Africa offers a wealth of climate-related investment opportunities. New value chains — from sustainable agribusiness to renewable energy — are taking root as the continent’s industrial mix extends beyond extractives and other traditional sectors (EY, 2020). A young and growing population is increasingly keen to tackle big challenges. At the same time, the continent faces issues ranging from lack of energy access to water scarcity, to acute food insecurity, and more. The COVID-19 pandemic, Russia’s invasion of Ukraine, rising debt, and climate change-induced severe weather magnify these risks.

Africa requires USD 2.8 trillion between 2020-2030 to implement its Nationally Determined Contributions under the Paris Agreement. This is the cost of the continent’s contribution to limiting warming to 1.5°C and addressing the biggest impacts of climate change. However, annual climate finance flows in Africa stand at only USD 30 billion.

The socio-economic, ecological, and developmental benefits of climate finance investments far outweigh the costs of implementing them. This report, through robust evidence, aims to identify opportunities to scale up climate finance to ensure a just, fair, and inclusive transition for the region.

Explore all of the research in the State of Climate Finance in Africa series:

Key findings

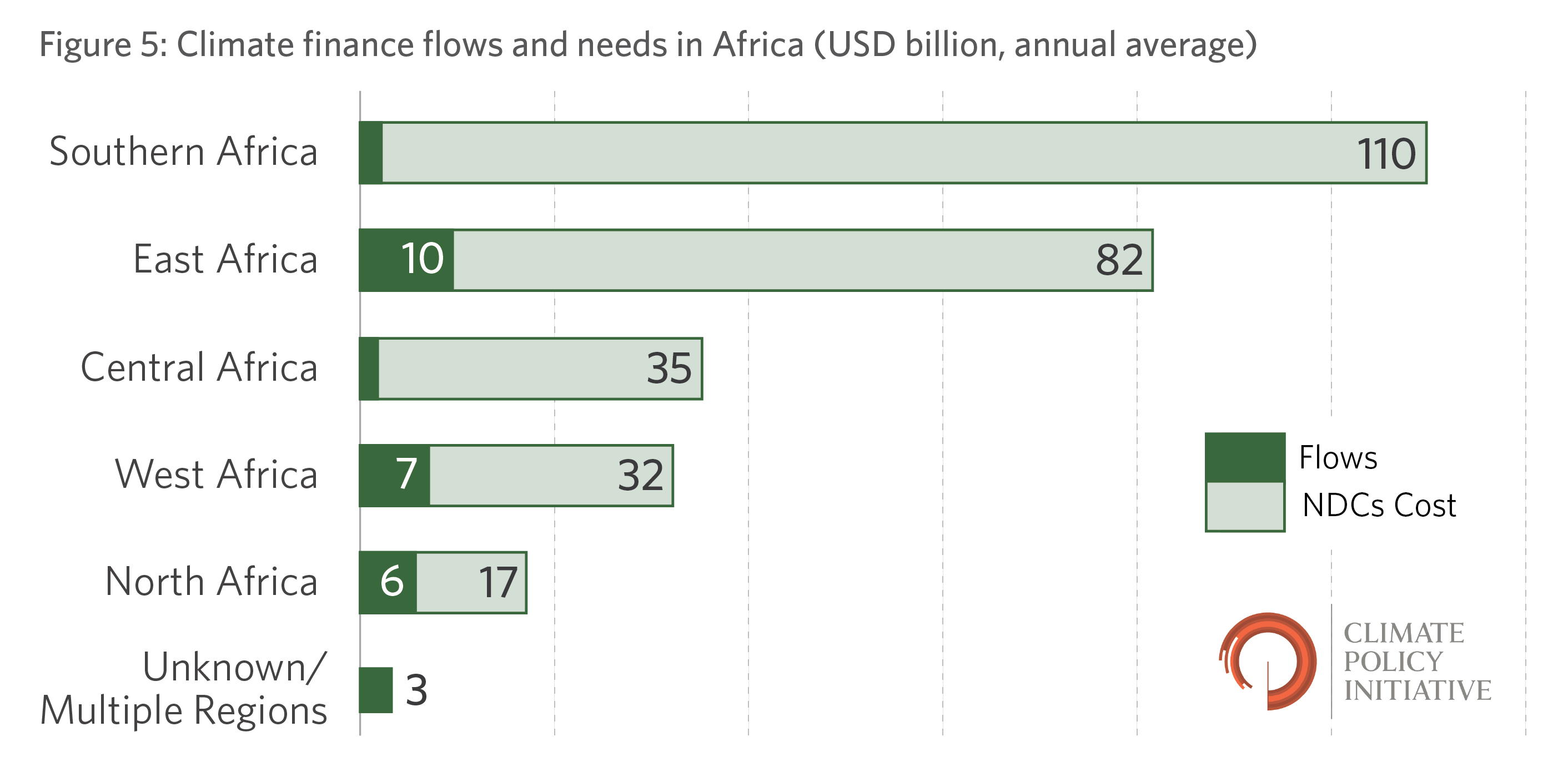

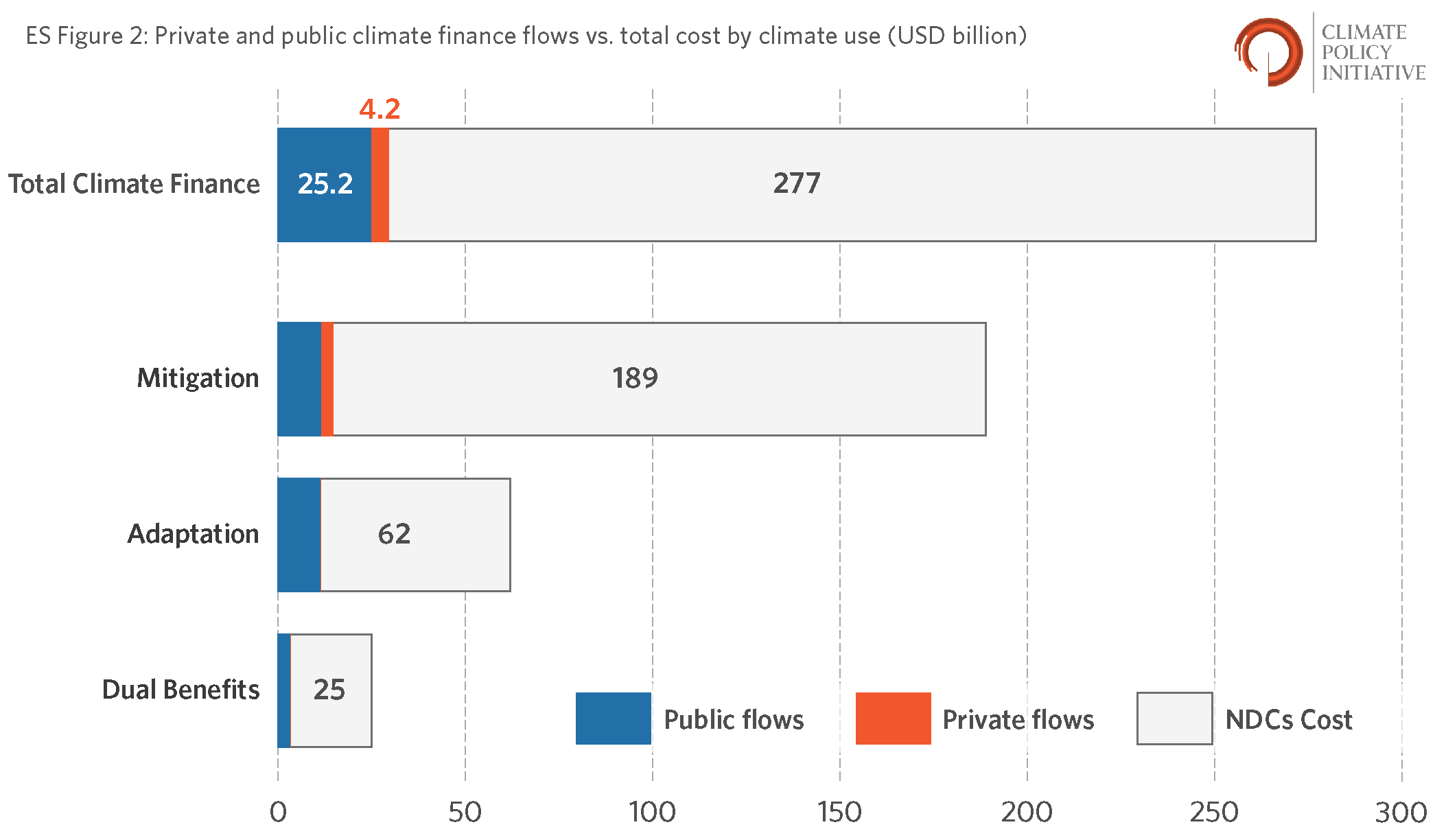

Stakeholders must do more to fill Africa’s climate finance needs. CPI estimates that the continent requires USD 277 billion annually to implement its NDCs and meet 2030 climate goals. But annual climate finance flows in Africa stand at only USD 30 billion. This gap is likely even wider as countries often underestimate their financial needs, especially in relation to adaptation, due to data and methodological problems in costing their NDCs (UNFCCC, 2021). Time is of the essence; delaying action will cost the continent more in the future.

Investment gaps vary between countries. All sub-regions receive significantly less finance than they need. However, the Southern African region bears the largest financing gap in absolute terms. This is mainly attributed to the high climate finance needs identified by South Africa alone—USD 107 billion annually, combined with one of the lowest regional levels of climate investment. Countries in Central and East Africa face the largest climate investment gaps as a percentage of GDP: 26% and 23% on average, respectively. North African countries face the lowest climate investment gaps (3% of GDP), but absolute climate finance needs in those countries still exceed flows by three to six times.

