Introduction

Climate-related events such as hurricanes, earthquakes, and other natural disasters can significantly impact a country’s fiscal position and debt sustainability. Constraints in responding effectively to such events undermine development progress and climate objectives and, in extreme cases, can lead to debt distress. This particularly affects regions frequently facing natural disasters and climate-vulnerable countries, including small island developing states (SIDS), but is also relevant to vulnerable emerging and developing economies.

Climate-resilient debt clauses (CRDCs) are one tool to mitigate these challenges. These create an ex-ante agreement to postpone a country’s debt repayments if a specified set of circumstances occur, creating fiscal space for emergency response and reconstruction.

The FiCS Lab Working Group on CRDCs emerged from discussions at the 2023 FiCS Summit in Cartagena, which identified CRDCs as a thematic priority for this initiative. Throughout 2024, the working group convened monthly, chaired by Gregory Hill, Vice President of Finance and Corporate Services at the Caribbean Development Bank (CDB). Its members have explored key considerations and best practices related to CRDC implementation. This note has been drafted by Climate Policy Initiative (CPI) to support the discussions of the working group. It is informed by these discussions but does not necessarily represent the views or positions of any participating institution or individual.

What are climate-resilient debt clauses?

CRDCs are terms that can be included in debt contracts to create a state-contingent instrument. These clauses identify a set of conditions (or triggers) under which debt service is temporarily frozen, and the repayments postponed according to a pre-agreed schedule. They are usually neutral in terms of net present value (NPV) for the creditor—incurring no loss but rather deferring the repayment schedule.

This provides temporary liquidity in the event of a natural disaster. While of limited duration, the pause in repayments creates breathing room for the beneficiary country to respond to the emergency situation, thus reducing the risk of debt service becoming unsustainable. As they are a contractual arrangement, the activation of CRDCs does not trigger cross-default clauses, protecting ongoing access to external financing.

From the creditor’s perspective, these clauses provide greater certainty about repayments than ex-post reprofiling, reducing transaction costs and the risk of litigation. A potential drawback for commercial lenders is that in the event that rescheduling proves insufficient, and the sovereign later has to restructure its debt, the rescheduled payments would be within scope of the restructuring, while creditors with the same original repayment terms and no CRDC would have continued to receive payments in the interim. This would create a de facto junior status of claims including CRDCs, though this has not yet been tested in practice, given that the use of CRDCs is still nascent. Broad adoption of CRDCs will reduce this risk as the share of outstanding obligations that include such clauses increases over time (similar to the experience of the introduction of collective action clauses).

Given that CRDCs are a relatively new contingent instrument, there are few precedents to identify credit rating agencies’ reaction to their activation. In practice, assessments will be circumstance-specific and depend on each instance of drafting the clauses, as well as the debtor country’s financial agreements. However, there appears to be broad consensus that—subject to certain parameters, including NPV neutrality—CRDCs would be ratings-neutral for the borrowing country, and that commercial debt with built in debt suspension clauses would not automatically trigger credit events. For example, the 2022 Barbados Climate-Resilient Debt Clauses: A primer for FiCS members Eurobond, which included a CRDC, received a ‘B’ rating from Fitch, in line with the sovereign issuer default rating. The expectation is that the use of CRDCs would also be ratings-neutral for commercial lenders.

These clauses could have some impact for multilateral development banks (MDBs), depending on the share of their portfolios that include CRDCs. In a positive development for MDBs, Fitch stated in its recently updated supranational rating methodology that MDB credit ratings would not be affected by their provision of CRDCs. Fitch stated that activation of the clauses would not be considered as arrears, being contractual, but could create impacts through other channels—e.g., liquidity or the assessment of other risk factors—if a large share of a bank’s portfolio was affected.

CRDCs have been used in bonds by three Caribbean SIDS: Grenada, Barbados, and the Bahamas. For example, Grenada’s 2015 hurricane bond was triggered in late 2024, resulting in the suspension of USD 12 million in interest payments, equivalent to 11% of the bond’s value.

