Concessional capital—finance offered at more favorable terms than the market—must increase by at least fivefold by 2030 to achieve the Paris goals. Affordable capital is essential to driving the low-carbon and resilient transition, especially for sectors and activities that are either nascent or do not yield revenue streams. It is also necessary for protecting the regions and populations most vulnerable to the impacts of climate change. Concessional capital is crucial in reducing the average cost of capital in investments, creating markets, and fostering enabling conditions for private actors to fill the multitrillion-dollar climate investment gap. Climate Policy Initiative’s Global Landscape of Climate Finance 2023 (the Landscape) found that concessional finance was only 11% of total climate finance with the rest focusing on market-rate debt and equity instruments.

Assessing a baseline for concessional climate finance is crucial to understanding how it can be scaled up and where to direct it to unlock further capital for action. This report uses data from the Landscape to track concessional climate finance channelled both internationally and domestically, with particular focus on cross-border flows. Building on publicly available data on international concessional climate finance, we dig deeper into the sources, climate-related uses, sectors, and geographic destinations of these flows from 2019 to 2022. This research captures primarily international concessional loans (low-cost debt) and grants, excluding any market-rate financial instruments.

Key findings

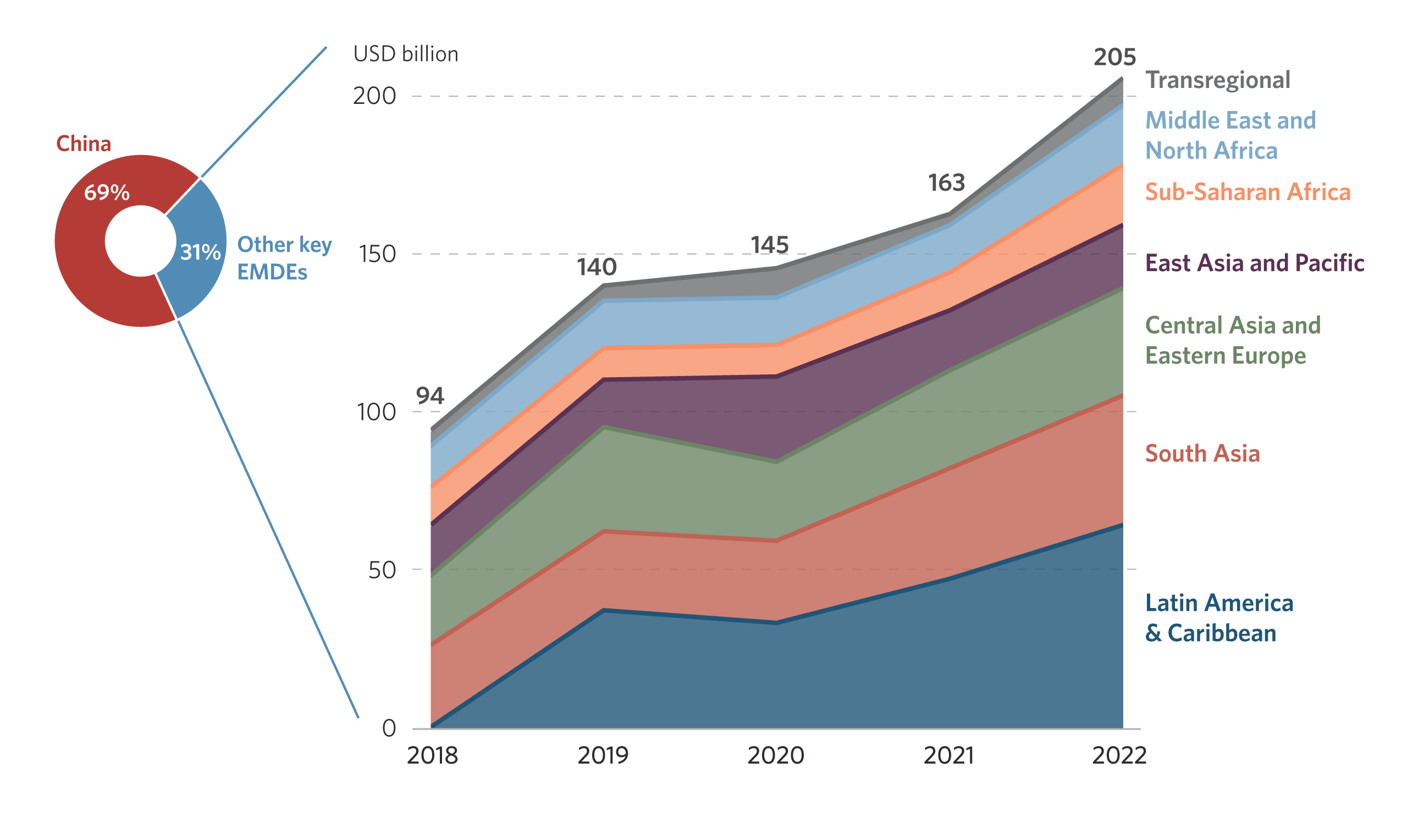

