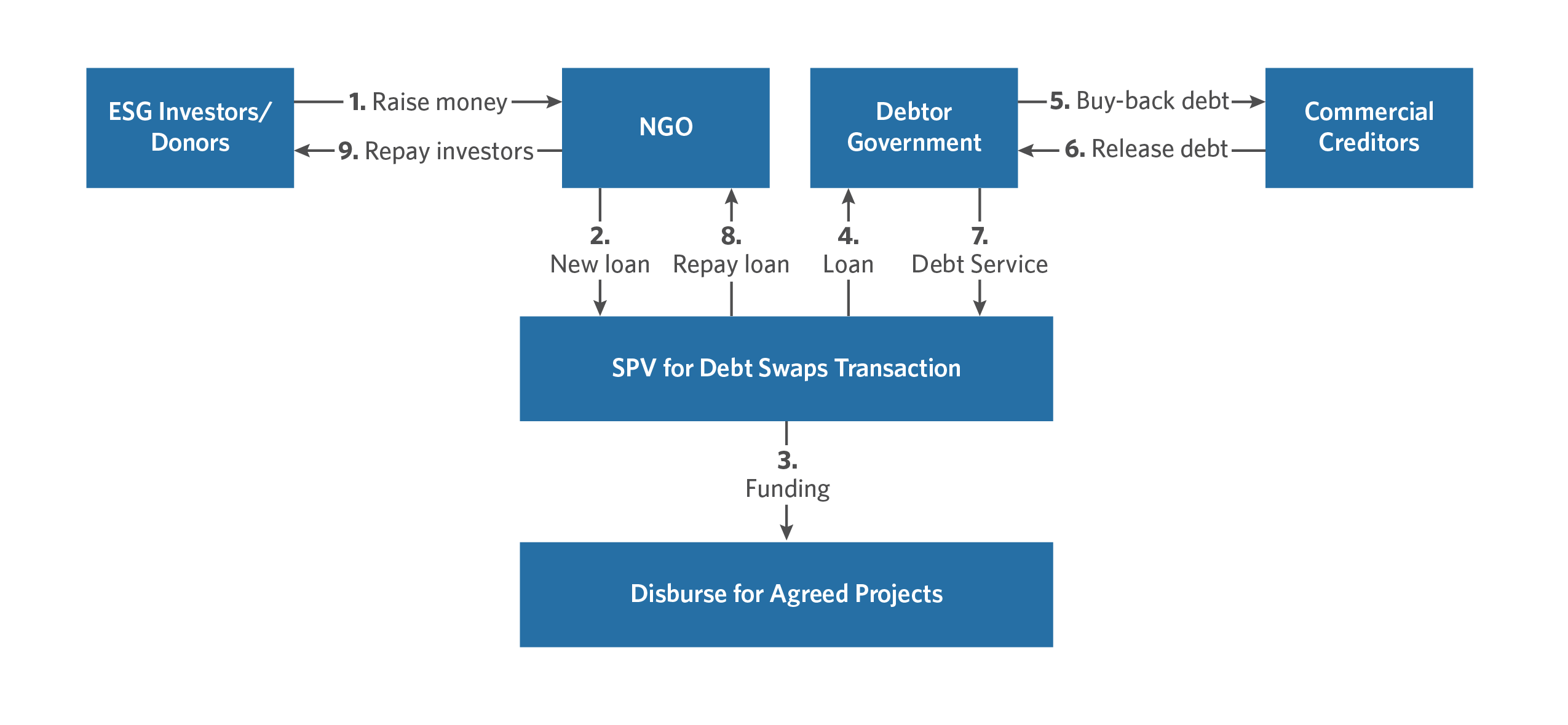

Figure 2 illustrates a trilateral swap among an NGO, commercial creditors, and a government, with the following steps:

1: The NGO raises funding (loans/grants) from ESG investors.

2: Funding is on-lent to a special purpose vehicle (SPV).

3-4: The SPV funds agreed-upon projects and also provides a loan to the government.

5-6: The government uses this loan to buy back debt from commercial creditors.

7-9: Debt service from the government flows back to the SPV, the NGO, and the original investors.

