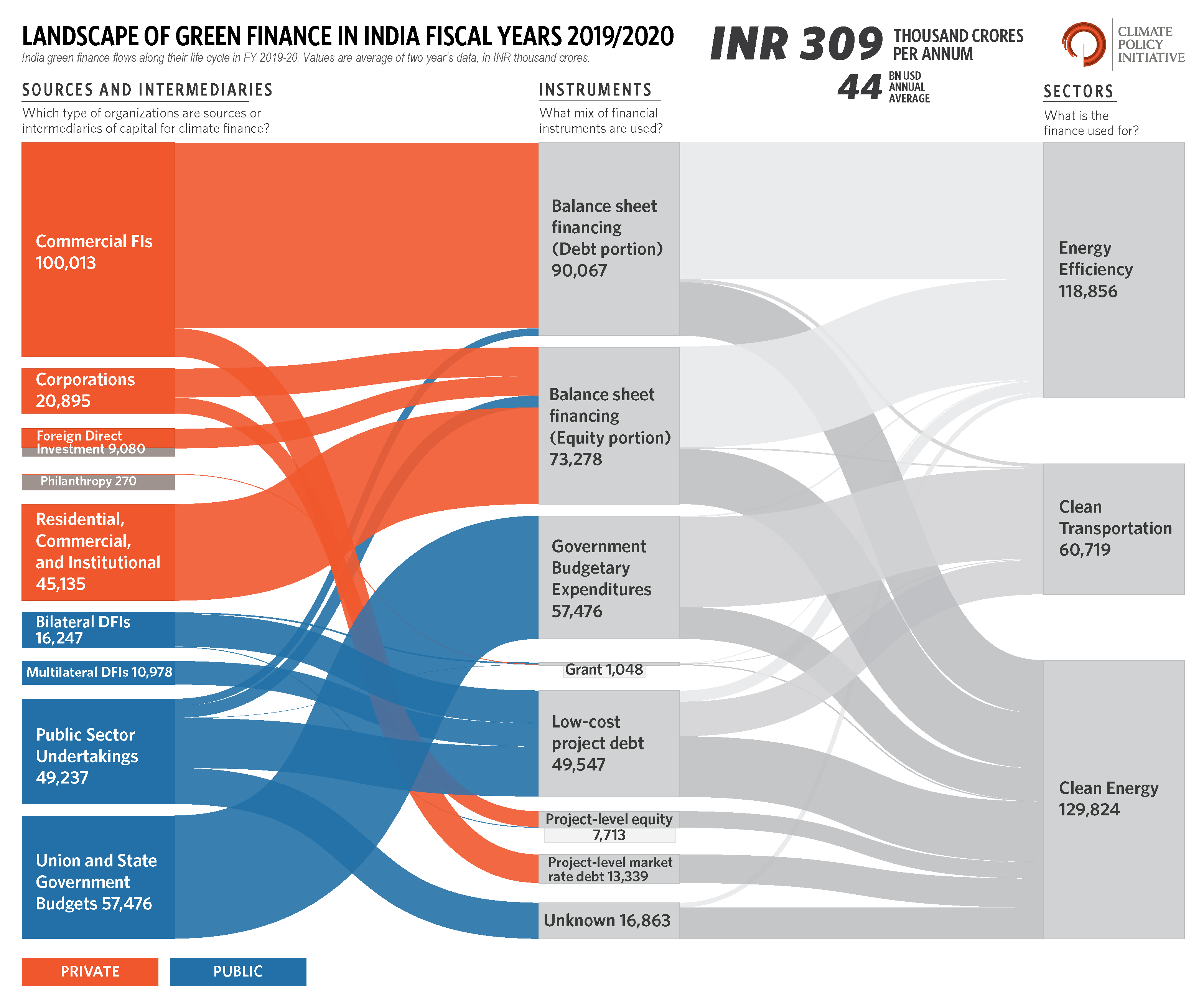

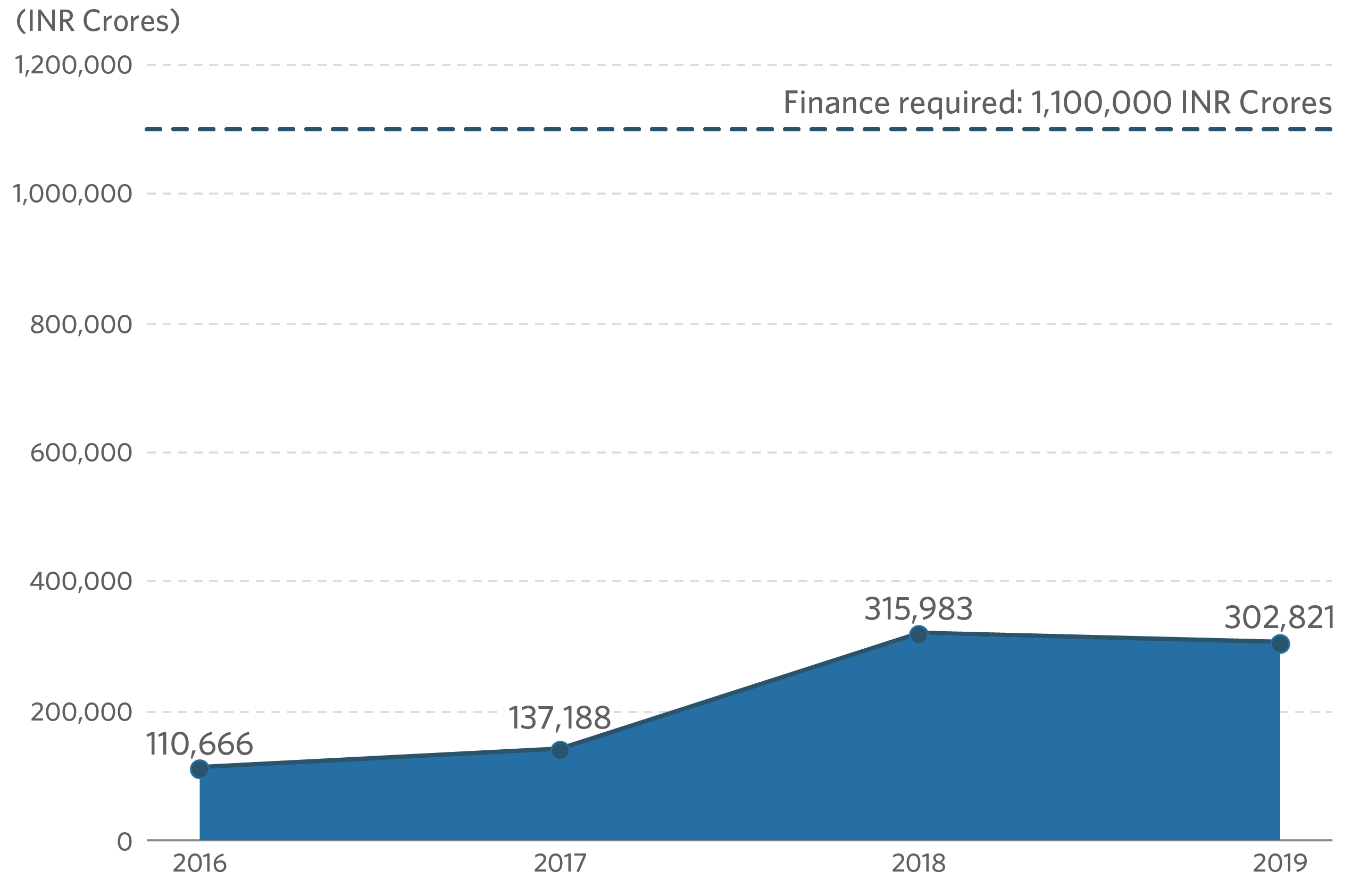

Green finance flows in India are falling far short of the country’s current needs. In 2019/ 2020, tracked green finance was INR 309 thousand crores (~USD 44 billion) per annum, approximately a fourth of India’s needs.

