Finance Landscape of Highways and Railroads: Elements for Strengthening the Governance of Infrastructure Investments in the Brazilian Amazon

INTRODUCTION

Quality infrastructure is an essential pillar for promoting economic growth and improving livelihoods. The Brazilian reality, however, is one of precarious transport structures, with a growing consensus on the need to increase investments in the sector (CNI 2022; CNT 2022).

In the Amazon, this scenario is even more evident, as it is the most economically isolated region in the country (Araujo, Bragança, and Assunção 2022). Brazil has a comprehensive portfolio of federal and state transportation infrastructure projects planned for the next decade in the Amazon, including projects to facilitate the flow of goods for export, to improve the connection of the region with domestic and international markets, and to meet local demands (MINFRA and EPL nd; PPI nd). However, the experience of recent decades suggests that investments in the land transport sector in the Amazon face implementation challenges and generate considerable socio-environmental damage, with large infrastructure projects being a leading driver of deforestation (Berenguer et al. 2021; Ahmed et al. 2021; Barber et al. 2014).

Fragilities in the government’s decision-making process, the lack of transparency and adequate socio-environmental analysis, as well as a planning process that does not consider the future of the Amazon and the way in which its natural resources are used, all contribute to how infrastructure development has impacted the Amazon region (Chiavari et al. 2020; Chiavari et al. 2022). In addition, governmental supervisory bodies have pointed out problems of misallocated resources and waste resulting from the paralysis of works financed with federal resources (TCU 2019).

To help ensure a better governance of investments in the Amazon, researchers from Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio) have created an innovative landscape for public and private financing of road and rail projects in the North Region and in Brazil.[1] This report fills a knowledge gap about the investment scenario of the land transport sector over the last decade, identifying and quantifying the volume of funds flowing to these sectors, the main actors involved, the financial instruments used, and the activities funded. With this initiative, CPI/PUC-Rio offers a baseline that makes it possible to monitor the evolution of investments in the land transport sector in the coming years. The analysis also presents elements to contribute to the discussion on how to attract new resources and better direct investments.

This Landscape complements CPI/PUC-Rio’s study on regulatory and institutional aspects of land infrastructure projects in the Amazon, which identifies concrete actions for the short, medium and long-term that can have a relevant positive impact on the decision-making process, reduce project execution risks, and improve the quality of the infrastructure in the region (Chiavari et al. 2022).

KEY TAKEAWAYS

- The Landscape reveals that, between 2012 and 2021, the North Region of Brazil received R$ 30.6 billion (US$ 1 billion) of a total of R$ 179.7 billion (US$ 62.9 billion) in financing mapped for highway and railroad projects in Brazil. In the North, the rail sector received 55% (R$ 16.7 billion / US$ 6.8 billion) of public and private funding. This allocation was strongly influenced by one project — the Carajás Railroad (Estrada de Ferro Carajás – EFC) —, which received R$ 14.5 billion (US$ 6.1 billion) in the past decade (48% of the total mapped for the North Region), mostly from Brazilian Development Bank (Banco Nacional de Desenvolvimento Econômico e Social – BNDES) financing. New highway and railroad projects planned for the North could attract a large volume of financing to the region, which makes it necessary to adopt clear criteria for prioritizing the allocation of public resources, transparency in the application of resources, and an evaluation of the results of these investments.

- The federal government was the primary source of funding for road and rail infrastructure in the North between 2012 and 2021, directing nearly two-thirds (R$ 20.8 billion / US$ 8.3 billion) of the finance tracked to these sectors over the period: R$ 9 billion (US$ 2.9 billion) from the public budget and R$ 8 billion (US$ 5.4 billion) from subsidized loans. The scale of the federal government’s spending on transportation infrastructure in the North suggests that it is essential to make improvements in the government’s decision-making process, adopting a more careful assessment of the socio-environmental impacts of projects and making the governance of public investments in the region more robust, as well as establishing rules that mandate more rigorous socio-environmental analyses for infrastructure projects and better governance of public investments.

- The volume of funds directed to highways and railroads from the public budget between 2012 and 2021 remained constant in the North, in contrast to all of Brazil, where it fell by 53%. This shows that compared with the rest of the country, the North was less affected by measures adopted in the past decade to reduce government participation as a source of funding for infrastructure investment.

- Most of the funds disbursed through the public budget went to the road sector —, which, in the North, received 99% of the R$ 9 billion (US$ 2.9 billion) tracked and was channeled by the National Department of Infrastructure and Transportation (Departamento Nacional de Infraestrutura de Transportes – DNIT). Of these funds, 79% (R$ 7.1 billion / US$ 2.2 billion) financed the maintenance and operation of existing highways, and 20% (R$ 1.8 billion / US$ 701 million) went to the construction of new ones. Finance from the public budget played a key role in the road sector, and these funds, even while considered insufficient,[2] will continue to be important for the sector given the difficulty of expanding highway concessions and increasing private investments in the North Region.[3]

- Private actors played a substantial role in financing the road and rail sectors in the period surveyed, channeling R$ 6.7 billion (US$ 1.9 billion) to the North Region through three large-scale infrastructure projects financed by five incentivized debentures. Vale S.A. was responsible for the largest share of these funds, investing R$ 3.3 billion (US$ 1.2 billion) in the Carajás Railroad. Overall, there is a challenge to diversify the funding sources and significantly increase private participation in the land transport sector. Greater transparency in relation to the resources raised by the projects and the activities financed is essential to allow a more reliable classification of the private finance sources and a better understanding of the existing bottlenecks to attract private investments in the region.

- International resources played an important role in financing transportation infrastructure in the North. Even though concentrated in just a few projects, this international financeis equivalent to almost a third of the resources applied in the region through the public budget.Multilateral Development Banks (MDBs) financed R$ 3 billion (US$ 911 million) in subsidized loans in the region. The New Development Bank (NDB) invested more in land transport in the region than any other MDB, financing R$ 2.2 billion (US$ 498 million) in total through two projects: a highway pavement and rehabilitation program in the state of Pará, and the Carajás Railroad, for which it made a loan to Vale S.A. Considering the relevance of the NDB’s activities in the region, more robust standards of transparency must be adopted and aligned with those of other MDBs, such as the World Bank and the Inter-American Development Bank (IDB), banks that publish documentation of financed projects on their websites. Nevertheless, the need for greater transparency is also valid for MDBs in general, given the lack of standardized information available for public consultation about projects financed by these actors, especially detailing the use and disbursement of finance throughout the implementation of the projects.

FINANCE LANDSCAPE FOR HIGHWAYS AND RAILROADS

CONTEXT

Improvements to land transport infrastructure are essential to promoting economic growth in developing countries, due to their potential to reduce transport costs both within a country’s borders and internationally (Limao and Venables 2001; Atkin and Donaldson 2015; Costinot and Donaldson 2016; Donaldson and Hornbeck 2016). Evidence shows that investment in infrastructure can stimulate economic recovery in the short term and generate lasting growth and stability in the long term (GI Hub 2021).

Brazil’s weak transport infrastructure is inferior in quality and quantity to that of much of the rest of the world (WEF 2019). A study conducted by the National Confederation of Transportation (Confederação Nacional do Transporte – CNT) in 2022 classified 66% of Brazilian highways as fair, bad or very bad. Among the highways managed by the government evaluated by the Confederation, only 25% were in excellent or good condition. Taking into account the pavement of roads, CNT estimated that the state of the pavement imposed an additional transport cost of 33%. Considering that only 12.4% of the roads in Brazil are paved, the extra transport cost for unpaved roads is even greater. Operation costs accounted for 12.6% of Brazilian GDP in 2020, and estimates indicate that they could reach 13.3% in 2022 (CNT 2022).

