What is international development and cooperation?

International development and cooperation refers to finance flows of international origin destined for the climate agenda in Brazil, including flows from MDBs, governments, climate funds, and philanthropies, among others. These flows represent the direct contribution of international actors to climate mitigation and adaptation in Brazil.

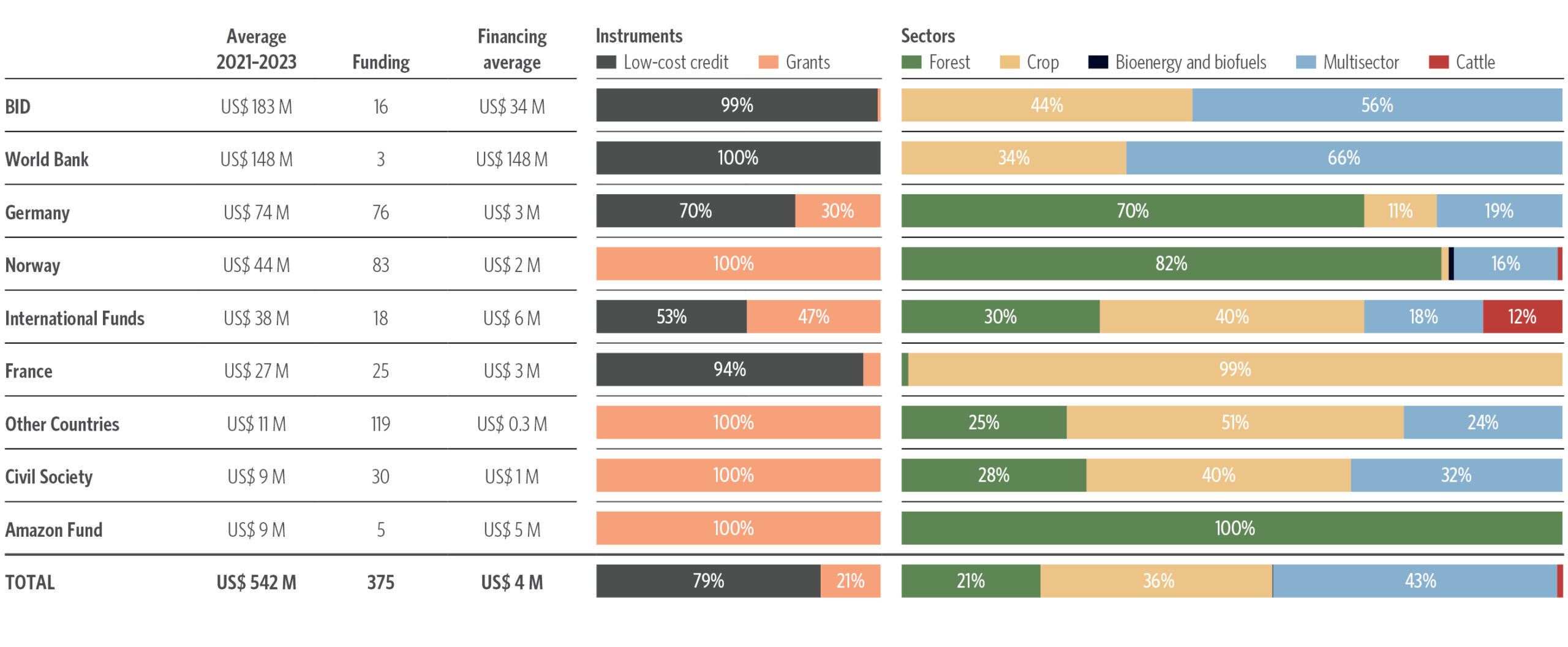

Resources from international development and cooperation financed US$ 548 million per year on average between 2021 and 2023, 3% of the total tracked for the period. Among these flows, MDBs stand out, responsible for 61% of the resources, and international governments, with 29% of what was tracked, with the forest sector being the main beneficiary.[1]

Figure 14. Climate Finance for Land Use in Brazil for International Development and Cooperation

by Source of Funds

Source: CPI/PUC-RIO with data from BNDES (2023), OECD-DAC (2022), IDB (2023), IBRD (2023), KfW (2023), GEF (2023), NORAD (2023), German Federal Ministry for Economic Cooperation and Development (2023), 2024

