Supporting a sustainable recovery

Context

The COVID-19 pandemic has worsened the debt vulnerabilities of many low- and medium-income sovereigns. Debt levels were already high for many even prior to COVID outbreak, but are now exacerbated because government revenues have declined as a result of limited economic activity – while the timing and the quantum of debt servicing payments remain the same.

The IMF estimates that the ratio of public debt service costs to government tax revenue will exceed 20% in a majority of low-income and emerging countries in 2021. As a greater proportion of these governments (now reduced) revenues are now dedicated to servicing debt, spending towards reviving growth or achieving climate goals will likely take a backseat. Depending on the fiscal situation of a nation, there’s a need to provide fiscal headroom through either of the following routes:

- Debt suspension

- Debt forgiveness

- Reorientation of debt so that service payments are utilized for a green recovery

Existing interventions to address sovereign debt

More than 70% of non-developed world debt service due in 2021 is owed by Upper MICs. While there are interventions focused on providing debt relief to Low Income Countries (LICs), no such interventions exist to support Middle Income Countries (MICs). Even if MICs do not face an imminent liquidity crisis, they still need support to ensure fiscal resources are available for economic stimulus and climate action. The magnitude of policy stimulus measures in response to COVID-19 outbreak (% of GDP) is much smaller for developing countries compared to that for the developed – implying that these countries need assistance.

Expanding the Use of Debt for Climate Swaps

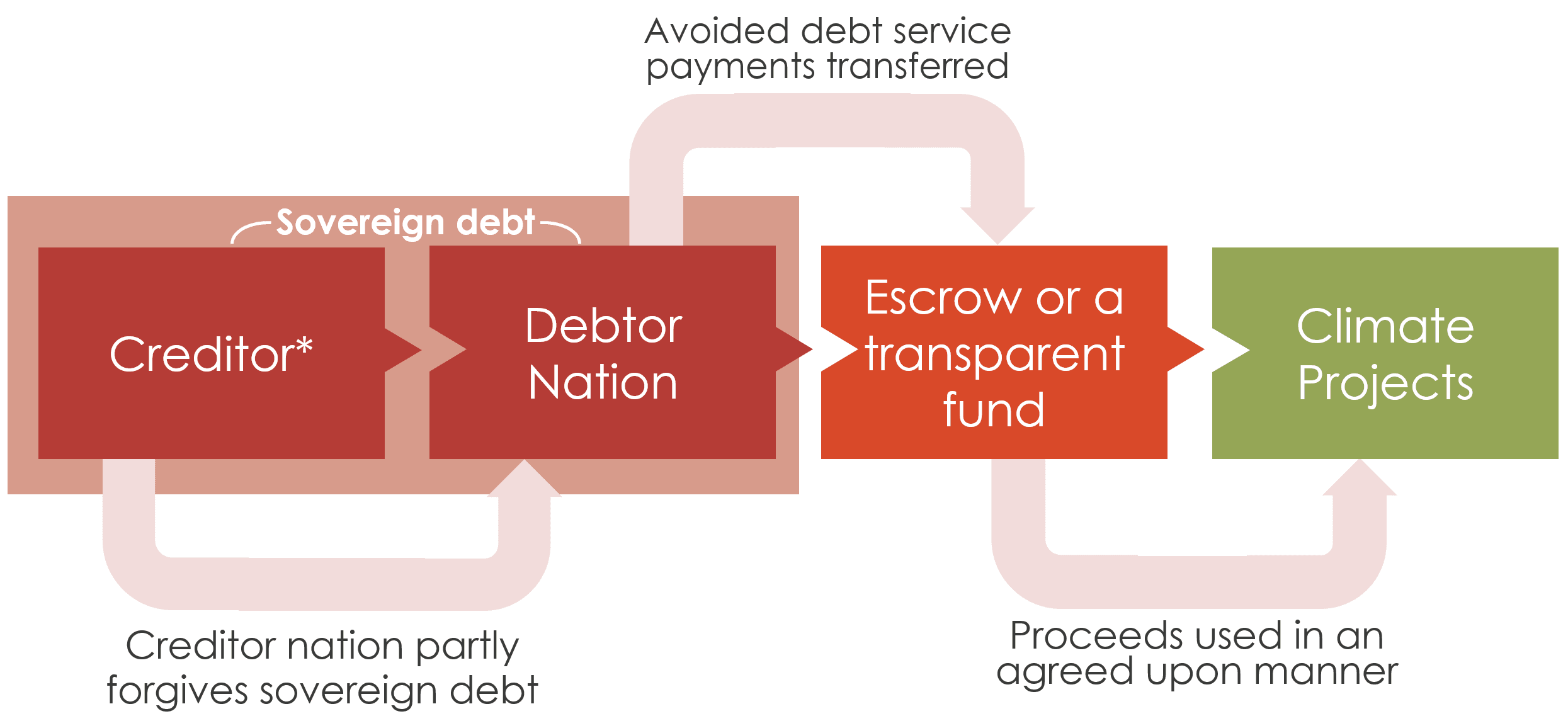

Debt for Climate (DFC) swaps are a type of debt swap in which the debtor nation, instead of continuing to make external debt payments in a foreign currency, makes payments in local currency to finance climate projects domestically on agreed upon terms. DFC swaps can reduce the level of indebtedness as well as free up fiscal resources to be spent on green investments. While each transaction will vary, a generic structure of a DFC swap agreement is represented by the following instrument mechanics:

Alternatively, new debt can be issued by a debtor nation to replace existing debt with a commitment to use proceeds to address climate change through mutually agreed performance-linked incentives such as lower interest rates, grants, carbon offsets to service interest, etc.

DFC swaps would be used to generate the following outcomes:

- Enhanced climate spending: The avoided debt service payments should be used for climate friendly activities or to incentivize participation in climate friendly sectors.

- Boosting economy recovery: Given suppressed economic demand, the investments can stimulate private investment and assist in economic recovery, while incorporating climate resilience and protecting biodiversity.

- Reduced external sovereign debt: DFC swaps help highly-indebted nations (who are still servicing their debt) reduce debt service and free up cash flows for more productive investments.

In this blueprint, we suggest eligibility and condition criteria, principles for using proceeds from swaps, and offer concrete opportunities for using the redirected flows in select countries to address mitigation through examples such as accelerated coal power retirement, increased energy efficiency adoption, and adaptation and nature-based solutions to enhance resilience.