CRDCs have potential for much broader use. In principle, they could be applied to any country. In practice, they are likely to be of greatest value to low-income countries, SIDS, and other developing countries that are particularly vulnerable to the impacts of climate change and the least able to absorb the impacts of natural disasters. CRDC introduction is also less likely to negatively impact the liquidity of debt instruments in such countries, whereas the potential impact on liquidity is a greater consideration for larger economies.

Amid growing public debt distress and lack of debt transparency, globally and especially in low-income and vulnerable middle-income countries, the upcoming Fourth International Conference on Financing for Development (FfD4) discussions in Seville in 2025 will prioritize the mainstreaming of standardized statecontingent debt clauses, including CRDCs. FfD4 plays a significant role in shaping the international financial architecture and reinforcing the essential link between development and climate action. Addressing debt vulnerabilities through instruments like CRDCs not only enhances financial resilience but also helps climate-vulnerable countries to respond effectively to crises without compromising their long-term goals.

Main design features of CRDCs

The key features considered in existing CRDC models are:

- Range of events covered by CRDCs to date have focused coverage on hurricanes, while more recent discussions have expanded to encompass a broader range of exogenous events (i.e., those outside the control of the authorities) that can have significant negative economic impacts on the borrower (e.g., earthquakes, tsunami, droughts, and pandemics).

- Triggers for CRDCs can include a combination of both parametric triggers (which can be measured independently) and proxy triggers (declarations by relevant authorities or international organizations).

- Terms of the deferral mainly include length of the deferral; number of deferrals allowed; whether a deferral applies to interest, principal, or both; and the repayment modalities.

In November 2022, the Private Sector Working Group on CRDCs, convened by the UK, brought together international financial institutions, G7 and borrowing countries, and private sector representatives to develop a guidance note for CRDCs. This led to the International Capital Market Association’s (ICMA) publication of a standardized term sheet, as summarized in Table 1. This publication marked a significant step toward standardizing CRDCs and provided a practical framework to facilitate their broader adoption.

While initially designed with private creditors in mind, the ICMA Term Sheet has influenced the policies of MDBs and development finance institutions (DFIs), strengthening calls for CRDC adoption.

Ongoing work and experiences of CRDCs among FiCS members

Among private creditors, the adoption of CRDCs has been slow, with the 2022 Barbados Eurobond as the main example. Several countries advocated for the implementation of CRDCs since the publication of the ICMA Term Sheet. At the 2023 Paris Summit 73 countries joined a call for action led by the UK, France, Barbados, Ghana, the USA, Canada, and Spain for bilateral, multilateral, and private-sector creditors to introduce CRDCs by the end of 2025. Japan also announced plans to pilot CRDCs in new sovereign lending to Pacific Island countries as of May 2024. The MDB Vision Statement, also adopted at the summit, called for MDBs to adopt CRDCs. Several MDBs and DFIs have committed to implementing CRDCs, often starting with a select group of countries. MDBs are also piloting disaster risk insurance products, such as parametric insurance and catastrophe bonds (CAT), and providing technical assistance or programs to support the development of instruments for climate and disaster risk finance and insurance mechanisms.

The IDB offers principal payment options to 12 eligible countries, offering a fixed term deferral of two years for principal repayments only. The World Bank currently offers CRDCs to the International Bank for Reconstruction and Development and International Development Association eligible Small States Economies, members of the Small States Forum, and SIDS, as defined by the UN. The European Investment Bank is also implementing such clauses. The African Development Bank, European Bank for Reconstruction and Development (EBRD) and the Asian Development Bank are working to implement CRDC pilot arrangements. The EBRD planned to offer CRDCs in new loan agreements with sovereign, sovereign guaranteed, and municipal clients from lower-middle-income countries by mid-2024 to enable debt deferral on pre-agreed terms after extreme climate-related and natural disasters, covering floods, droughts, and earthquakes. The EBRD is also planning to extend CRDCs to municipal clients (regions and cities), recognizing individual regions’ vulnerability to natural disasters. The CDB has carried out work assessing the impact of implementation of CRDCs at scale. A number of export credit agencies are also implementing (e.g., UK Export Finance) or considering (e.g., Agence Française de Développement) the adoption of CRDCs.