The Landscape of Green Finance in India evaluates finance flows to key real economy sectors — clean energy, clean transport, and Energy efficiency. The study tracks both public and private sources of capital — domestic as well as international — and builds a framework to track the flow of finance right from the source to the end beneficiaries through different instruments. This year, the Landscape also provides a first-of-its kind evaluation of adaptation financing for select sectors.

It is estimated that to achieve India’s Nationally Determined Contributions (NDCs) under the Paris Agreement, the country requires approximately INR 162.5 lakh crores (USD 2.5 trillion) from 2015 to 2030, or roughly INR 11 lakh crores (USD 170 billion) per year. In 2021, India put forth enhanced ambitions on climate action and announced the Panchamrit targets, which include adding 500 GW of non-fossil fuel-based energy capacity and meeting 50% of its energy requirements through non-renewable sources. Such enhanced ambition requires mobilization of green finance at a much faster pace.

In the two years since our initial report, green finance flows increased by 150% from FY2017/FY2018 to FY2019/FY2020.

In the overall increase, public sector flows increased 179% and private sector flows by 130%. This shows increased commitment from public sources – both domestic and international. However, given the level of need and ambition, private sector finance mobilization must significantly outpace public sector finance in the years to come.

Figure 1: Tracked green finance investments and the estimated finance required to meet current NDCs

We must acknowledge that a portion of this increase could be attributed to improved data collection. Improvements in green finance tagging have taken place since our previous report. However, reporting remains anemic, especially in the private sector. This is a significant issue not only in understanding the current level of green finance, but in attracting additional capital; reducing information asymmetry will help uncover opportunities, including attracting capital earmarked for green investment. A concerted effort by public and private sectors is vital to increase the quality and quantity of data that is available online.

Domestic sources of finance

Domestic sources continue to account for the majority of green finance, with 87% and 83% in FY2019 and FY2020, respectively. Of these domestic sources, the private sector contributed about 59%–INR 156.9 thousand crores (USD 22 billion))[1]. Public sector flows were evenly distributed between Government Budgetary spends (Central and State) and PSUs at approximately 54% and 46% respectively.

International sources of finance

The share of international sources increased from 13% in FY 2019 to 17% in FY 2020. Public sources (Official Development Assistance (ODA)[2] and Other Official Flows (OOF)[3]) accounted for 60% of international finance over the two-year period. Foreign Direct Investment (FDI) flows increased substantially from FY2016-2018, reaching nearly INR 9 thousand crores (USD 1.2 billion) in FY2020. However, green finance still only accounts for ~3% of total FDI inflows to India[4].

Sectors – Climate mitigation

The total fund flow towards mitigation was almost equally split between clean energy (42%) and energy efficiency (38%), and was significantly higher than clean transport (17%).

The clean energy sector was equally split between public and private sources, with finance flows from PSUs at 35%, followed closely by Commercial FIs at 27%. Domestic inflows (82%) were far greater than international (18%).

Within the clean energy sector, solar projects received the greatest share of financial investments at INR 54 thousand crores over 2019/2020, accounting for 41% of the total finance flows to the clean energy sector.

Clean transportation received the maximum funding from public sources (96%) amounting to INR 58 thousand crores for FY2019/FY2020. Domestic finance inflows at 72% were far greater than international flows at 27% (of which 99% came from international public sources).

Mass Rapid Transit System (MRTS) accounted for over 87% of the total fund flow to the sector. Despite electric vehicles (EV)s receiving less than 1% of total fund flows to clean transport, FY2020 witnessed an annual increase of 80% to the sub-sector.