Details of recent innovative examples

a. In 2023, Ecuador completed the largest ever DFC swap, converting USD 1.6 billion of commercial debt into a USD 656 million loan by issuing blue bonds with the help of Credit Suisse. This transaction was creditenhanced by guarantee from the Inter-American Development Bank (IDB) and political-risk insurance provided by the US Development Finance Corporation (USDFC). This combination of guarantees and insurance improved the credit rating of the blue bonds, making them more appealing to investors. It marked the first instance where a multilateral institution combined guarantees with political-risk insurance to mobilize resources. The deal required Ecuador to increase the protection of its marine reserves by 60,000 square kilometers and to improve sustainable fishing practices. The Oceans Finance Company was a key adviser to the transaction, helping to shape the deal and providing early-stage development capital along with other parties.

b. In 2021, the Government of Belize completed a USD 364 million DFC conversion, by repurchasing USD 553 million of its public debt at a 45% discount through a Blue Loan facilitated by The Nature Conservancy (TNC) and financed by Credit Suisse. As part of the deal, Belize committed to protecting 30% of its ocean territory, including the Mesoamerican Reef, by 2026 through a marine spatial planning process and established an independent conservation fund. The transaction was managed by TNC’s subsidiary NatureVest and was credit-enhanced by the USDFC through political-risk insurance.

c. In 2015, Seychelles entered a DFC swap with TNC to buy back USD 21.6 million of its official bilateral debt, mainly owed to Paris Club creditors, at a discounted price of UD 20.2 million. This transaction was funded by private philanthropic contributions and a loan from TNC’s NatureVest. The debt was purchased by the newly created Seychelles Conservation and Climate Adaptation Trust (SeyCCAT). In exchange, Seychelles issued two promissory notes totaling USD 21.6 million to repay the TNC loan and to endow SeyCCAT. As the new debt owner, SeyCCAT provided Seychelles with extended repayment terms, easing the government’s cash-flow burden. As part of the agreement, Seychelles committed to protecting 30% of its marine waters, safeguarding 15% of high-biodiversity areas, and implementing a marine spatial plan to update coastal zone management, fisheries, and marine policies. Since the swap, Seychelles has expanded its protected marine areas from 0.04% to 30% of its national waters.

Some key considerations for the success of a DFC swap

a. Fiscal conditions: The presence of both climate and debt challenges does not automatically justify the use of DFC swaps. CPI and IMF analyses have found that these swaps are most effective when the primary barrier to climate investment is limited fiscal space. In such situations, traditional climate finance instruments like green loans or bonds are insufficient, as they would further increase debt 4Debt for Climate Swaps – A primer for FiCS members burdens. Instead, addressing this constraint requires fiscal support, which can take the form of climatec onditional grants, DFC swaps, or comprehensive debt restructuring that integrates climate conditions. In situations where a country is already experiencing debt distress, DFC swaps are generally less effective because they require the debt service savings to be committed to climate projects instead of providing debt relief.

However, DFC swaps remain a valuable tool when they: (1) Expand the fiscal capacity of a debtor country that cannot afford climate investments through additional borrowing alone, and (2) Are structured to maximize benefits for the debtor.

b. Additionality: The structure and design of a DFC conversion must enable investments that are truly additional, meaning that they go beyond what governments have already planned or budgeted for. It is crucial to emphasize this concept so that the concessional funds contributed to the swap (in the form of credit enhancement, donations, etc.) do not merely substitute or repurpose existing financial commitments, and that they generate new and incremental environmental benefits. The swap design must include impact metrics that ensure additionality. These metrics are also essential to provide the donors with proof that the funds are used effectively to achieve the intended outcomes.

c. Coordination: The design of DFC swaps should facilitate and support coordinated efforts across national platforms and stakeholders. This involves creating a framework that encourages collaboration between various government ministries, local authorities, and other relevant entities in the country. The goal is to ensure that these swaps form part of a cohesive national program aligned with broader environmental and development objectives.

d. Capacity of debtors: Country institutions must possess the necessary capacity to realize meaningful benefits from DFC swaps. Effective use of these arrangements requires expertise in both debt management and negotiation, as well as the capability to implement and monitor comprehensive climate or nature programs. Preparation often involves protracted preparations over 2-4 years, typically including identification of suitable projects, coordination among multiple parties, and lengthy negotiations. In some cases, it may be more efficient to cancel the existing debt and reissue it under the same DFC conditions to a select group of investors—be they public or private—who are open to swap arrangements. This can streamline restructuring, especially when alternative assets like carbon credits are used to satisfy interest payments and even a portion of the principal.