Although CRDCs have broad support, some obstacles to implementation remain. The identification of suitable triggers is challenging, particularly for events other than hurricanes, where data is lacking and work on defining standards is ongoing. There is also a live debate on the suitability and feasibility of expanding the use of CRDCs beyond sovereign debt to include subnational governments and state-owned enterprises. Market acceptance is also a hurdle, with concerns over the impact of the introduction of CRDCs on market indexes and liquidity. There are also concerns about appropriate pricing, and whether CRDCs could result in increased borrowing costs.

General considerations for all public financial institutions

Public development banks (PDBs) and other public financial institutions balance financial stability with development objectives, differentiating them from private entities. This dual mandate enables PDBs to adopt more flexible approaches to implementing CRDCs, but also requires careful consideration. The items below address factors relevant across all FiCS members while recognizing the context of public institutions.

- Market acceptance and cost implications: While CRDCs can enhance fiscal resilience, concerns remain about their potential impact on borrowing costs and market perception. Public financial institutions must navigate these concerns by demonstrating that CRDCs are structured to be NPV-neutral and by engaging with market stakeholders to build confidence in the products. Case studies showcasing successful implementation and highlighting the decisions specific to PDBs can help to address scepticism and foster wider acceptance.

Box 1: UKEF’s early adoption of CRDCs

UK Export Finance (UKEF) was the first export credit agency (ECA) to offer CRDCs in direct and restructured sovereign lending to low-income countries and SIDS, with its policy launching in April 2023. This initiative was announced at COP27, following the launch of UKEF’s Climate Change Strategy in 2021 and is also part of the UK Government’s broader objective to improve the financial resilience of climate-vulnerable countries. CRDCs offered by UKEF allow for principal and interest payments to be deferred for 12 months and will thereafter be repayable over a 5-year period, with the schedule tailored to the borrowing country’s individual requirements. UKEF has now signed or is in the final stages of agreeing CRDC-containing lending arrangements with eight borrowing countries; and has been working internationally to encourage the adoption of CRDCs by other ECAs and official sector lending institutions.

UKEF has been providing large scale sustainable financing—around GBP 7 billion (USD 9.1 billion) since 2019 and has committed another GBP 2 billion (USD 2.5 billion) for projects globally, including in Africa, Asia and Europe.

UKEF’s example shows that market acceptance of CRDCs can be bolstered by transparent communication, alignment with national climate strategies, and demonstration of minimal or neutral impact on credit terms.

- Concentration and portfolio risk: Public financial institutions with geographically concentrated lending portfolios must carefully assess the implications of highly correlated risks. For example, a regional development bank (RDB) operating in disaster-prone areas may face synchronized shocks that could simultaneously trigger CRDCs across multiple loans, potentially straining liquidity. Establishing dedicated liquidity buffers or access to contingency credit lines can help to mitigate this concentration risk. Institutions should also engage credit rating agencies to ensure that such mechanisms do not negatively impact their credit standing.

Box 2: Caribbean Development Bank’s CRDC assessment

Given the Caribbean region’s acute vulnerability to climate shocks and mounting debt challenges, the CDB is an institution where CRDCs could support its borrowing members, but the implications of offering them on a significant share of its loan portfolio requires careful consideration.