In this regard, Brazil would need annual investments of about 4% of its GDP to reach the level of capital stock required to modernize its transport infrastructure with universal, high-quality services (CNI 2022). Of the total investment gap, 60% should be invested in transport infrastructure: highways, railroads, waterways, ports, airports, and urban mobility.[4] The current gap increases production costs — reducing competitiveness. It also hinders mobility and the provision of basic services to the population and compromises Brazil’s development potential.

In the past ten years, the Brazilian government has put in place a series of measures to attract investment in the infrastructure sector, while at the same time reducing government spending and state participation as a source of funding for the sector. Yet the magnitude of investment needed and the importance of infrastructure investment requires policy that prioritizes this agenda. CPI/PUC-Rio’s innovative Finance Landscape contributes to the discussion by identifying and quantifying the finance flows directed to the road and rail network in the past decade, and by creating a baseline that will enable the tracking of resources directed to projects in these sectors over the coming years. Furthermore, this publication raises important elements for public and private actors, such as, which regulatory and institutional improvements are needed to attract new private capital flows, and how to direct public investments.

However, increasing infrastructure finance without improving its governance will not produce the desired social benefits, given the budgetary losses that come with a lack of planning, poor allocation of resources, and the inefficient implementation of infrastructure projects, and adverse socio-environmental impacts that could be avoided or, at least, mitigated.

Although this publication does not analyze the outcomes from investments tracked in terms of effectiveness, an audit carried out by the Brazilian Court of Accounts (Tribunal de Contas da União – TCU) revealed a scenario of infrastructure construction — financed with federal resources — stalled throughout the country (TCU 2019). The TCU identified that 25% of the works managed by the National Department of Transport Infrastructure (Departamento Nacional de Infraestrutura de Transportes – DNIT) were paralyzed and recommended optimizing the use of federal public resources and reducing waste resulting from the inactivity of works financed with these resources.

Finally, it is worth noting that improvements to transport infrastructure are not limited to the infrastructure’s ability to generate growth and productivity. Quality infrastructure includes socio-environmental criteria and must prioritize sustainability.

Land transport infrastructure is one of the leading drivers of deforestation in the Amazon (Berenguer et al. 2021). Until 2006, approximately 95% of forest conversion occurred within 5.5 km of roads (Ahmed et al. 2013; Barber et al. 2014). Currently, in the state of Pará alone, four major federal investments for large-scale infrastructure are slated — Ferrogrão, BR-155/158, BR-163/230/MT/PA and BR-230/PA —, with the potential to deforest 6,989 km² in 30 years (Bragança et al. 2021). Furthermore, the state of Pará plans to add more than 90 state highways with impacts not yet accounted for (Chiavari et al. 2022). Reversing the nexus between deforestation and terrestrial infrastructure is extremely important and the financing of projects in the Amazon must be increasingly attentive to this issue.

“Increasing infrastructure finance without improving its governance will not produce the desired social benefits.”

METHODOLOGY

In this report, researchers from CPI/PUC-Rio have developed an approach to quantify and compare highway and railroad, from various sources. Since some data are not available by municipality, the North Region was chosen as an approximation of the Brazilian Amazon.

To better understand how land transport infrastructure is financed in Brazil, this study adopts the methodology developed by CPI for tracking global climate finance. In this publication, however, the flows presented do not differentiate between finance flows that are aligned with climate goals and those that are not.[5]

The first step in the exercise is to organize the finance ecosystem of these sectors, aiming to identify:

- Actors: Who are the public and private actors involved in the investments?

- Financial Instruments: Which instruments are used to finance the projects?

- Subsectors: What volume of resources is flowing into highways and railroads?

- Which activities are financed with the resources tracked?

Figure 1. Finance Ecosystem for Highways and Railroads in Brazil

Source: CPI/PUC-Rio, 2022

1. Government Expenditures: These include federal government spending on highways and railroads, along with monitoring activities and expenditures related to policy planning and implementation for these sectors.

2. Financial and Capital Markets: These include operations carried out by public and private banks with earmarked and non-earmarked loans, such as BNDES credit lines, Constitutional Financing Funds, and loans funded by banks from their own resources. It also encompasses securities issued in the primary market, such as debentures and other corporate bonds.

3. International Development and Cooperation: These are resources channeled from MDBs and cooperation agencies from developed countries, with the technical cooperation of governments, as well as funding for specific infrastructure programs or projects.

This publication quantifies the primary finance flows to the ecosystem above, based on available data (Appendix 1), however, it does not represent an exhaustive list of all flows directed toward these sectors.[6] Furthermore, this report does not analyze the quality of the infrastructure and construction carried out with the tracked investments.

This study uses the annual average exchange rate for each year the publication covers (2012 to 2021) that is published by the Central Bank of Brazil and available in its Time Series Management System (Sistema Gerador de Séries Temporais – SGS).

CHALLENGES OF THIS EXERCISE

Several factors, such as the high number of infrastructure construction projects financed, the diversity of agents involved, the lack of standards and of a central register with projects’ financial information, and the fact that it is not mandatory to disclose funding sources or the level of investment for rail and roads projects, make the tracking of these transport infrastructure financial flows a complex exercise.

The Finance Landscape of highways and railroads is innovative because it presents a snapshot of these sectors’ public and private financial flows over the past decade, with a special focus on the North Region. However, given the complexity of this exercise, some financial instruments are not depicted by the numbers presented in this report. Details of the data and sources analyzed may be consulted in Appendix 1.

The first challenge identified is that the flows presented in the road and rail finance ecosystem (Figure 1) are disclosed through various accounting schemes such as financial values for expenditures, commitments, or banks’ balance sheet portfolios. A few assumptions are adopted to ensure that the flows tracked reflect each instrument’s characteristics, making it possible to compare them. For example, to avoid overestimation in the public budget, the flows tracked represent federal government expenditures. This accounting scheme was chosen because the commitments established in Brazil’s Annual Budget Law (Lei Orçamentária Anual – LOA) tend to be greater than the amount actually spent by the federal government, which occurs because of fiscal restrictions and negotiations at the legislative branch.

For projects financed with loans from BNDES or MDBs, or with funding from incentivized debentures, the flows represent the financial commitments assumed during the period analyzed. In other words: the value of the contract since it is difficult to obtain consistent data on disbursements for these projects over time.

The Landscape does not include banking finance with non-earmarked resources or market-rate loans. Data for these flows are disclosed through an aggregated form for banks’ balance sheet portfolio, and not at the loan-level, and are therefore not comparable to the other flows tracked. Based on the National Classification of Economic Activities (Classificação Nacional de Atividades Econômicas – CNAEs), the banks’ balance sheet portfolio for economic activity related to the road and rail sectors was nearly R$ 8 trillion (US$ 1.48 trillion) in December 2021. This amount illustrates the magnitude of these sectors in the banking system; however, it should not be compared with the other flows presented.[7]

“The first challenge identified is that the flows presented in the road and rail finance ecosystem (Figure 1) are disclosed through various accounting schemes such as financial values for expenditures, commitments, or banks’ balance sheet portfolios.”

Another challenge for this type of exercise is the difficulty of accessing information and funding destinations, especially for private projects on road and rail. For example, for incentivized debentures — an important instrument for raising private funds for infrastructure — the characteristics of the projects financed are not systematically organized. To identify road and rail projects that use this financial instrument, it is necessary to analyze every bond issuance document of public offer or deed of issuance. This is the only way to characterize the projects and determine the location of the highways where the resources will be invested.[8] For all other corporate bonds, including debentures, this level of project information is not available, making it impossible to map the volume of finance directed to road and rail projects.

