Indonesia’s Just Energy Transition Partnership launched its Comprehensive Investment and Policy Plan (CIPP) on 21 November 2023.

The CIPP was a multi-stakeholder effort that took ten months to prepare and will be treated as a living document, subject to regular updates to reflect global trends and national priorities. CPI was heavily involved in the process, supporting both the JETP Secretariat’s overall editorial process and the Finance Working Group’s specific input to the CIPP. Below are some highlights from the document, which can be accessed at https://jetp-id.org/cipp.

JETP funds coverage and composition

Total investment required for the CIPP Power Sector Pathway is USD 97.1 billion, over two-thirds of which (or USD 66.9 billion) is to finance 400+ priority projects in order for Indonesia to achieve its power sector transition pathway goals by 2030. The USD 20 billion package deal of Indonesia’s JETP therefore still leaves a sizable 70% financing gap.

Figure 1. Breakdown of Indonesia’s JETP funding

As half of JETP financing commitment is from the International Partners Group (IPG), the following risks should be considered:

- Potential adverse impact on fiscal balance. All public funding commitments from IPG are channelled through financing intermediaries such as MDBs, DFIs, or PT SMI (Indonesia’s ETM Country Platform Manager), requiring a sovereign guarantee that puts pressure on fiscal capacity. The indicative amount that the Government of Indonesia (GoI) will need to set aside for such guarantee is up to ~ USD 8.4 billion.

- No accessible guarantee facility. Guarantees offered by the US and UK can only be accessed upon hitting a single-borrower limit[1] imposed by the World Bank as a financing intermediary, which GoI has yet to show any precedence of hitting.

- Limited access to financing for independent power producers (IPPs). Loans offered by IPGs are channelled as sovereign lending, which can only be accessed by SOEs, thus limiting access to concessional financing for IPPs.

- Stringent funding terms and conditions by IPG and intermediaries. GoI is not only exposed to foreign exchange risk due to non-local currency denominated facilities but also the high cost of safeguarding, e.g., application of specific provisions across different intermediaries. In addition, financing intermediaries usually impose a minimum ticket size requirement, thus constraining smaller projects to be financed.

Eligible investment areas and targeted impact

In achieving JETP targets, CIPP upholds key elements in guiding JETP’s on-grid pathways, comprising (i) emission peak of power sector at no more than 250 MT by 2030, (ii) RE generation share of 44% by 2030, and (iii) achievement power sector’s NZE by 2050. Thus, CIPP identifies 5 investment focus areas (IFAs) to accelerate decarbonization of Indonesia’s power sector that boosts an opportunity for Indonesia to shift to a more sustainable power system while ensuring the transition is affordable. The IFAs include:

IFA 1: Transmission Lines and Grid Deployment at around 14.000 km circuit of transmissions costing up to USD 19.7 billion;

IFA 2: Early Coal-fired Power Plant (CFPP) Retirement and Managed Phase-out requiring up to USD 2.4 billion;

IFA 3: Dispatchable Renewable Energy Acceleration at 16.1 GW built out by 2030, costing up to USD 49.2 billion;

IFA 4: Variable Renewable Energy (VRE) Acceleration at 40.4 GW built out by 2030, costing up to USD 25.7 billion by 2030; and

IFA 5: Renewable Energy Supply Chain Enhancement mainly supports the manufacturing capability to meet domestic demand for supply chain components of RE projects, particularly large-scale solar PVs. The investment needed would be closely associated with Indonesia’s requirements to boost the pipeline for solar PV project development, improve cost effectiveness of domestic solar PV manufacturing, tackle regulatory and market barriers, and address the environmental footprint of the industry.

Beyond these key areas, the sixth IFA, Energy Efficiency and Electrification, is planned to be added in the subsequent 2024 version of the JETP CIPP. Moreover, two supporting areas have been incorporated to achieve the main CIPP pathways of on-grid power sector emissions peak by 2030 with no more than 250 MT CO2, RE share of 44% by 2030, and net zero emissions in the power sector by 2050:

- Transmission lines and grid deployment that connect power systems and upgraded control rooms and sensors to increase flexibility and support integration of new technologies, especially variable renewables, demand response, and electrical vehicles; and

- Renewable supply chain enhancement to develop local manufacturing capabilities that support the anticipated massive renewable capacity addition.

The rapidly falling costs of renewable technologies provide an opportunity for Indonesia to shift to a more sustainable power system while ensuring the transition is affordable. Managed phase-out of coal-fired power plants is expected to reduce emissions while also harnessing system flexibility that can facilitate a more secure transition as well as renewables capacity growth to enter the power system.