In 2024, the CDB commissioned a study to explore the potential impact of incorporating CRDCs into a substantial share of its loan portfolio. This study leverages stochastic modeling to evaluate the impact of CRDCs on the CDB’s financials, effectively capturing extreme and tail risk scenarios. In collaboration with Lazard, the CDB defined key trigger parameters for CRDCs and evaluated their impact on its balance sheet. The analysis established that, given CDB’s portfolio and the region’s vulnerability to climate events, the possibility of CRDCs being triggered at sufficient scale to negatively impact its liquidity position cannot be discounted. For this reason, robust financial protections and mitigation strategies were examined, such as liquidity buffers and risk mitigation policies and instruments, as key elements to be put in place before CRDCs could be adopted at scale. This is to ensure the safeguarding of the CDB’s own long-term financial stability and AA+ credit rating. Adoption at the scale envisaged by the study would be a considerable step forward in leadership and innovation in disaster risk finance, as no multilateral institution currently offers CRDCs to a majority of its borrowing members.

The CDB’s work on CRDCs is ongoing and the bank plans to examine the key mitigating strategies to build the additional financial resilience to accommodate their use in the future. The bank envisions that this work will not only create value for its borrowing member countries, but also establish a disaster risk financing model for institutions to adopt globally.

- Disaster risk management systems: The effectiveness of CRDCs depends on borrowers’ capacity to manage disaster-related risks. Borrowing entities should have comprehensive disaster risk management frameworks that include tools like parametric insurance, CAT bonds, and contingency funds. PDBs and DFIs can provide technical assistance to strengthen these frameworks, alongside enhanced CRDC adoption as part of a broader strategy to support emergency preparedness and financial resilience.

- Trigger design and data reliability: MDBs and DFIs can support the development of regional data hubs and partnerships with key institutions like risk pools (e.g., the Caribbean Catastrophe Risk Insurance Facility, CCRIF) to improve access to high-quality data. Flexibility in trigger design, such as combining parametric and policy-driven triggers, can enhance their applicability across different regions and disaster types.

Tailored considerations for specific sub-groups

- Multilateral Development Banks

- Compatibility with preferred creditor status: For MDBs, CRDCs must be implemented in a manner that is compatible with their preferred creditor status. Crucially, all features must be agreed ex-ante, making deferral part of the normal operations of the instrument, rather than requiring an ex-post rescheduling/restructuring of an obligation.

- Public Development Banks and other DFIs

- Eligibility and scope: CRDCs have historically been included in sovereign debt contracts, but expanding their use to subnational entities, such as municipalities, can increase their relevance for PDBs that focus on domestic development. However, this expansion introduces new legal and operational complexities, requiring a robust assessment for the borrowers’ governance, creditworthiness, and alignment with local regulations.

- Institutional advantages of PDBs and DFIs: Public lenders often have stronger relationships with their borrowers and a dual mandate that balances development objectives with financial considerations. This allows for more flexible CRDC implementation, such as customized deferral schedules and adaptive triggers. However, they should also be mindful of their operational capacity to manage these tailored arrangements effectively.