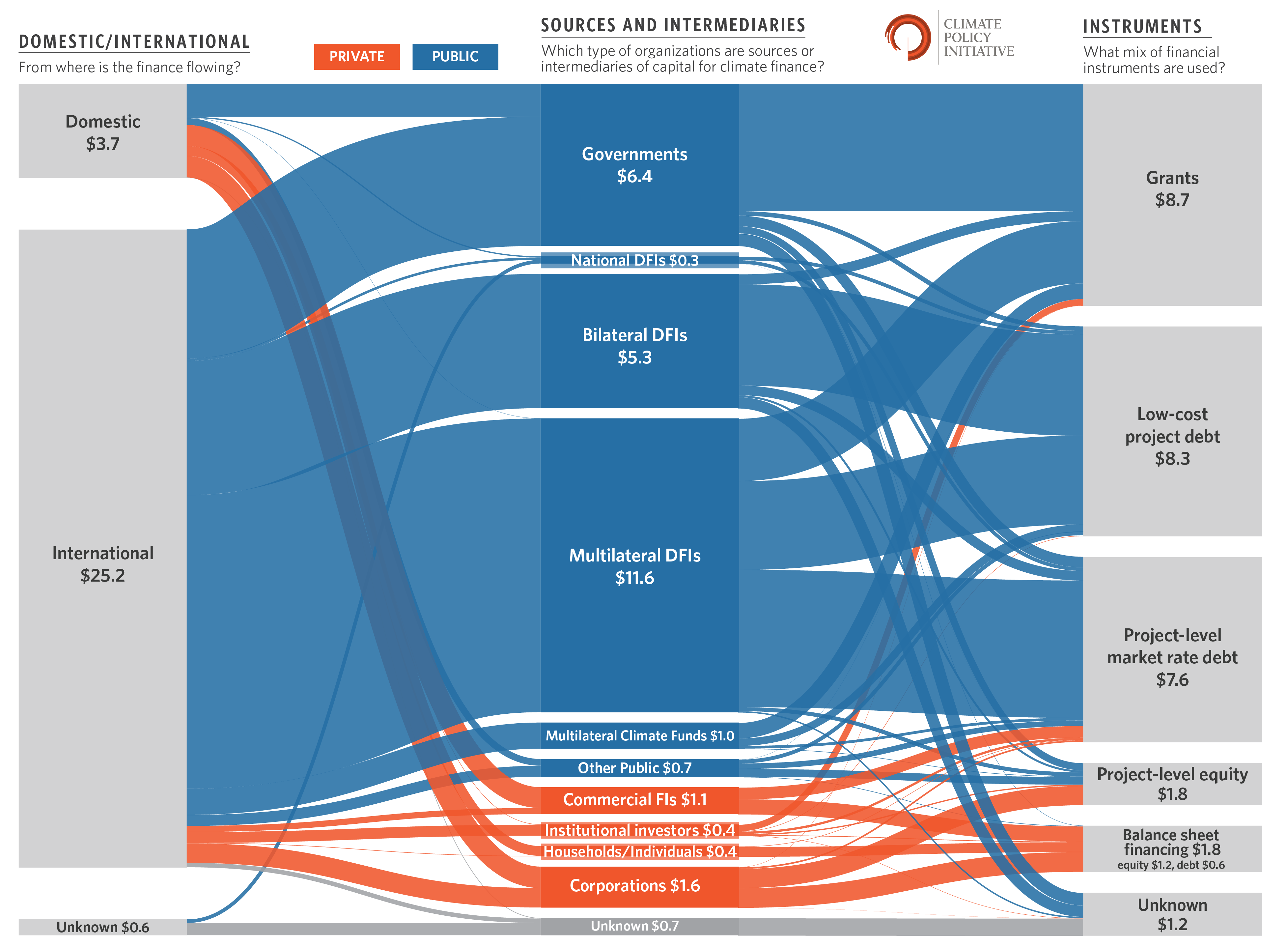

International public finance climbed marginally from 2019 to 2020. The COVID-19 pandemic did not disrupt growth in this tranche of funding, which grew from USD 22.3 billion in 2019 to USD 24.3 billion in 2020. Multilateral Development Financial Institutions (DFIs) and climate funds were the largest source of public climate finance (49%), followed by bilateral development partners including bilateral DFIs (22%), international governments (16%) and climate funds (4%).