International concessional climate finance increased by 50% from 2019 reaching USD 81 billion in 2022. While this increase is a step in the right direction, this amount remains low compared to not only global needs but also other climate-damaging concessional flows for fossil fuels. Fossil fuel subsidies reached USD 1.3 trillion in 2022 and international public funding for the fossil fuel sector was at least USD 47 billion per year between 2020 and 2022. These are substantial pools of funding that have great potential to be redirected to support concessional finance for climate action and a just and sustainable development more broadly.

Global official development assistance (ODA) increased by 22% in 2022 compared to the previous year, reaching USD 287 billion, partly because of increased aid and support for Ukraine. USD 109 billion of this ODA was in the form of grants, with climate-related grants making up 35% (USD 38 billion).

Where is concessional climate finance going internationally?

- International concessional climate finance has increased. Most international concessional climate finance was provided by bilateral development finance institutions (DFIs) (33%), followed by multilateral DFIs (30%), and direct project-level international funding from governments and their agencies (26%). Multilateral environment and climate funds provided 5% of concessional climate finance. While the volumes provided by MCFs are comparably low, their concessional nature creates the potential to advance transformative, systemic change while building markets and capacity to mobilize additional finance.

- About 360 institutions provided international concessional finance for climate action between 2019 and 2022. About 10 institutions provided 70% of concessional finance. Having many avenues for accessing concessional capital may increase the availability of climate finance. However, having a multitude of finance providers, each with its own disbursement process, can increase transaction costs and logistical hurdles for recipients and therefore, result in delayed climate action.

