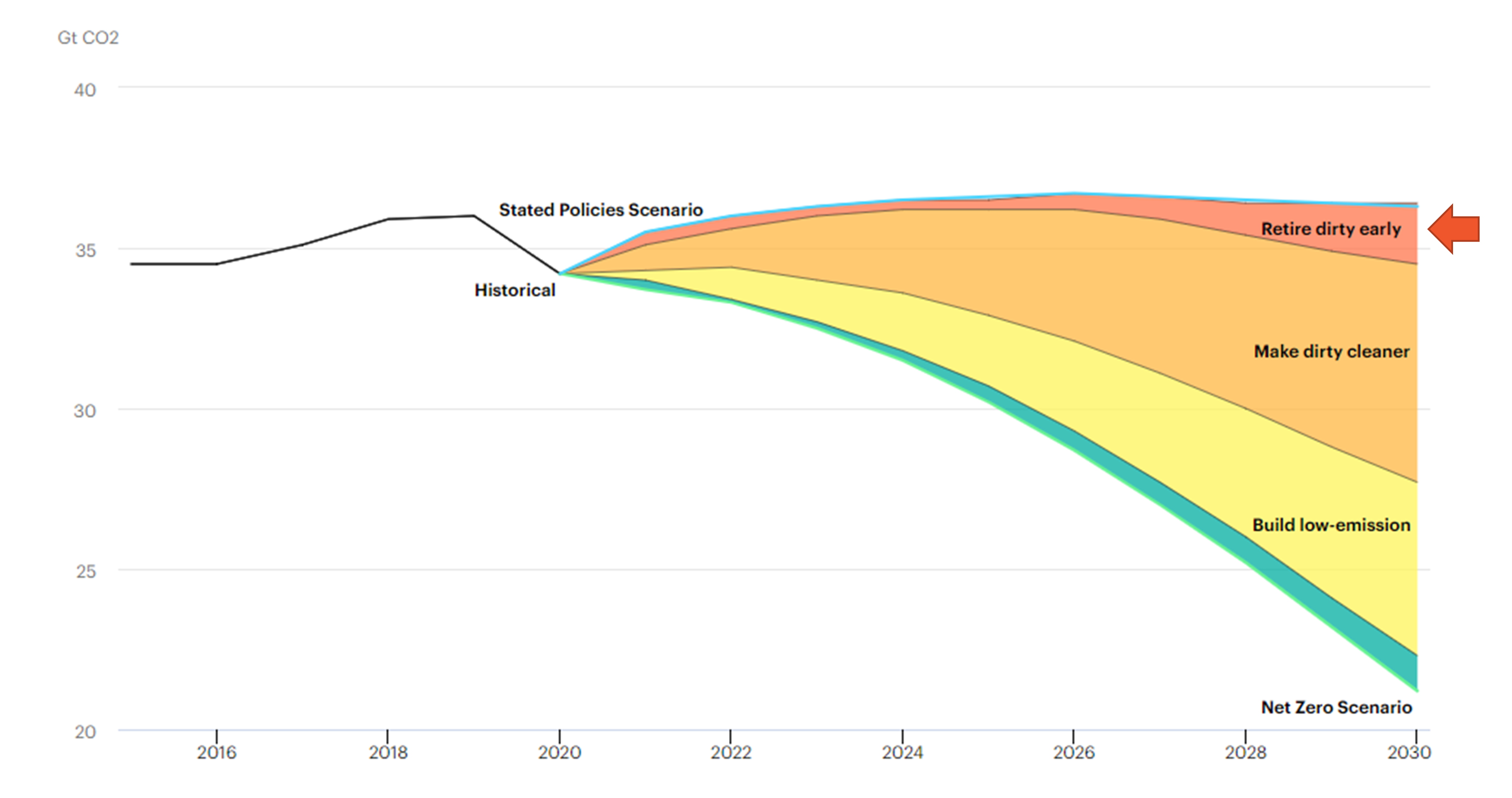

To meet the global temperature goal of the Paris climate agreement, the retirement of existing, unabated coal-fired power plants will need to accelerate. According to the IEA, unabated coal power generation must end by 2030 in OECD countries and 2040 in developing economies, in addition to halting the financing of new coal plants that will lock in emissions for years to come (IEA, 2021; Macquarie et al., 2020).

Rather than allowing unabated coal plants to function until the end of their lifecycles, plants can be retrofitted or retired early in a managed and just fashion, a key ambition of the Just Energy Transition Partnerships (JETP). ‘Managed coal phaseout’ is used in this brief to describe the managed phaseout of unabated coal-fired power generation, through retirement or complete retrofitting of plants to produce clean energy, before the end of the plant’s lifecycle (Buchner et al., 2022).

Figure 1: The need to retire coal assets

There is growing demand for financing to meet the objective of early retirement. Such financing, however, creates a potential dilemma: adding emissions-intensive assets to the financing institution’s portfolio during a time when financial institutions are increasing efforts to reduce the emissions covered in their portfolios. In the private sector, as of April 2022, 547 financial institutions representing USD 129 trillion in assets under management and advice have announced net zero targets (Solomon, 2022). On the public finance side, 20 of the largest 70 public financial institutions have made a net zero or Paris alignment target and 39 have set institutional climate strategies (Ortega Pastor et al., 2022).

This consultation brief outlines several approaches to deal with this possible friction. In particular, the brief focuses on public finance institutions concerned about potential conflicts between their portfolio emissions targets, Paris alignment, and managed coal phaseout investments, though some of the thinking is applicable to private finance institutions as well. There is a particularly strong case for the involvement of public finance institutions—including multilateral, bilateral and national development banks—in supporting the credible financing of managed coal phaseout as defined in the Guidelines, as these investments need to be executed carefully to reduce negative impacts on communities and are often uneconomical from a purely financial perspective.

Under current emissions’ attribution methods, such as the Partnership for Carbon Accounting Financials (PCAF) and the GHG Protocol (2015), funding a project or transaction within a coal transition mechanism will result in an increase in portfolio emissions (PCAF, 2020). As described in Section 2, Managed Coal Phaseout Finance Mechanisms, there are a variety of mechanisms that can potentially be used to finance managed coal phaseout. Under these mechanisms, the coal plant emissions from the investment would be added to the portfolio emissions that financial institutions are trying to reduce. This can result in increased portfolio emissions beyond the planned pathways and interim portfolio targets, which is particularly notable given the current social and political attention given to net zero targets, Paris-aligned investment pathways, and interim portfolio emissions targets.

This brief is part of a broader body of work that supports managed coal phaseout financing. In November 2022, Climate Policy Initiative (CPI), Rocky Mountain Institute (RMI), and Climate Bonds Initiative released the Guidelines for Financing a Credible Coal Transition, a framework for assessing the climate and social outcomes of coal transition mechanisms, designed to help financial institutions determine if financing a coal transition mechanism is likely to result in a credible, just, and managed phaseout of the coal operations. The Guidelines, as well as several other publications on this topic, also lay out the benefits of managed coal phaseout and reductions in real economy emissions, which are the emissions that exist outside the financial sector and impact the global temperature (Bhat et al., 2023; GFANZ, 2022b; Holzman & Kekki, 2023; PWC, 2022).

As this is a working paper, we encourage feedback and comments on our findings. Please contact Nicole Pinko at nicole.pinko@cpiglobal.org. We look forward to hearing your thoughts.