A contribution to guiding action across the financial system

CONSULTATION DRAFT

The Framework for Sustainable Finance Integrity (“Framework”) is a draft document, intended as a contribution to a clear pathway to financial system integrity and materiality that will help smooth the financial sector’s move to sustainability and net zero and reinforce the multiplier effect these actions will have on achievements in the real economy. The document outlines a set of guardrails to deliver results and foster integrity. The document has been developed based on a rigorous, technical evaluation of existing initiatives and critical actions identified by civil society.

In conjunction with the Framework, to further facilitate cross-institutional collaboration, CPI developed three investment blueprints for financial instruments that can deliver concrete action consistent with the Framework for Sustainable Finance Integrity.

The Framework was reviewed and guided by an Advisory Council of leading personnel and organizations from each segment of the financial ecosystem, including insurers, commercial banks, development banks, asset managers, civil society, and government representatives across Asia, Africa, Europe and the Americas.

Press Release: Public and private financial leaders seek to contribute to greater integrity and coordination in sustainable finance commitments.

Context

The financial system lies at the heart of a sustainable future, particularly in the wake of the COVID-19 pandemic. Financial actors, including governments, central banks and financial supervisors, development finance institutions, commercial banks, asset owners, asset managers, and insurers, can work together to create a financial ecosystem that accurately prices risk and rewards sustainability, thus supporting the move towards a sustainable, net zero future. As economies move from relief to recovery, extensive evidence suggests that meeting the Sustainable Development Goals and Paris Agreement objectives could bring widespread economic, health, and employment benefits, and improve economic and financial stability post-COVID. Restoring nature and biodiversity are job-intensive activities and can help regions hard-hit by the economic crisis. The IMF recently estimated the multiplier effect for green spending, including clean energy and biodiversity conservation, to be two to seven times greater than non-green spending. Yet to date, only a few relief efforts have mainstreamed the multiple challenges facing both present and future societies, increasing the potential for risk into the future and leaving aside the benefits of a sustainable transition.

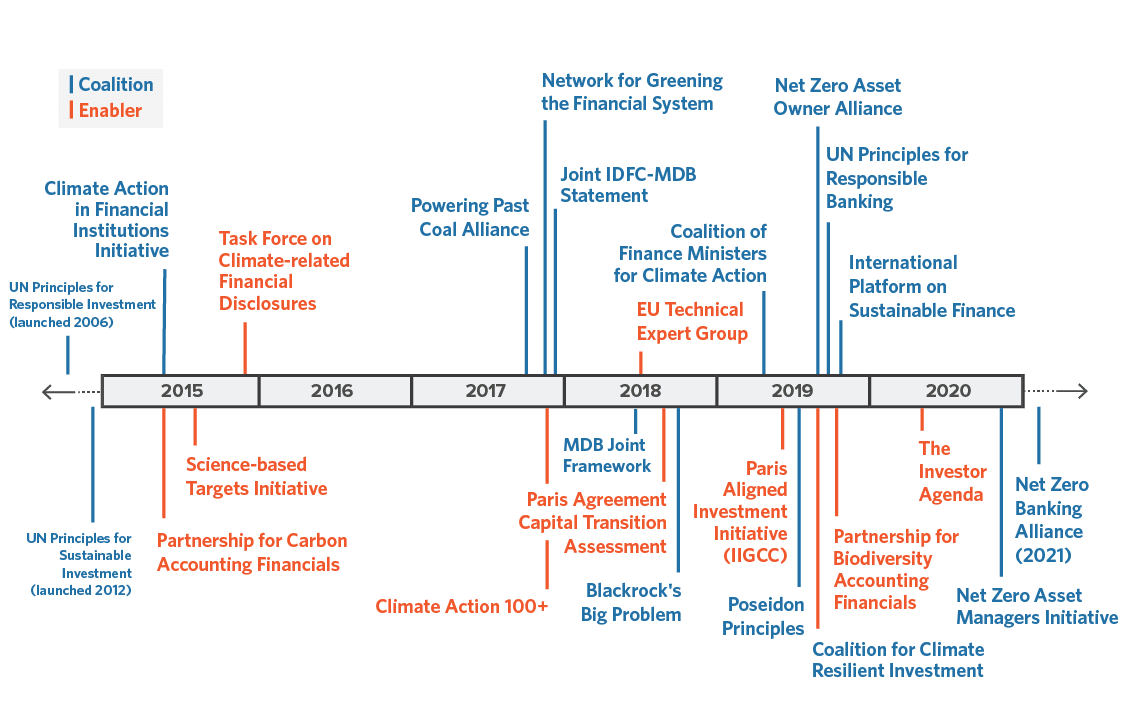

This is not to discount progress. Financial actors have formed coalitions to promote sustainable finance (Figure 1, below), with many reaffirming commitments in the wake of COVID-19. These include public sector coalitions, such as the Coalition of Finance Ministers, the Network for Greening the Financial System (for central banks), the group of Multilateral Development Banks, and the International Development Finance Club, and private sector coalitions such as the Net Zero Asset Owners Alliance, the Net Zero Asset Managers Initiative, the Net Zero Banking Alliance, the Investor Agenda, Principles for Responsible Banking, and Principles for Responsible Investment.

