Determining climate finance needs in developing economies is critical to identify financing gaps and opportunities to guide stakeholders to effectively access, allocate and mobilize climate finance. Such data supports international policy processes, like the determination and implementation of a new collective and quantified goal on climate finance and accelerates action. The process of estimating needs also helps in assessing the effectiveness of climate finance flows.

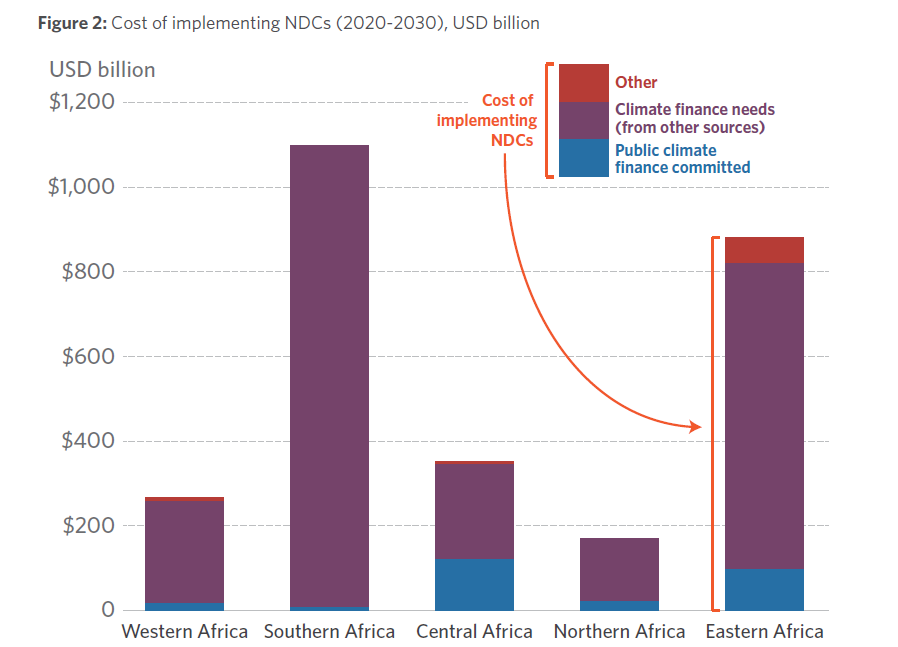

51 out of 53 African countries that submitted Nationally determined contributions have provided data on the costs of implementing their NDCs. Collectively, they represent more than 93% of Africa’s GDP. Based on this data, it will cost around USD 2.8 trillion between 2020 and 2030 to implement Africa’s NDCs.

African governments have committed USD 264 billion of domestic public resources, about 10% of the total cost. USD 2.5 trillion must come from international public sources and the domestic and international private sectors. This external financial support, required beyond domestic public sources, is defined as “climate finance need”. While almost all African regions have expressed high needs, these could be underestimated due to a lack of capacity and guidance to make accurate assessments and a lack of data from subnational governments and vulnerable communities. Countries may not be able to provide as much domestic public finance as initially estimated given high debt levels amid unanticipated budgetary pressures — for example, from the COVID 19 crisis.

Current levels of climate finance in Africa fall far short of needs. Africa’s USD 2.5 trillion of climate finance needed between 2020 and 2030 requires, on average, USD 250 billion each year. Total annual climate finance flows in Africa for 2020, domestic and international, were only USD 30 billion (CPI forthcoming), about 12% of the amount needed. The financing gap is significant: All African countries together have a GDP of USD 2.4 trillion (World Bank 2021), implying that 10% of Africa’s current annual GDP needs to be mobilized above and beyond current flows every year for the next 10 years. By contrast, 4.95% of GDP was expended on health in Sub-Saharan Africa in 2019.

