Following the Money: Financing Bioeconomy in Brazil

In Brazil, bioeconomy[1] has emerged as a new paradigm for economic development, based on the sustainable use of biodiversity to generate wealth, with inclusion and social justice, while respecting traditional peoples. To make this model viable, it is essential to mobilize public and private resources at scale, to guarantee the necessary finance for it to thrive.

To this end, researchers from Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-RIO) analyzed and quantified the financial flows disbursed between 2021 and 2023 to boost the bioeconomy in Brazil. This analysis identifies the amount directed by public and private sources of funds, both domestic and international, and specifies the channels of disbursement, the financial instruments used, and the financed sectors.

This exercise makes it possible to monitor the evolution of bioeconomy resources and assess whether they are increasing in a way that is compatible with Brazil’s National Bioeconomy Strategy (Estratégia Nacional de Bioeconomia),[2] identifying finance gaps and designing more effective investment strategies to foster innovations that value products compatible with the forest and other forms of native vegetation and boost a just, resilient, and low-carbon economy.

This resource tracking considers bioeconomy in its broadest sense, as a production model based on the use of biological and renewable resources for the production of food, energy, inputs, materials and other goods and services. In this broader concept, bioeconomy encompasses several sectors, including crops and native crop extraction, planted forests, biotechnology, bioproducts, bioenergy, and biofuels. The result of this tracking identifies consolidated instruments that finance significant amounts of money for bioeconomy sectors, with extensive participation by private actors and important action by public authorities. Delving deeper into these instruments and the role of financial actors in this agenda shows that it is possible to expand finance for strategic bioeconomy sectors that are currently underfunded.

Climate Finance Flows for Bioeconomy in Brazil, 2021-2023

Note: The values refer to the average amount of financial flows in billion Brazilian Real (R$) during the analyzed period, deflated by the IPCA using December 2023 as reference. The values were converted into United States Dollar (US$), according to the average exchange rate for the corresponding year, as provided by the Central Bank of Brazil (Banco Central do Brasil – BCB).

Source: CPI/PUC-RIO with data from SICOR/BCB, SIOP/MPO, MAPA, SES/SUSEP, MMA, BNDES, MME, B3, NINT, OCDE-DAC, BID, World Bank, GEF, GIZ, Norad, 2024

