Created under the U.S. Inflation Reduction Act 2022, the Greenhouse Gas Reduction Fund (GGRF) is set to provide USD 27 billion in grants to mobilize financing and private capital to address the climate crisis through projects that reduce GHG emissions in the United States. The funds will be made available to state, local, and Tribal governments, as well as non-profit institutions, especially for low-income and disadvantaged communities (LIDACs).

The GGRF presents a transformational opportunity to accelerate progress towards climate justice in the United States. This funding has the potential to go beyond emissions reduction by supporting sustainable community and economic development in LIDACs, and enhancing climate resilience in these communities that are frequently on the front lines of climate change.

The GGRF could help to align climate, community, and financial actors to establish a virtuous cycle that increases the wealth and resilience of LIDACs while reducing GHG emissions. Investment in emissions reduction technologies can jumpstart various benefits for LIDACs, including increased household wealth and health due to low-cost and reliable renewable energy, building electrification, and electrified transport technologies. Higher demand for labor and local expertise to build and install clean technologies can boost job creation, thereby promoting wealth creation and economic mobility. Additionally, channeling federal funds through community development financial institutions (CDFIs) and green banks can increase access to finance in LIDACs, facilitating sustainable economic development.

Nevertheless, several challenges must be overcome to enable effective implementation of the GGRF. These include:

- The short timeframe for GGRF disbursement may leave the most disadvantaged communities behind.

- The diverse operational capacity and range of experience of CDFIs in climate-related underwriting means that they vary in their ability to effectively absorb and deploy GGRF funds.

- Varied experience among green banks of lending in LIDACs creates a need for TA to scale their investments in these communities.

- The large number of diverse GGRF stakeholders creates challenges for coordination and systemic learning while deploying the funds.

- Barriers exogenous to the GGRF, such as limited workforce capacity and pipeline development, pose risks to the success of projects.

