Scope of tracking

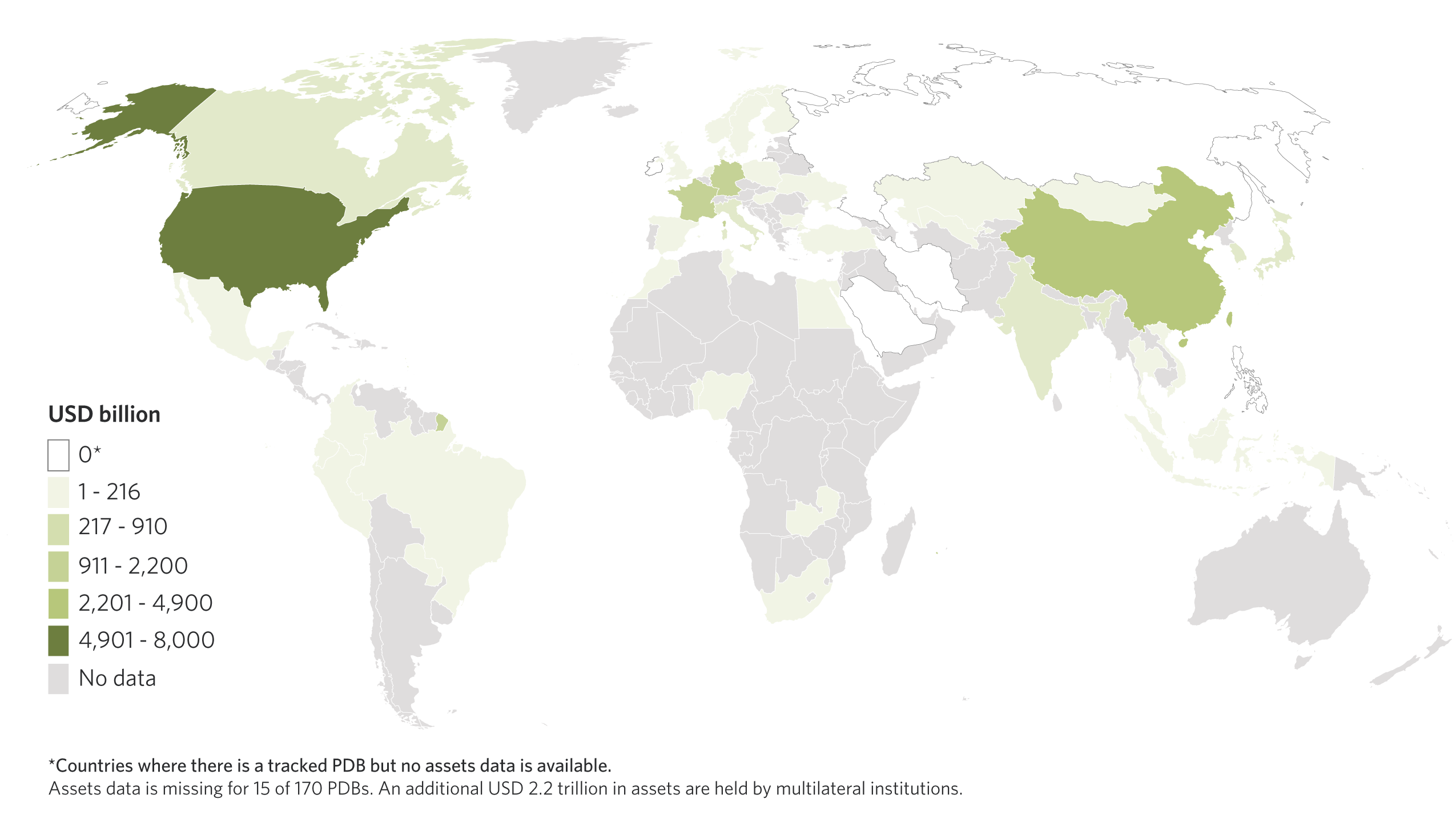

CPI has expanded its tracking of the climate ambition of public development banks (PDBs) to cover commitments made by 170 institutions over the period 2015-24, which currently hold USD 21.8 trillion in assets, over 95% of global total for PDBs.

The 2024 tracking of sample goes beyond the scope of previous tracking exercises (70 largest PDBs) to include 100 additional institutions, primarily aiming to increase coverage of small-to-medium PDBs (by assets managed) operating in emerging markets and developing economies (EMDEs), a subset of PDBs that CPI has recently identified as key transition facilitators with burgeoning climate engagement (CPI 2024). Tracking is further enhanced by newly developed artificial intelligence and machine learning (AI/ML) tools, including multi-lingual web scraping and metadata extraction, to better collect information on PDBs’ climate commitments. These methods are detailed in this dedicated blog post.