Finance Flows

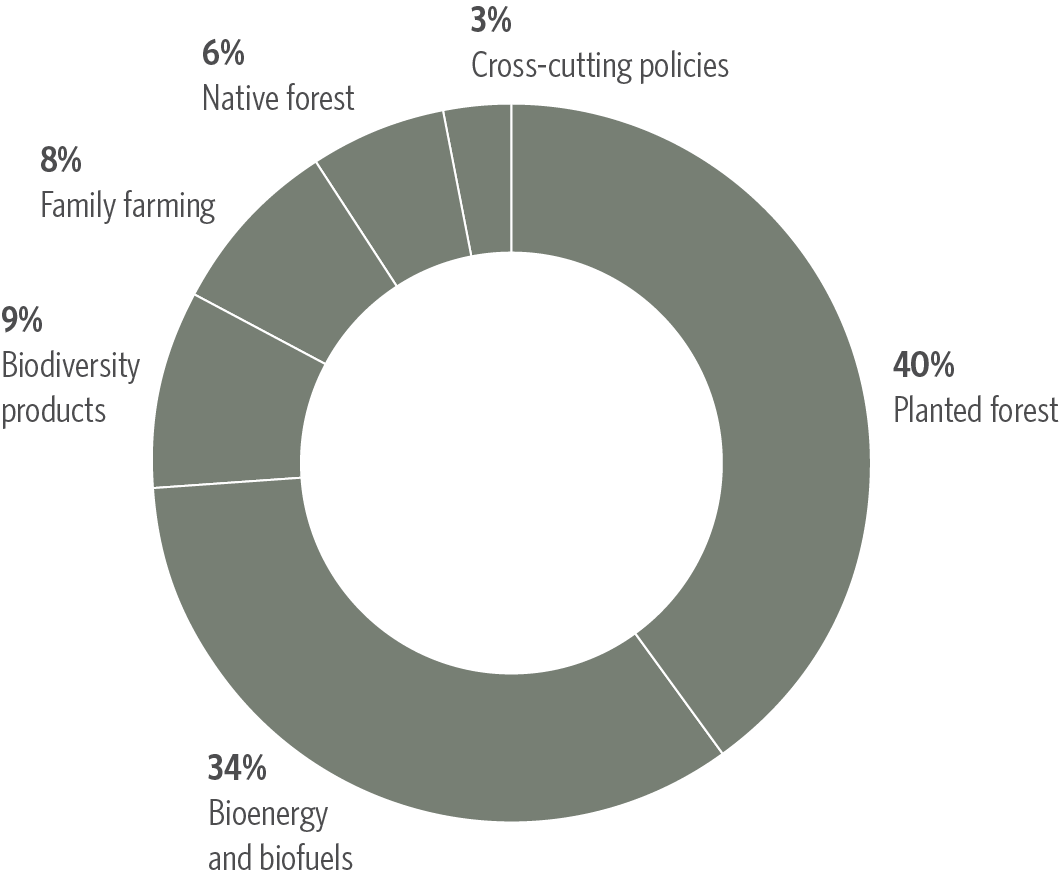

Three quarters of finance flows to the planted forest and bioenergy and biofuels sectors, but Brazil faces challenges in promoting a bioeconomy based on biodiversity products.

• Finance for the bioeconomy in Brazil averaged US$ 3.213 billion/year between 2021 and 2023.

• Together, the planted forest and bioenergy and biofuels sectors were the main recipients of this finance, receiving an average of US$ 2.391 billion/year, which is equivalent to 74% of the total finance tracked in the period.

• The planted forest sector received 40% of the total finance tracked over the period, US$ 1.289 billion/year, and primarily focused on eucalyptus. This amount is concentrated in large projects, with a single company (Suzano) responsible for 71% of this amount, through three thematic bonds and one investment by the Brazilian Development Bank (Banco Nacional de Desenvolvimento Econômico e Social – BNDES).

• The bioenergy and biofuels sector receive 34% of the country’s bioeconomy finance, which was equivalent to US$ 1.101 billion/year. Innovative finance instruments—Decarbonization Credits (Créditos de Descarbonização por Biocombustíveis – CBIOs) and thematic bonds—accounted for 87% of this amount and the BNDES contributed 13%.

• On the other hand, products from Brazilian biodiversity received US$ 0.280 billion/year (9%), family farming received US$ 0.267 billion/year (8%), native forests received US$ 0.178 billion/year (6%), and public policies that cover the agenda across the board, such as land regularization and investments in research and development (R&D), received US$ 0.095 billion/year (3%).

Note: The values refer to the average amount of financial flows during the analyzed period, deflated by the IPCA using December 2023 as reference.

Source: CPI/PUC-RIO with data from SICOR/BCB, SIOP/MPO, MAPA, SES/SUSEP, MMA, BNDES, MME, B3, NINT, OCDE-DAC, BID, World Bank, GEF, GIZ, Norad, 2024