For international public actors, this analysis does not include the flows for loans made by MDBs to subnational governments without a specific commitment. These transactions are important to Brazilian subnational governments, especially in the current context of fiscal restraint. However, for this type of finance, there are no mandatory requirements for spending these resources on specific programs or policies. Subnational entities use this finance as a complementary source of funds for their budgets.

“Another challenge for this type of exercise is the difficulty of accessing information and funding destinations, especially for private projects on road and rail.”

Finally, it is difficult to give a clear picture of the Brazilian Amazon with the currently available data since they do not necessarily reflect the location of a project. Location information in the data may instead indicate the place of origin of the financial transaction or the geographic location of the borrower. Additionally, location data for the financial flows are often only available at the state level. Since municipal data are not released, thus making it difficult to characterize flows specifically directed to the Amazon.

Location information for bank loans with earmarked or non-earmarked funds usually reflects the municipality of the agency where the loan was negotiated, rather than the location of the project where the funds were invested. Similarly, information disclosed on firms requesting loans refers to the tax domicile of the business and not the location where the project financed will be executed.

This means, for example, that on the one hand, a company responsible for a project to build and maintain roads in the Amazon could have a tax domicile in other regions of Brazil, like in the Southeast or Midwest Regions. On the other hand, due to the high volume of capital needed to implement a land infrastructure project, the financial negotiations would likely take place in a major financial center such as São Paulo or Rio de Janeiro, rather than in the location where the project is to be implemented. In both cases, the official record of information in the national financial system may not reflect the actual locations of the highways and railroads that are financed. The same kind of problem arises with the financial flows of other transport infrastructure sectors, such as waterways or ports.

Analysis of direct BNDES transactions provides a deeper understanding of the complexity of characterizing the locations of the projects mapped. For example, the Carajás Railroad was the main project financed by the development bank in the North between 2012 and 2021. As an interstate project passing through the states of Maranhão and Pará, the data shows some of the loans as being a project located in Maranhão, while in others, the location is classified as an “interstate project”. To tackle this challenge and provide a more accurate picture of finance flows, this Landscape considers a project to be located in the North Region when at least one of the states in which a project will be implemented belongs to that region. Without this standardization, the BNDES financing would be significantly underestimated.

“Finally, it is difficult to give a clear picture of the Brazilian Amazon with the currently available data since they do not necessarily reflect the location of a project. Location information in the data may instead indicate the place of origin of the financial transaction or the geographic location of the borrower.”

FINANCIAL LANDSCAPE OF HIGHWAYS AND RAILROADS IN THE NORTH REGION AND IN BRAZIL

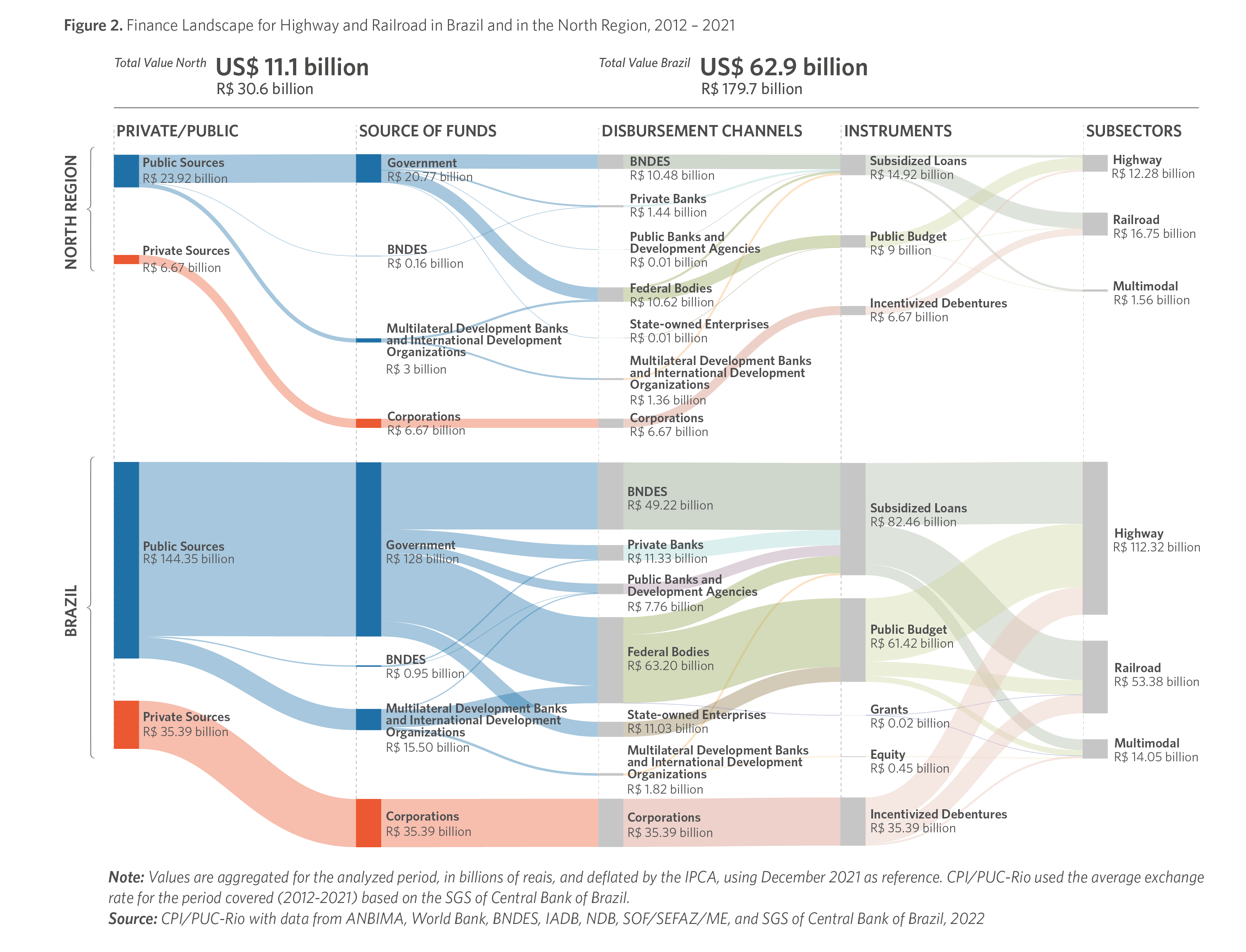

This Landscape of finance for highways and railroads presents a snapshot of public and private financing, from national and international sources, directed to these sectors between 2012 and 2021, in the North Region and Brazil. The Sankey diagram (Figure 2) provides a comprehensive overview of the life cycle of the tracked financial flows, by sector, from the sources of the funding, through the disbursement channels, financial instruments used, and finally to the activities financed.

To better understand the financing directed to the North Region in the past decade, the flows to the region are presented in the foreground, so that the life cycle of this financing may be compared to that of Brazil as a whole. The results are shown for the aggregate finance flows for the period between 2012 and 2021, using available data (Appendix 1).

Figure 2. Finance Flows for Highways and Railroads in the North Region and in Brazil, 2012 – 2021

Note: Values are aggregated for the analyzed period, in billions of reais, and deflated by the IPCA, using December 2021 as reference. CPI/PUC-Rio used the average exchange rate for the period covered (2012 – 2021) based on the SGS of Central Bank of Brazil.

Source: CPI/PUC-Rio with data from ANBIMA, World Bank, BNDES, IADB, NDB, SOF/SEFAZ/ME, and SGS of Central Bank of Brazil, 2022

MAIN FINDINGS

The North Region received 17% (R$ 30.6 billion / US$ 11.1 billion) of the R$ 179.7 billion (US$ 62.9 billion) finance tracked for highways and railroads in Brazil between 2012 and 2021.