Just transition components and costing

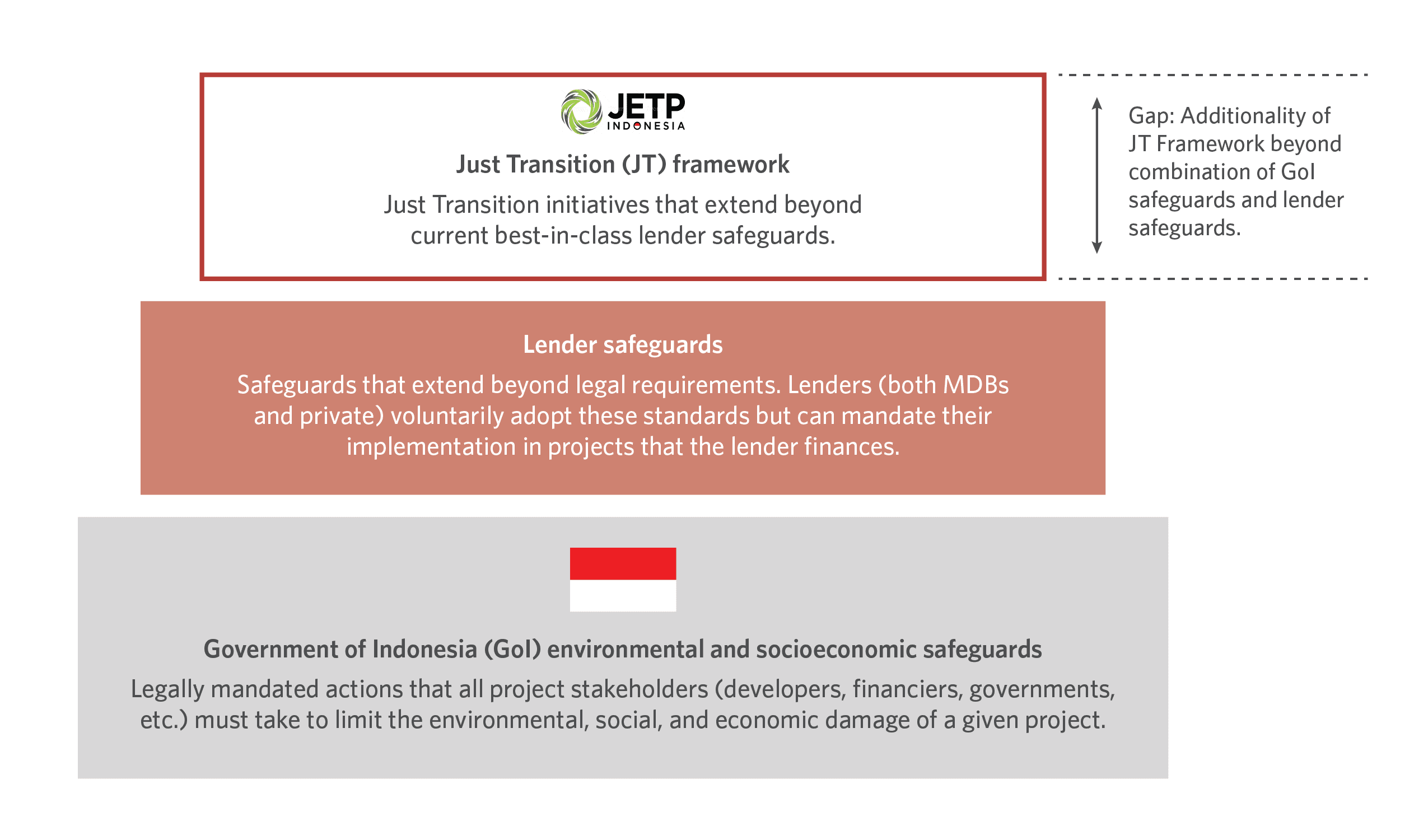

CIPP’s Just Transition (JT) Framework builds on existing safeguards in Indonesia through processes such as the Environmental Impact Analysis (AMDAL) and the Land Acquisition and Resettlement Plan. These basic safeguards as well others adopted by lenders (MDBs, DFIs, private sector) are incorporated as Standards in the JT Framework, therefore ensuring no duplication of work and cost.

Figure 2. Additionality in the JT Framework

One additional component, known as ‘Standard 9’, has also been developed specifically to support economic diversification and transformation, mitigate risks such as residual impact of CFPP retirement, and enhance social, economic, and environmental opportunities.