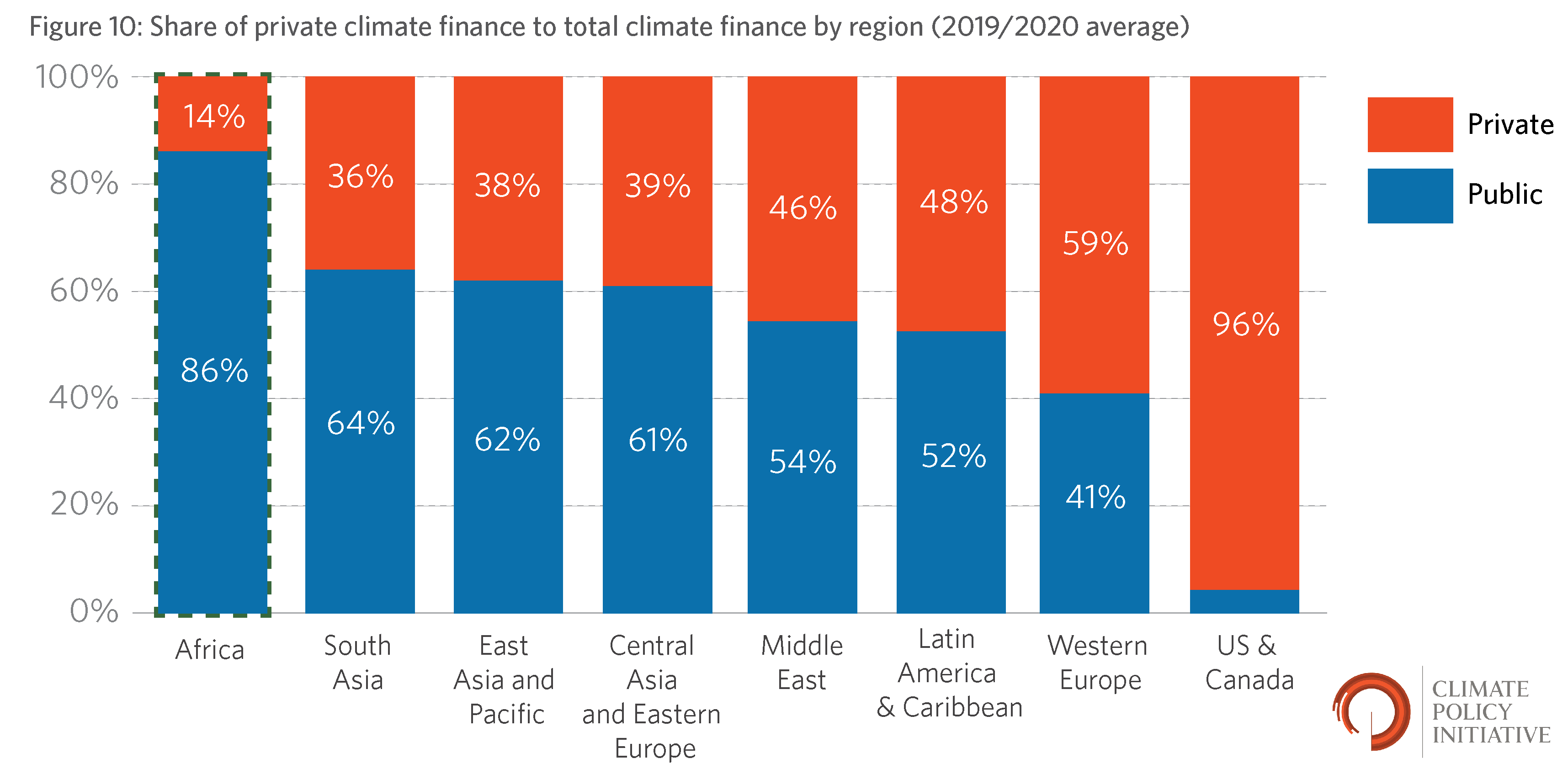

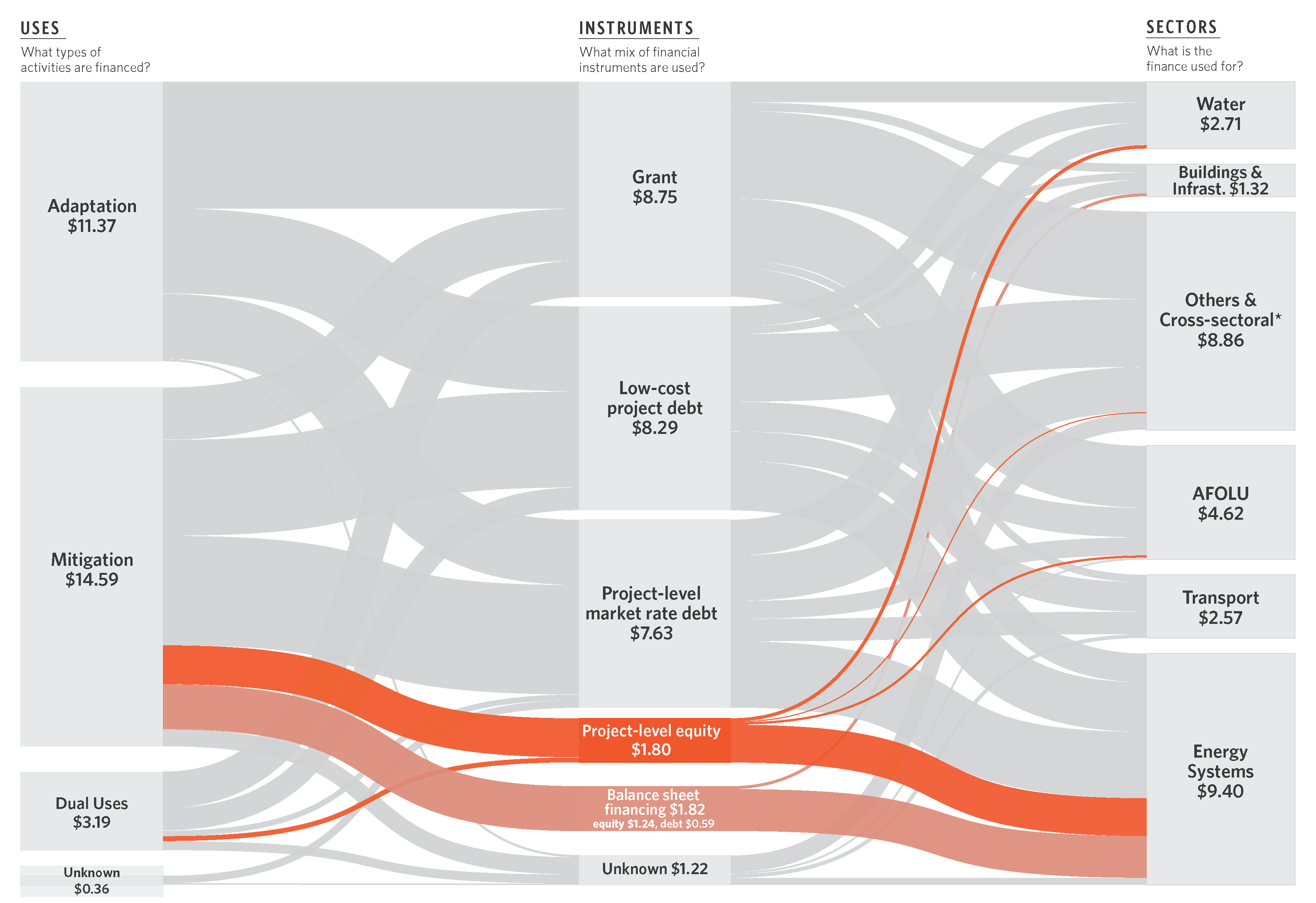

The private sector needs to step up. It contributed only 14% (USD 4.2 billion) of total climate finance in Africa, much lower than in other regions like South Asia (37%), East Asia and Pacific (39%), and Latin America & Caribbean (49%) (CPI, 2021a). Sources of private sector investment were split between domestic (49%), international (39%), and unidentified sources (12%). At the sectoral level, the private sector — largely corporates and commercial financial institutions — invested mostly in mitigation projects (81%). Supportive public interventions, growing maturity of renewable energy technologies, and better funding models for renewable energy projects versus adaptation-based projects largely drove this trend.