Sources of Funds

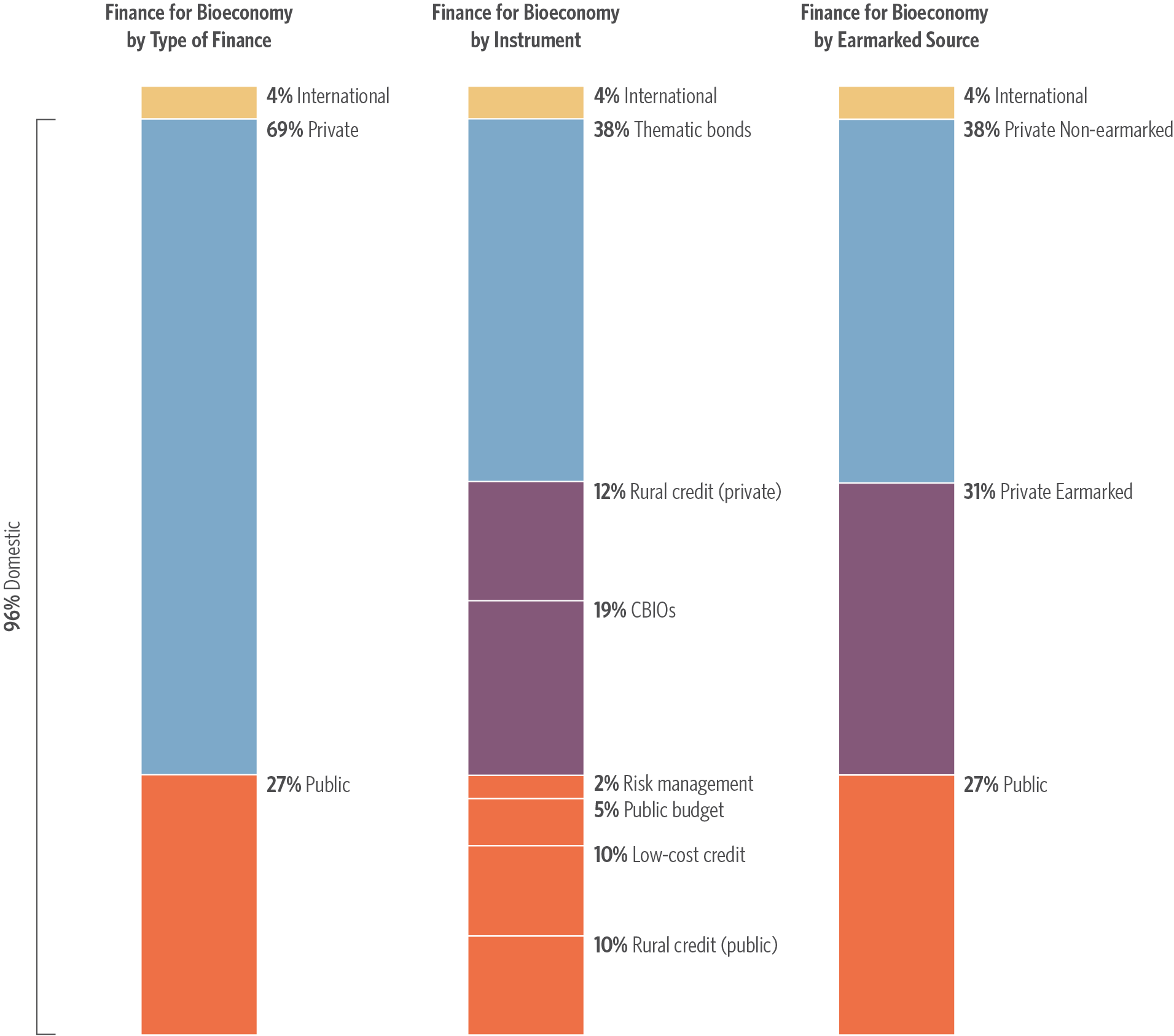

Finance for bioeconomy came primarily from private domestic sources (69%), but a relevant part of these resources was directed by public policies.

• Domestic sources channeled 96% of the finance for bioeconomy (US$ 3.102 billion/year). While 69% (US$ 2.196 billion/year) of this finance came from private sources, the public sector played an important role in this spending by directing resources through public policies, such as private rural credit and CBIOs, which together accounted for 31% of the finance tracked.

• International sources represented 4% of the total financed tracked (US$ 0.111 billion/year) and pri-marily originated from low-cost credit and donations from international governments—especially the governments of Germany (43%) and Norway (34%)—and international climate funds (14%). These international flows comprised the main source of funds for the native forest sector.