Most of the region’s tracked finance came from public sources (domestic and international), which mobilized 78% (R$ 23.9 billion / US$ 9.2 billion) of the tracked flows.

International public financing channeled through MDBs directed 10% (R$ 3 billion / US$ 911 million) of the flows to the North Region, investing in three projects financed by subsidized loans.

Although private finance represents 22% (R$ 6.7 billion / US$ 1.9 billion) of the flows directed to the region, they may be underestimated due to the lack of transparency and project data for these transactions.

Among public finance, the federal government is the main source of funding tracked, being responsible for 68% (R$ 20.8 billion / US$ 8.3 billion) of financing for projects in the region. These flows were channeled through BNDES’ activity and federal public investment in the transport infrastructure sector.

Federal Bodies’ entities are the main disbursement channel directing 35% (R$ 10.6 billion / US$ 3.5 billion) of the finance tracked for the region.

BNDES is also an important disbursement channel, financing R$ 10.5 billion (US$ 4.8 billion) through its direct financing support with subnational entities and large and medium-sized companies.

Corporations accounted for 22% (R$ 6.7 billion / US$ 1.9 billion) of the flows to the region.

Subsidized loans and the public budget are the main instruments financing highways and railroads in the North, with a total investment of R$ 23.9 billion (US$ 9.2 billion).[9]

Subsidized loans (domestic and international) were the primary financing instrument, representing 49% (R$ 14.9 billion / US$ 6.3 billion) of the resources mapped during the period.

The public budget channeled 29% (R$ 9 billion / US$ 2.9 billion), while incentivized debentures were responsible for 22% (R$ 6.7 billion / US$ 1.9 billion) of the flows identified.

The rail sector was the main beneficiary of public and private financing in the North Region, 55% (R$ 16.7 billion / US$ 6.8 billion) of resources were directed to the rail sector, and 40% (R$ 12.3 billion / US$ 3.8 billion) to the road sector. Nationally, however, the road sector received a higher share of the resources, or 62% (R$ 112.3 billion / US$ 38.4 billion) of the finance tracked, while the rail sector received 30% (R$ 53.4 billion / US$ 19.7 billion).

PUBLIC ACTORS

Public Actors are key players in financing highways and railroads in Brazil.

Between 2012 and 2021, the federal government invested about R$ 128 billion (US$ 46.7 billion) in Brazil highways and railroads, representing 70% of the finance flows tracked. These resources were channeled by two instruments: R$ 67.4 billion (US$ 26 billion) from BNDES subsidized loans (38%), and R$ 61.4 billion (US$ 21 billion) from the public budget (34%).[10] In the past decade, the participation of government’s instruments in financing for highways and railroads in Brazil plunged, from 86% in 2012 to 32% in 2021 (Figure 3). BNDES has notably reduced its role in infrastructure funding in Brazil since 2019, although it is still an important actor in the sector.[11]

In 2018, the long-term rate (Taxa de Longo Prazo – TLP) replaced the long-term interest rate (Taxa de Juros de Longo Prazo – TJLP) in BNDES loans.[12] This change was an important factor in decreasing the bank’s financing participation in Brazil, including in the land transport infrastructure sector. The adoption of the TLP made BNDES financing conditions similar to those of other market actors and contributed to the increased participation of the private sector in recent years.

Another important change occurred in 2011, with the creation of fiscal incentives (tax-exempt) for investors buying debentures to finance infrastructure projects or Research, Development, and Innovation (RD&I) defined as high priority by the government. These bonds, known in the market as incentivized debentures, have been traded since 2012.[13]

In the North Region, the federal government represents the main source of funding as well, directing R$ 20.8 billion (US$ 8.3 billion) to the road and rail sectors between 2012 and 2021. Subsidized loans from BNDES are the primary financial instruments for land transport infrastructure in the North. About 18% (R$ 11.8 billion / US$ 5.3 billion) of BNDES finance for highways and railroads in Brazil were applied in the region.

Figure 3. Total Finance by Instrument for Highway and Railroad Projects in Brazil, 2012 – 2021

Note: Values deflated by the IPCA, using December 2021 as reference. Values are aggregated for the analyzed period, in billions of reais, and deflated by the IPCA, using December 2021 as reference. CPI/PUC-Rio used the average exchange rate for the period covered (2012 – 2021) based on the SGS of Central Bank of Brazil.

Source: CPI/PUC-Rio with data from ANBIMA, World Bank, BNDES, IADB, NDB, SOF/SEFAZ/ME, and SGS of Central Bank of Brazil, 2022

To what extent is BNDES involved in road and rail projects?

At the national level, BNDES transactions are relatively balanced between the road and rail sectors. Of the transactions identified, 52% (R$ 34.8 billion / US$ 12.3 billion) were allocated to highways, and 43% (R$ 29 billion / US$ 12.1 billion) to railroads.

Regarding the allocation of BNDES’ loans for highways, of the R$ 34.8 billion (US$ 12.3 billion) tracked for Brazil, only R$ 288 million (US$ 145 million) financed projects in the North Region (Figure 4). The state of Amazonas was the main beneficiary, obtaining a R$ 278.6 million (US$ 143 million) loan to widen the state highway AM-070. BNDES transactions for rail projects represented 96% (R$ 11.5 billion / US$ 5.1 billion) of the flows tracked for the region. The Carajás Railroad project was the main catalyst for the bank’s transactions in the region, raising R$ 9.8 billion (US$ 4.6 billion), or 82% of the flows mapped for subsidized loans from BNDES in the region.

Figure 4. BNDES Finance for Highway and Railroad Projects in the North Region and Other Regions of Brazil, 2012 – 2021

Note: Values deflated by the IPCA, using December 2021 as reference. Values are aggregated for the analyzed period, in billions of reais, and deflated by the IPCA, using December 2021 as reference. CPI/PUC-Rio used the average exchange rate for the period covered (2012 – 2021) based on the SGS of Central Bank of Brazil.

Source: CPI/PUC-Rio with data from BNDES and from the SGS of Central Bank of Brazil, 2022

To what extent does the federal government invest in highways and railroads?

First and foremost, it is important to note that public budget financing of these sectors remained constant in the North, in contrast to the drop seen in the other regions of Brazil over the past decade (Figure 5).

The road sector received the most funds from the public budget. Between 2012 and 2021, 76% (R$ 46.5 billion / US$ 15.5 billion) of financing from the public budget in Brazil was invested in highways, while just 17% (R$ 10.7 billion / US$ 4.1 billion) went to railroads — less than a quarter of the amount invested in roads.

The public budget is also an important financial instrument for these sectors in the North, directing a total of R$ 9 billion (US$ 2.9 billion) to highways and railroads in the region. This amounts to 15% of Brazil’s total funding from that instrument.

In the North, the disparity between the sectors in the allocation of funds from the public budget is even greater than at the national level: highways received 99% of the R$ 9 billion (US$ 2.9 billion) tracked for the region.[14]

The resources disbursed through the public budget were predominantly channeled through direct investments from DNIT (R$ 8.7 billion / US$ 2.9 billion) and with a low participation of budget execution by the states of the region. Approximately R$ 300 million (US$ 148 million) of finance under the responsibility of DNIT was identified as transfers or as budget execution delegated to these subnational entities.

Figure 5. Total Finance by Public Budget Funding for Highway and Railroads Projects in the North Region and Other Regions of Brazil, 2012 – 2021

Note: Values deflated by the IPCA, using December 2021 as reference. Values are aggregated for the analyzed period, in billions of reais, and deflated by the IPCA, using December 2021 as reference. CPI/PUC-Rio used the average exchange rate for the period covered (2012 – 2021) based on the SGS of Central Bank of Brazil.