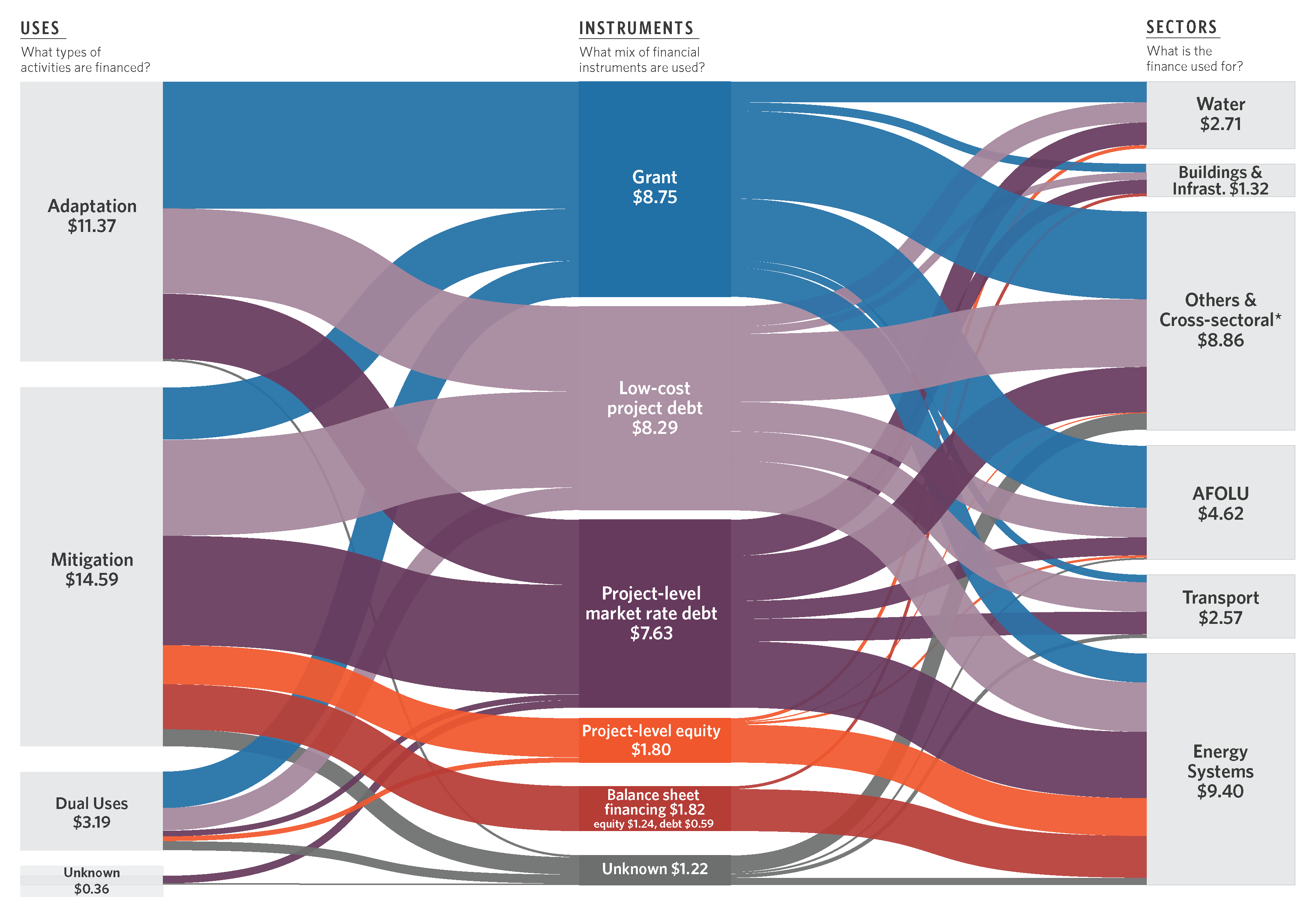

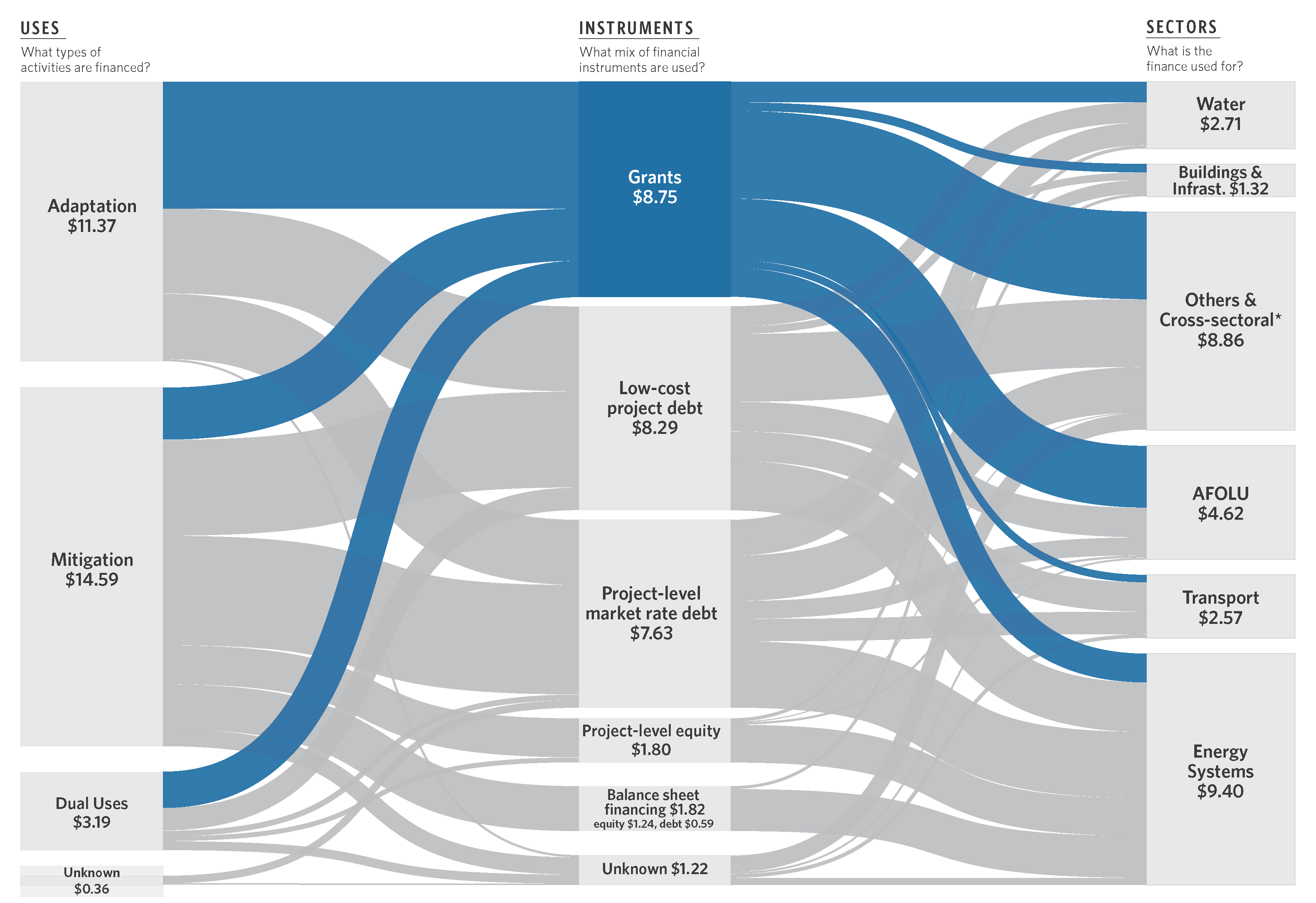

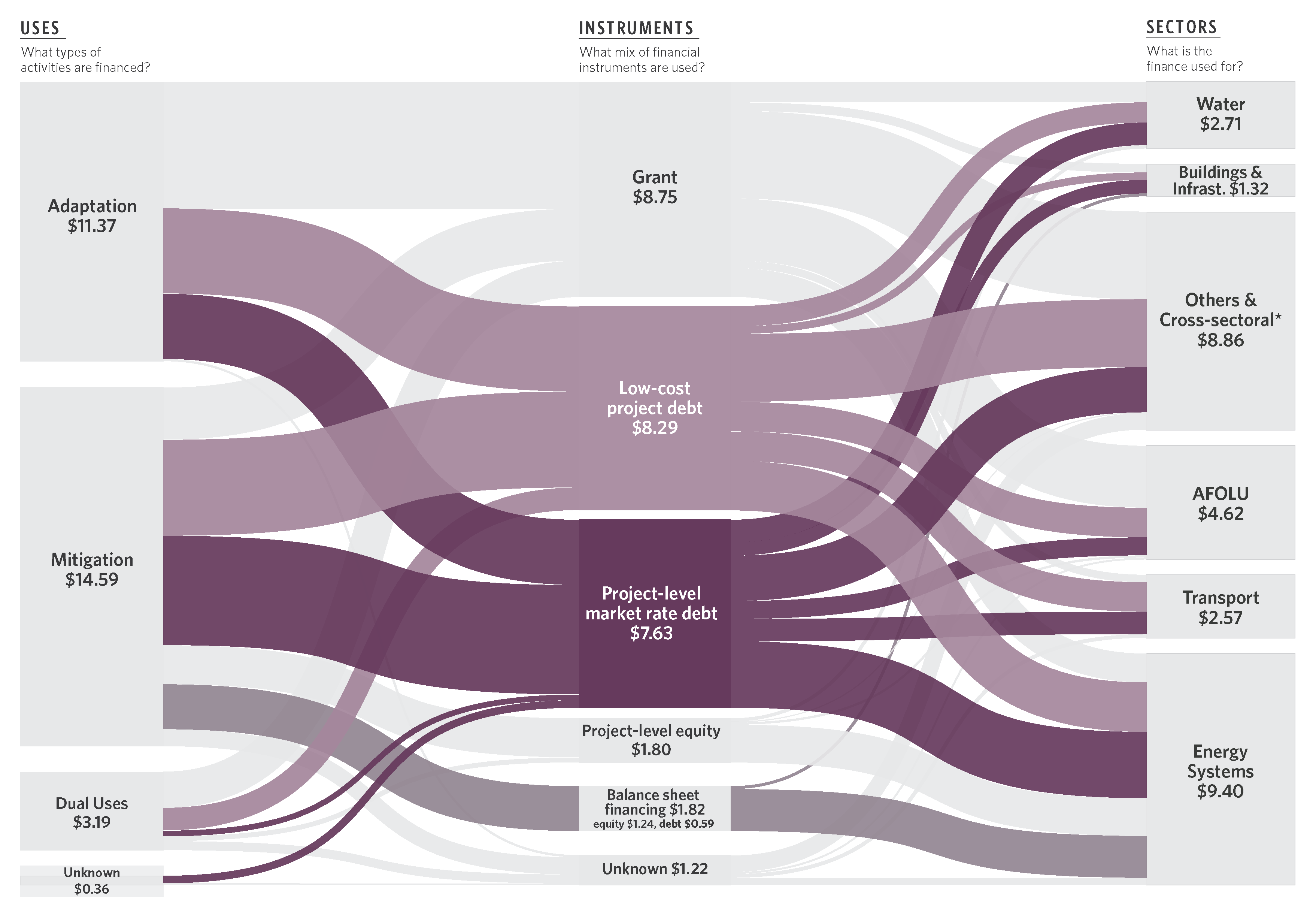

Africa strikes a better balance between adaptation and mitigation than other regions. Mitigation accounted for 49% (USD 14.6 billion) of climate finance flows in Africa, followed by 39% (USD 11.4 billion) towards adaptation, and 12% (USD 3.5 billion) to dual benefits. This is in contrast to other regions globally where adaption represents only 7%–16% of total climate finance. This is a positive trend, given Africa’s disproportionately high vulnerability to climate change. Yet funding for both adaptation and mitigation must still increase by at least six and 13 times, respectively.

Stakeholders need to boost funding for Agriculture, Forestry and Other Land Use in particular. Despite the sector’s economic and social importance, and implications for food security, gender, biodiversity, and water security, it drew only 16% of the total climate finance in Africa.