Note: The values refer to the average amount of financial flows during the analyzed period, deflated by the IPCA using December 2023 as reference.

Source: CPI/PUC-RIO with data from SICOR/BCB, SIOP/MPO, MAPA, SES/SUSEP, MMA, BNDES, MME, B3, NINT, OCDE-DAC, BID, World Bank, GEF, GIZ, Norad, 2024

Financial Instruments

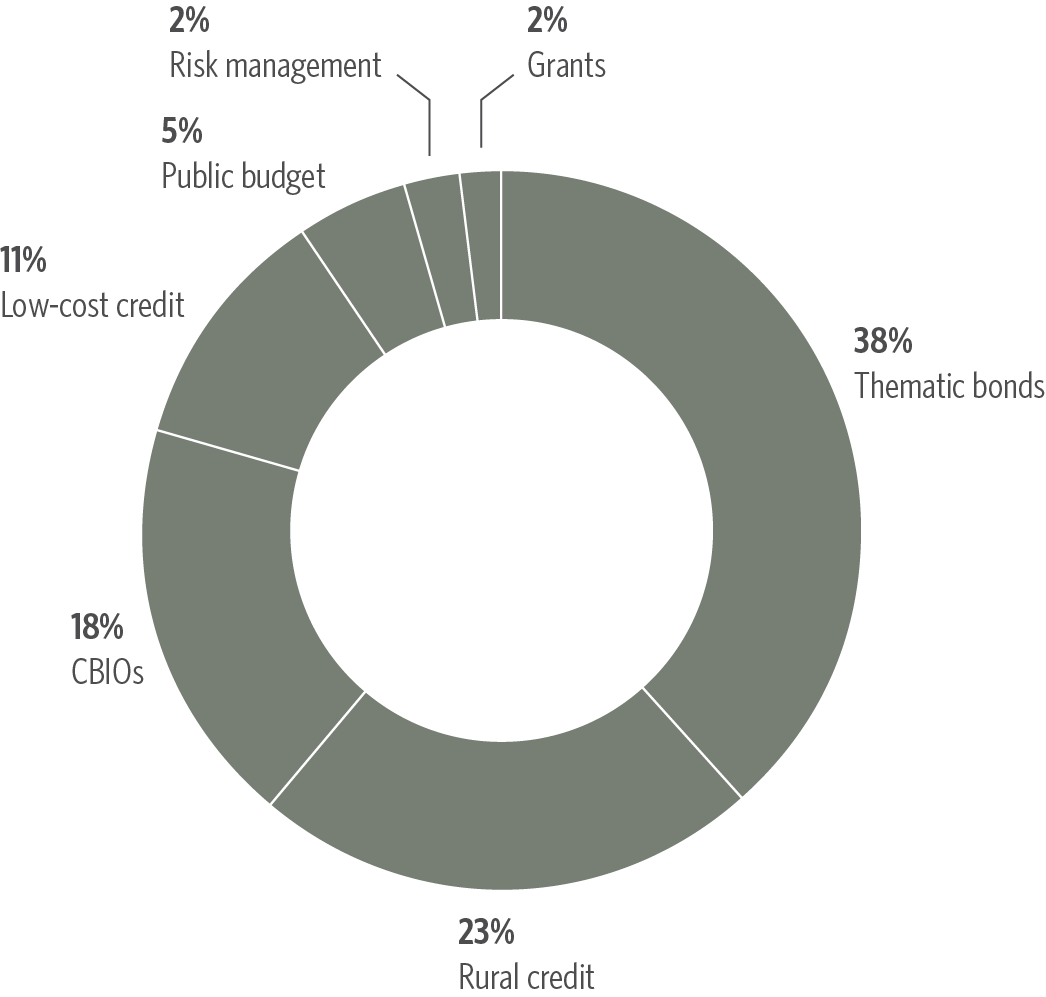

Innovative instruments, such as thematic bonds and CBIOs, accounted for 56% of finance for bioeconomy, but were used exclusively for the planted forest and bioenergy and biofuels sectors.