Appropriate financing is critical to enable implementation of the JT Framework, especially for these aspects that are additional to the basic safeguards. As many just transition initiatives have limited private returns but very high potential social returns, public funding support in the form of grants are the most appropriate for Standard 9 interventions that extend beyond the responsibilities of a single project.

As the IPG committed a designated grant of approximately USD 200 million for just transition activities such as capacity building, scoping studies, and piloting, there are various opportunities that CIPP can further explore to enhance economic justice at the community level. Implementation at subnational level can therefore take on different forms ranging from the introduction of new policies to the expansion of government programs related to just transition, such as through community-based renewable energy, application of the circular economy, training for female-owned SMEs, among others, to not only improve energy access but also job creation at the grassroots level.

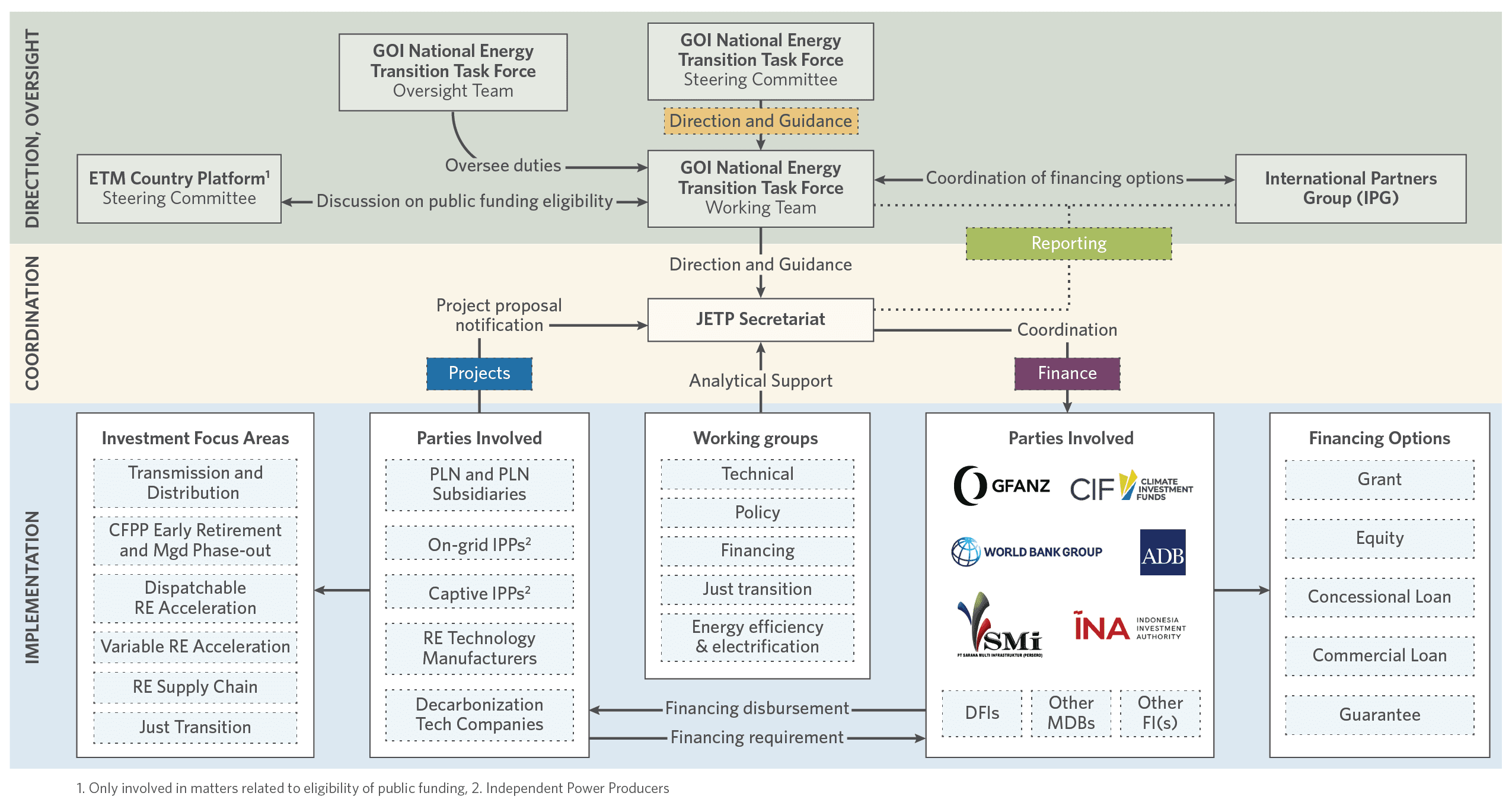

The governance structure of CIPP implementation

CIPP provides guidance in the JETP implementation mechanism to facilitate sustained and visible collaboration across key stakeholders including GoI and all institutions relevant to JETP, such as the IPG, Glasgow Financial Alliance for Net Zero (GFANZ), the private sector, and civil society organizations.