The expanded scope and depth of tracking presented in this report is intended to reflect the critical role that PDBs play in directing financing flows towards low-emission climate-resilient development pathways, particularly in EMDEs. Broadly, findings show that climate ambition among PDBs still has not reached a level commensurate with the scale of action needed from PDBs to close the global six-fold gap between climate finance flows and needs (CPI 2024).

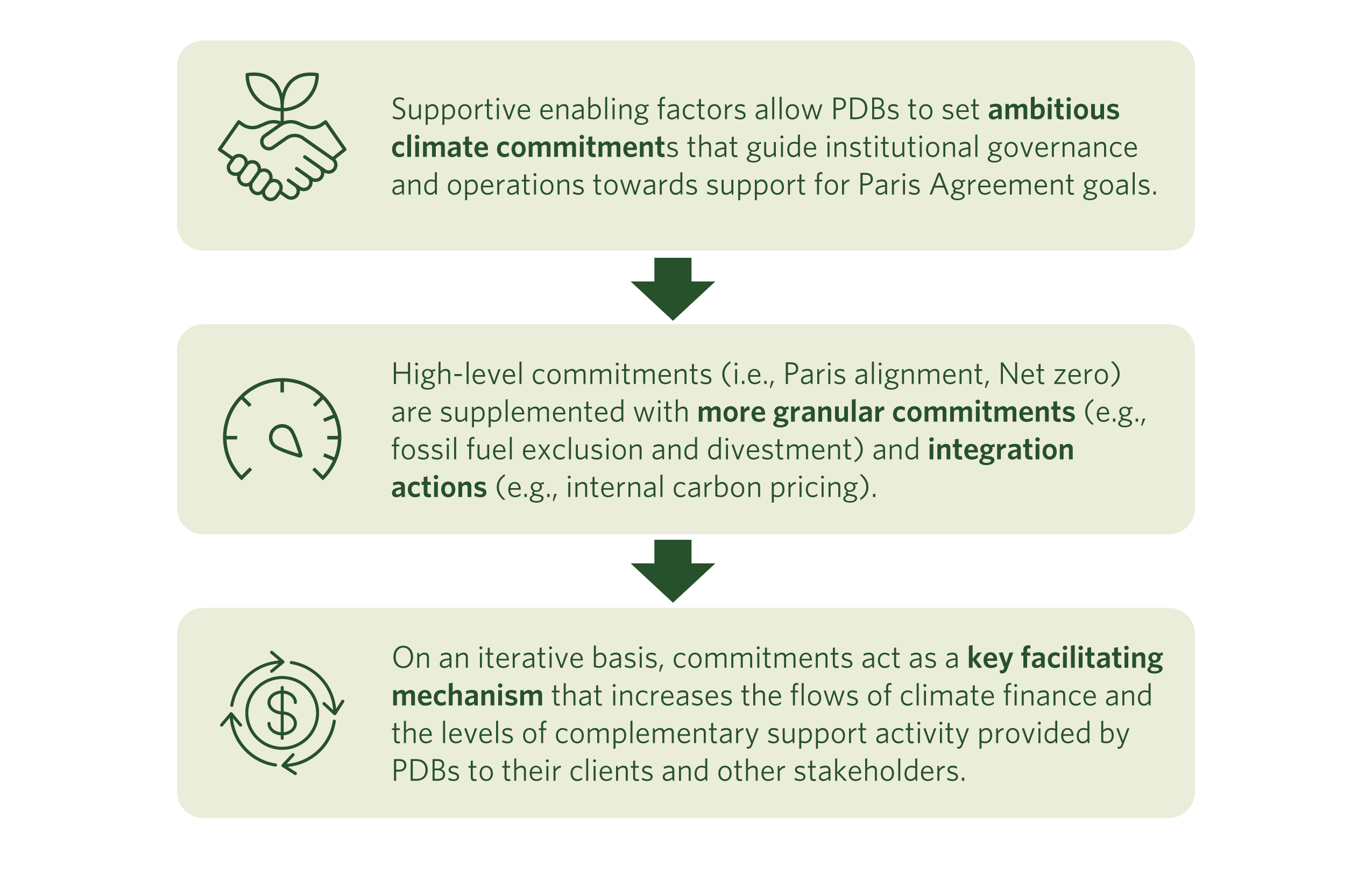

Charting a pathway towards raising and achieving PDBs’ climate ambition requires an understanding of the contextual factors that PDBs must navigate during that process, outlined as a framework in Figure ES2 below. This high-level strategic framework forms the scope of analysis in the body of this report.

Accordingly, this report looks beyond trends in PDBs’ climate commitments to specifically assess the relationship between key enabling factors and PDBs’ overall climate ambition. It also explores the extent to which PDB climate ambition is reflected within PDBs’ direct financing towards real economy climate projects. The resulting strategic insights can be leveraged to inform PDBs, host governments, and other relevant stakeholders of the critical actions needed to first raise, then achieve, broad and impactful climate ambition among PDBs globally.