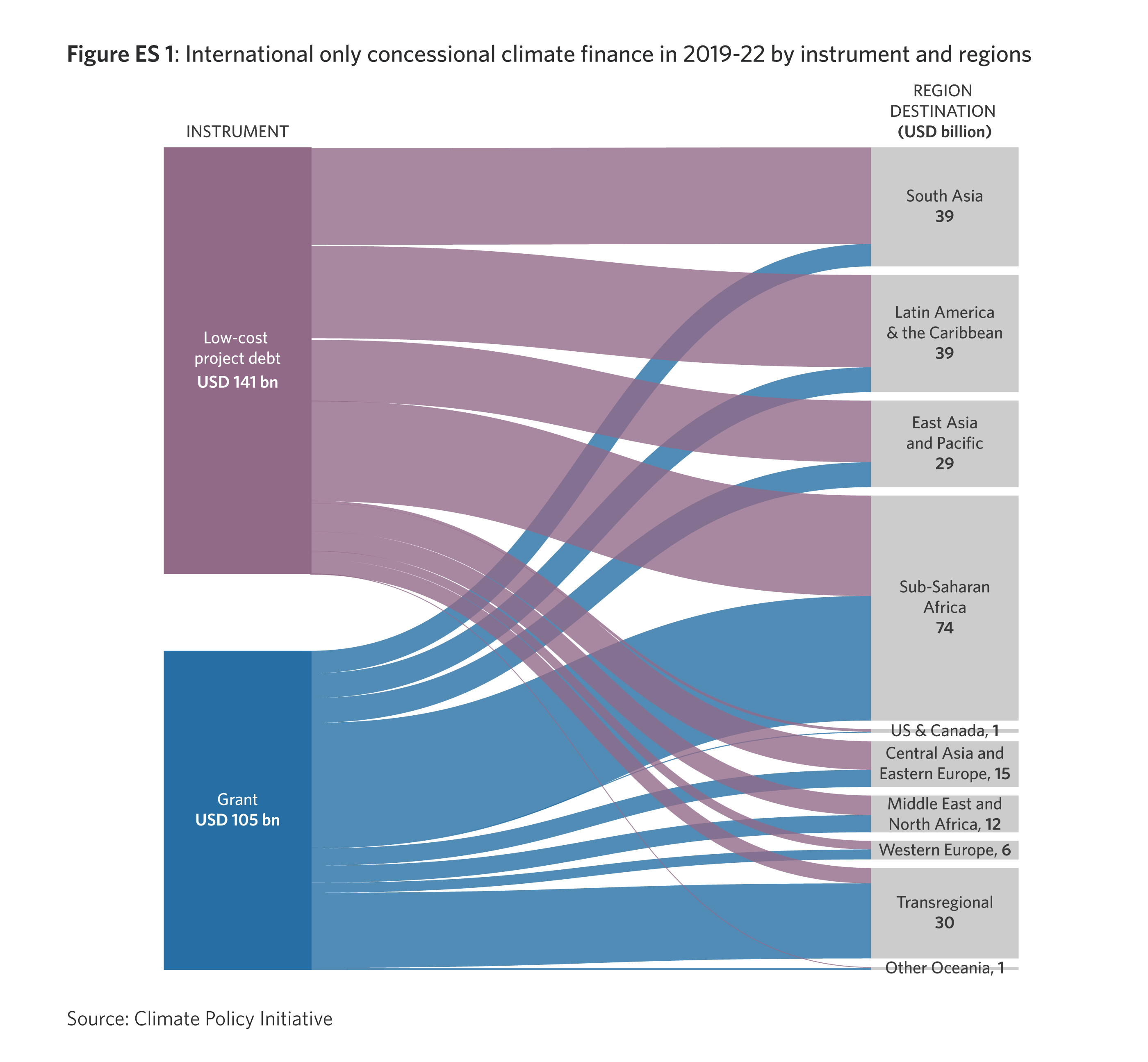

- Over time, the share of loans and grants remained fairly similar with concessional loans accounting on average for 57% and grants for 43% between 2019 to 2022. Total international grant finance reached USD 38 billion in 2022, compared to an average of USD 22 billion between 2019 and 2021.

- Least-developed countries (LDCs) received approximately 33% (USD 21 billion annual average) of total international concessional climate finance. The rest of the EMDEs (excluding China) received a further 60% of these flows. Sub-Saharan Africa was the primary destination of international concessional climate finance, receiving 30% of the total, followed by South Asia and Latin America and the Caribbean, each receiving 16% of the total.

- Countries affected by fragility and conflict have received less concessional climate finance in those years. For example, Myanmar, Burkina Faso, Niger, and Sudan have experienced stark decreases in international concessional climate finance between 2019 and 2022 in the years of increased conflicts. Countries affected by fragility and conflict receive less adaptation finance compared to other low-income countries indicating the importance of strengthening delivery channels in those countries.

- Almost 42% of international concessional climate finance targeted climate mitigation activities between 2019 and 2022. Adaptation and resilience efforts received 36% of concessional climate finance over the same period. Activities with dual objectives (both mitigation and adaptation) received the remaining 22% and it increased over the years. Dual objectives finance enables a more systemic transformation, but still leaves a large gap for adaptation and resilience where concessional finance is critical considering its public good character.

- Compared to low-cost loans, international grants for climate action tended to target projects with smaller ticket sizes, tilting their focus toward shorter-term outcomes and impacts. Between 2019 and 2022, the average ticket size was

USD 3 million for projects financed by grants and USD 74 million for low-cost debt. Small ticket size projects often deter large institutional investors, leaving financing to public development finance institutions or development aid agencies.