• Thematic bonds leveraged private resources for the bioeconomy agenda and constituted the main financial instrument tracked, having raised US$ 1.198 billion/year (38%). Thematic bonds were used to raise funds for the planted forest and bioenergy and biofuels sectors.

• Rural credit was the second most important financial instrument tracked, channeling US$ 0.754 billion/year, equivalent to 23% of the flows in the period. Of the rural credit resources for bioeconomy, 36% were channeled through the National Program for Strengthening Family Farming (Programa Nacional de Fortalecimento da Agricultura Familiar – PRONAF), a credit line that serves family farmers.

• CBIOs,[3] an instrument created for fuel distributors to buy decarbonization credits to encourage the production and consumption of biofuels and finance the decarbonization of the transport sector, mobilized US$ 0.600 billion/year, 18% of the total tracked between 2021 and 2023.

• Low-cost credit channeled US$ 0.362 billion/year to bioeconomy, or 11% of the total tracked in the period, most of which were granted by BNDES (86%). BNDES finance concentrated on the bioenergy and biofuels and planted forest sectors, which together accounted for 81% of the bank’s resources tracked for the bioeconomy. The bank plays the role of financier for low-cost credit, totaling US$ 0.314 billion/year (55%). In addition, BNDES also finances rural credit, totaling US$ 0.253 billion/year (44%), and manages the Amazon Fund, with a total of US$ 0.003 billion/year (1%).

• Expenditure from the federal public budget to finance bioeconomy amounted to an average of US$ 0.162 billion/year (5%). These resources were mostly earmarked to support public policies that cut across the bioeconomy agenda (58%), with an emphasis on land regularization and research and development finance. The public budget also played a key role in financing the native forest sector (33%), and was responsible for paying the costs of government bodies whose work is key to carrying out actions related to the bioeconomy—in particular the Brazilian Indigenous People Foundation (Fundação Nacional dos Povos Indígenas – FUNAI), the Brazilian Institute of Environment and Renewable Natural Resources (Instituto Brasileiro de Meio Ambiente e dos Recursos Naturais – IBAMA), the Chico Mendes Institute for Biodiversity Conservation (Instituto Chico Mendes de Conservação da Biodiversidade – ICMBIO), and the Brazilian Forest Service (Serviço Florestal Brasileiro – SFB)—and expenses aimed at protecting traditional peoples and communities.

Note: The values refer to the average amount of financial flows during the analyzed period, deflated by the IPCA using December 2023 as reference.

Source: CPI/PUC-RIO with data from SICOR/BCB, SIOP/MPO, MAPA, SES/SUSEP, MMA, BNDES, MME, B3, NINT, OCDE-DAC, BID, World Bank, GEF, GIZ, Norad, 2024

