This publication is CPI’s analysis of Sustainable Agriculture Finance Facility, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

Sustainable agriculture is vital to Brazil’s economic and climate goals. It limits deforestation while increasing crop yields, boosting climate resilience, and generating income. The country has 180 million hectares of pasture land, half of which is considered degraded and unproductive.

An emerging trend in sustainable agriculture is ICLF, or integrated crop-livestock-forest systems, which combines different production systems, yielding economic and environmental benefits. Brazil has the goal of implementing five million hectares of ICLF systems by 2030 as part of its Nationally Determined Contributions to reduce greenhouse gas emissions. Yet ICLF adoption rates remain low due to credit lines poorly adapted for its implementation and a lack of information.

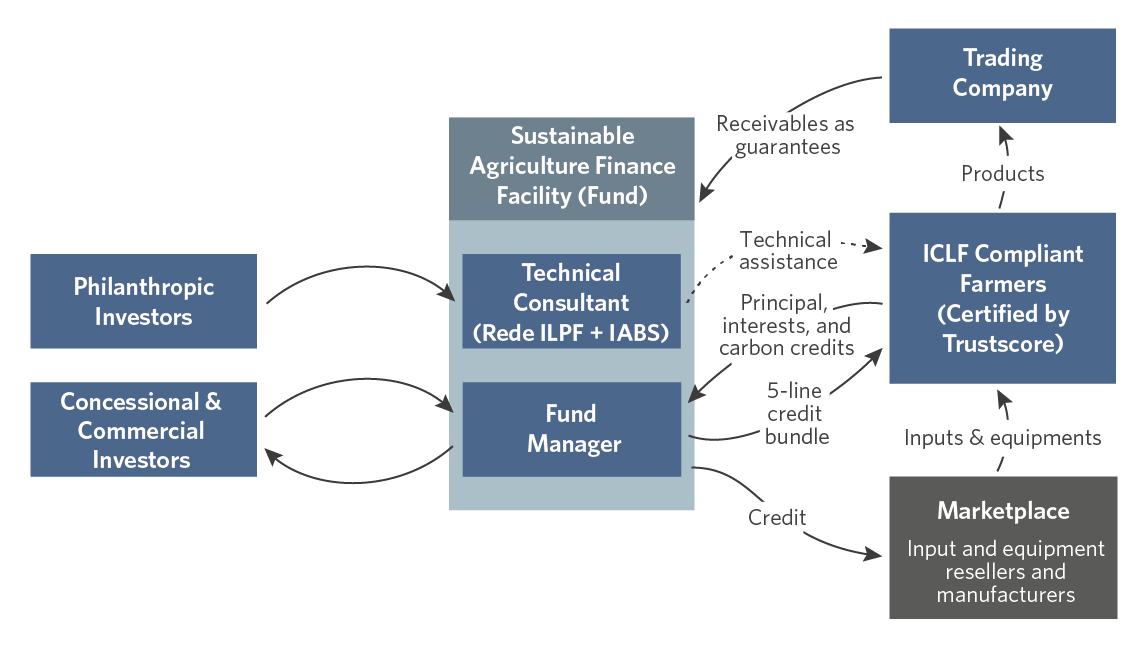

The Sustainable Agriculture Finance Facility provides customized bundled loans that match the farmers’ needs and takes into account specific ICLF parameters.

INNOVATION

SAFF provides a five-line credit bundle with tailored timeframes for different ICLF uptake stages that cater to the risk and cash flow profile of ICLF systems, coupled with a unique specialized certification and technical assistance program.

It is the only credit vehicle to focus on the adoption of ICLF practices in Brazil. SAFF is also the only fund to have a certification system unique to ICLF, which works to evaluate/provide credit scores and monitor impact.

IMPACT

ICLF practices intensify livestock and increase meat production by threefold while growing income fivefold.

The pilot is expected to mobilize USD 68 million for 90,000 hectares in Brazil’s Center-South. At scale the instrument can reach USD 380 million or 500,000 ha, drawing on new areas and biomes, such as the Amazon and the Northeast of Brazil.

Proponents estimate an additional 13 million ha of ICLF in Brazil by 2030. Considering that the instrument address 15% of this potential, it could reach USD 1.4 billion in ten years.

SAFF’s pilot can store 2.5 million tons of carbon dioxide. This is equivalent to the greenhouse gas emissions of 540 thousand cars in one year.

DESIGN

The instrument is modeled as a ten-year revolving credit facility with five lines of credit, one for each type of product being financed: land management, soil recovery, livestock, equipment and forestry.

The facility will draw from concessional and commercial capital to build up an investment fund. The fund will lend to ICLF compliant farmers through a virtual marketplace comprised of ICLF-approved suppliers. Farmers can withdraw their loans in inputs and equipment only, in order to avoid misplacement of resources.

At the same time, philanthropic investors will fund a parallel structure that will pay for the technical assistance embedded in the loan product.