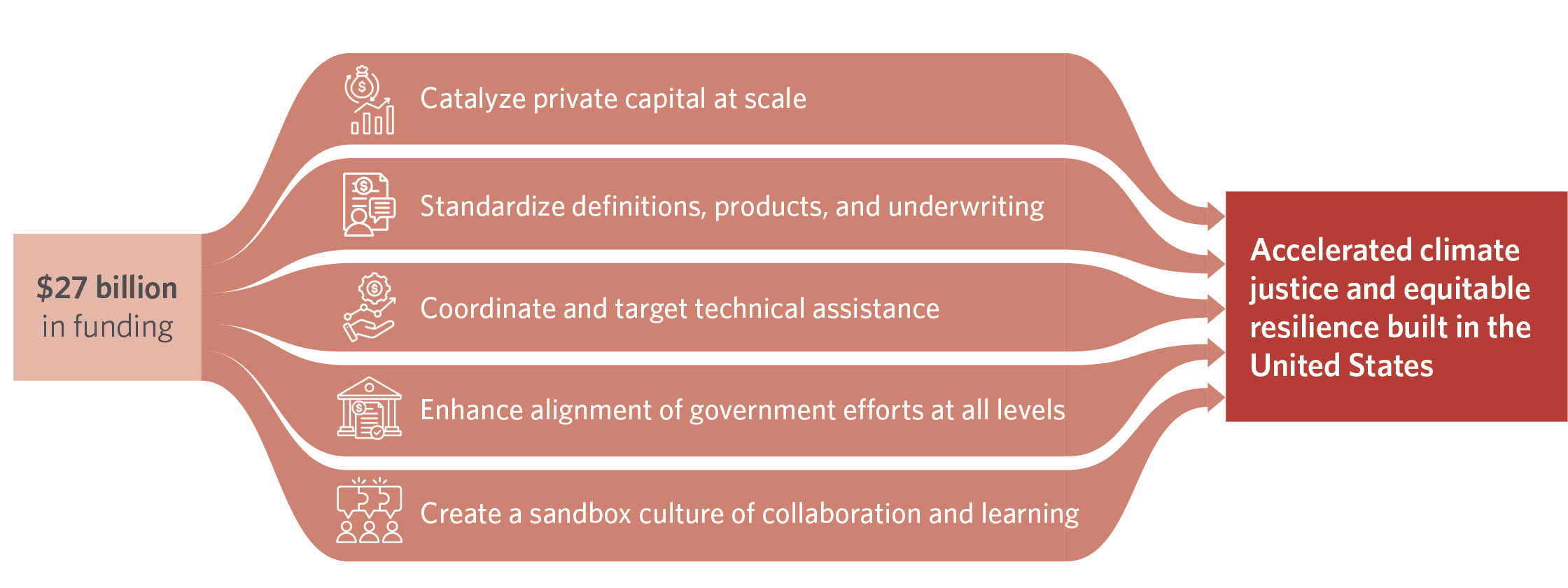

Five recommended actions to achieve the GGRF’s potential

CPI has identified five areas of action that can help the GGRF achieve its potential. These do not align explicitly with the barriers described above, but rather holistically address the challenges to GGRF implementation, recognizing the interrelated nature of these barriers. These areas require coordination across all GGRF stakeholders, including at all levels of government, community groups, financial institutions, small businesses, philanthropies, and more. Our vision to achieve this transformation includes actions to:

1. Catalyze private capital at scale

While the GGRF’s USD 27 billion in grant funding represents a substantial increase in federal support for LIDACs, this pales in comparison to the estimated USD 2.8 trillion in climate finance required by these communities through 2035 under a national pathway to net zero GHG emissions by 2050 (see below for details). Therefore, GGRF funds must be used to catalyze larger volumes of private climate finance for LIDACs in order to deepen the scale and scope of impact in accelerating climate justice. This could be done by supporting a more robust secondary market for GGRF-supported loans; guarantee funds; senior lending facilities; and securitization vehicles.

2. Standardize definitions, products, and underwriting

To make the abovementioned financing structures possible and to rapidly scale lending, the GGRF can encourage the development and deployment of shared underwriting standards, definitions, and processes. Standardization of financial products, term sheets, use cases, and underwriting criteria can encourage replication, reduce duplication, and alleviate capacity constraints.

3. Coordinate and target technical assistance

As the GGRF and its associated financing structures increase the volume and delivery speed of available capital, coordinated and targeted TA can help to ensure that the most disadvantaged communities are able to receive support. This can build a more robust system for delivery for end users as well as clients of CDFIs and banks, while also supporting local ecosystems for broader economic, innovation, and community development. A hub-and-spoke TA framework would allow for centralized support at the national level, while providing specialized support regionally and thematically (e.g., by lender and technology type, and for rural/Native communities, etc.).

4. Increase alignment of government efforts at all levels

Intra- and inter-government coordination is necessary to increase the effectiveness of each government agency’s action. However, many are unaware of the climate finance opportunities offered by other agencies or levels of government. As a result, they do not always align on timelines, priorities, definitions, permitting, or application processes. Federal, state, and local government incentives should be braided to make project development easier and to enhance the impacts of individual incentives

5. Create a sandbox culture of collaboration and learning

Creating a culture of collaboration and learning around the GGRF will enable real-time iterations and delivery at speed. By implementing such structures from the outset, GGRF stakeholders can share lessons learned in real-time, allowing for rapid recalibration around best practices. A centralized learning hub, innovation labs, targeted convenings, and accountability frameworks would be key elements for such a sandbox culture.

Updated estimates of GGRF investment needs

CPI has also updated our estimates of the investment needed in GGRF priority project categories in order to achieve net-zero GHG emissions nationwide by 2050, which we first released in conjunction with our interim report on GGRF implementation in 2023.

Our updated estimates indicate that nationwide investment needs in GGRF priority project categories add up to USD 9.1 trillion through 2035. Of this amount, USD 2.8 trillion (31%) will be needed in census tracts classified as LIDACs—in line with the share of the nation’s population in these communities.

CPI has created a data map to allow users to browse and view our detailed estimates down to the census tract level, across the nation.

We are also happy to provide access to a datafile containing the full, census tract-level estimates upon request; please contact Chris Grant (chris.grant@cpiglobal.org) and Matthew Solomon (matthew.solomon@cpiglobal.org).