Rural Credit and Biodiversity Products

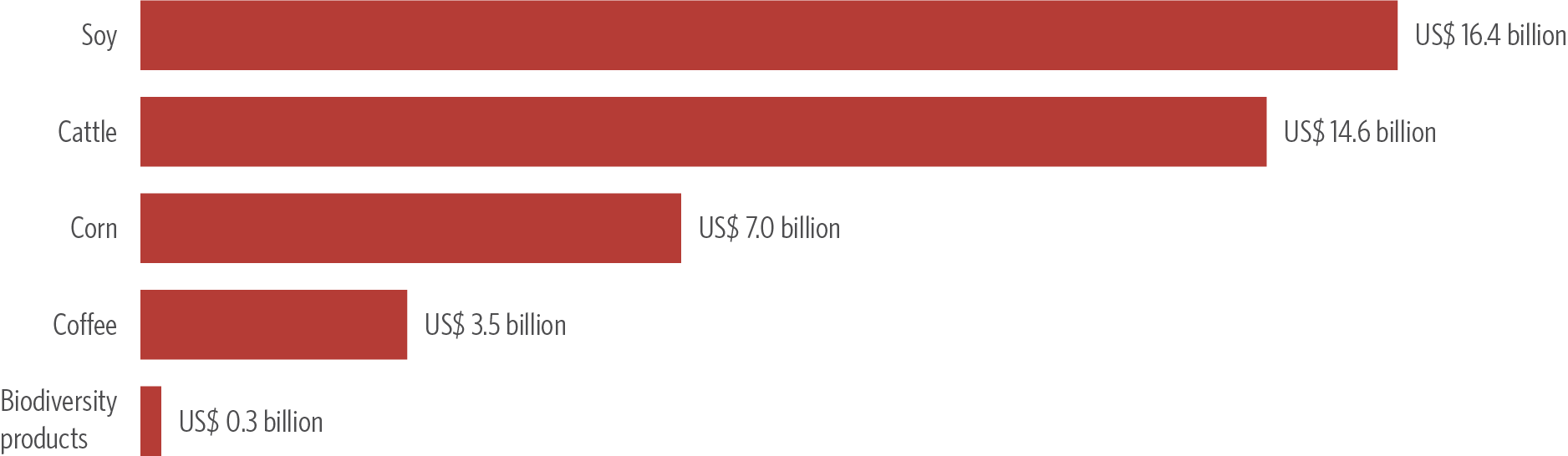

Rural credit is a consolidated instrument of national financing, but finance for biodiversity products via rural credit came to only 2% of the amount channeled to soy between 2021 and 2023.

Note: The values refer to the average amount of financial flows in Brazilian Real (R$) during the analyzed period, deflated by the IPCA using December 2023 as reference. The values were converted into United States Dollar (US$), according to the average exchange rate for the corresponding year, as provided by the Central Bank of Brazil (Banco Central do Brasil – BCB).

Source: CPI/PUC-RIO with data from SICOR/BCB, 2024

• Rural credit was responsible for 99% of the finance for the biodiversity products tracked. Although it is the main instrument for the sector, finance via rural credit for these products was significantly lower compared to others. While soy received US$ 16.4 billion/year, cattle US$ 14.6 billion/year, corn US$ 7.0 billion/year and coffee US$ 3.5 billion/year, biodiversity products only received US$ 0.3 billion/year.

• The survey of agricultural crops financed by rural credit included 31 products from Brazilian biodiversity.[4]