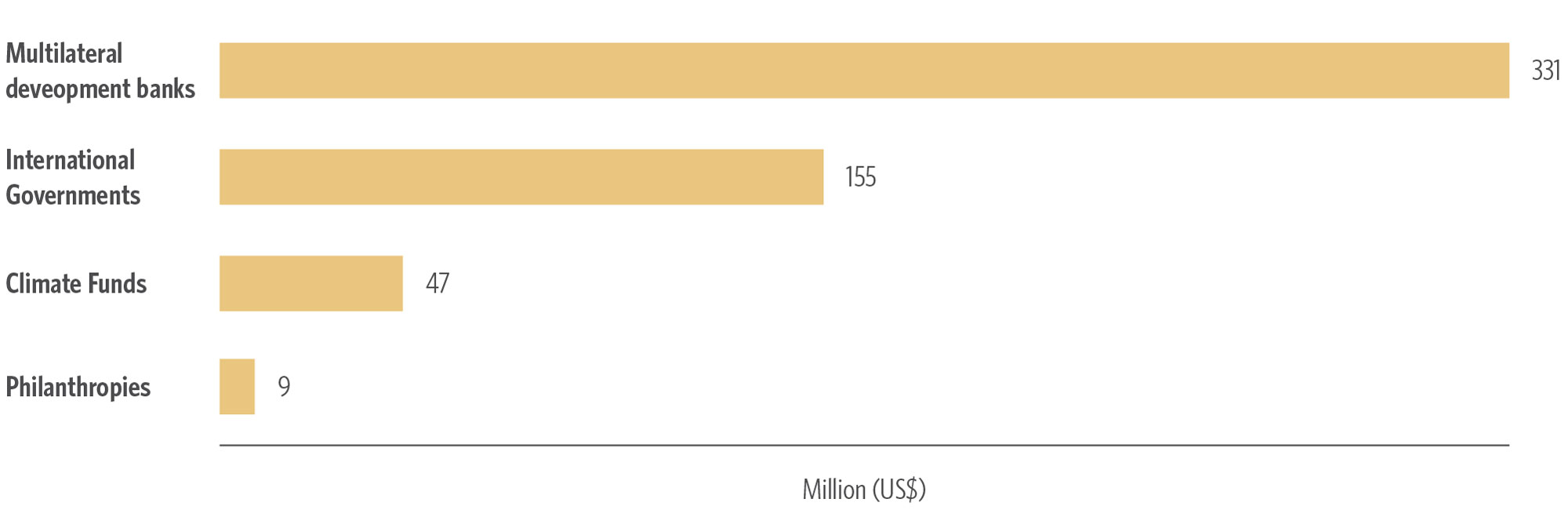

Figure 15. International Development and Cooperation by Actor, Instrument and Sector, 2020-2023

Note: Flows from Germany include resources from the German Ministry for Economic Cooperation and Development, GIZ, and KfW.

Source: CPI/PUC-RIO with data from BNDES (2023), OECD-DAC (2022), IDB (2023), IBRD (2023), KfW (2023), GEF (2023), NORAD (2023), German Federal Ministry for Economic Cooperation and Development (2023), 2024

Multilateral development banks, through the IDB and the World Bank, were the main source of international flows with US$ 331 million per year over the period. This amount was concentrated in a few large multisectoral loan projects for government support of climate goals, with a non-exclusive focus on the forest sector.

The IDB stood out as the main international player over the period, mobilizing 33% of international climate flows in the three-year period, with an average of US$ 183 million per year in 16 different projects. However, only two projects accounted for 83% of these amounts:

- The largest project considered was Descarboniza Pará, representing 53% of the bank’s flows over the period with US$ 300 million. The Pará state government’s project aims to achieve net-zero GHG emissions by 2050, through sustainable land use focused on forest recovery and the implementation of low-carbon agriculture practices (BID 2023).

- The AgroNordeste program is a MAPA action plan aimed at strengthening agriculture in the northeastern states and northern Minas Gerais through the adoption of climate-aligned technologies and environmental regularization of properties (CNA 2021). It received USD 230 million from the bank, 61% of which was directed towards climate objectives, amounting to US$ 157 million, which represents 30% of the IDB flows considered over the period.

