Key Findings at a Glance

There is room for IFIs to reallocate investments to more effectively meet their climate and development goals:

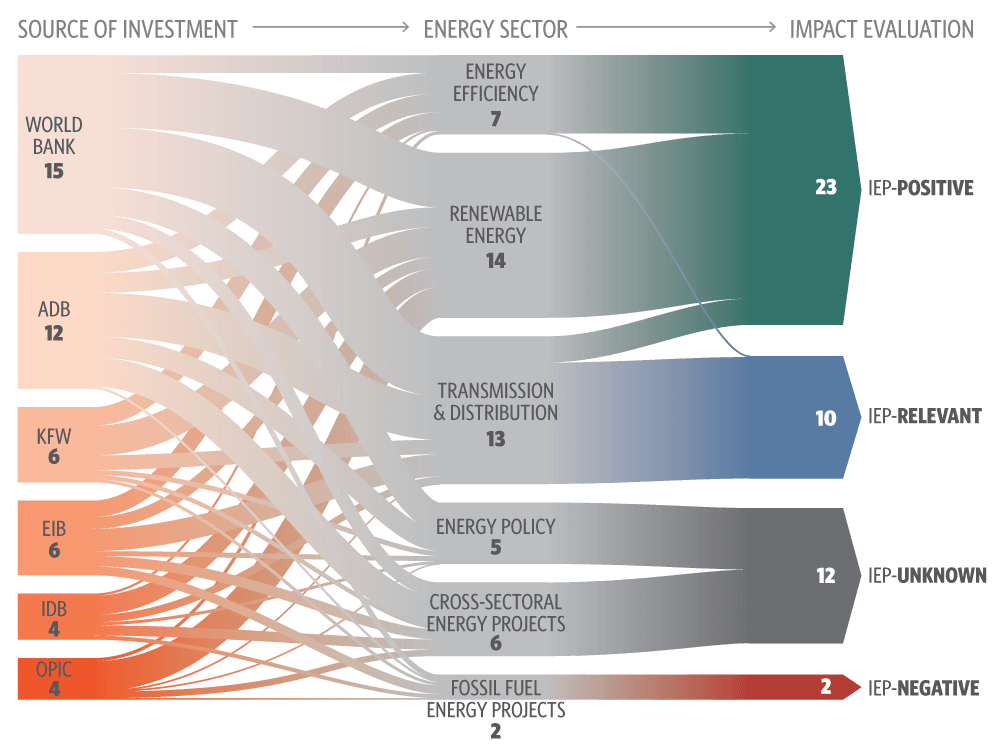

- Energy efficiency projects improve energy productivity across the board, delivering economic, social, and environmental benefits while lowering energy use but represented only 14% of IFIs’ energy portfolios from 2012 to 2014.

- Renewable projects deliver economic, social, and environmental benefits. They always improve energy productivity when compared to fossil fuel energy.

- Non-energy investments account for 80% of the total IFI interventions we captured, highlighting the huge potential gains from mainstreaming energy efficiency and IEP across IFIs’ portfolios.

- Many existing IFI policies, targets and processes improve energy productivity and each IFI can learn from the best practices of its peers.

- A joint IFI initiative establishing a common framework to assess energy investments’ productivity in economic, social, and environmental terms could show governments and donors how to most effectively direct resources to both reduce emissions and grow economies.

Summary

Energy use is both the major contributor to global greenhouse gas emissions and a vital component of both sustainable development and economic growth. Inefficient and high-carbon energy may help address energy security in the short-term but, over the longer-term, its associated climate and health impacts may well reverse any gains and exacerbate the challenges that countries face in meeting their citizens’ material needs at a reasonable cost.

This disconnection is particularly relevant for International Financial Institutions (IFIs). They play an important role in unlocking and scaling up investments in the energy sector and are tasked with supporting the implementation of the Paris Agreement and the achievement of the Sustainable Development Goals (SDGs).

For IFIs, balancing and integrating these different mandates will be challenging but essential. Energy interventions will be a critical component in achieving these goals.

IFIs are responding to these challenges and have committed to approximately double climate finance by 2020. However, maximizing the positive impacts of their energy commitments as countries shift towards more efficient and less carbon-intensive energy systems requires that they be able to accurately weigh the costs and benefits of different energy interventions.

This report develops an innovative approach to help IFIs deliver on their mandates to increase economic productivity and meet environmental and social objectives while lowering energy use from fossil fuel sources.

The approach integrates climate and development goals into an expanded concept of energy productivity to enable IFIs to more clearly assess the impacts of their actual and potential energy interventions. We call it an “assessment of integrated energy productivity impact”. If adopted by IFIs, such assessments would allow IFIs to adjust their internal lending processes, strategies and targets to better meet international policy goals, such as those laid out in the SDGs, Sustainable Energy for All (SE4ALL) initiative and the Paris Agreement.

This report uses this approach to assess the operational principles, strategies, and investment portfolios of seven key bilateral and multilateral IFIs to identify best practice on a qualitative basis. It also prepares the way for later quantitative analysis. Download the PDF to read more.