This report utilizes a methodology to quantify and compare financial flows for land use with climate action components between mitigation, adaptation, dual benefits (mitigation and adaptation), and loss and damage. This approach builds on CPI’s international experience in tracking global, regional, and national climate finance developed over more than ten years, starting with the Global Landscape of Climate Finance (Buchner et al. 2023), and is constantly being improved.

This is the second edition of the Landscape of Climate Finance for Land Use in Brazil. The first edition covers the period from 2015 to 2020 (Chiavari et al. 2023); this new edition updates the results for the period from 2021 to 2023. The improved analysis of the data revealed an 18% increase in flows in the previous period[1] mainly the result of a more precise delimitation of rural credit flows.

The methodological criteria adopted in this publication to classify the activities tracked as aligned with climate objectives have been adapted to the Brazilian context. This results in the inclusion of public policies aimed at protecting the rights of indigenous peoples and financing their activities, environmental and land-title regularization, land use planning and combating deforestation, and agricultural practices compatible with the tropical crop model developed in Brazil. Four sources of information were used to incorporate climate criteria for land use in the country:

- CPI – Agriculture and forestry-related activities aligned with climate objectives (Rosenberg et al. 2018; Chiriac, Naran, and Falconer 2020; Buchner et al. 2021).

- Public Consultation no. 82 of 2021 of the Central Bank of Brazil (Banco Central do Brasil – BCB) – Sustainability criteria applicable to the granting of rural credit (BCB 2021).[2]

- CPI/PUC-Rio – Government policies and actions for the conservation and restoration of forests and for the development of sustainable agriculture that contributes to achieving Brazil’s Nationally Determined Contribution (NDC) climate targets (Antonaccio et al. 2018).

- Rio Markers for climate change from the Development Assistance Committee of the Organization for Economic Co-operation and Development (DAC/OECD) – Finance flows aligned with UNFCCC objectives (OECD 2018).

Appendix I presents a detailed list of the criteria used to define which financial flows are aligned with climate objectives in this work. The criteria are divided as follows:

- Climate use: (i) mitigation; (ii) adaptation; (iii) mitigation and adaptation; (iv) loss and damage. [3]

