Mandated by the International Development Finance Club (IDFC) and the European Climate Foundation, Climate Policy Initiative (CPI) and the Institute for Climate Economics (I4CE) conducted a research project in two parts:

- Part 1, led by I4CE, establishes a theoretical and conceptual basis for alignment, analyzing and describing the emerging interpretations of the definitions, principles, and approaches across the financial community, and builds on the experience of the Climate Action in Financial Institutions Initiative.

- Part 2, led by CPI, identifies the changes the Paris Agreement implies for the role of Development Finance Institutions (DFIs) – specifically members of the IDFC – and how they may implement these changes through a targeted set of activities.

Part 1: Alignment with the Paris Agreement: Why, What and How for Financial Institutions?

The Paris Agreement has reframed climate action from a focus on the near-term incremental increase of adaptation and mitigation actions, to more emphasis on the importance of the long-term transformation of economies and societies. The Agreement highlights the importance of bottom-up, country-led approaches to low greenhouse gas (GHG) and climate-resilient development, or ‘national pathways’ to simultaneously achieve both climate and sustainable development objectives. This reframing implies that that all actions of governments and non-state actors should be consistent with economic and social development, and, in turn, consistent with the long-term goals of the Paris Agreement.

Financial institutions and other economic actors – whether seeking sustainable development impacts or those with a commercial focus – have an interest to align their activities with the long-term goals of the Paris Agreement.

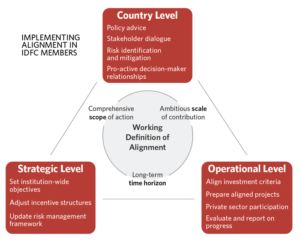

This report proposes a framework that can be used by financial institutions seeking to align their strategies and operations with the Paris Agreement. The framework specifies three dimensions for action: A comprehensive scope of action; a long-term time horizon to guide impact; and an ambitious scale of contribution.

Whether institutions are principally focused on sustainable development impacts or commercially-oriented, a commitment to ‘Paris alignment’ is a commitment to adopt the Agreement’s high level of ambition. However, the scale of contribution of financial institutions will vary as institutions may be involved in different types of business lines that have impact-oriented objectives or more commercial objectives. Nevertheless, for all financial institutions to be aligned requires that they scale-down and halt activities inconsistent with these goals and contribute, whenever possible, to the national attainment of low-GHG, climate-resilient development.

In practice, this requires financial institutions to integrate Paris alignment considerations in strategic governance and in operational frameworks for decision making and investment. Ensuring that all of an institution’s activities are consistent with the long-term goals is important. However, it is also important for institutions to determine and act on how they can best leverage their potential to support low-GHG, climate-resilient transformations in their countries and sectors of operations.

To view the Part 1 report on I4CE’s website, click here.

Part 2: Implementing Alignment: Recommendations for the International Development Finance Club

Members of the IDFC, 24 national, bilateral, and regional development finance institutions with more than USD 4 trillion in assets under management, can play a critical role in supporting the economic transformation of their countries of operation towards Paris alignment. IDFC members’ close relationships with national and sub-national governments allow members to provide direct input and feedback on policy design and influence project pipelines (Crishna Morgado et al. 2019). Also, their diversity of clients in the public and private sectors allows them extraordinary reach across investment value chains.

All IDFC members will need to make changes to the way they do business to support the long-term transformational change required by the Paris Agreement. This report proposes that alignment implementation can be facilitated by focusing on the following areas:

- An internal working definition of alignment can serve as a common basis for implementation throughout the organization by clearly articulating how the institution will contribute to the Paris Agreement objectives and by sending a clear signal to staff, external market participants, and other stakeholders that climate action underpins the institution’s development objectives. The working definition can describe how the scope, scale, and time horizon dimensions of alignment apply to the institution.

- For publicly mandated development finance institutions, the ability to implement alignment will be greatly facilitated – or constrained – by their countries of operation, both through enabling environments as well as the influence of governments on IDFC members through their Boards. However, IDFC members are also uniquely positioned and trusted to support governments to contribute most effectively to the objectives of the Paris Agreement, to which they have all agreed. Therefore, we propose in this study that alignment starts with the special relationship IDFC members have with the governments in their countries of operation.

- Paris alignment will require executive leadership to influence how decisions are made and the modalities to execute them. Alignment can be embedded in the strategic level of the organization by adopting institution-wide objectives; a well-structured incentive and support system, and an updated risk management framework.

- At the operations level, alignment requires changes in how investments are assessed and how capital is deployed. All investments across the institution’s operations will need to be assessed against alignment criteria, and capital should be deployed using modalities that help deliver the transformative change necessitated by the Paris Agreement.

While IDFC members share a common goal, the differences between them in terms of internal capacity, mandate, national circumstances, and resources imply a range of possible short-term paths. However, these must converge with urgency towards activities reflecting the full scope, scale, and time horizon of the Paris Agreement objectives.

The transition to alignment for the IDFC, individually and collectively, will not be easy, and it will take time – and therefore it should start now. With the roadmap to alignment presented here as a guide, members can scale up and build upon successful examples of existing practices with the sustained, focused effort required across all activities for the Paris Agreement’s goals to be met.

While meeting this challenge will require unwavering commitment and engagement from members themselves, partnerships with others outside the IDFC will be vital. Collaboration with other financial institutions, both public and private, will be needed to streamline methodologies, metrics, and programming; reduce duplication; and accelerate the development of appropriate policy and financial instruments. Most crucially, IDFC members will need support – both political and financial – from the international community and shareholder governments to reach their potential to drive investment towards a Paris-aligned future.