Renewable portfolio standards (RPS) are an important part of the U.S. renewable energy policy landscape.Twenty-nine states, from California to North Carolina, have enacted these policies to require utilities to provide at least some of their power from renewable sources. This year, at least fourteen of these states considered bills that would have watered down or repealed these policies. But these rollbacks proved to be unpopular, and on balance state legislatures have made RPS policies more ambitious in 2013.

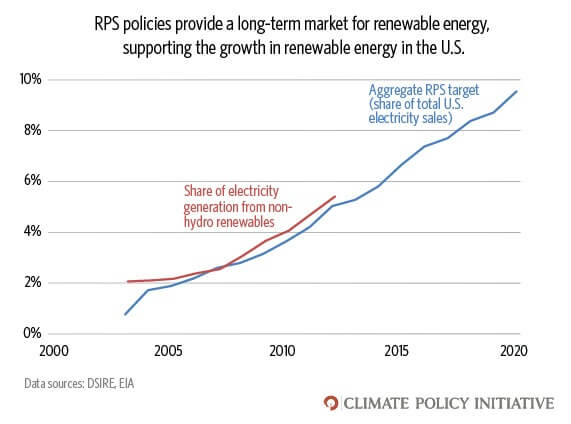

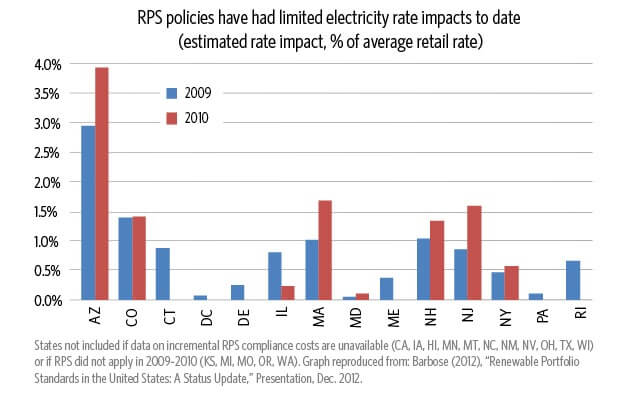

Renewable portfolio standards (RPS) are an important part of the U.S. renewable energy policy landscape.Twenty-nine states, from California to North Carolina, have enacted these policies to require utilities to provide at least some of their power from renewable sources. This year, at least fourteen of these states considered bills that would have watered down or repealed these policies. But these rollbacks proved to be unpopular, and on balance state legislatures have made RPS policies more ambitious in 2013.Taken together, RPS policies will require nearly 10% of electricity sold in the U.S. to come from renewable sources by 2020. And with the help of federal tax credits, grants and loan guarantees, most RPS policies appear to have had limited impacts on electricity rates so far. But every state’s RPS is different, and the diversity of policy designs is a great opportunity to learn what is working well and what can be improved in these policies.

So what seems to have worked well?

- Many RPS policies encourage long-term contracts for renewable energy, which CPI has found can significantly lower the cost of deploying renewables. The price volatility of tradable renewable energy credit (REC) markets in states like New Jersey and Massachusetts have made financing difficult and expensive. But long-term contracting programs in these REC-market states and in other states appear to encourage lower-cost financing for renewables by providing stable sources of revenue, reducing the cost of deploying renewable power.

- Renewable energy auction mechanisms like those in California and Illinois appear to have delivered renewable energy at fairly low costs and to have reduced regulatory uncertainty and delays that can make renewable project development more costly.

- Ambitious RPS targets in some states have driven substantial deployment. California is the nation’s second-largest electricity market, and with a requirement that a third of its electricity come from renewable energy, the state has been the nation’s dominant renewable energy market driver. California alone represents roughly one quarter of the combined U.S. RPS target through 2020.

- Many RPS policies are close to meeting their goals with existing contracts. To keep driving demand for new renewable energy projects, their targets need to be increased and time frames extended.

But renewable portfolio standards also face challenges.

- Some states have cost caps and other “off-ramp” clauses. These are often put in place to protect ratepayers, but are sometimes poorly defined and create significant uncertainty for market participants.

- Ambiguity in the legal language in some RPS policies has created a lot of uncertainty around whether and how they will be met.

- Some states may not be willing to pursue their renewables goals with reduced federal support. Many of the stimulus-related federal renewable energy incentives have wound down, and the production tax credit for wind, a key federal support policy, is due to expire at the end of 2013.

- There isn’t much transparent and comparable information about the costs and accomplishments of state RPS policies. This lack of good information can make it hard for policymakers to demonstrate the value of these policies. However, several recent reports (from Clean Energy State Alliance, Lawrence Berkeley Labs, and Union of Concerned Scientists) have begun to address this lack of good information by documenting the achievements of RPS policies.

State renewable portfolio standards provide a long-term market signal that complements federal incentives, encouraging deployment while minimizing the cost to electricity consumers, although there are ways these policies can be improved. Nevertheless, RPS policies are a critical part of the policy landscape for renewable energy, and this year, state legislatures showed that RPS policies still retain broad political support.