This publication is CPI’s analysis of GreenStreet Africa, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

Sub-Saharan Africa has one of the largest Energy Access gaps on the planet: Less than half of the region’s population has access to reliable electricity.

This problem extends beyond households to civic life, where hospitals, schools and other essential services lack reliable electricity. Now more than ever, hospitals and health clinics require reliable electricity connections to provide critical patient care during the COVID-19 pandemic.

While grant funds exist for solar energy installation, many donor-funded systems fail because of a lack of funds for ongoing operations and maintenance.

Additional barriers include high upfront cost, minimal investor engagement, and lack of interest from service providers.

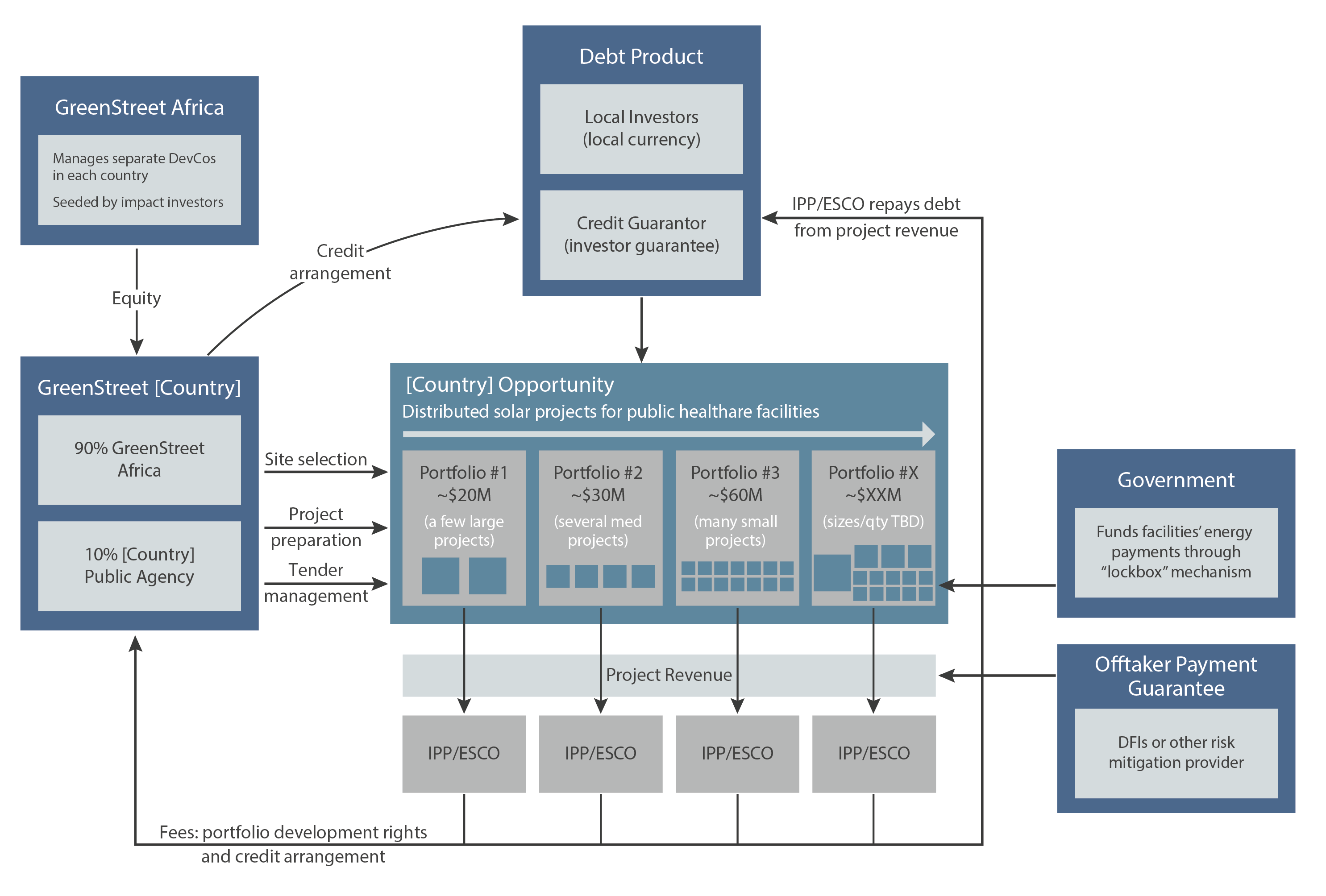

GreenStreet Africa develops and aggregates portfolios of distributed solar projects at public health and education facilities for implementation by private IPPs or ESCOs, financed with local capital markets solutions.

INNOVATION

GreenStreet’s combination of a public-private partnership, portfolios bundling together individual projects, and guarantee-backed local-currency debt financing is unique among distributed solar development models for the public sector.

Bringing project sourcing and development under the umbrella of an aggregated portfolio structure will unlock economies of scale, enabling faster development of solar distributed generation sited at public facilities.

IMPACT

An initial pilot is planned with Nigeria’s Rural Electrification Fund as the public agency partner and InfraCredit as the local bond underwriter and guarantor. The pilot portfolio will supply reliable solar energy for up to six healthcare facilities that currently rely on diesel generators and unreliable grid connections.

Within 5 years of initial deployment, the Lab estimates that GreenStreet can drive the development of more than 150 megawatts of distributed solar. This would eliminate over 40,000 metric tons of carbon dioxide emissions per year, while also reducing both local air pollution and high energy costs associated with diesel generators.

In addition to its positive SDG7 impact, GreenStreet contributes to the achievement of SDGs 3,4,5, and 13.

DESIGN

Led by GreenMax Capital Advisors, GreenStreet Africa will establish public-private partnerships at country level with local public agencies. These partnerships will identify and develop shovel-ready portfolios of distributed energy projects that can be tendered to service providers such as independent power producers (IPPs) or energy services company (ESCOs) for project construction and operation.

This bundled approach creates portfolios large enough to appeal to institutional investors, while enabling the development of relatively small projects that would struggle to access affordable funding if developed individually.

Along with the portfolio development rights, the service provider gain access to a prearranged local currency debt package to fund project construction.

This debt is backed by a guarantee to reduce risk to institutional investors/lenders, and facilities’ energy supply contracts are separately supported by third-party payment guarantees.

The GreenStreet model also includes operations and maintenance in facilities’ energy supply contracts, ensuring that projects stay online for their entire useful life, creating long-term value for both the developer and the public facility off-taker.

GreenStreet’s development model becomes more efficient over time, allowing subsequent portfolios to be developed with less time and money.