Introduction

Adaptation finance tracked in the Global Landscape of Climate Finance (GLCF) in 2023 reached an all-time high of USD 63 billion annual average for 2021/22, growing 28% from the annual average in 2019/20. This growth still falls far short of the estimated needs for adaptation of USD 212 billion per year by 2030 for developing economies alone. Public actors dominate tracked adaptation finance: private sector adaptation finance tracked by CPI was approximately USD 1.5 billion in 2021/22 on annual average.

The actual amount of private sector investment in adaptation is likely significantly higher than the finance captured within CPI’s tracking work. Severely limited reporting of private sector adaptation finance creates significant challenges in tracking overall adaptation flows. For example, no climate adaptation finance tracking effort to date has successfully captured aggregate investment in the following categories: adaptation-focused SMEs; finance from private equity (PE) / venture capital (VC) firms to adaptation-related early-stage companies; insurance premiums that incentivize resilient construction; consumer spending on adaptation solutions and technologies; or corporate balance sheet finance for adaptation of corporate assets.

The lack of data on private adaptation finance yields significant uncertainty regarding progress on addressing climate vulnerabilities and leaves public and private decision makers without critical information on where they should target existing and additional investments. Limited data and reporting on private adaptation finance also reinforce the common narrative on the scarcity of viable business models for adaptation. Public finance is critical, but if adaptation is framed solely as a public issue, we risk missing the tremendous potential of the private sector to mobilize the levels of capital required to meet global adaptation investment needs.

Summary of approach

This work has two central objectives:

-

To develop a taxonomy for private adaptation finance tracking that is comprehensive, descriptive, and in harmony with wider efforts in the community, building upon existing attempts to define and classify adaptation finance in both a public and private context. The objective of this work is to structure the taxonomy so that it can be increasingly incorporated into CPI’s existing tracking of climate finance, including the GLCF.

-

To build a repeatable and flexible computational framework for expanding the scope of trackable private adaptation finance data. The method (which is ultimately intended to be open source) will allow CPI—and ideally the broader community, including policymakers and capital allocators in the private sector—to more readily assess the adaptation relevance of investments. The dataset builds upon prior adaptation finance tracking approaches, with the inclusion of additional data sources. The application of a suite of machine learning tools and algorithms that leverage large language models allows efficient and accurate categorization of finance flows according to the taxonomy developed and can accommodate evolution of that taxonomy.

