In 2019, the building sector accounted for the largest share of global energy consumption (35%) and energy-related CO2 emissions (38%) (UNEP 2020). This significant contribution to global energy demand explains why large-scale energy efficiency measures in the building sector are central to most scenarios that target ambitious decarbonization. To achieve these targets, it is necessary to monitor energy efficiency investments in the building sector to assess if those investments are achieving efficiency at the required scale and pace.

Energy efficiency investments in new buildings and retrofits are incremental in nature as they lead to a decrease in energy use compared to a baseline situation. Therefore, energy efficiency investments in buildings per se correspond to the incremental investment made towards energy efficiency improvements only and not the total investment towards building and construction.

Because most energy efficiency investments in buildings are components within larger projects, they are difficult to extract from the overall cost of the project. Additionally, there is a lack of understanding of the extent to which energy efficiency investments are consistent with low-carbon pathways. Energy efficiency gains may lead to a certain reduction in greenhouse gas (GHG) emissions, but it is unclear whether such improvements are sufficient for a timeley net zero emissions pathway. Therefore, tracking energy efficiency investments in buildings is challenging, compounded by the absence of comprehensive asset-level data, as well as a lack of clear definitions, standards, and benchmarks for assessing the energy efficiency performance of buildings.

Given the inertia of the building stock, not addressing these issues is a high risk for creating significant further lock-in of inefficient and high-energy consumption patterns.

To understand how to accelerate investments in energy-efficient buildings, a systematic assessment of current investment flows is needed. This can help identify the challenges and entry points to scale investments, while also measuring year-to-year progress. Establishing a consistent and standardized methodology will help to avoid potenital greenwashing of investments made towards buildings that result in little to no energy efficiency gains. It can also help to build investor confidence in the market to ensure investments are made where they are actually needed.

This brief aims to address the energy efficiency data gap by proposing a methodology for estimating climate finance in energy efficiency in newly constructed green buildings and by adding a more granular view on the alignment of projects—and investments—with low-emission scenarios. To achieve these goals, we frame our approach around five dimensions, summarized in Table ES1. Together, these dimensions constitute a framework to conduct a more accurate tracking of energy efficiency investments in green buildings.

Central to this approach, we use a ‘energy efficiency cost premium’ method to measure energy efficiency investments in new buildings that received a green certification in 2019 and 2020. The energy efficiency cost premium is the incremental investment on energy efficiency improvement above a baseline of spending for conventional (less efficient) equipment or service. We also look at the energy performance of the stock of these newly certified green buildings to assess if existing certifications and schemes provide reliable benchmarks for decarbonization targets.

The work relies on a CPI-created global database of more than 16,000 green building certifications from 2019-2020, compiled by collecting and processing asset-level certificates that amount to over 214 million square meters of certified floor area, 96% of which were new constructions. This is roughly 2% of the 5 billion square meters of new floorspace being added per year (IEA, 2021c).

CPI’s approach to overcome existing barriers in tracking incremental energy efficiency investments in buildings

Key Findings

Energy efficiency investment in certified green buildings is a fraction of total investments in buildings.