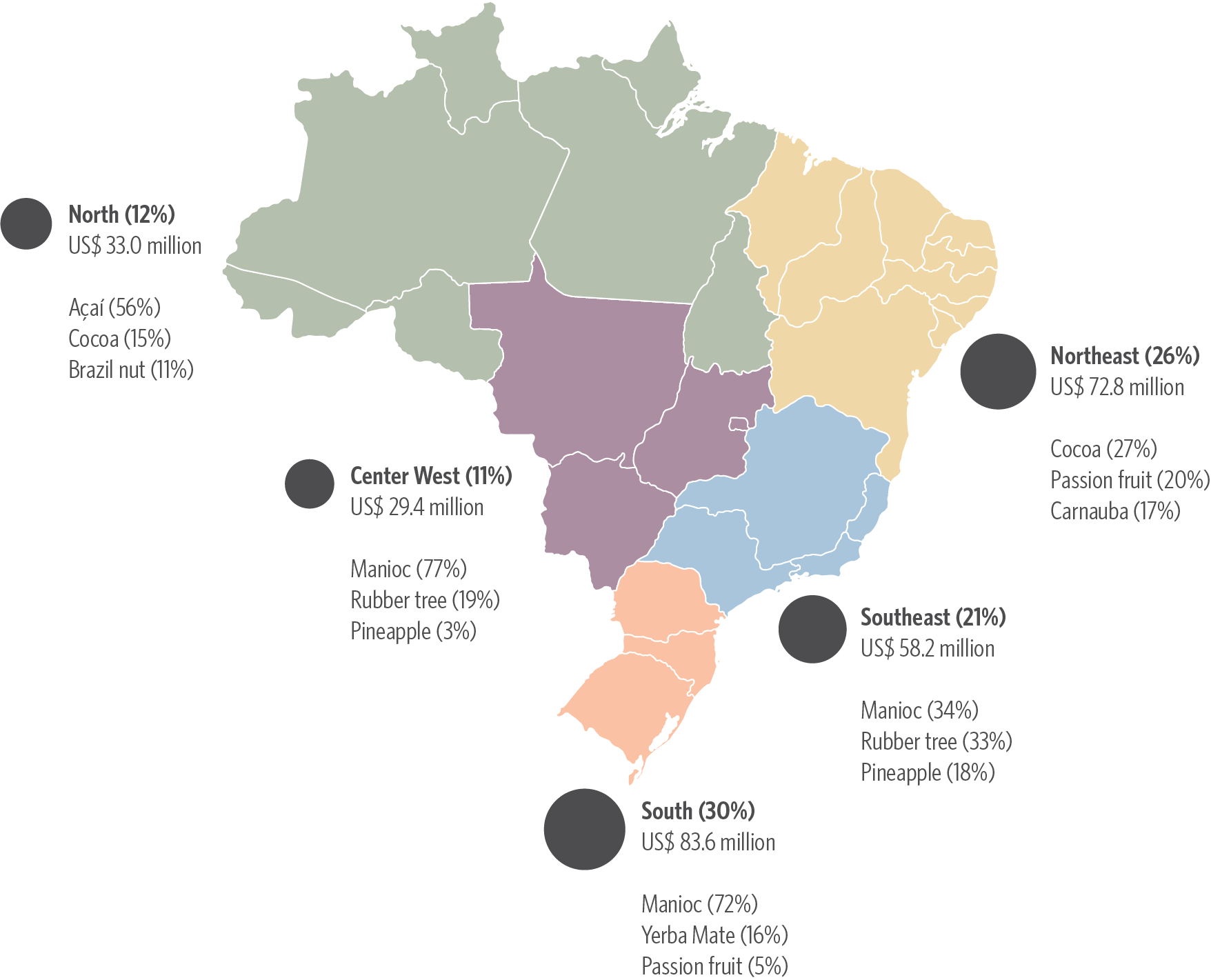

• Among these products, those that received the most finance via rural credit included cassava, totaling US$ 337 million/year (41%); cocoa, totalling US$ 81 million/year (10%); rubber trees, totaling US$ 76 million/year (9%); and açaí, totalling US$ 70 million/year (8%). Together, these products accounted for 68% of the sector’s total. Although on a smaller scale, passion fruit, pineapple, yerba mate, carnauba, palm, cashew, Brazil nuts, and pupunha also received a combined US$ 84 million/year via rural credit in the various regions of Brazil (31% of the sector’s total).

• The Southern region received the most finance for biodiversity products from 2021 to 2023, accounting for 30% of the total. Cassava, which originates in the Amazon but is grown all over the country, benefited most from the finance. The state of Paraná is the second largest producer of the root, through technology-intensive crops, and the largest producer of industrially processed products, such as cassava starch.[5]

• The Northeast region was the second largest recipient of finance, accounting for 26% of the total, with cocoa production in Bahia standing out. The Southeast region came in third, receiving 21% in the period, with rubber trees being the second product to receive the most finance in the region (33%). This is understandable given that São Paulo state produces the most natural rubber in Brazil, accommodating a large part of the rubber crop in the Southeast, even though it is a tree that originated in the Amazon region.

• Although bioeconomy based on biodiversity products is crucial for sustainable development in the Amazon, the Northern region only received 12% of finance for biodiversity products between 2021 and 2023, slightly more than the Center West (11%). The Brazil nut, a typical input from the North Region, which holds extreme ecological, economic, and social importance, only received US$ 3.5 million/year (10%).

