This piece originally appeared on the World Bank blog and is cross-posted here.

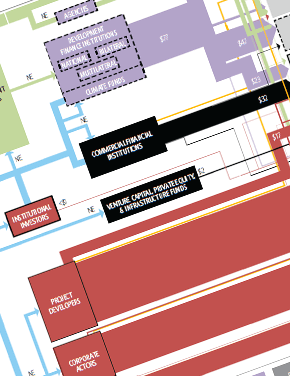

Unlocking finance is an essential part of avoiding that future. But, before leaders can determine how much more money is needed, they need to establish how much is already flowing, what the main sources are, and where it’s going. These are the key questions my team and I at Climate Policy Initiative aimed to answer with the release of the “The Landscape of Climate Finance 2012”. Our analysis estimated global climate finance flows at an average $364 billion in 2011. To put this in context, according to the International Energy Agency, the world needs $1 trillion a year over 2012 to 2050 to finance a low-emissions transition, so current finance flows still fall far short of what is needed. Private finance dominates but public finance plays a key role Confirming last year’s findings, we found that private finance – predominantly of domestic nature – represented the lion’s share of this total, almost 74%. Public funds, estimated at $16 to $23 billion, played a pivotal role in catalyzing private investments, as well as providing bilateral aid to developing countries. Public and private finance institutions played an important role in raising and channeling $110-120 billion of global climate finance flows. Public intermediaries such as the World Bank channeled about two thirds. National, Sub-regional and Bilateral Finance Institutions delivered another $54 billion. These actors proved critical in enabling otherwise unviable projects through the use of concessional loans and grants, accounting for 60% and 7% of their financing respectively. The San Giorgio Group initiative allowed us to further explore and highlight the key role of finance institutions. The Ouarzazate I Concentrated Solar Power case study provides a good example. Other key players in climate finance included private commercial banks and infrastructure funds, which distributed around $38 billion, including project-level debt and direct investments. Last but not least, project developers provided equity capital and know-how. Where is the $364 billion going? Risk coverage gaps: a barrier to investment In the absence of comprehensive regulation and in the face of fiscal weakness in the developed world, weakness in capital markets, and bias towards short-term growth, green financing faces an uphill battle. Significant challenges remain including how to scale up actions to meet global needs, how to design risk-return arrangements to attract public and private capital, and how to disburse climate funds effectively. Our work demonstrates that current climate finance flows still falls far short of what is needed to finance a low-emissions transition. This is one of the most pressing collective challenges of our time, a fact that should concern all of us. With global finance needs growing daily, 2013 should be the year real progress is made on the climate finance front. CPI is committed to advancing knowledge around climate finance. This understanding is critical for governments and policy makers who are working to use resources most effectively. Global leaders have spoken strongly on the urgent need for climate action, putting it back on top of the 2013 agenda. During his inaugural address and State of the Union speech, President Obama gave clear signals about his intentions to address this issue in his second term. At the World Economic Forum in Davos, president of the World Bank Group Jim Yong Kim reminded economic leaders about the potentially devastating impacts that could occur in a world 4°C warmer by the end of the century.

Global leaders have spoken strongly on the urgent need for climate action, putting it back on top of the 2013 agenda. During his inaugural address and State of the Union speech, President Obama gave clear signals about his intentions to address this issue in his second term. At the World Economic Forum in Davos, president of the World Bank Group Jim Yong Kim reminded economic leaders about the potentially devastating impacts that could occur in a world 4°C warmer by the end of the century.

A couple of weeks ago in a freezing Washington I had the opportunity to share the findings of the report, and the Climate Finance Flows Diagram (or “spaghetti” diagram, so-called for its tangle of finance flows) to an expert audience of practitioners at the Word Bank’s premises.

The large majority of climate finance captured in the Landscape 2012 was invested in mitigation measures. Emerging economies like China, India, and Brazil were key recipients. Renewable energy generation projects and energy efficiency attracted the bulk of finance, 85% and 4% of the total respectively. We are still unclear on how much is going to adaptation measures.

The San Giorgio Group also allowed us to examine the critical issue of risk coverage in our recent Risk Gaps papers. Getting the risk-return equation right, in fact, is essential to attract investors such as pension funds and insurance companies, whose contribution was about $620 million for the year 2011. This relatively small figure sharply contrasts with the $71 trillion in assets that institutional investors manage. A variety of risk management instruments have been designed to overcome risk barriers and encourage investment in low-carbon technologies to scale up.