Source: CPI/PUC-Rio with data from SIOP of Ministry of Economy (SOF/SEFAZ/ME), and SGS of Central Bank of Brazil, 2022

Between 2012 and 2021, the North Region received 19% of the R$ 46.6 billion (US$ 15.3 billion) of finance channeled by DNIT. Of these disbursements in Brazil, R$ 38.4 billion (US$ 12.3 billion) were allocated to maintenance and operation and R$ 5.7 billion (US$ 2.2 billion) to construction of road sections. Over the years, while DNIT expenditures have remained constant in the North Region in real terms, there has been a variation in these investments in the other regions. For example, the R$ 2.6 billion (US$ 480 million) of DNIT flows tracked for other regions in 2021 were equivalent to just over half of 2012 investments (Figure 6).

Figure 6. Total Finance by Expenses Paid in the Public Budget under the Responsibility of DNIT, 2012 – 2021

Note: Values deflated by the IPCA, using December 2021 as reference. The tracked flows refer to investments in highway and railroad construction and maintenance and also include current expenditures in administration, oversight, and planning activities. Values are aggregated for the analyzed period, in billions of reais, and deflated by the IPCA, using December 2021 as reference. CPI/PUC-Rio used the average exchange rate for the period covered (2012 – 2021) based on the SGS of Central Bank of Brazil.

Source: CPI/PUC-Rio with data from SIOP of Ministry of Economy (SOF/SEFAZ/ME), and SGS of Central Bank of Brazil, 2022

Which activities does the public budget support?

On a national level, of the resources disbursed from the public budget (R$ 61.4 billion / US$ 21 billion), a majority (63%) was allocated to the maintenance and operation of existing roads, while just 12% went to the construction of new roads.

In the North, this allocation pattern was even clearer, as 79% (R$ 7.1 billion / US$ 2.2 billion) of the financial flows from the public budget were allocated to the maintenance and operation of existing roads, and 20% (R$ 1.8 billion / US$ 701 million) to the construction of new highways.

Maintenance and operation work on small sections of highways may be waived from environmental licensing and/or admit simplified studies. Thus, transparency is essential to allow greater oversight of public spending and enable an effective assessment of the impact of construction.

“In the North, this allocation pattern was even clearer, as 79% (R$ 7.1 billion / US$ 2.2 billion) of the financial flows from the public budget were allocated to the maintenance and operation of existing roads, and 20% (R$ 1.8 billion / US$ 701 million) to the construction of new highways.”

Which states receive the most public budget resources?

In terms of the distribution of federal budget finance among the seven states of the North Region for highways and railroads, between 2012 and 2021, 28% (R$ 2.6 billion / US$ 877 million) were allocated to the state of Pará, followed by 17% (R$ 1.5 billion / US$ 603 million) to the state of Rondônia (Figure 7).

Figure 7. Total Finance by Public Budget Expenditures for Highway and Railroads Projects by North Region States, 2012 – 2021

A. Total Finance Per Year

B. Total Finance Per State

Note: Values deflated by the IPCA, using December 2021 as reference. In 2020 and 2021 the largest part of the resources mapped in the region is marked with the North locator, and therefore, it is not possible to know the direction of these resources to the states of the region. In those years, respectively, only 14% and 9% of these flows mapped for highway and railroad projects in the region have the UF locator of the disbursements. CPI/PUC-Rio used the average exchange rate for the period covered (2012 – 2021) based on the SGS of Central Bank of Brazil.

Source: CPI/PUC-Rio with data from SIOP of Ministry of Economy (SOF/SEFAZ/ME), and SGS of Central Bank of Brazil, 2022

To what extent are the Constitutional Financing Funds used to support highway and railroad projects?

Constitutional Financing Funds (Fundos Constitucionais de Financiamento – FCFs) did not play an important role in directing resources to road and rail projects, despite representing a substantial source of subsidized loan within their area of operation — the North, Northeast, and Midwest Regions.[15]

In 2020, the Constitutional Financing Fund of the North (Fundo Constitucional de Financiamento do Norte – FNO), operated by the Banco da Amazônia, established the FNO-INFRA, a credit line to finance infrastructure investment projects, and in particular, public-private partnerships (PPPs) in sanitation, energy, ports, airports, roads, railroads, and waterways, among others. However, in practice, through 2021 this credit line was only used for energy generation and transmission projects (Appendix 2).

INTERNATIONAL PUBLIC ACTORS

Three projects financed by multilateral development banks in the North Region represent nearly a third of the public budget finance for highways and railroads in the region.

In the past decade, 9% (R$ 15.5 billion / US$ 5.8 billion) of the flows tracked for road and rail projects came from international funding sources. This financing was primarily channeled through subsidized loans to subnational government programs for investments in roads. The main international actors for these sectors are the IDB, the World Bank, and the NDB.[16]

Subsidized loans channeled by MDBs represented 97% (R$ 15 billion / US$ 5.7 billion) of the total volume of resources awarded by these international actors for highway and railroad projects in Brazil. The IDB was the only international actor that funded technical cooperation projects with grants (R$ 16.2 million / US$ 4.3 million). The NDB was the only MDB to finance the tracked sectors through equity, investing R$ 454 million (US$ 115 million) in Patria Investments’ “Patria Infrastructure Fund IV”, which aims to finance infrastructure projects in Brazil.

In the North, although MDBs invested in only three projects over the past decade, those projects channeled R$ 3 billion (US$ 911 million) in financing, which is equivalent to nearly a third of the public budget resources directed to that region, in real terms.

Between 2012 and 2021, the NDB invested more in land transport in the North than any other MDB, with a total of R$ 2.2 billion (US$ 498 million) for two projects.[17] In 2021, the NDB approved R$ 825.5 million (US$ 153 million) to finance a road rehabilitation and paving program in the state of Pará, and in 2019, it awarded funding in the amount of R$ 1.4 billion (US$ 345 million) to Vale S.A. to increase cargo transport capacity in the complex that includes the Carajás Railroad and the Ponta da Madeira port terminal. In 2012, the World Bank made a loan to the state of Tocantins in the amount of R$ 807.2 million (US$ 413 million), with the goal of improving the quality of road transport in the state.[18]

“Subsidized loans channeled by MDBs represented 97% (R$ 15 billion / US$ 5.7 billion) of the total volume of resources awarded by these international actors for highway and railroad projects in Brazil.”

MDB’s relevance in financing road and rail projects varies from one region of Brazil to another (Figure 8). The IDB was the main MDB to finance road and rail projects in Brazil in terms of total financial value (R$ 8.5 billion / US$ 3.5 billion). However, between 2012 and 2021, the IDB had no activity in the North. Most of its investments went to the Southeast (R$ 4.5 billion / US$ 1.8 billion), and it also financed projects in the Northeast (R$ 2.2 billion / US$ 984 million) and in the South (R$ 1.8 billion / US$ 717 million).

The World Bank allocated its resources more equally between the Southeast (R$ 1 billion / US$ 489 million), Northeast (R$ 929 million / US$ 275 million), North (R$ 807 million / US$ 413 million) and South (R$ 733 million / US$ 375 million). The NDB financed less overall but concentrated its investments in the North Region (R$ 2.2 billion / US$ 498 million), while also investing in projects in the South (R$ 874 million / US$ 169 million) and at the national level (R$ 454 million / US$ 115 million).[19]

Figura 8. Total Finance by Multilateral Development Banks for Highway and Railroad by Region in Brazil, 2012 – 2021

Note: Values deflated by the IPCA, using December 2021 as reference. Between 2012 and 2021, the New Development Bank invested R$ 454 million in highway and railroad projects in Brazil. In this period, the actions mapped were classified as “national” as opposed to actions that are implemented in a specific region in the country. CPI/PUC-Rio used the average exchange rate for the period covered (2012 – 2021) based on the SGS of Central Bank of Brazil.

