Executive Summary

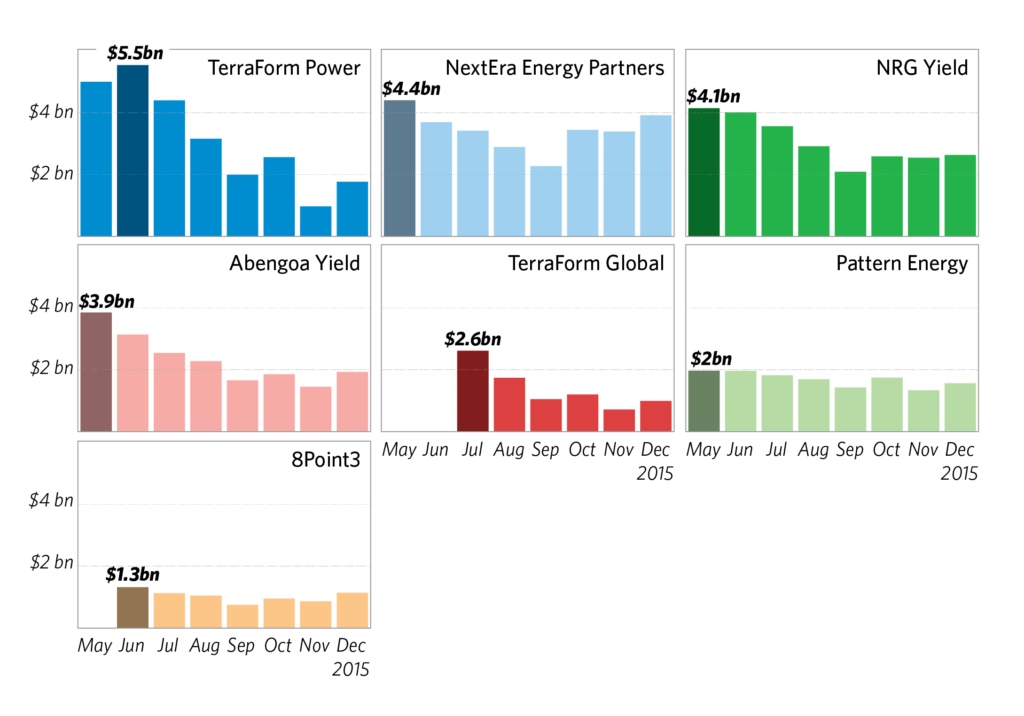

US-based YieldCos, such as Terraform Power and NRG Yield, raised equity worth $23bn by mid-2015, only to see their share prices fall by as much as 60% just a few months later. The rise and fall of new investment ideas nearly always provides valuable lessons, and the US YieldCos are no exception.

The creators or sponsors of YieldCos looked to a world in which financial markets were craving investments that delivered a high-yield at relatively low risk. Recognizing that their portfolios of contracted renewable energy assets with strong cash flows and low risk provided the perfect match for yield-seeking investors, developers and independent power producers created new corporate vehicles to be sold and traded on stock market exchanges. By converting these illiquid investments into liquid ones, US YieldCos opened up the opportunity to invest in renewable energy projects to a much wider range of investors than were previously available.

However, by promising investors aggressive annual dividend growth, US YieldCo creators added risk back into the equation as the vehicles became reliant on the ready ability to raise new equity and debt capital in order to acquire new assets and fuel targeted growth. Our analysis shows that growth raised the implicit unlevered cost of equity by nearly 200 basis points, from 4% to 6%.

Accessing lower-cost finance for renewable energy means taking what was good from the original story, while avoiding the added risk. The key is to develop a new style of YieldCo, or a Clean Energy Investment Trust (CEIT), tailored to the needs of yield hungry investors, offering high yields without the expectations and risks of growth.

Climate Policy Initiative is leading a programme over the next 6 months to develop a new financing model for clean energy as part of the Rockefeller Foundation’s Zero Gap Initiative which supports innovative financing mechanisms to deliver positive social, economic and environmental outcomes.

Peak market valuation of the seven US listed YieldCos, mid-2015 and their subsequent performance through the end of 2015