However, while many initiatives make commitments to align finance with the Paris Agreement and Sustainable Development Goals and target net zero emissions, mainstream sustainability in operations, and disclose risks, the sum total of commitments would almost certainly not add up to a net zero sustainable trajectory: the pace of change and impact on the real economy is likely to be too slow, with lock-in of high carbon assets and serious unmitigated climate risks far before 2050, and far too little attention paid to other environmental and social issues such as biodiversity and just transition. The siloed approaches of coalitions also make some challenges difficult to overcome, such as the immediate need for debt relief and restructuring in some developing countries that will require more than one set of financial actors to engage. There is therefore a need to increase the ambition, credibility, and accountability of coalition commitments and provide the connective tissue between the various coalitions and efforts to help strengthen their contributions towards the sustainable, net zero path.

In addition, there is no universally accepted framework against which to measure progress nor a commonly accepted understanding of what all financial actors should be doing at minimum and what the most ambitious institutions should strive towards to remain leaders. As commitments have proliferated, different organizations have proposed sector-specific benchmarks or methodologies and tools for individual financial institutions to measure alignment of portfolios and new investments, but there are no universally accepted standards. There is also currently no organization that is tracking the progress of the financial system overall, nor analyzing the impact, separately and in aggregate, of the commitments. Similarly, the many institutions that have not made commitments are also not routinely identified and tracked.

The financial system therefore stands at a critical moment, with an accelerating pace of sustainability and net-zero pronouncements by a range of actors. While welcome, this rapid proliferation has exposed missing links: how to 1) understand and ensure the integrity and accountability of the many individual pledges and sectoral initiatives, 2) coordinate across siloes of public and private financial actors to ensure coherence and impact on net zero and sustainability, and 3) focus on sustainability and social justice beyond climate mitigation to address the many inequalities and vulnerabilities the COVID-19 crisis has highlighted.

The Framework for Sustainable Finance Integrity

This draft Framework for Sustainable Finance Integrity (“Framework”) is intended as a contribution to a clear pathway to financial system integrity and materiality that will help smooth the financial sector’s move to sustainability and net zero and reinforce the multiplier effect these actions will have on achievements in the real economy. The document outlines a set of guardrails to deliver results and foster integrity. The document has been developed based on a rigorous, technical evaluation of existing initiatives and critical actions identified by civil society.

The draft framework suggests minimum benchmarks for meaningful sustainable finance commitments and identifies leadership benchmarks to highlight best practices in sustainable finance across the major sectors of the global financial system. These benchmarks recognize that there is value in having as many financial actors as possible move towards sustainable, net zero operations, but at the same time, that continual strengthening and improvement is imperative to reach critical global goals this decade. The Framework also suggests a credible approach that academia, think tanks, and civil society can use to analyze and monitor progress on sustainability, and hold providers of finance to account.

Benchmarks are defined in three categories that were developed based on a bottom-up analysis of commitments:

- Targets and objectives: This category includes targets that financial sector actors have set at the strategic level of institutions, encompassing long-term targets that focus on Paris Agreement and Sustainable Development Goal alignment and/or reaching net zero emissions for both new investments and overall portfolios, as well as more specific targets that would illustrate interim progress and help drive action in the near-term: for example, climate finance and near-term emissions reduction targets, as well as targets to phase out fossil fuel financing and investment. While most financial sector targets to date have focused on climate mitigation, targets for pollution (e.g., “zero pollution”), adaptation and resilience finance, biodiversity conservation, and just transition are also considered in this category and highlighted where information is available.

- Implementation: This category covers the measures that an institution would take to achieve its targets and to improve its ability to do so. It includes approaches to mainstream sustainability in its governance and operations, for example via mandates and strategies, decision-making processes and tools, investment products, performance management, and risk management. It includes actions taken on shareholder, client, and policy engagement. It also includes commitments made to cooperate with others in the sector, for example through sharing of best practices.

- Metrics and transparency: This category covers the development and adoption of metrics to track and report on performance both internally within the organization as well as externally, for example via climate- and nature-related disclosures, and to use that data to improve performance over time.

The Framework lays out a set of “minimum” and “leadership” benchmarks in these categories.

Collaboration across the financial system

In addition to establishing benchmarks, several areas in high need of collaboration across the financial system were identified to drive further progress, and are highlighted in the last section of the consultation draft. These types of collaboration are required to make sure that the efforts of individual actors and coalitions add up to the systemic change needed for the financial sector to not only participate in, but also accelerate, the sustainable transition.

To further facilitate cross-institutional collaboration, CPI developed three investment blueprints for financial instruments

- Debt for Climate Swaps

- Recovery Bonds

- Results-based Financing

that can deliver concrete action consistent with the Framework for Sustainable Finance Integrity. These blueprints describe financial structuring and other implementation requirements that, we believe, show strong promise for green and resilient recovery finance. As with the Framework, these blueprints are intended as proposals for discussion and, ultimately, action.

Next steps

The draft Framework was released on 10 May 2021 in a soft launch event featuring Advisory Council members. A revised version is planned in advance of COP26 and other major autumn 2021 events such as the Finance in Common summit. This is not a new standalone initiative or reporting requirement for institutions, and endorsement will not be sought, to maintain independence. Feedback is welcome.

In addition, the project will also seek to provide analytical contributions to some of the key sustainable finance areas that require significant cross-sectoral collaboration, which have also been identified in the draft framework document, and to measure progress in the financial system according to the framework.