Methodology

This publication presents an initial tracking of financial flows for bioeconomy in Brazil, building off the methodology and database from CPI’s Landscape of Climate Finance for Land Use in Brazil.[6] The approach was based on over a decade of CPI’s international experience in tracking climate finance from the Global Landscape of Climate Finance 2023[7] and adapted for the Brazilian context. Authors used CPI/PUC-RIO’s publication, Bioeconomy in the Amazon: Conceptual, Regulatory and Institutional Analysis,[8] to define bioeconomy criteria and adapt this tracking approach.

The theoretical framework for bioeconomy was used to filter and categorize the land use data. This tracking is not exhaustive and has two important gaps:

• Resources for bioeconomy that go beyond land use are not included in this analysis, particularly related to research and development.

• Data sources lack sufficient transparency and important information for categorizing finance, especially in the private capital and credit markets. In addition, rural credit databases do not make it possible to identify the production method to assess the sustainability of biodiversity products.

Nevertheless, this publication serves as an important starting point for understanding the state of bioeconomy finance in Brazil, recognizing that there are additional flows that are not covered in this analysis.

[1] Bioeconomy is the production, use and conservation of biological resources, including related knowledge, science, technology, and innovation. Learn more at: IACGB. Global Bioeconomy – What is Bioeconomy. nd. bit.ly/4ebahmu.

[2] Decree no. 12,044/24, June 5, 2024. bit.ly/4g65CnF.

[3] CBIO is an instrument established in 2019 by the Brazilian National Biofuels Policy (Política Nacional de Biocombustíveis – RENOVABIO). Each CBIO corresponds to one ton of carbon equivalent avoided, emitted by biofuel producers and importers. The Brazilian National Agency for Petroleum, Natural Gas and Biofuels (Agência Nacional de Petróleo, Gás Natural e Biocombustível – ANP) determines compulsory annual individual greenhouse gas (GHG) emission reduction targets for fuel distributors, to be met by purchasing CBIOs.

[4] The classification of Brazilian biodiversity products presented here was based on the products provided for in the Minimum Price Guarantee Policy for Socio-Biodiversity Products (Política de Garantia de Preços Mínimos para os Produtos da Sociobiodiversidade – PGPMBIO) and on consultations carried out at Flora e Funga do Brasil – REFLORA, administered by the Rio de Janeiro Botanical Garden Research Institute. The survey of agricultural crops financed by rural credit showed only the popular name of the species. Based on this information, the scientific name was converted for consultation on Reflora to check which of the mapped species are considered native. Based on this, 31 products from Brazilian biodiversity were listed: açaí, mulberry, andiroba, aroeira (pink pepper), baru, cocoa, cajá, cashew, camapu, carnauba, baru nut, cashew nut, Brazil nut, cupuaçu, yerba mate, guaraná, guariroba, jabuticaba, macaúba, cassava, mangaba, passion fruit, palm, palm heart (pupunha, açaí), pupunha, rubber tree, taperebá, tucum, umbu, and urucum.

[5] Conab. Mandioca – Análise Mensal – Maio 2024. 2024. Access date: September 4, 2024. bit.ly/3Mz68Nu.

[6] Chiavari, Joana et al. Landscape of Climate Finance for Land Use in Brazil. Rio de Janeiro: Climate Policy Initiative, 2023.

bit.ly/LandscapeLandUse.

[7] Buchner, Barbara et al. Global Landscape of Climate Finance 2023. Climate Policy Initiative, 2023. bit.ly/47h7kyn.

[8] Lopes, Cristina L. and Joana Chiavari. Bioeconomy in the Amazon: Conceptual, Regulatory and Institutional Analysis. Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/BioeconomyAmazon.

This work is supported by a grant from the Norway’s International Climate and Forest Initiative (NICFI). This publication does not necessarily represent the view of our funders and partners.

The authors would like to thank Augusto Monnerat, Eduardo Minsky, and Renan Florias for research assistance. We would also like to thank Natalie Hoover El Rashidy, Giovanna de Miranda, and Camila Calado for editing and revising the text, and Nina Oswald Vieira and Meyrele Nascimento for formatting and graphic design.