Source: CPI/PUC-Rio with data from the IDB, World Bank, NDB, and SGS of Central Bank of Brazil, 2022

PRIVATE ACTORS

Private Actors’ participation in financing highways and railroads increased in the past decade.

Between 2012 and 2021, R$ 35.4 billion (US$ 10.1 billion) were financed by private sources through incentivized debentures, representing 20% of tracked flows in the period. The finance obtained through incentivized debentures for the road and rail sectors grew by over eight times, from R$ 1.1 billion (US$ 587 million) in 2012 to R$ 9.6 billion (US$ 1.8 billion) in 2021.

At the same time, a smaller share of resources was allocated by financial instruments with funds from public domestic sources, such as the public budget and subsidized loans, which saw drops of 53% and 91%, respectively, from 2012 to 2021. Notably, subsidized loans from BNDES fell from R$ 13.9 billion (US$ 7.1 billion) in 2012 to R$ 1.1 billion (US$ 231 million) in 2021 (Figure 9).

The increase in flows from private funding sources corresponds to a period of strong fiscal restraint that saw a drop in public investment and a lower SELIC rate (i.e., the overnight rate of the Central Bank of Brazil). In recent years, the federal government has also adopted a series of measures to boost private participation in infrastructure investment in the country, including the recent passage of the authorization system for rail exploration. And the Investment Partnership Program (Programa de Parcerias de Investimentos – PPI) acts by making rounds of road concessions, and by pushing renovations of rail concessions forward on the agenda, among other initiatives.

In the North, incentivized debentures also played a key role in project funding, financing R$ 6.7 billion (US$ 1.9 billion) during the period. Two rail projects raised R$ 5.3 billion (US$ 1.6 billion) from four incentivized debentures, and one road project raised R$ 1.4 billion (US$ 259 million).

Incentivized debentures play an important role in financing transport infrastructure in the North. Although the survey identifies only three projects in the region that used this instrument, the volume of funding represented 22% of the total financial flows tracked for the region. Additionally, these rail projects represented 39% of the total finance obtained through incentivized debentures for the rail sector in Brazil.

Figure 9. Total Finance by Incentivized Debentures and BNDES’ Subsidized Loans for Highway and Railroads Projects in Brazil, 2012 – 2021

Note: Values deflated by the IPCA, using December 2021 as a reference. CPI/PUC-Rio used the average exchange rate for the period covered (2012 – 2021) based on the SGS of Central Bank of Brazil.

Source: CPI/PUC-Rio with data from BNDES, ANBIMA, and SGS of Central Bank of Brazil, 2022

Although private actors became a more important source of finance for highways and railroads over the past decade, the current volume of resources mapped in this analysis is still lower than the amount invested by BNDES early in the decade. While incentivized debentures financing has grown substantially in recent years, it represented just 18% of the debentures market in 2021 — ten years after this fiscal incentive was introduced.[22]

Furthermore, the energy sector is the main sector obtaining finance through incentivized debentures — R$ 110.3 billion (US$ 28 billion) from 348 incentivized debentures issued between 2012 and 2021. Over the same period, far fewer resources were raised for land transport infrastructure using this instrument, in terms of both volume of funds and number of debentures issued. The roads sector obtained R$ 25.7 billion (US$ 7.7 billion) from 42 debentures, and the rail sector R$ 25.4 billion (US$ 6.1 billion) from 29 debentures (Law no. 12,431/2012).

It is important to note that conventional debentures, other corporate bonds, and Share Investment Funds for Infrastructure (Fundos de Investimento em Participações em Infraestrutura – FIP-IEs) can also be important instruments for financing the land transport sector. However, it is not possible to include these instruments in this Landscape. Their inclusion could cause double counting since there is no publicly available information on the application of resources in specific projects or activities for these types of finance. Another difficulty related to these instruments arises from the fact that there is no data on the destination of the funds raised, and there is likewise no consistent data on the funds’ portfolios. In other words, it is not possible to get project-level data for conventional debentures or FIP-IEs related to the flows tracked.

It is, therefore, still challenging to provide an accurate picture of private finance for the infrastructure sector. The flows tracked tend to be underestimated due to the lack of consistent, standardized data disclosure.

The Investment Monitor platform (Monitor de Investimento), developed by the Ministry of the Economy in partnership with the IDB, allows for the consulting of summarized information for projects of different sectors, including the estimated investment, deadline, among other information. However, it does not release information about how much has already been invested, the sources of funding (public or private), or the financial instruments used to fund the projects.

Infrastructure Projects in the North Financed by Incentivized Debentures[20]

In 2014, Vale raised R$ 1.5 billion (US$ 640 million) for investments to connect mine S11D — in the city of Canaã dos Carajás — to the Carajás Railroad. In 2015, the company issued a second debenture of R$ 1.8 billion (US$ 551 million) to expand this railroad, investing in the duplication of rail lines, remodeling existing rail yards, and the construction of bridges and rail viaducts, among other activities.

Rumo Logística was another company using incentivized debentures to finance projects in the North. In 2019, the company raised R$ 1 billion (US$ 264 million) to improve and expand the North-South Railroad, which links the municipality of Porto Nacional, in Tocantins, to Estrela d’Oeste, in São Paulo. In a second issuance in 2020, the company raised R$ 880 million (US$ 171 million), which also went to the North-South Railroad.

In 2021, Holding do Araguaia S.A., a member of the EcoRodovias Group, raised R$ 1.4 billion (US$ 259 million) for the highway network BR 153/414/080, which passes through the states of Goiás and Tocantins. According to analyzed documents, these funds were directed to activities such as road restoration and maintenance, monitoring, conservation, and increasing system capacity.[21]

Conclusion

Infrastructure investments can help developing countries boost their economies. Brazil, in particular, lags behind much of the world in terms of the quality and quantity of its infrastructure, which impacts the quality of life of its population and the competitiveness of its businesses and compromises the country’s development potential.

It is estimated that Brazil will need annual investments — public, but mostly private — of about 4% of its GDP to reach the level of capital stock required for quality transport infrastructure (CNI 2022). However, making improvements requires socio-environmental criteria that prioritize sustainability.

This discussion is particularly relevant for the North, given how important the region is to the Amazon. CPI/PUC-Rio analyses show that logistics investments in the Amazon can intensify the potential risk of deforestation in the region, both directly and indirectly. Therefore, to plan new infrastructure investments in what is the world’s largest tropical forest and an essential provider of ecosystem services for the Brazilian people and economy, requires two agendas for the Amazon be put in place concurrently: (i) one focused on regulatory and institutional improvements for the land transport infrastructure sector, ensuring governmental decision-making processes with defined and sequential stages and clear competencies that aim to anticipate socio-environmental analysis, improve the quality of socio-environmental studies, and increase transparency in the sector; and (ii) the other to strengthen the governance of investments in the region, optimizing the use of resources and ensuring the efficient implementation of infrastructure projects, that incorporate a planning process that takes into account the future of the Amazon and the use of its natural resources. If these agendas do not move forward at the same time, there is a risk that new investments will end up financing low-quality projects, with devastating consequences for the Amazon.

To improve the governance of public and private investment in land infrastructure in the region, it is essential to understand the role of the various financial instruments, the volume of resources invested, and the allocation of the existing finance. This understanding allows decisionmakers to improve proposals in accordance with each financial instrument’s specificities.