Mitigation accounts for the largest share of reported needs in 2020-2030, at 66% of total climate finance needs. Mitigation needs are predominantly split across four sectors: transport (58%), energy (24%), industry (7%), and agriculture, forestry, and other land use (AFOLU) (9%). However, results are heavily weighted to a few countries, in particular South Africa, which accounts for most transport needs. Excluding South Africa, the composition of mitigation needs per sector is energy (39%), AFOLU (27%), industry (20%), and transport (10%).

Adaptation accounted for only 24% of total climate finance needs identified, despite Africa being highly vulnerable to climate change and calls for a better balance of finance between mitigation and adaptation. Adaptation needs are likely to be underestimated due to a lack of data and technical expertise to estimate the true cost of adaptation measures. There are social, economic, and political barriers at play — for example, the uncertainty of future emissions and how these will influence adaptation needs. In countries that provided sector specific data, adaptation needs were mainly reported for agriculture (25%), water (17%), infrastructure and building (12%), disaster prevention and preparedness (10%), and health (8%). 10% of total climate finance was allocated to dual benefit actions which have both mitigation and adaptation actions.

The private sector has significant potential to meet Africa’s climate finance needs, but NDCs rarely discuss its role. Public funding alone will not be sufficient, given the magnitude of investments needed, and current and future constraints on public domestic resources in Africa. However, most current climate financing in Africa is from public actors (87%, USD 20 billion) with limited finance from private actors (CPI 2021).

Some private investment can come from shifting existing flows towards climate action. For example, public and private sector financial institutions invested at least USD 130 billion into fossil fuel companies and projects in Africa between 2016 and 2021 (Geuskens and Butijn 2022). In the transport sector, infrastructure commitments totaled USD 32.5 billion in Africa in 2018, but only USD 100 million of that was tracked as adaptation finance, suggesting that most finance to the sector is not climate resilient (CPI 2021). Different types of investors can also be tapped. For example, African pension funds have USD 700 billion in assets under management, and sovereign wealth funds have USD 16.4 billion in assets under management (Soumaré 2020). Assets under management as a percentage of GDP for the five countries with the largest pension funds in Africa varies between 8.4% (Nigeria) and 84.6% (Namibia) (Irving 2020).

To mobilize private finance, public actors need to improve policy frameworks and investment environments and deploy concessional financing to target investment barriers (CPI 2021). Investment barriers are typically context specific but can include technology specific barriers such as uncertainty with respect to performance; policy barriers such as uncertain permitting processes; investment environment barriers such as lack of liquid financial markets; and bankability barriers such as off-taker creditworthiness and high debt costs (see, for example, CPI 2021 and CPI 2018).

The UNFCCC should develop guidance to support countries to determine their needs in a more comprehensive and robust way. Improving the quality of data on climate finance needs would support financing roadmaps that effectively target needs and mobilize capital. Although NDCs typically distinguish between mitigation and adaptation needs, many do not further disaggregate by economic sector and subsector. More granular information on the role and magnitude of external finance needed from different private and international sources would be useful. Needs as a percentage of GDP are highly variable across countries, indicating a lack of standardization of methodologies and uncertainty around what climate action will ultimately cost. Many estimates lack input from across government and nongovernmental stakeholders, subnational actors, and vulnerable groups. NDCs tend not to consider or quantify the structural problems that many African countries are faced with, for instance, high debt vulnerability.

The 27th Conference of the Parties (COP 27) offers opportunities at the international, national, and regional levels to improve the determination of climate finance needs and accelerate implementation of NDCs. Countries need stronger guidelines, for example as part of the Enhanced Transparency Framework agreed at COP 26, as well as the capacity support — through direct technical assistance as well as knowledge sharing initiatives — to implement them. Guidelines should explain how to assess needs using bottom-up approaches based on sector and project plans, in addition to the top-down macroeconomic approaches often used to generate aggregated data.

Robust estimates of needs can be an important driver of financing and policy decisions. While most African countries have taken initial steps to understand their climate finance needs, there is significant scope to improve the quality of those estimates and translate them into clear financing roadmaps – both national and international – that can underpin NDCs and ultimately implementation of the Paris Agreement.