The World Bank mobilized 27% of international development and cooperation resources in the three-year period, with an average of US$ 148 million per year distributed over just three projects. These include large amounts of finance for projects by state agencies or state governments mobilizing resources for the climate agenda. The Brazilian Climate Finance Project is a project in partnership with Banco do Brasil to offer carbon mitigation benefits in the bank’s credit lines. It received USD 500 million in credit from the World Bank, counted as 40% aligned with land use, which represents US$ 208 million (considering inflation adjustments). The other projects are credit to support state programs in Goiás and Santa Catarina, respectively, for sustainable recovery and safe water management, totaling US$ 235 million.

International governments, in turn, financed US$ 155 million per year over the period, representing 29% of the tracked international development and cooperation flows. The native forest sector benefited from US$ 91 million per year, especially from the governments of Germany and Norway, representing 15% of the flows to native forests tracked over the three-year period.

Finance from Germany, including the work of GIZ and KfW, represented 14% of what was tracked in this section, with US$ 74 million per year over the period, distributed over 76 different projects, 30% of which was through grants. The native forest sector received 69% of these flows, with the highlight being KfW’s 2022 finance to Banco do Brasil for reforestation and restoration of degraded areas, worth US$ 87 million.

The Government of Norway stands out as the largest donor to the forest sector through finance from the Norwegian Agency for Development Cooperation (NORAD), mainly through Norway’s International Climate and Forest Initiative (NICFI). There were US$ 44 million per year in 83 different grants, with an average value of US$ 2 million, for afforestation and reforestation, environmental protection, and strengthening indigenous communities. Norway is responsible for 34% of the total climate grants tracked for the land use sector in the country.

France, for its part, provided 5% of the flows in this section by providing finance for two agricultural ventures in Brazil, in 2021 and 2022, by Proparco, the subsidiary of the French Development Agency (Agence Française de Développement – AFD) for private sector development. These two projects accounted for 94% of the country’s climate flows over the period, aimed at climate adaptation of agricultural operations.

International funds have allocated US$ 38 million per year in climate finance to the land use sector in Brazil. The International Fund for Agricultural Development (IFAD) was responsible for 39% of these amounts, with US$ 15 million in 2021 for the Planting Climate Resilience in Rural Communities in the Northeast project, in partnership with the federal government and the BNDES.

Amazon Fund

The Amazon Fund is the main climate fund channeling international resources for land use in Brazil, receiving significant grants from international governments and other actors and directing these amounts to projects through the BNDES. This report accounts for BNDES-approved contributions to the fund and does not add grants to the Amazon Fund to climate finance flows to avoid double counting and prioritize tracking at the project level.

The Amazon Fund’s operations were suspended between 2019 and 2023, following the dissolution of its structure, formalized with the extinction of the Amazon Fund Guidance Committee (Comitê Orientador do Fundo Amazônia – COFA) through Federal Decree no. 9,759/2019. On 1 January 2023, its governance structure was re-established, and the Fund received new grants and resumed approving projects.[2] [3]

In 2023, five projects were approved, mobilizing US$ 26 million from the Fund, equivalent to 2% of the international flows tracked over the period. The end beneficiaries of these funds were mainly indigenous peoples, traditional communities, and family farmers in the Amazon region. Throughout 2023, a large volume of new finance was mobilized and announced for the Amazon Fund. New contracts signed totaled R$ 726 million (US$ 145 million) and R$ 3.1 billion (US$ 626 million) in new grants were announced.

[1] The main source of data for this section is the OECD report on Development Finance for Climate and Environment (OECD 2024), which compiles the financial flows from different international sources for the theme. This report is published with reference to data from two previous years after all the data from the originating institutions has been made available. Therefore, the latest year available is 2022. For the 2023 data, this report has instead sought primary data from the main sources of funding. This represents a methodological change for the year 2023. As a result, the 2023 data will be altered in future updates of this report to reflect the information made available by the OECD, with other flows that are not yet available for consultation and application of this institution’s methodology.

[2] Learn more at: Decree no. 9.759, April 11, 2019. bit.ly/4f9hc0h.

[3] Learn more at: Decree no. 11.368/2023, January 1, 2023. bit.ly/3BZqwFA.