Key findings

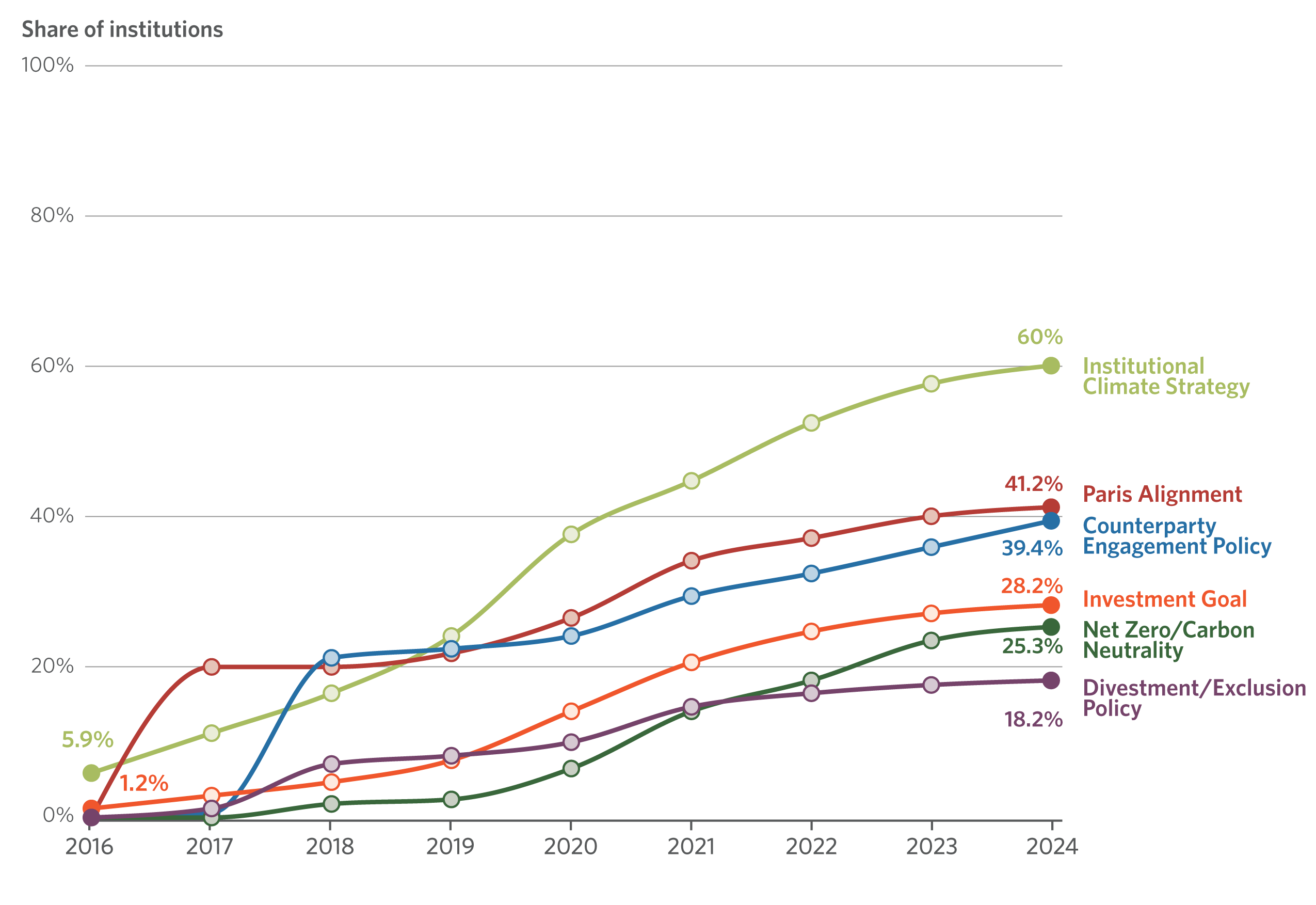

Climate ambition among tracked PDBs is plateauing, even though less than half of tracked institutions (70 of 170) have pledged to fully align operations with the Paris Agreement.

The rate of new climate commitments made by PDBs appears to be declining at a juncture where rapid scaling of PDB climate finance support is crucial. Global climate finance flows must increase sixfold against 2022 tracked levels by 2030 to meet the average estimates of global climate finance needs (CPI 2024).

As shown in Figure ES3, the rate of new climate commitments made by PDBs appears to be declining at a juncture where rapid scaling of PDB climate finance support is crucial. Global climate finance flows must increase sixfold against 2022 tracked levels by 2030 to meet the average estimates of global climate finance needs (CPI 2024c).

The slowing adoption of climate commitments across PDBs is related to continuous polarization of climate ambition from 2016 to 2022, during which institutions either set comprehensive climate commitments or only made limited commitments, with little movement in between.