While early responses to the COVID-19 pandemic were focused on rescue efforts, governments are now transitioning into economic recovery efforts. The five Asian countries analyzed in this report — India, Indonesia, the Philippines, Singapore, and South Korea —have together announced a total of USD 884 billion in COVID-19 recovery stimulus packages since the outbreak of the pandemic in February 2020. But how effective will those public investments be in producing long-term, sustainable growth?

This study, jointly produced by Climate Policy Initiative and Vivid Economics maps the ‘greenness’ of these fiscal stimulus measures and their contribution towards country-level climate objectives. Compared to business-as-usual stimulus measures, green stimulus measures have been proven to provide both short-term economic gains and build national wealth in the long-term[1]. Green recovery measures, such as investment in renewable energy, low emission transport, energy efficiency, and nature-based mitigation and adaptation solutions provide higher employment intensity, along with other financial returns and wider social benefits[2], than policies that seek to prop up aging, more polluting means of production.

Growth models that rely on the depletion of natural capital and accelerate the climate crisis are not sustainable, because emissions-heavy and environmentally-harmful business models are now facing the risk of depleting raw materials, less demand, and ultimately stranding financial assets[3]. Restoring nature and biodiversity, aggressively transitioning into renewable energy, and investments in sustainable infrastructure are job-intensive activities that can help regions hard-hit by the economic crisis, while also contributing to each country’s climate goals. The Coalition of Finance Ministers for Climate Action emphasized that following immediate action to manage the crisis, policymakers need to design and implement recovery strategies that support sustainable growth over the medium and long term[4].

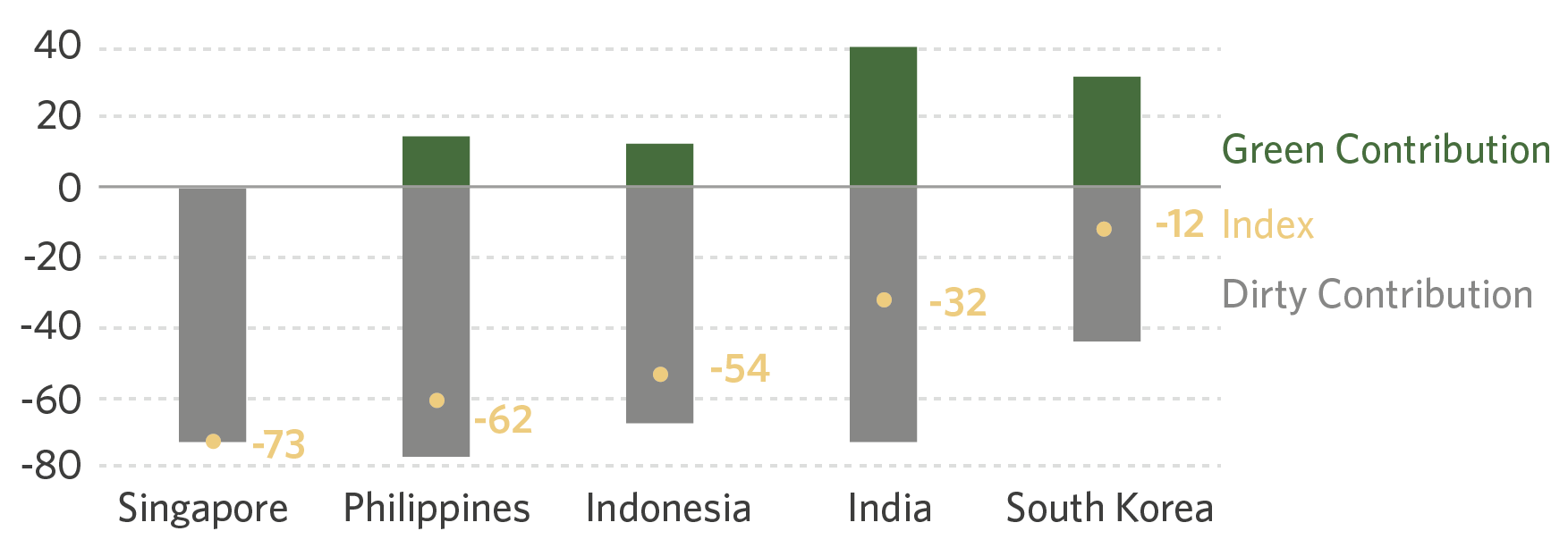

The analysis presented in this study builds on the Greenness of Stimulus Index (GSI) developed by Vivid Economics to assess the sustainability implications of fiscal stimulus packages across the five Asian countries included in this study. The index, presented in Figure 1, suggests that countries are not doing enough to incorporate climate considerations into their fiscal stimulus responses.