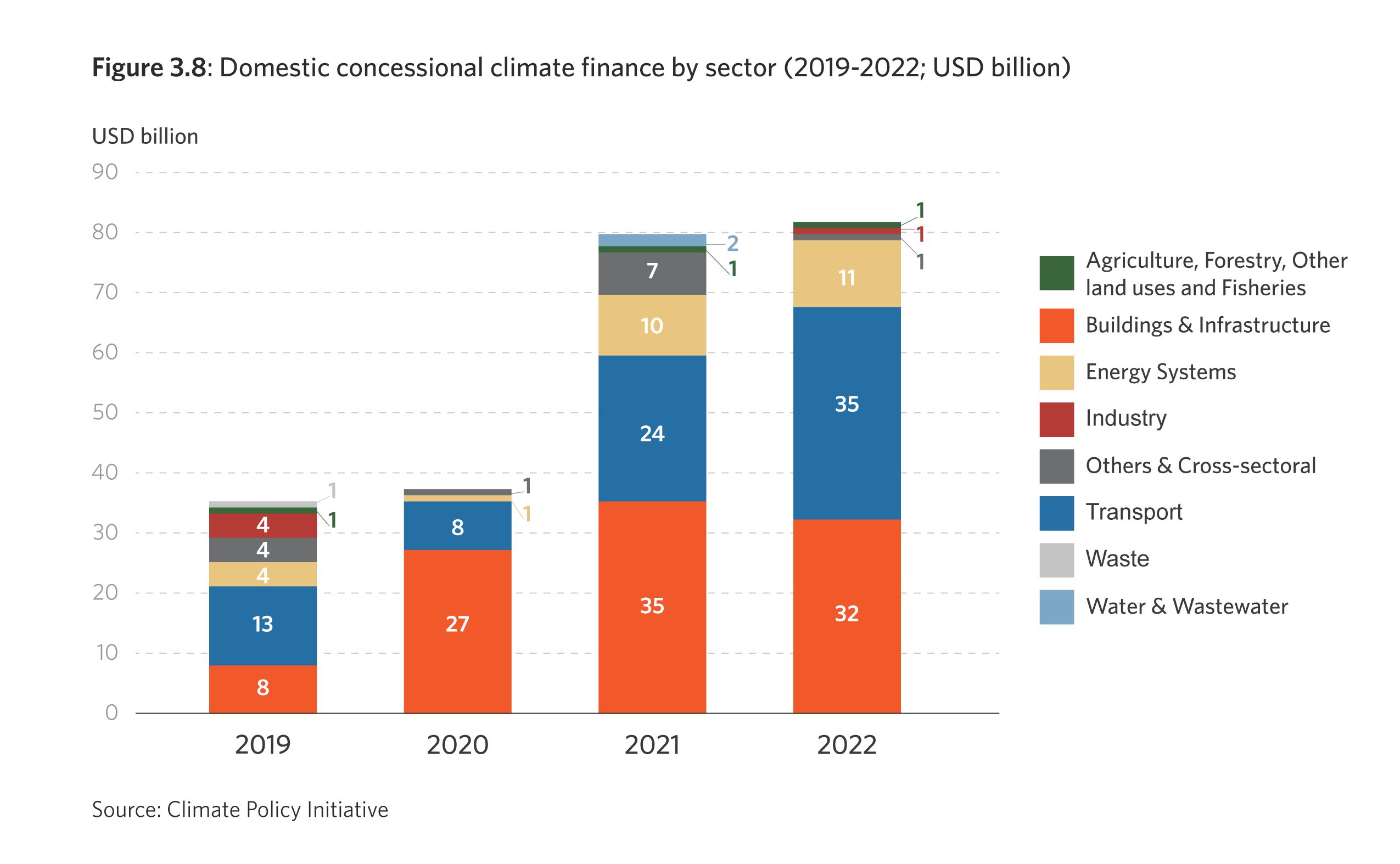

- Approximately 37% of international concessional finance supported the direct infrastructure costs in the transport, energy systems, and water and wastewater sectors. A further 15%, or about USD 28 billion, provided policy and capacity-building support to national governments in developing countries, mainly in the form of technical assistance grants. The share of such policy support, which is a critical enabler of more systemic, country-driven transformations, had increased in 2022 compared to 2019.

- We found no coordinated approach or impact metrics for concessional funding channeled by international actors although some efforts among MDBs are emerging e.g. MDB Common Approach to Measuring Climate Results. In addition, data on the mobilization of public and private climate finance using public concessional resources remains fragmented.

What is the status of domestic concessional climate flows?

- While this report focuses on international concessional climate finance, we acknowledge that domestic flows also significantly contribute to national climate action. These can be provided in the form of subsidies or low-cost debt through fiscal transfers or public domestic financial institutions.