Figure 3. Indonesia’s JETP governance structure

The implementation and governance of JETP is designed to ensure leadership and ownership that provides clear strategic direction, transparency and integrity, accountability by implementing institutions to all partners, and a robust decision-making process to unlock and scale up funding from diverse sources that target JETP IFA and appropriate financing instruments.

Recommended policy reforms

Various sustainable finance initiatives have been initiated, such as the Sustainable Finance Roadmap Phase I and II and the Indonesian Green Taxonomy (THI) 1.0, to support Indonesia’s net zero emission target. Yet, Indonesia needs to expand its existing green and sustainable finance framework, to widen its investment coverage in decarbonization activities. Subsequently, GoI issued Law No. 4 Year 2023 (UU P2SK)[2] which sets out a legal framework to enable the expansion of sustainable investment coverage to include the transition finance, that is relevant to the current domestic and international decarbonization ambitions, such as JETP and ETM. Transition finance allows the dynamic process of mainstreaming the principles of sustainability principles to provide solutions for whole-of-economy decarbonization (OECD, 2022).

The next phase of Indonesia’s Green Taxonomy would therefore need to unlock transition finance as it plays a pivotal role in enabling the implementation of long-term financial sector reform to drive the path to net zero and more sustainable practices. Consideration of transition activities in the taxonomy could bridge the gap between traditional and green finance, particularly in facilitating investment for early coal decommissioning (i.e. CIPP IFA 2), as long as it is within the defined parameters and good governance practice of business and financiers (e.g., risk management procedures and internal control).

Watch this space

As the CIPP becomes the basis for the JETP implementation phase, here are several key issues which still need to be addressed, further refined, and incorporated into subsequent updates of the document:

Captive power decarbonization

While the off-grid captive power systems are outside of the scope of the current CIPP, a more detailed study and roadmap on decarbonizing Indonesia’s off-grid captive power systems will be conducted in conjunction with the CIPP implementation. The captive power roadmap is planned as a strategy document for GoI in its off-grid power sector planning and policymaking to identify and implement necessary measures to achieve a comprehensive energy transition as part of the JETP process.

Early coal retirement

As JETP funds only allocate finance for 1.7 GW of early coal retirement, considerably less than an earlier proposition of 5.5 GW, analyses and guidelines for priority initiatives and potential collaborations are needed. Below are some resources that CPI has contributed and continues to work on:

- GFANZ Coal Managed Phased-Out Guidelines as a knowledge partner

- CPI, together with Climate Bonds Initiative (CBI) and RMI, developed a Guidelines for Financing a Credible Coal Transition, to provide a framework for assessing the climate and social credibility of financial transactions that aim to accelerate a managed phaseout of coal-fired power plants

- CCCI carbon credit mechanism a project-based approach that aims to catalyze the just transition of coal-fired power plants in emerging economies over the coming years, avoiding the planned release of millions of tons of carbon dioxide (CO2).

- Energy Transition Accelerator (ETA) aimed at leveraging high-integrity carbon credits to catalyze private investment in holistic energy transition strategies compensates developing countries for verified emissions reductions.

Just Transition Funds

A just transition approach requires examining the opportunities created by the energy transition investment that can bring positive impacts or benefits. Appropriate financing is highly critical in enabling the implementation of the JT Framework, specifically for Standard 9 (economic diversification and transformation) as an additional component to the basic safeguards.

CPI’s Just Transition work identifies pathways for sustainable and equitable development that accounts for the impacts on all key stakeholders at all levels from national to local—workers and communities, public and private employers, governments, financial institutions—and further identifies policy and finance tools that can help support more affordable, sustainable and just energy transitions.

[1] Single Borrower’s Limit (“SBL”) intends to limit or restrict a lender’s risk of exposure to single borrowers by preventing the lender from extending large credit accommodations to one country as borrower. Indonesia as, the World Bank’s International Bank for Reconstruction and Development (IBRD) member countries, is subject to a Single Borrower Limit (SBL). An annual surcharge on loan balances in excess of the respective country’s SBL threshold will be determined from time to time.

[2] Law No. 4 Year 2023 (UU P2SK) concerning Development and Strengthening of the Financial Sector