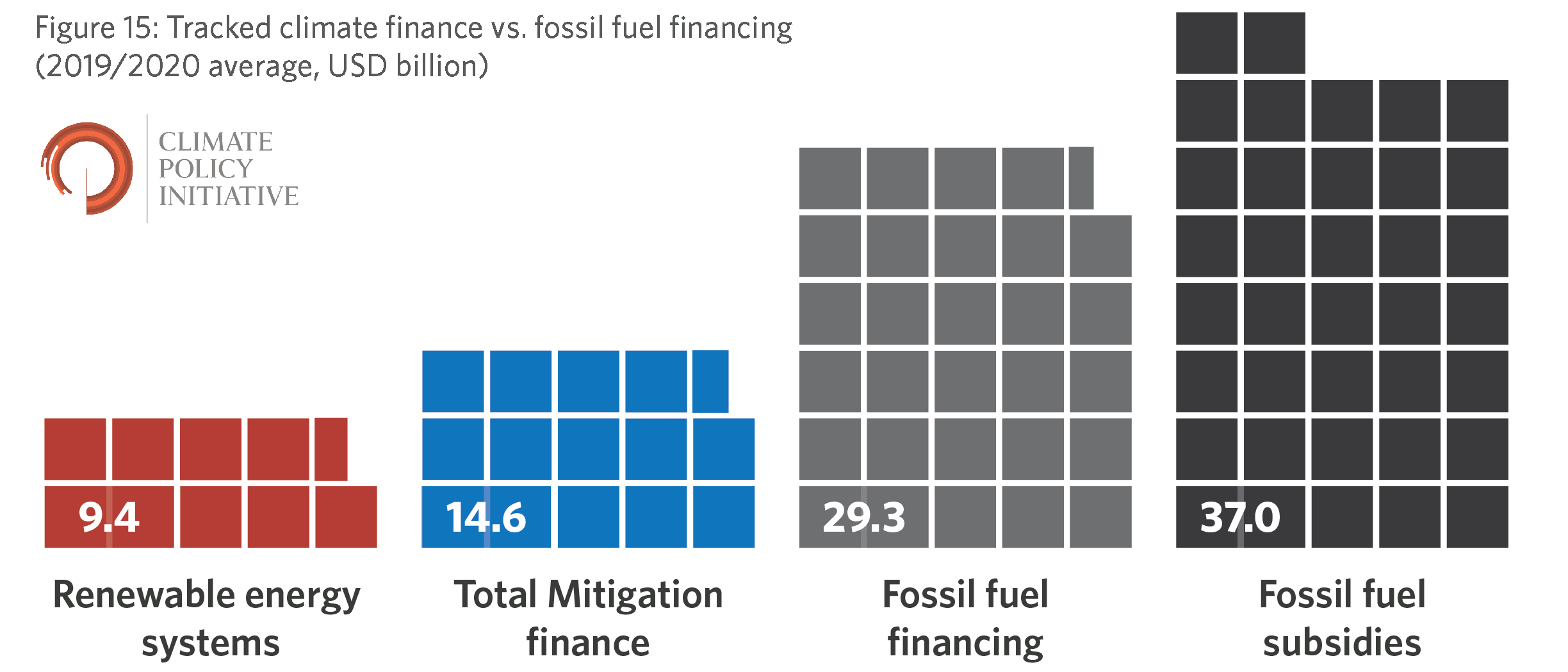

There is huge potential to translate Africa’s sustainable energy needs into investment opportunities and reduce investments in fossil fuels. Africa will need around USD 133 billion annually in clean energy investment to meet its energy and climate goals between 2026–2030 (IEA, 2022). However, annual investment in renewable energy — arguably the most attractive sector for commercial investors — stands at a mere USD 9.4 billion. This is a fraction of the continent’s investment in fossil fuels (USD 29 billion/year between 2016–2021), and government subsidies for fossil fuels (USD 37 billion/year in 2019/2020) (Banktrack 2022).

Opportunities and recommendations

To address the current climate financing gap and accelerate investment into Africa’s diverse opportunities, we propose the following immediate priorities:

Adapt strategies to address current and future country realities. Currently, debt accounts for more than half of climate finance. This exacerbates already high debt vulnerabilities amid other ongoing crises such as the Covid-19 pandemic, food insecurity, and exchange rate vulnerabilities. Guarantees, insurance, and currency hedging could better address current fiscal realities and catalyze more private investment (OECD, 2020a). Stakeholders should tailor their solutions to local factors like depth of capital markets and implementation capacity.

Boldness to fund hard-to-abate sectors and less mature markets. While lending via traditional instruments (debt, equity, and grants) is critical, concessional finance players should take on greater risk, and, once they are de-risked and the project is operational, exit. Public actors should continue to lend to energy projects when needed and focus grants on adaptation and AFOLU projects. Stakeholders should commit concessional finance to hard-to-abate sectors like industry and urban infrastructure; sectors where the transition has hardly begun — like natural capital in carbon sinks, biodiversity, and ecosystem preservation; and nascent areas like the blue economy and green-fintech.

Catalyze private finance, including domestic capital. Private climate finance comprises half of total climate finance globally. In Africa it is only 14%. Actual risk, perceived risk, and ticket sizes dissuade private capital players, but several steps could be taken to expand investment. Development partners could target higher leverage ratios through blended financing structures, with a particular focus on an enhanced role for private insurance and partial guarantees. They could also support capacity building, both within domestic finance institutions and in developing a pipeline of investable opportunities.

Data tracking and disclosure to inform financing strategies. Data is crucial for converting NDCs into climate finance strategies, building effective solutions, and informing investors. Yet pervasive data gaps exist across actors and sectors. Governments should ’climate tag’ to track their revenue and expenditure. This can support the deployment of existing budgets towards climate-friendly activities and redirect them away from carbon-intensive ones. Since climate information is critical to investors, private companies also need to produce this information. Overall, stakeholders need to boost climate risk analysis, and better track the progress in translating net zero pledges into tangible targets and flows.

Enhance the enabling environment through capacity building. Stakeholders should support governments to make smarter climate decisions and develop climate-relevant policies. Some African countries have relatively robust regulatory frameworks in place (e.g., climate finance acts, green bond investment guidelines, green fiscal incentives), but many do not. Governments can learn from their peers, jointly develop best practices, and inform regulations. This will help build enabling environments and unlock private investment.

Facilitate climate investment at a sub-national level. Africa is urbanizing quickly, yet some regulations limit provinces, counties, and cities from expanding their financial or operational capabilities. Empowering local governments would improve vertical integration by avoiding policy gaps between national action plans and local initiatives. It could also ensure horizontal coordination across local governments.

This research was also featured in the Global Center on Adaptation’s report, Financial Innovation for Climate Adaptation in Africa.