Finance inflow to the energy efficiency sector was primarily from the private sector (91%). Domestic fund inflows at 96% were far greater than international flows at 4%.

While finance flows to the Energy efficiency sector increased by 26% from FY2019 to FY2020, fund flows to process efficiency and green buildings decreased in FY2020 by 83% and 81% respectively. These drops may be attributed to changes in design of the scheme run for process efficiency by the Government of India (GoI), the onset of Covid, and variation in the size of projects in the case of green buildings.

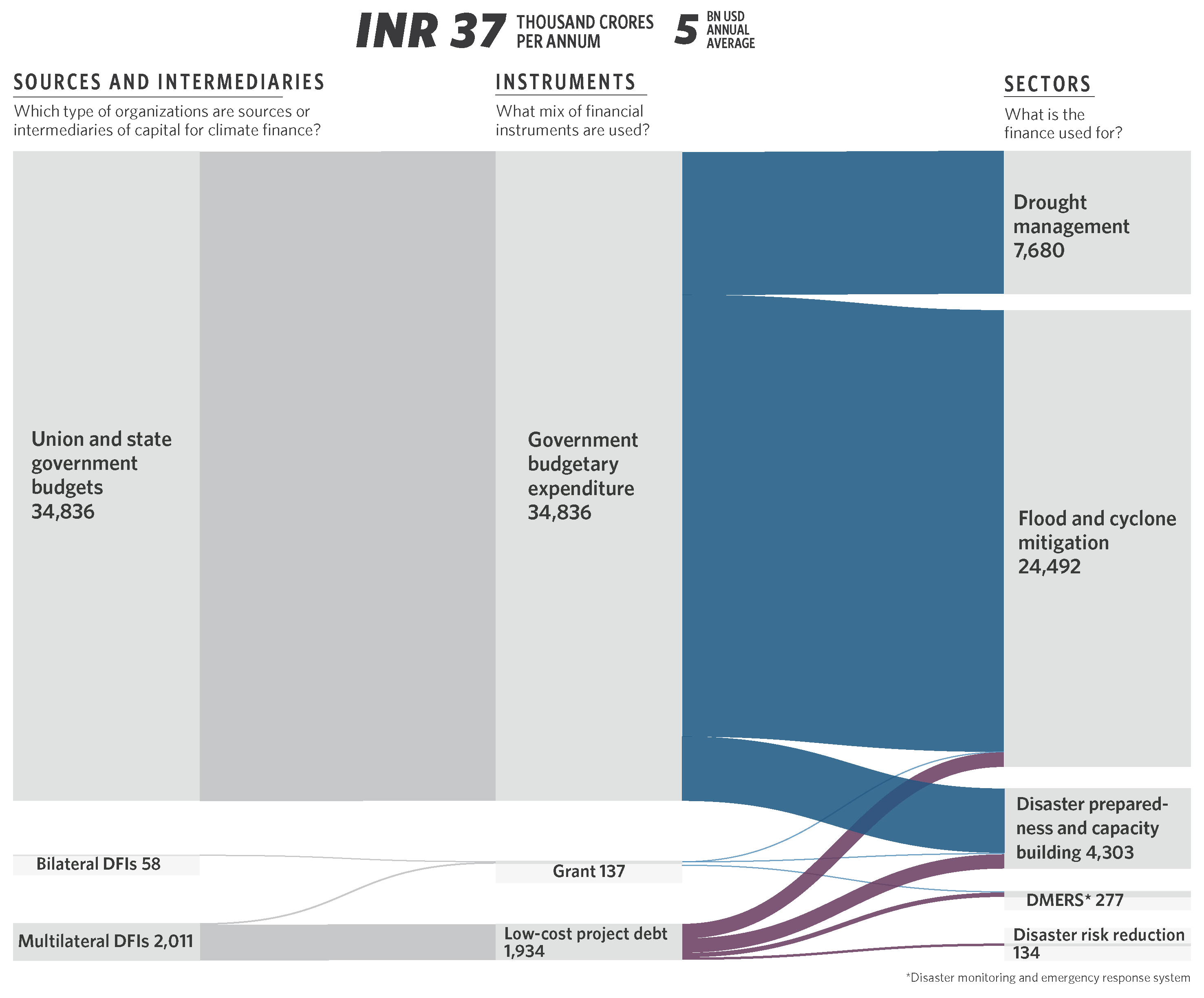

Climate adaptation

This report presents a first-of-its-kind analysis of adaptation funding in India. For the adaptation sectors,[5] the total amount of green finance was INR 37 thousand crores (USD 5 billion) per annum over FY2019/FY2020[6]. The major source of Adaptation funding was domestic (94%), and it was fully funded by Central and State government Budgets.

Concluding observations

- Green finance flows must increase rapidly to ensure that India meets its Panchamrit targets.

India needs approximately INR 162.5 lakh crores (USD 2.5 trillion) till 2030 for NDCs and INR 716 lakh crores[7] (USD 10.1 trillion) to achieve Net-Zero emissions by 2070. By conservative estimates, the current tracked green finance in India represents less than 25% of the total requirement across sectors just to meet the NDCs. This accounts for mitigation only. Adaptation flows are even more muted.

Public finance has played a major role in increasing green finance flows, but more involvement of the private sector is required. To achieve this, public finance must increasingly play a role in mobilizing private finance. International finance—through DFIs, philanthropy, and others—also needs to play a bigger role in directly supporting India’s green transition and in mobilizing private finance. Further, while overall finance flows to mitigation sectors have increased, the majority of the flows remain concentrated in select sectors that have more market maturity. Additional policy support and investment mobilization are required to mobilize earlier-maturity sectors such as decentralized energy sources and EVs. - A strong policy environment is critical to enabling green finance at scale.