Source: Vivid Economics and CPI analysis

South Korea has announced the largest stimulus package (USD 333.7 billion), followed by India (USD 332.9 billion), Singapore (USD 85.7 billion), Indonesia (USD 74.7 billion), and the Philippines (USD 17.0 billion). As a percentage of GDP (Gross Domestic Product)[5], Singapore has provided the largest share of recovery packages (24%), followed by South Korea (20%), India (12%), Indonesia (6%), and the Philippines (4%).

Interactive: Environmentally related stimulus packages by country, green vs. dirty by total investment

South Korea has the highest share of green stimulus measures as well, accounting for 53% of environmentally related measures. Meanwhile, India allocated 31% of its stimulus for environment related activities, and Indonesia directed 4% of its stimulus towards green outcomes. And based on our analysis, Philippines and Singapore have included no commitment towards green outcomes. Therefore, within the portion of environmentally relevant stimulus, the share of ‘dirty’ stimulus outweighs the stimulus directed towards green measures in almost all cases.

Interactive: Environmentally related stimulus packages by country, green vs. dirty by proportion

Table ES1. Summary of stimulus packages in five Asian countries

| Country | Total Stimulus | Env. Relevant Share | Green | Neutral | Dirty | Main Sectors |

| Indonesia | USD 74.7bn | USD 6.3bn | 4% | 0% | 96% | Energy |

| India | USD 332.9bn | USD 89.5bn | 31% | 21% | 47% | Energy, Industry |

| Singapore | USD 85.7bn | USD 483m | 0% | 18% | 82% | Transport |

| South Korea | USD 333.7bn | USD 70bn | 53% | 0% | 47% | Industry, Energy |

| Philippines | USD 17.0bn | USD 689m | 0% | 50% | 50% | Agriculture Industry |

Source: Vivid Economics and CPI analysis

To ensure a sustainable recovery across the five Asian countries, there is a definitive need for governments to integrate green considerations into the design of their COVID-19 stimulus packages. These countries can pursue three recommendations to enable the desired outcome.

- First, countries should increase the size of stimulus packages that support environmentally beneficial outcomes across sectors.

- Second, countries should integrate green conditionalities when providing support and bailouts to environmentally-damaging activities.

- Finally, countries should introduce a broader range of green support measures, such as tax reductions for green products and subsidies for R&D, alongside investing in sustainable infrastructure.

Countries can lay the foundations for long-term sustainable growth only by implementing support packages that maximize stimulus effects in the short term and mitigate environmental degradation in the long term. Such measures offer governments a win-win solution, by maximizing the stimulus effects in the short term and mitigating environmental degradation in the long term.

[1] Green budgeting and tax policy tools to support a green recovery (OECD, 2020). http://www.oecd.org/coronavirus/policy-responses/green-budgeting-and-tax-policy-tools-to-support-a-green-recovery-bd02ea23/

[2] “Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change?” Hepburn, C., O’Callaghan, B., Stern, N., Stiglitz, J., and Zenghelis, D., Oxford Smith School Working Paper No. 20-02, May 2020. https://www.smithschool.ox.ac.uk/publications/wpapers/workingpaper20-02.pdf; https://wwf.panda.org/?364346/Nature-based-solutions-post-COVID-19-recovery: https://www.wri.org/news/coronavirus-nature-based-solutions-economic-recovery

[3] The decline of oil has already begun (Green Peace, March 2020)

[4] The Coalition of Finance Ministers for Climate Action (“the Coalition”) is a group of fifty-two finance ministers, engaged in efforts to address climate change through economic and financial policies. https://www.financeministersforclimate.org/news/better-recovery-better-world-resetting-climate-action-aftermath-covid-19-pandemic

[5] GDP refers to GDP current prices by the International Monetary Fund (IMF) in 2021. Available at: https://www.imf.org/external/datamapper/NGDPD@WEO/OEMDC/ADVEC/WEOWORLD/APQ