Role of Public Development Banks

a. Credit Enhancement by MDBs: MDBs and development finance institutions (DFIs) with an international mandate can increase attractiveness of DFC swaps by providing credit enhancement such as guarantees and political-risk insurance. These mechanisms are more challenging for national development banks (NDBs) to provide, as their credit rating is typically capped at that of the country’s sovereign debt rating. Notable examples of such credit enhancements include the recent swaps in Ecuador and Belize, where the IDB and USDFC offered partial guarantees and political-risk insurance, respectively.

b. Insurance by regional PDBs: MDBs typically provide only about 70% of the credit enhancement through guarantees, often necessitating the involvement of multiple MDBs to meet the full requirement. Insurance mechanisms by regional PDBs could address this gap by covering the remaining credit enhancement needs. They could act as an additional layer of credit enhancement by covering sovereign debt service payments. This could follow a first-loss, second-loss structure, where a MDB’s partial credit guarantee absorbs initial losses, and PDBs steps in only if that guarantee is exhausted.

c. Bilateral swaps: DFIs and Export Credit Agencies with claims abroad, can play a crucial role in a bilateral DFC swaps. Their involvement allows for leveraging existing debt claims to negotiate swaps that provide partial debt relief in exchange for funding environmental or climate projects.

d. Local currency solutions: There have been discussions and the possibility of swapping subnational debt, which is mostly denominated in local currencies. NDBs that have better credit ratings than subnational governments can participate in these solutions by purchasing local currency bonds issued by subnational governments or entities as part of the swap. NDBs can provide stable and predictable funding streams while mitigating the foreign exchange risks often associated with external debt. These NDBs can also enhance the attractiveness of these bonds by offering guarantees or other credit enhancement tools, improving their creditworthiness, and reducing the borrowing costs for subnational governments. These interventions not only mobilize private capital by de-risking investments but also create a more inclusive and accessible financing framework for local governments to address conservation and climate goals.

e. Support climate projects: PDBs—both national and subnational—can play a transformative role in amplifying the impact of conservation efforts funded through DFC swaps by offering strategically designed, subsidized loans to support sustainable economic activities in conservation areas. By aligning their financial products with the goals of the swaps, PDBs can establish a feedback loop that strengthens both environmental and socio-economic outcomes. For instance, they could provide low-interest loans to promote the adoption of eco-friendly fishing gear in regions undertaking marine conservation initiatives. Similarly, they could finance sustainable agriculture, eco-tourism ventures, and renewable energy projects that complement conservation efforts. This targeted approach would not only reinforce environmental preservation but also foster long-term community resilience by reducing dependence on unsustainable practices and creating incentives for sustainable development.

f. Delivery and monitoring of climate KPIs by PDBs: DFC swaps are often linked to key performance indicators (KPIs) that measure climate outcomes, rather than to specific expenditures or projects. Standardized KPIs could reduce monitoring costs for DFC swaps. PDBs in borrowing countries could play a key role in delivering and monitoring these KPIs, ensuring accountability and effectiveness in achieving the intended climate objectives. This linkage would improve the impact and transparency of debt swaps, aligning them more closely with measurable climate outcomes.

g. Creating government capacity for negotiation and implementation: PDBs in borrowing countries can play a crucial role in building government capacity for negotiating and implementing DFC swaps. These deals are often complex and require significant technical expertise. PDBs can:

- Provide financial structuring expertise, ensuring that the financial aspects of debt swaps are sustainable and aligned with fiscal policies.

- Offer legal and regulatory support, guiding governments through the legal frameworks and regulatory requirements necessary for executing complex financial transactions.

- Provide project management expertise or oversee the implementation of climate and nature projects, ensuring they are completed on time and within budget.

- Engage in capacity building, training government officials and stakeholders in negotiation skills, financial management, and project implementation.

- Facilitate coordination and communication between different ministries, local authorities, and other relevant entities to ensure a cohesive approach to implementing debt swaps.