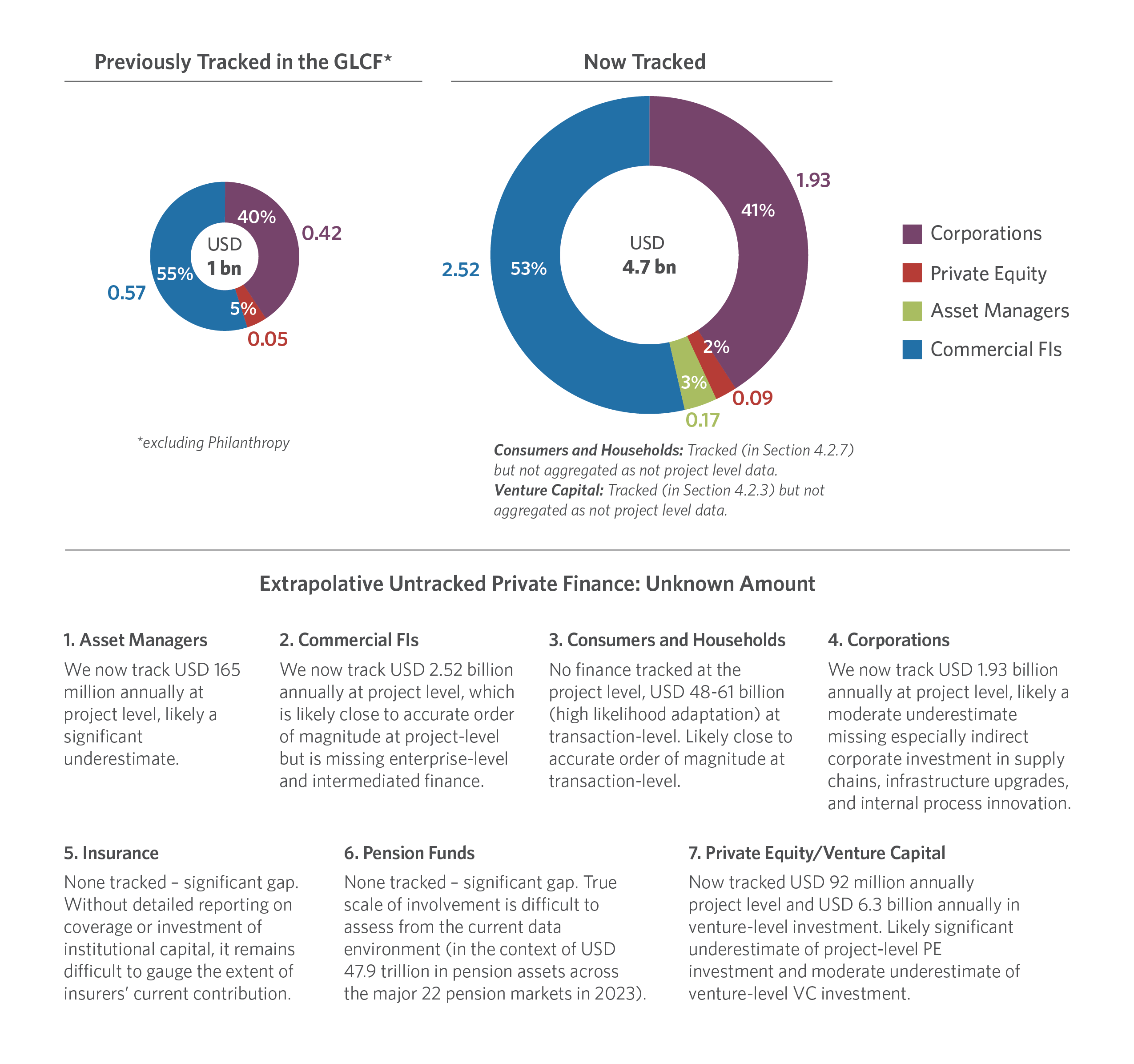

In pursuit of the above objectives, CPI, in collaboration with Vibrant Data Labs, has developed a computational approach to improve tracking of private sector adaptation finance data. These efforts have increased private adaptation finance tracked by more than four times from the approximately USD 1 billion previously tracked in CPI’s GLCF on average annually for the period 2019 to 2022 for the same set of private sector institutions. By applying the new methodology – including the bespoke taxonomy for identifying adaptation-relevant private finance – the tracking in this report now captures annual average flows of USD 4.7 billion from the private sector to adaptation-relevant activities.

Taxonomy

Informed by existing taxonomies’ limited applicability to private adaptation finance tracking, we developed new criteria for this tracking exercise. We classified flows as adaptation finance if they went to an activity that met all of the following criteria:

- The activity’s end users or beneficiaries (people, assets, etc.) are located in a setting with material physical climate risks/impacts.

- The activity materially reduces physical climate risks to the project or investment in which the activity occurs, materially reduces physical climate risk in other economic activities, or addresses systemic barriers to adaptation.

- The contribution to adaptation—i.e., adaptation-related outcomes—can be defined and qualitatively and/or quantitatively measured.

- The activity adopts the best available knowledge to provide solutions that do not lead to maladaptation of the direct user or the system in which the user operates and that manage against significant harm to other social and environmental objectives.

In order to apply these criteria, we developed an adaptation taxonomy that can be used to track private adaptation finance. It classifies climate adaptation activities according to a set of seven themes which are derived from the adaptation taxonomies developed by Tailwind and Climate Bonds Initiative (CBI) and are modified for the purpose of tracking financial flows. The intention here is to develop a consistent approach to identifying adaptation finance flows for private actors.

Within each theme, the taxonomy identifies a set of adaptation sectors, subsectors, and activities. The activities are intended to be: (a) collectively exhaustive of all the adaptation activities that would potentially receive trackable private financing and (b) mutually exclusive to the greatest extent possible. The taxonomy is a living document that is open to revisions in structure as well as the addition of missing sectors, subsectors, or activities.

The taxonomy tags each activity (165 activities in the September 2024 release) with the following elements:

| Topic | Purpose |

| Secondary Theme | While each activity is allocated to a single primary theme in the taxonomy, those that could reasonably belong to an alternative are assigned a secondary theme. |

| Activity Type | Each activity is classified as either (a) a product or service, (b) an enabling activity, or (c) intelligence. |

| Adaptation Likelihood | This indicator describes our confidence that any project matched to the given taxonomy activity could be considered an adaptation effort without further context. We categorize this likelihood on a three-point scale of low, medium, or high. |

| Maladaptation or Significant Harm Risk | Identifies if an activity has a high potential of either: a) being considered maladaptive or b) causing significant harm to other social and environmental objectives, even when minimum compliance and industry standards are followed. |

| Cities Relevance | Corresponds to any activity that significantly enhances cities’ adaptive capacity and resilience to climate-related risks. Activities are included if they are usually located within city boundaries or aim to address a climate risk faced by cities. |