This landscape offers an innovative portrait of these flows and provides a baseline that makes it possible to track the finance channeled to projects in the region in the coming years. At the same time, it highlights the need to increase transparency on the application of public and private resources in projects or specific activities and to improve how financial and socio-environmental information is collected and made available. The improvement in transparency will support the identification of financing gaps and opportunities for the land transport sector and to propose improvements to redirect investments.

“To improve the governance of public and private investment in land infrastructure in the region, it is essential to understand the role of the various financial instruments, the volume of resources invested, and the allocation of the existing finance. This understanding allows decisionmakers to improve proposals in accordance with each financial instrument’s specificities.”

Appendix 1. ADDITIONAL INFORMATION ON THE METHODOLOGY USED FOR FINANCE FLOW TRACKING

Table 1. Databases Analyzed

Source: CPI/PUC-Rio, 2022

Appendix 2. Financial Instruments of the National Policy for Regional Development (Política Nacional de Desenvolvimento Regional – PNDR)

Financial Instruments of the National Policy for Regional Development (Política Nacional de Desenvolvimento Regional – PNDR)

The Constitutional Financing Funds (Fundos Constitucionais de Financiamento – FCFs) represent an important source of subsidized loan for the North, Northeast and Midwest regions. They aim to contribute to economic and social development, strengthen small producers, and reduce income disparity.

An analysis of the aggregate data seems to suggest that the FCFs did not play an important role in the allocation of resources to road and rail projects. However, as is the case with the other banking transactions, it is currently impossible to identify the volume of funding for specific projects, since the data is released in aggregate form, rather than for each transaction.

Even if recent activities, like the Constitutional Financing Fund Panel, developed by the Regional Development Ministry, increase operational transparency for the FCFs, it is still not possible to characterize the lifecycle of these financing flows using the methodology from this Landscape.

The FCFs publish annual reports with budgetary schedules and execution of resources, by credit line and economic sector. However, the resources indicated for the land transport infrastructure sector are mixed with transactions for energy, sanitation, among others. So, it is not possible to specify, for example, the volume of transactions pertaining to road or rail projects.

In 2020, the North Constitutional Financing Fund (Fundo Constitucional de Financiamento do Norte – FNO), operated by the Banco da Amazônia, created the FNO-INFRA, a program to support infrastructure, with estimated application values of R$ 1.8 billion (US$ 349 million) in 2020 and R$ 2.6 billion (US$ 482 million) in 2021. Data from the Banco da Amazônia shows that in the program’s two years of operation, the application of resources exceeded the target. In 2020, the line had R$ 3.5 billion (US$ 679 million) in contracts (22 transactions), and in 2021 it had R$ 2.9 billion (US$ 537 million) in contracts (15 transactions).

The goal of the FNO-INFRA is to finance infrastructure investment projects, and especially PPPs in sanitation, energy, ports, airports, roads, railroads, and waterways, among others.

In addition to the Constitutional Funds, there are currently three development funds working to promote regional development in Brazil. The Amazon Development Funds (Fundos de Desenvolvimento da Amazônia – FDA), Northeast Development Funds (Fundos de Desenvolvimento do Nordeste – FDNE) and the Midwest Development Funds (Fundos de Desenvolvimento do Centro-Oeste – FDCO) participate in funding large ventures in the North, Northeast, and Midwest. This survey did not identify any road or rail sector projects funded by the FDA in the states in the North Region. Table 2 shows the transactions identified in the FDNE and the FDCO that went to projects in these sectors.[23]

Table 2. Road and Rail Projects with Resources from Regional Development Funds

Note: Values deflated by the IPCA, using December 2021 as a reference.

Source: CPI/PUC-Rio, 2022

[1] The North Region is the largest region of Brazil, corresponding to 45.3% of the national territory, and is the most relevant within the Amazon region. It comprises the states of Acre, Amapá, Amazonas, Pará, Rondônia, Roraima, and Tocantins. In this report it is used as a proxy for the Amazon region given data restrictions.

[2] A study conducted by National Transport Federation (Confederação Nacional do Transporte – CNT) evaluated 13,745 km of paved road network in the North Region and found that 79.2% of the network had some type of problem (classified as fair, bad, or very bad). Pavement conditions generate an increase of 43.6% in transport operating costs in the region (CNT 2022).

[3] Currently, in Brazil, only 11% of the paved road network is currently under private concession, while 89% is managed by the federal and state governments. The North Region only has highway concessions in the states of Pará and Tocantins (CNT 2022).

[4] CNI (2022) shows that an annual investment of 4% of GDP, for example, would lead to a stock of 60.4% in 2046, 25 years after the start of the new trajectory. This inventory level is reached when depreciation equals investment. The report uses a weighted average depreciation of 4.04% and an average growth of 2% p.a. (CNI 2022). If these variables grow on a different path than estimated, the investment required as a percentage of GDP will also change.

[5] Climate finance refers to primary investment flows of public and private capital, which directly or indirectly mitigate greenhouse gases or generate benefits for adaptation to climate change. The methodology and its composition are constantly evolving (Meatle et al. 2022).

[6] Instruments such as equity, investment funds, and corporate bonds are not represented by the numbers in this publication. Furthermore, since investments funds invest in financial instruments, such as the bonds and securities mentioned, including them in the tracking exercise could lead to double-counting.

[7] The Central Bank of Brazil releases monthly aggregate data on credit transactions received, through the Credit Information System (Sistema de Informações de Créditos – SCR). The value represents loans to firms for the following CNAEs: 4911-6/00 – Rail cargo transport; 4930-2/01 – Road cargo transport, except dangerous products and moving, municipal; 4930-2/02 – Road cargo transport, except dangerous products and moving, intermunicipal, interstate, and international; 4930-2/03 – Road transport of dangerous products; 5221-4/00 – Concessionaires of roads, bridges, tunnels, and related services.

[8] In addition, for some incentivized debentures issuances, the destination of resources is not explicitly stated in the documents analyzed, making it necessary to consult the federal government’s Official Daily Gazette (Diário Oficial da União – DOU), where ministerial orders are published authorizing a debenture issuance with the fiscal incentive. In a few cases, it was not possible to find any documents in the databases related to an issuance (deed or prospectus of issuance).

[9] These include finance administered by governmental entities such as the Ministry of Infrastructure, local authorities, and other bodies. State-owned companies channeled about 6% (R$ 11 billion / US$ 4.1 billion).

[10] BNDES funding sources are predominantly governmental, e.g., the Worker Support Fund (Fundo de Amparo ao Trabalhador – FAT) and the National Treasury. Between 2017 and 2021, these two sources were responsible for around 72% of the available funds, with 40% from the FAT and 32% from the National Treasury (Holz, Schutze, and Assunção 2022).

[11] Between 2012 and 2021, the BNDES approved financing value for all sectors of the Brazilian economy plunged dropped from R$ 328.8 billion (US$ 168.2 billion) to R$ 52.4 billion (US$ 9.7 billion). Over the entire period, 50% of the bank’s portfolio was allocated to the infrastructure sector. However, only 2% went to rail projects, and 3% to road projects, for a total of R$ 67.4 billion.

[12] Law no. 13,483/2017.

[13] Law no. 12,431, enacted in 2011, created fiscal incentives for investors buying debentures to finance infrastructure projects or for RD&I in the sector. The law exempts private individuals from paying income tax on their investment income and gives fiscal incentives to legal entities and funds that invest in these assets. The market has adopted the term “incentivized debentures” to refer to the debentures that fall within this law.