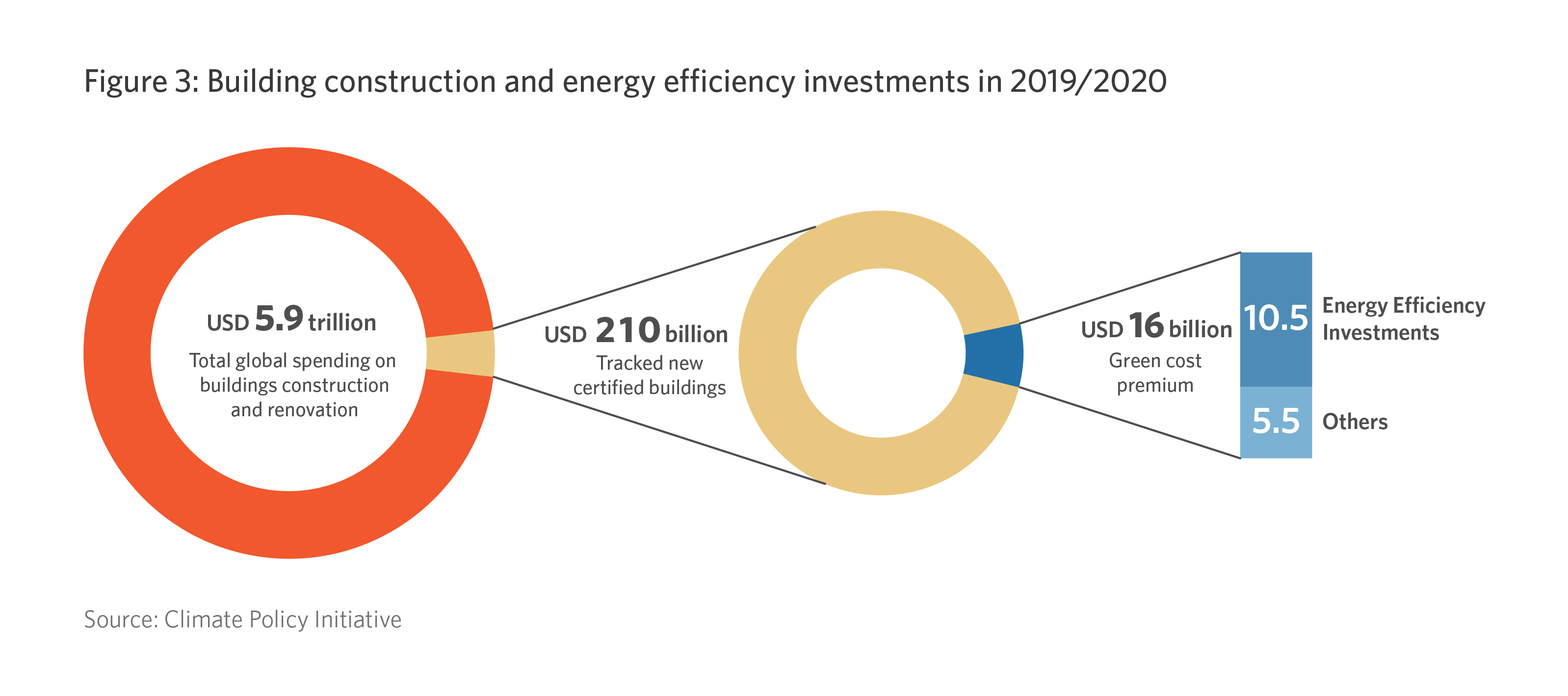

- For every USD 1 spent on energy efficiency gains, USD 19 was spent on conventional construction measures. Estimated overall investments in the construction of new, green-certified buildings averaged USD 206 billion annually in 2019-2020 out of the USD 5.9 trillion in total investments in buildings construction and renovation.

- Estimated incremental investments in energy efficiency in new certified green buildings averaged USD 10.5 billion in 2019-2020, amounting to about 5% of the total investments in those buildings. This suggests that using the full capital cost of certified green buildings to measure energy efficiency finance results in overestimating investment levels.

Certified green buildings generally perform better than conventional buildings, but with great variability.

- Most certified buildings do not achieve a drastic energy use decrease compared to a business-as-usual scenario. More than half of the certified floor area we tracked achieved less than a 30% incremental gain. Only a fourth of the certified surface reached over 40% efficiency gain. This variability can be partly attributed to diverging baseline contexts (e.g. countries that have more ambitious energy building codes), but also suggests that most green certificates are inconsistent indicators of the mitigation potential of investments in these buildings.

Better data and metrics are critical to measure alignment with net zero pathways

- A green certificate alone does not guarantee that an asset is aligned with a low-carbon trajectory. This is because the energy performance standards that green certifications set out are usually not derived from low-carbon scenarios. As mentioned, certified assets usually perform better than conventional ones. However, certification schemes rarely reflect the construction and energy performance needs of local (national, regional, municipal) low-carbon strategies.

Data Gaps and Limitations

Due to several issues related to the availability, quality, and robustness of publicly available data from the public and private actors, the scope of this study is limited to assessing energy efficiency investments and energy performance of new construction that received a green certificate. These issues include:

- Poor reporting on investment metrics: Granular data for investment metrics—cost of construction, green cost premium, share of energy efficiency in the green cost premium, operational energy performance of the building, etc.—which is key to the application of the methodology are not reported by investors. These additional costs are often project-specific and vary based on the choice of technology, the knowledge and experience of the building developers and users, the climatic zone, the type and level of certification available in the country, and other factors. To overcome these challenges, this study relies on a set of assumptions based on extensive literature review.