Green finance investments appear to be responding to the policy environment, with the Government making efforts to strengthen the green investment framework and green investment promotion.

For further impact, several policy considerations should be considered as key levers, including:- A green taxonomy

- An integrated domestic Measurement, Reporting, and Verification (MRV) system

- Coordinated policy interventions that target improving technology, and mainstreaming supply chains to accelerate investment and adoption in priority sectors that are lagging— such as electric vehicles and decentralized energy sources.

- Coordinated efforts across data collection, reporting, and access will increase green finance flows.

Reliable data is necessary to increase green investments. This may be achieved by furthering disclosure requirements and improving access to data, thereby reducing information asymmetry. Increasing the quantity and availability of green finance data will help uncover opportunities as well as attract capital earmarked for green investment. - Accelerating financial flows towards adaptation is critical.

India is one of the most vulnerable countries to climate change, and there is a pressing need for funds to flow into the Adaptation sector. Tracked finance for the sector stood at INR 37 thousand crores (USD 5 Billion) in FY 2020, which was severely short of the required needs. Collaboration and planning are key to increasing finance flows to the sector, as is the development of Adaptation investment plans at the State level.

Editor’s note: This report was updated in May 2024 to adjust an incorrect INR to USD conversion of estimated finance needs for adaptation (page 21).

[1] Biennial average

[2] OECD defines Official development assistance (ODA) as government aid designed to promote the economic development and welfare of developing countries. Source: s://data.oecd.org/drf/other-official-flows-oof.htm#:~:text=Other%20official%20flows%20(OOF)%20are,development%20

assistance%20(ODA)%20criteria.

[3] OECD defines Other official flows (OOF) as official sector transactions that do not meet official development assistance (ODA) criteria.

[4] https://dpiit.gov.in/sites/default/files/FDI_Factsheet_March20_28May_2020.pdf

[5] Includes only some specific sectors within adaptation. These numbers are not represented in the overall Sankey diagram.

[6] Biennial Average

[7] Exchange rate of INR 70.90 to 1 USD taken as given by RBI for FY2020