[14] Highways in the North Region are those with the most degraded pavement, the lowest mesh density among the regions of Brazil, and which, due to poor conditions, also have the highest increase in transport costs in the country (CNT 2022).

[15] Between 2016 and 2020, the Constitutional Financing Fund of the Northeast (FNE) scheduled the annual application of about R$ 28 billion, while the Constitutional Financing Fund of the Midwest (FCO) and the Constitutional Financing Fund of the North (FNO) scheduled the annual application of R$ 9 billion and R$ 6 billion, respectively (Pereira and Souza 2022).

[16] The Development Bank of Latin America (CAF) is not included due to the unavailability of its portfolio data and information related to the project. Currently, the Bank’s website only presents, in aggregate form, by year and country, approved amounts, active portfolio, and disbursements made. Data analyzed through the Development Assistance Committee (DAC) information system of the Organization for Economic Cooperation and Development (OECD) show that, for the land infrastructure sector in Brazil, CAF only approved urban mobility projects and, therefore, these flows were not included in the mapping because they are outside the scope of the analysis.

[17] NDB invested a total of R$ 3.5 billion (US$ 783 million) in the Brazilian land transport sector as a whole.

[18] Financing granted by MDBs is given in foreign currency, American Dollars or Euro, for example. In these cases, the values presented are calculated in Brazilian Reais based on the average exchange rate for the period and adjusted for inflation.

[19] The participation of the NDB refers to the contribution made by the Bank to the Fund “Patria Infrastructure Fund IV”.

[20] Values deflated by the IPCA, using December 2021 as reference.

[21] This issuance represented 7% of Brazil’s incentivized debentures financing for the roads sector between 2012 and 2021.

[22] Between 2017 and 2021, the finance obtained through incentivized debentures grew by an average annual rate of 74%.

[23] Due to the unavailability of consistent information that would allow for the characterization of the lifecycle of finance flows, these projects were not included in the tracked value of this Landscape.

The authors would like to thank Renan Florias and Rafael Gabbay for research assistance and Ana Cristina Barros, Luiza Antonaccio, and Juliano Assunção for valuable comments and suggestions. They would also like to thank Natalie Hoover El Rashidy, Giovanna de Miranda, and Camila Calado for the editing and revision of the text and Meyrele Nascimento, Nina Oswald Vieira, and Julia Berry for formatting and graphic design.

REFERENCES

Ahmed, S. E., Carlos M. Souza, Julia Ribeiro et al. “Temporal patterns of road network development in the Brazilian Amazon”. Reg Environ Change 13 (2013): 927–937. bit.ly/3zRd5Eo.

Araujo, Rafael, Arthur Bragança, and Juliano Assunção. Accessibility in the Legal Amazon: Delimiting the Area of Influence and Environmental Risks. Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/AMZInfluenceAndRisks.

Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais (ANBIMA). Projetos e Emissões Incentivadas (Lei 12.431). Data de acesso: 5 de maio de 2022. bit.ly/3F8M4yE.

Atkin, David and Dave Donaldson. “Who’s getting globalized? The size and implications of intra-national trade costs”. National Bureau of Economic Research (2015). bit.ly/3ROaYqa.

Barber, Christopher P., Mark A. Cochrane, Carlos M. Souza, and William F. Laurance. “Roads, deforestation, and the mitigating effect of protected areas in the Amazon”. Biological Conservation 177 (2014): 203-209. bit.ly/3OeOLRo.

Berenguer, Erika et al. “Drivers and Ecological Impacts of Deforestations and Forest Degradation”. Science Panel for the Amazon (SPA) 2021. bit.ly/3xOTeDo.

Bragança, Arthur, Luiza Antonaccio, Brenda Prallon, Rafael Araujo, Ana Cristina Barros et al. Governance, Area of Influence, and Environmental Risks of Transport Infrastructure Investments: Case Studies in the State of Pará. Rio de Janeiro: Climate Policy Initiative, 2021. bit.ly/3V47dyq.

Casa Civil. Lei nº 12.431. 2011. bit.ly/3VfdYiy. Access date: October 5, 2022.

Chiavari, Joana, Luiza Antonaccio, Rafael Araujo, Ana Cristina Barros, Arthur Bragança et al. Roadmap for Sustainable Infrastructure in the Amazon. Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/SustainableInfrastructureAMZ.

Chiavari, Joana, Luiza Antonaccio, Ana Cristina Barros, and Cláudio Frischtak. Brazil’s Infrastructure Project Life Cycles: From Planning to Viability. Creation of a New Phase May Increase Project Quality. Rio de Janeiro: Climate Policy Initiative, 2020. bit.ly/3O4C3Ug.

Confederação Nacional da Indústria (CNI). Agenda de Privatizações: Avanços e Desafios. 2022. bit.ly/3tKahop.

Confederação Nacional do Transporte (CNT). Pesquisa CNT de Rodovias 2022. 2022. bit.ly/3STpuxE.

Costinot, Arnaud and Dave Donaldson. “How large are the gains from economic integration? Theory and Evidence from US agriculture, 1880-1997”. National Bureau of Economic Research (2016). bit.ly/3Mdy7kN.

Donaldson, Dave and Richard Hornbeck. “Railroads and American Economic Growth: A “Market Access” Approach”. The Quarterly Journal of Economics (2016): 799-858. bit.ly/3UBzigR.

Fórum Econômico Mundial (FEM). Relatório de Competitividade Global. 2018. bit.ly/3yuMBqQ.

World Economic Forum (WEF). The Global Competitiveness Report. 2019. bit.ly/3DZNz1D.

Global Infrastructure Hub (GI Hub). The vital role of infrastructure in economic growth and development. 2021. bit.ly/3McQIgU.

Holz, Rhayana, Amanda Schutze, and Juliano Assunção. A Atuação do BNDES na Amazônia Legal. Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/3S9LB2j.

Instituto Fiscal Independente (IFI). Relatório de Acompanhamento Fiscal. 2022. bit.ly/3FYoUtl.

Inter. B Consultoria Internacional de Negócios. Carta de Infraestrutura: uma análise retrospectiva do estoque e fluxo dos investimentos em infraestrutura e projeções para 2022. 2022. bit.ly/3ESzeEF.

Limao, Nuno and Anthony J. Venables. “Infrastructure, geographical disadvantage, transport costs, and trade”. The world bank economic review 15, no. 3 (2001): 451-479. bit.ly/3T83Ciz.

Meatle, Chavi, Rajashree Padmanabhi, Pedro de Aragão Fernandes, Anna Balm, Githungo Wakaba et al. Landscape of Climate Finance in Africa. Africa: Climate Policy Initiative, 2022. bit.ly/3grfU7C.

Ministério da Economia (ME), Banco Interamericano de Desenvolvimento (BID). Monitor de Investimentos. bit.ly/3MIXD1s.

Ministério da Infraestrutura (MINFRA), Empresa de Planejamento e Logística (EPL). PNL 2035: Plano Nacional de Logística. nd. bit.ly/3XdmRtN.

Ministério do Desenvolvimento Regional. Painel Fundos Constitucionais. Access date: June 15, 2022. bit.ly/3AQImqT.

Pereira, Leila and Priscilla Z. Souza. Priorities That Do Not Prioritize: The Mismatch Between the Objectives and the Application of Resources from Constitutional Funds Leads to Credit Concentration in the Rural Sector. Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/3PxfnhZ.

Programa de Parcerias de Investimentos (PPI). Projetos. nd. bit.ly/3HNqkIb.

Secretaria-Geral. Lei nº 13.483. 2017. bit.ly/3VCrCw1. Access date: October 5, 2022.

Tribunal de Contas da União (TCU). Acórdão nº 1079. 2019. bit.ly/32gokrh.