- Lack of accessible and consistent data on energy performance of certified green buildings: Green building certification schemes use different energy performance metrics to assess the buildings they certify. Beyond scheme specificities, the lack of transparent access to both ex-ante estimates and ex-post measurements of certified buildings’ energy performance at the asset-level prevents a thorough assessment of projects.

- Difficulty in tracking a wider range of energy efficiency investments: Given the data availability, this study focused on measuring financial flows towards energy efficiency gains in buildings that achieved a green certification. Yet, there are various ways in which energy efficiency gains can be achieved in buildings, for example, through provision of loans, funds, or credit lines for energy efficiency projects, expenditure on research and development, budgetary allocations for policies and regulations, implementation of building codes and standards, etc. Additionally, the buildings which are energy efficient but have not acquired green building certifications are also excluded from the scope of this study as there is no comprehensive database to collect and track these types of investments in energy efficiency in buildings.

- Lack of data on investments for retrofits: Because green building certificates are primarily being delivered to new construction rather than to retrofitted buildings (only 4% of tracked certified floor area), the methodology for estimating investments towards retrofitting is not developed at this stage.

- Lack of inclusion of lifecycle emissions: Life cycle carbon emissions in the building sector can be divided into five stages: material preparation, construction and reformation, operation, demolition, and waste treatment and recycling (Gong and Song, 2015). Our study only accounts for the solutions that exist to lower the energy budget of the operating phase of buildings, during which at least 80% of the lifecycle energy is consumed (Prakash et. al, 2010).As the emissions from this phase reduce, the lifecycle emissions will take primary importance. However, currently, there is limited commitment from green building certifications to include mitigation of lifecycle emissions in the certification process.

Our Recommendations

There is a need for standardized reporting of energy efficiency investments and the energy performance of buildings.

- More investors and businesses are committing to decarbonize their investment portfolios. However, there is an overall lack of transparency and accountability in the building sector in terms of investments towards energy efficiency and their impact. This contributes to the current lack of publicly available information on these crucial factors. A standardized reporting mechanism at the asset level will improve the consistency, comparability, and robustness of publicly available data. Such asset-level data will also have significant implications on improving the tracking of investments and energy performance of a building.

Assets should be monitored on an ongoing basis, benchmarked against tailored net zero scenarios, and set energy efficiency and decarbonization targets for the building.

- Energy efficiency investment is a moving target: what is considered energy efficient today may no longer be in the future. Transparency in regular monitoring and reporting will help ensure that targets are successfully implemented and help avoid the greenwashing of investments made towards buildings that have little or no potential to cut energy demand.

Retrofitting at scale needs to be emphasized in developed economies while reassessing the need for constructing new buildings.

- The majority of tracked green building certifications are acquired for new buildings in Western Europe and North America. Only 4% of the tracked certified floor area corresponded to retrofitted buildings. It is important to reorient the focus on certifying retrofits, instead of new construction in developed economies. Considering the large stock of existing buildings in these countries, it should also be assessed if there is a need for constructing new buildings at all. Certifying new buildings should be prioritized in emerging markets where the need for new construction is incomparable in order to leverage the massive low-carbon investment opportunity and avoid lock-in of decades of inefficient building stock.

The ‘energy efficiency cost premium’ methodology developed in this brief can serve as a guide to estimate energy efficiency investments in buildings.

- Given the limitations of green certificates, other types of information and approaches are needed to guide investment. Public and private actors can apply the ‘energy efficiency cost premium’ method to measure incremental investments, and voluntarily disclose the premium deployed towards low-carbon assets in their decarbonization and transition plans. The location-specific asset-level primary data on investment metrics, such as cost of construction, green cost premium, and share of energy efficiency investment in green cost premium, are key to the application of this methodology. They can develop and use this primary data based on the local baselines for energy performance, aligned with the local decarbonization trajectories.

Multi-stakeholder engagement is required to address key data gaps in estimating energy efficiency investments in buildings.

- Various stakeholders on both the public and private side need to be engaged to address the key data gaps on estimating energy efficiency investments. Multi-stakeholder collaboration is crucial to overcome the barrier of uncoordinated and fragmented efforts from various actors in the construction industry and making the data available and accessible for everyone.