| Gender Relevance | Corresponds to any activity that significantly and disproportionately benefits women or other marginalized genders. Almost all activities can be implemented in a way that is gender-responsive, but the tagging of gender relevance is intended to identify activities that nearly always contribute to gender equity. |

| Mitigation Co-Benefit | Corresponds to any activity that directly and significantly reduces the potential release of greenhouse gas (GHG) emissions (e.g., wildfire management) or directly captures existing GHG emissions (e.g., resilient soil management). |

| Climate Hazards | Corresponds to the hazards that an activity either directly or indirectly addresses. Associating each activity with the climate hazard it is addressing will allow taxonomy users, including CPI, to comment upon the relative financial flows mitigating each risk, as well as providing important information for assessing adaptation relevance. |

| Private Actors | The taxonomy associates each activity with the private actors that are likely to significantly contribute to its investment. This will facilitate more efficient data collection, as the assessment will allow CPI to narrow the range of data sources investigated for each activity. |

Our aim is that beyond its use for this tracking exercise, this taxonomy can also serve as a useful tool for financial actors to develop a better sense of which investment might qualify as adaptation and to become familiar with key adaptation-investment considerations like maladaptation. The taxonomy is not intended to offer investment-specific guidance or a whitelist of adaptation activities.

We consider the taxonomy a living document that is malleable and open to revision at all levels. Its iterative nature allows it to evolve and adapt quickly. We welcome comments on the taxonomy: contact information is available on the “Read Me” tab of the document.

Data Process

Informed by the structure provided by the taxonomy, the process for creating the private adaptation finance data followed a five-step approach developed collaboratively with Vibrant Data Labs:

- Step 1: Data Scoping. Available data sources are identified based on various criteria such as theme, activity, and actor type. This stage focuses on collecting comprehensive data, including direct financing information, aggregated market data for specific products, and corporate A&R policies.

- Step 2: Data Collection. Data is prioritized by its importance and the scale of investment it represents. The collection involves ingesting raw data, which can be obtained through data sharing agreements, direct downloads, or web scraping.

- Step 3: Data Tagging. Following collection, a subset of this data is labeled according to a taxonomy for developing a supervised large language model classifier and evaluating the taxonomy mapping.

- Step 4a: Classification Model Development. The labeled data is used to fine tune a Machine Learning model that categorizes each entity description based on its alignment with adaptation, mitigation, or “dual-purpose” goals.

- Step 4b: Identifying Adaptation-Relevant Projects and Entities. Data from all sources are standardized and combined to create a uniform dataset, including adaptation activity attribution. Upon completion of processing data sources into a cohesive dataset, a classifier is applied over company, organization, and project names/descriptions to identify those with adaptation or dual benefits.

- Step 5a: Taxonomy Mapping. Once the data are filtered to adaptation-relevant entities (e.g., projects, companies, organizations), each is mapped to the most conceptually similar activities in CPI’s adaptation taxonomy. This process also requires that each activity and level of the taxonomy have good descriptive language to compare against the descriptions of each entity.

- Step 5b: Revision and Improvement. This stage involves thoroughly reviewing the mapping process to ensure accuracy and relevance within the taxonomy. It focuses on identifying areas where the taxonomy may need updates—such as refining language for clarity or adjusting the taxonomy scope by adding or removing specific activities. This iterative review process enables flexibility in the taxonomy to align with evolving project classifications and adaptation activities.

- Step 6: Data Analysis. Finally, the processed and standardized data is analyzed in the Data Analysis stage, which focuses on examining the private adaptation finance dataset to extract insights, trends, or other valuable information.

We followed this approach to evaluate climate adaptation finance flows from the seven private institution types we evaluate as most likely to be financing adaptation given their ubiquity in the financial markets, engagement with one another, and exposure to climate risk. While these institutions do engage with one another and while capital flows between institution types, the analysis in this report is conducted at the institution level in order to more coherently assess each institution’s involvement in adaptation finance.

The private sector actors involved in adaptation finance we consider for this work are: commercial banks, asset managers, private equity (PE) / venture capital (VC) firms, pension funds, insurers, corporations, and households and consumers.

Key Findings

Through the methodological and data work represented in this analysis, we have increased the annual average tracked private adaptation finance for the period of 2019 to 2022 from our prior finding of USD 1.0 billion to USD 4.7 billion. The most substantial improvements in tracking have come from data on asset managers, commercial FIs, individuals [consumers] and households, and corporations. The figure below summarizes the advancement in tracking achieved in this analysis.