- Data on domestic concessional climate finance is scarce across countries given the general lack of transparency in climate relevance of public budget expenditure.

- However, available information indicates that domestic concessional climate capital is exclusively channeled by governments and national development finance institutions, highlighting the important role of national institutions. We anticipate that considerable adaptation spending is being included in government budgets, but the lack of data hinders the tracking of these flows.

- Domestic concessional finance is concentrated in high-income economies. Around 75% of these investments were made within Western Europe and 15% in East Asia and the Pacific. Domestic concessional climate investment in the rest of the world stood at just 10% based on available data.

- Domestic concessional climate finance tends to support governments’ long-term objectives with clear and predictable timelines and signals to the private sector.

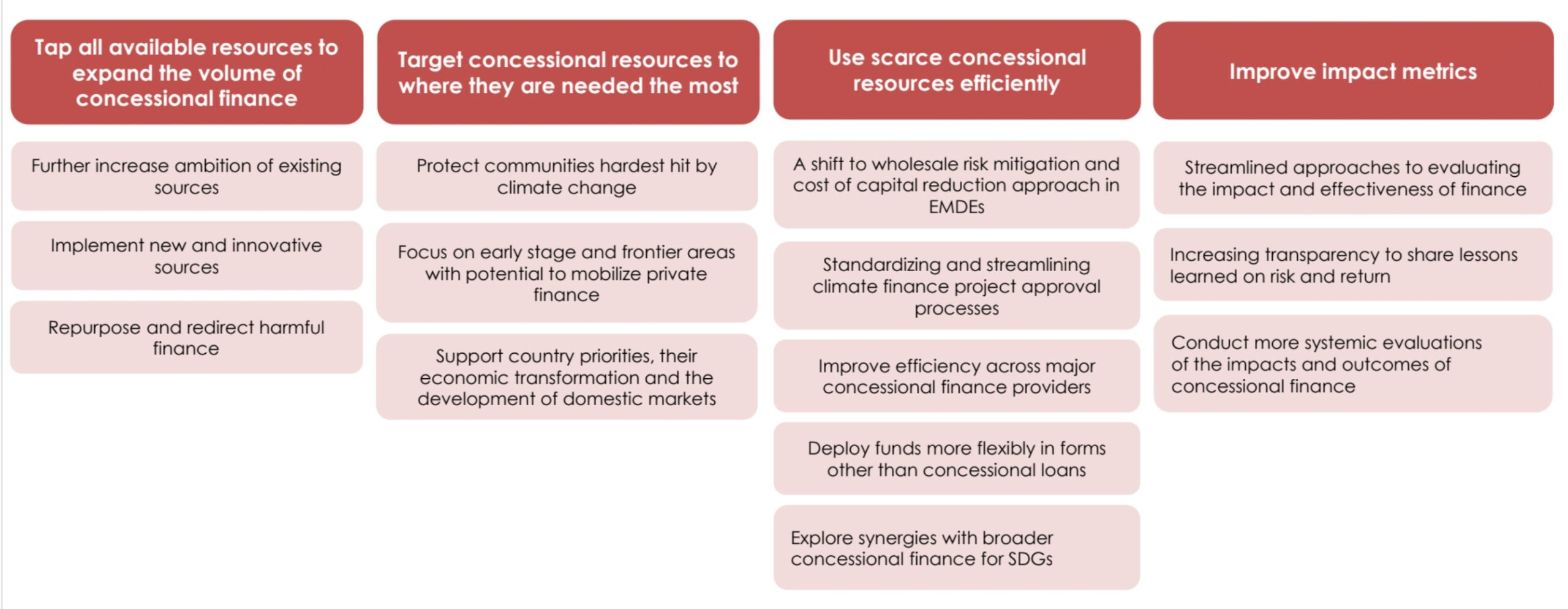

Recommendations

Given the scarcity of concessional climate finance, both internationally and domestically, international cooperation is required to scale these flows within a more coherent climate finance architecture. We must move beyond ambiguous invocations of “private sector mobilization” to a truer private sector view for a long-term and sustained funding of the climate investment gap.

Some specific strategies for concessional climate finance providers to enhance the scale and efficiency of their activities are outlined below.