Decision tree for the adoption of CRDCs

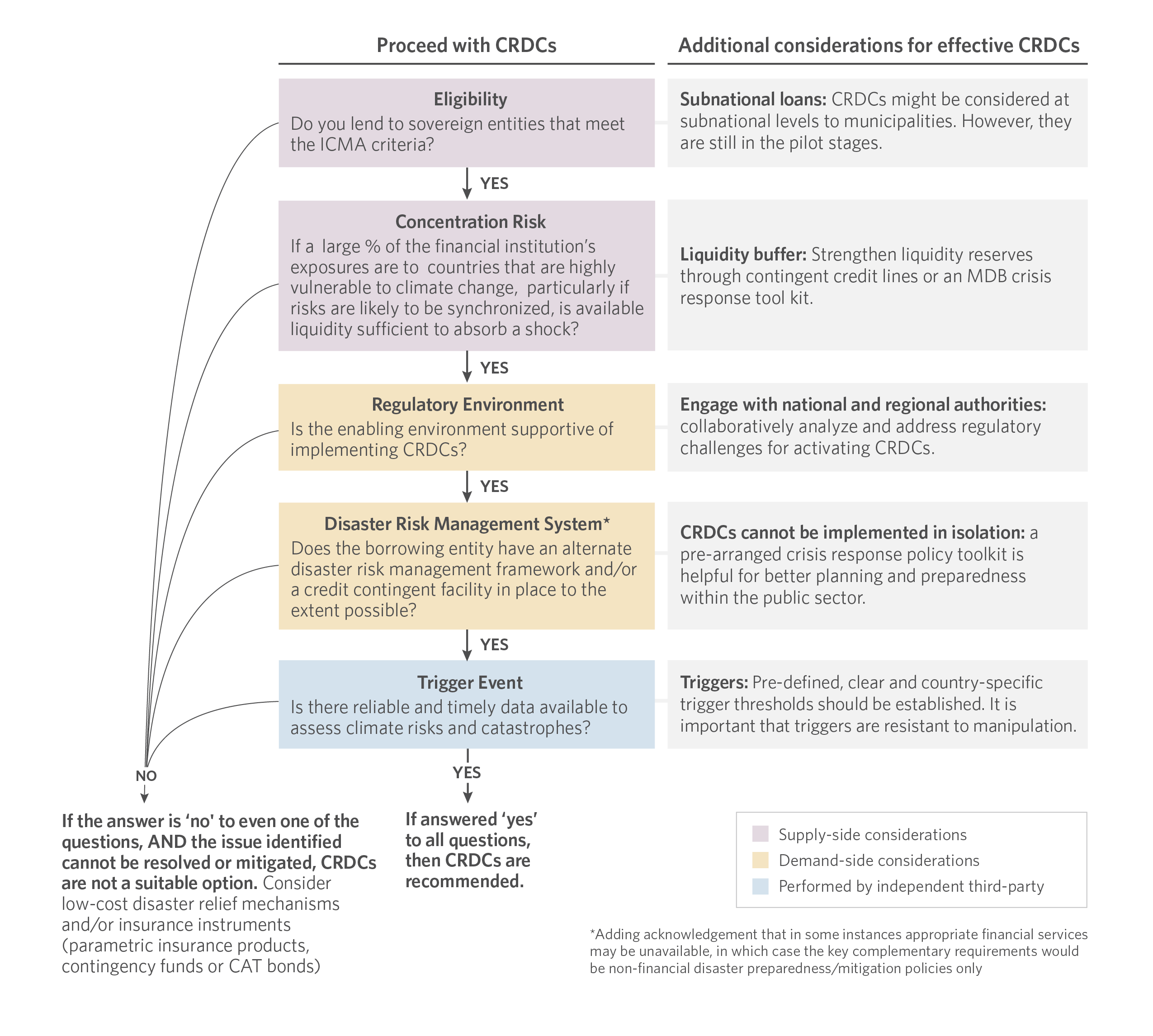

CPI has devised the below decision tree with the aim of guiding DFIs through key supply and demand considerations to determine the feasibility of offering CRDCs. It is intended as a visual tool to support initial policy discussions within an institution and highlight preliminary areas of work.

Figure 1: Decision tree for the adoption of CRDCs

The CRDC decision tree highlights key criteria but is not an exhaustive resource and is intended to be read in conjunction with the rest of this primer.

The decision tree consists of two columns:

- Proceed with CRDCs: This column is the starting point of the decision tree, including questions on a series of key criteria. Each question represents a critical decision point where a “yes” response allows the DFI to progress downward through the column, indicating that offering CRDCs is feasible based on their inputs. If the DFI’s response is “no” or not a straightforward “yes”, they would need to explore the second column.

- Additional considerations for effective CRDCs: This column outlines additional steps that would enable DFIs to offer CRDCs. While not generating a definitive “no” or simple “yes” these considerations suggest that providing CRDCs would be feasible following certain adjustments or conditions.