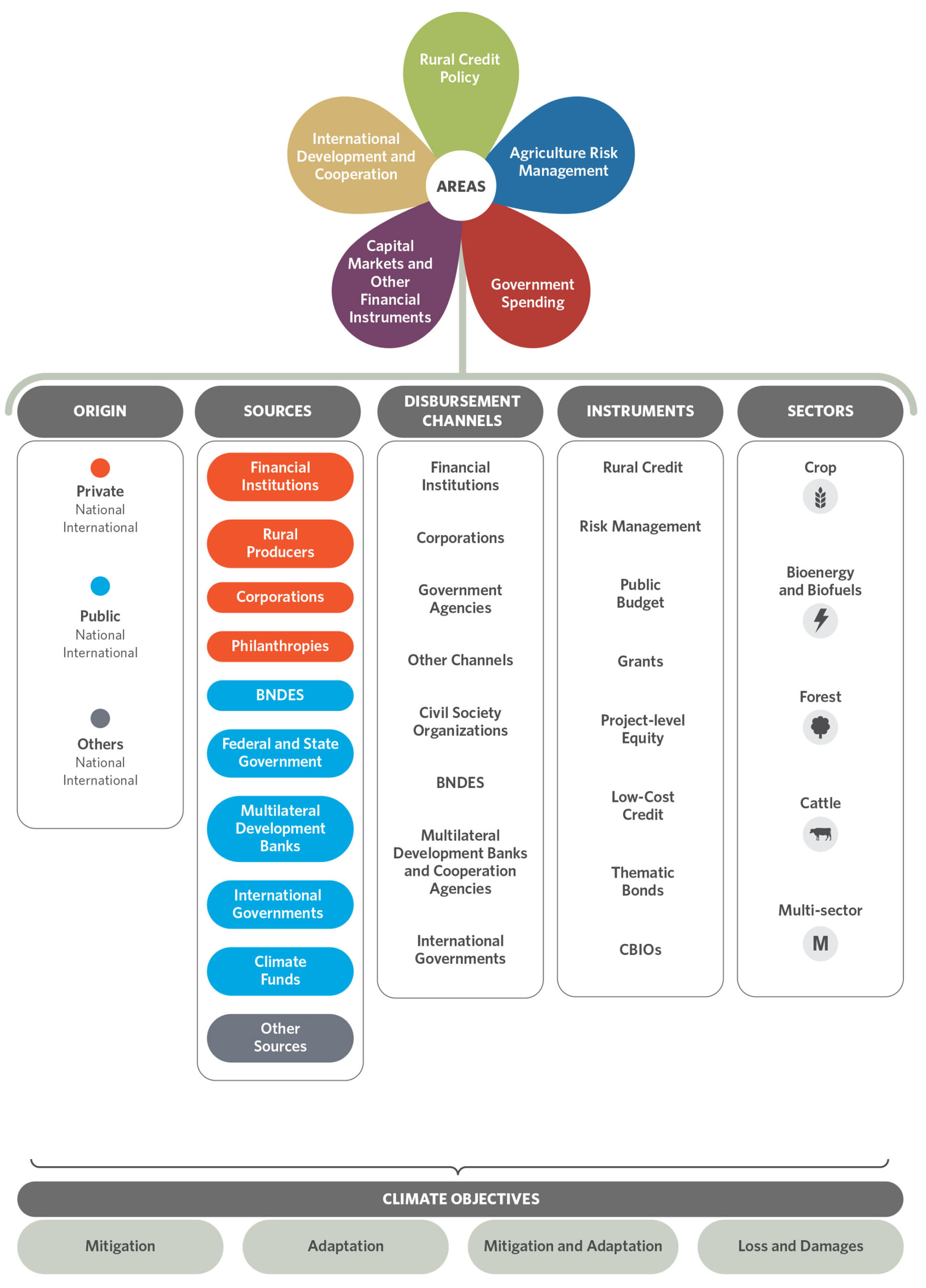

- Area: (i) rural credit policy; (ii) agriculture risk management; (iii) government spending; (iv) capital markets and other financial instruments; (v) international development and cooperation.

- Sectors: (i) crops; (ii) forests; (iii) cattle; (iv) bioenergy and biofuels; (v) multisectoral.

Appendix II describes the five areas relevant to climate finance in Brazil, as well as specifying the databases used for each one. An important methodological precaution was to avoid double-counting financial flows.

This work tracked resources from public and private sources, both domestic and international, extending the research of the previous study to the period from 2021 to 2023. The financial flows were adjusted for Inflation, consumer prices for the United States (FPCPITOTLZGUSA), with December 2023 as the reference. For finance originally granted in a currency other than the US dollar, such as Brazilian Reais or Euros, the amounts were converted into US dollars using the average exchange rate for the year corresponding to the flow and then adjusted by the FPCPITOTLZGUSA.

The main source of data for the international development and cooperation session is the OECD’s Development Finance for Climate and Environment report (OECD 2024). The most recent data available is for 2022. For the 2023 data, the analysis used used primary data provided directly by the main sources of international resources tracked, in particular multilateral banks (MDBs), international governments, and international climate funds. This was necessary in order to make the data presented in this section compatible with the other databases used in the rest of the report. In future editions of this report, data for 2023 provided by the OECD will be incorporated for a more reliable tracking of international flows.

An innovation in this edition of the report was the inclusion of the category of loss and damage among climate uses and the classification and quantification of financial flows earmarked for this agenda. Loss and damage is considered the third pillar of climate action, along with adaptation and mitigation (Broberg and Romera 2020). Unlike adaptation, they take place after the occurrence of climate events and are concerned with the mitigation of the economic and non-economic effects of these events, whether acute or chronic (Stout 2023). This report considers rural compensations expenses for climate losses to be only those resulting from government programs that subsidize these costs, based on the understanding that the compensations paid by private insurers is represented in the policy premium paid by the contractor. This new category has been included because of the significant growth in these compensations caused by climate events and the expectation of an increase in agriculture losses caused by such phenomena in the future.

The tracking of climate finance is challenged by a lack of transparency in the application of public and private climate-aligned resources. Private resources especially lack transparency regarding their application and tend to be underreported due to a lack of information about their flows. Consistent alignment with the practices of the environmental, social, and governance (ESG) agenda requires broad disclosure of activities for monitoring by society and shareholders, ensuring a better understanding of the implementation and impact of projects. Clearer and more accessible disclosure of information would allow for more accurate estimates of private resources aligned with climate objectives.

Figure 1 presents the Climate Finance Ecosystem for land use in Brazil, organizing financial flows into five areas: rural credit policy, agriculture risk management, government spending, capital markets and other financial instruments, and international development and cooperation (described in Appendix II). The ecosystem structures the relationship between the different types of actors involved and characterizes climate-aligned financial flows. The databases searched for the five areas of climate finance made it possible to extract information to characterize the flows in terms of the origin of resources, sources of resources, disbursement channels, instruments, sectors, and climate use. Definitions for each of the categories and subcategories in this figure can be found in Appendix III.

Figure 1. Climate Finance Ecosystem for Land Use in Brazil

Source: CPI/PUC-Rio, 2024

[1] The Landscape of Climate Finance for Land Use in Brazil (Chiavari et al. 2023) presented an average of US$ 6.6 billion billion per year, corrected to December 2020. With the methodological improvements included in this version, the new value tracked is US$ 7.8 billion, an increase of 18%. Considering that the figures in this report are presented with monetary correction for December 2023, the average presented here for the period 2015 to 2020 is SUS$ 8.6 billion per year.

[2] Although not listed in the BCB’s public consultation No. 82, all the lines of the Program to Reduce Greenhouse Gas Emissions in Crops (ABC+ Program), the National Program to Strengthen Family Farming under the ABC (PRONAF ABC+) and the Northern Constitutional Finance Fund under the ABC (FNO-ABC) were considered to be climate-aligned.

[3] The highlighting of the climate use “losses and damages” is an innovation compared to the previous report, introduced due to the increase in public compensation flows for climate losses in agriculture.