Institutional investors, such as pension funds and insurance companies, hold a vast share of society’s wealth with over USD 71 trillion of assets under management. Despite being frequently cited as potential sources of large-scale investment for wind farms or solar plants, CPI recently found that barriers and management practices prevent all but a few institutional investors from actively engaging in renewable energy projects.

That’s why, when an institutional investor does engage in a renewable energy project, it is important to draw out lessons to understand what worked, what was needed to encourage their participation, and what potential exists to replicate and scale similar approaches.

In a new case study, CPI describes these insights from a windfarm with a unique financing arrangement: The Jädraås Onshore Windfarm in Sweden.

The windfarm is the largest in Scandinavian Europe at 203 MW, delivering power to 100,000 homes. Swedish project developer, Arise Windpower, and UK private equity investor, Platina Partners, share one third of the EUR 360 million project cost. The remaining two-thirds is secured equally with debt from conventional commercial bank lenders, and innovative lending from an institutional investor, Danish pension fund, PensionDanmark, whose position was guaranteed by the Danish state-backed export credit agency, EKF (Eksport Kredit Fonden).

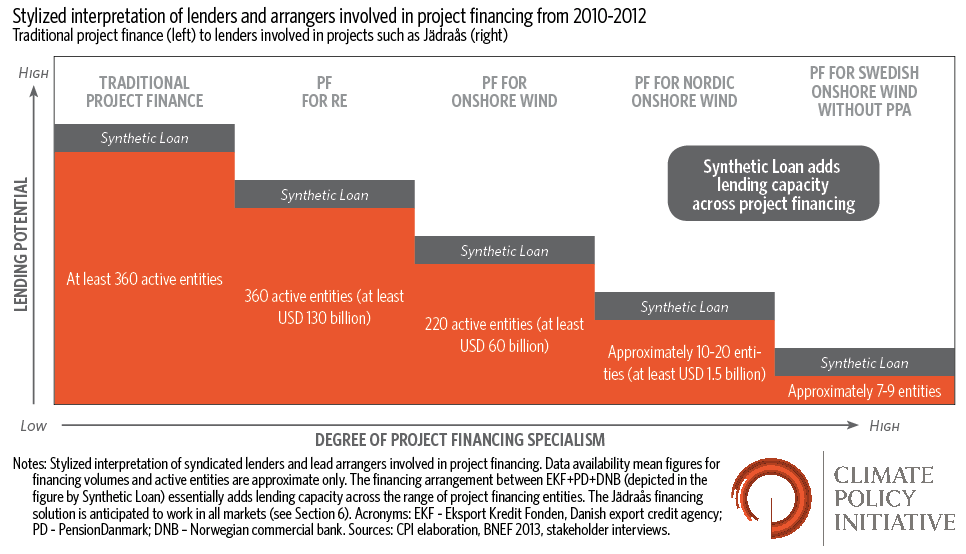

As we describe in the case study, the unique financing arrangement essentially created a Synthetic Loan to slot in alongside commercial lending at commercial interest rates to expand existing lending capacity (see figure), and allow the pension fund to receive returns above those of AAA rated government bonds, with no additional investment risks.