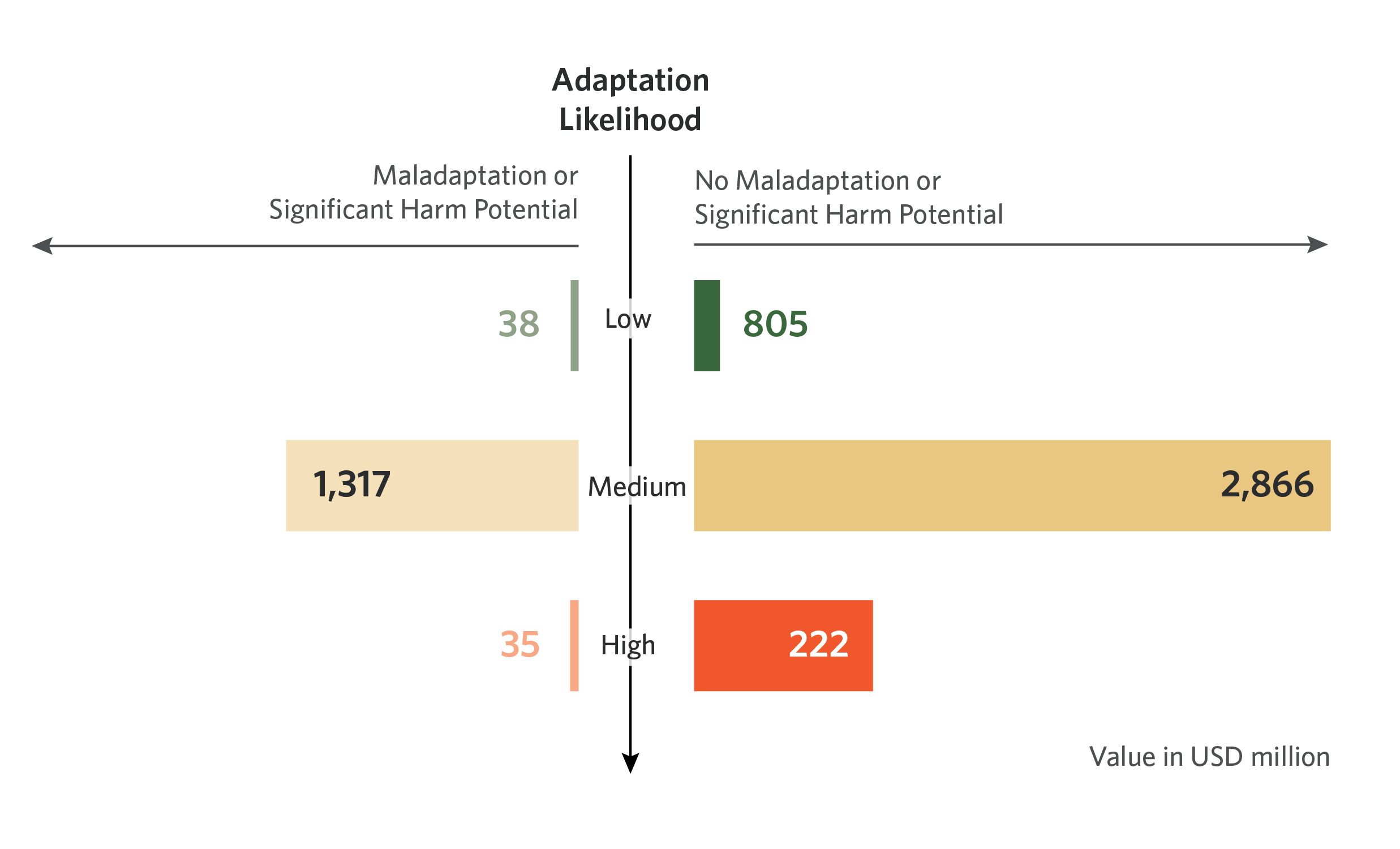

Tracked adaptation finance from the private sector under the approach captured in this report can be disaggregated by the likelihood of adaptation relevance (approach described in further detail in Section 3.1.3 of the report and in the Taxonomy “Read Me” tab). We find that 5% of finance tracked has a high likelihood of being adaptation, 79% has a medium likelihood, and 16% has a low likelihood. We also find that a total of 27% of finance tracked holds potential for maladaptation or significant harm risk (described in Section 3.1.4), fairly proportionately distributed across likelihood of adaptation.

While much more can be done, this report represents a significant advancement in Methodology and execution of private adaptation finance tracking. Limited data and reporting on private sector adaptation finance reinforces the common narrative that there are limited or no viable business models for adaptation. This is simply untrue, as this analysis indicates. Indeed, private finance will be critical to mobilize the levels of capital required to meet global adaptation investment needs. This analysis points the way forward in improving our collective understanding of private adaptation finance flowing today, in order to ultimately drive a material increase in future finance from private actors towards adaptation.

Page updated on November 18, 2024, to add clarity to description of the data process deployed.